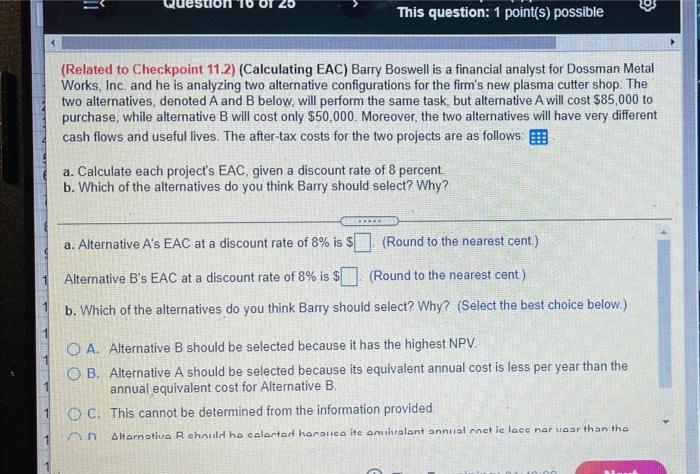

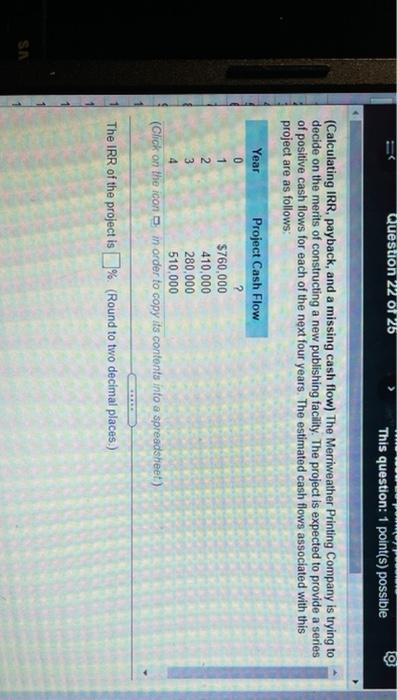

deslion 10 OT 20 This question: 1 point(s) possible (Related to Checkpoint 11.2) (Calculating EAC) Barry Boswelli a financial analyst for Dossman Metal Works, Inc. and he is analyzing two alternative configurations for the firm's new plasma cutter shop. The two alternatives, denoted A and B below, will perform the same task, but alternative A will cost $85,000 to purchase, while alternative B will cost only $50,000. Moreover, the two alternatives will have very different cash flows and useful lives. The after-tax costs for the two projects are as follows. a. Calculate each project's EAC, given a discount rate of 8 percent b. Which of the alternatives do you think Barry should select? Why? a. Alternative A's EAC at a discount rate of 8% is $1(Round to the nearest cent.) Alternative B's EAC at a discount rate of 8% is $ (Round to the nearest cent) b. Which of the alternatives do you think Barry should select? Why? (Select the best choice below.) O A. Alternative B should be selected because it has the highest NPV O B. Alternative A should be selected because its equivalent annual cost is less per year than the annual equivalent cost for Alternative B. OC. This cannot be determined from the information provided. Altarnative Rohould be colected horanca te ontvalant annual retic loce nervoar than the Question 22 of 25 Pom o) This question: 1 point(s) possible (Calculating IRR, payback, and a missing cash flow) The Merriweather Printing Company is trying to decide on the merits of constructing a new publishing facility. The project is expected to provide a series of positive cash flows for each of the next four years. The estimated cash flows associated with this project are as follows: Year Project Cash Flow 0 2 1 $760,000 2 410,000 3 280,000 510,000 (Click on the icon in order to copy its contents into a spreadsheet) 4 The IRR of the project is % (Round to two decimal places.) SA deslion 10 OT 20 This question: 1 point(s) possible (Related to Checkpoint 11.2) (Calculating EAC) Barry Boswelli a financial analyst for Dossman Metal Works, Inc. and he is analyzing two alternative configurations for the firm's new plasma cutter shop. The two alternatives, denoted A and B below, will perform the same task, but alternative A will cost $85,000 to purchase, while alternative B will cost only $50,000. Moreover, the two alternatives will have very different cash flows and useful lives. The after-tax costs for the two projects are as follows. a. Calculate each project's EAC, given a discount rate of 8 percent b. Which of the alternatives do you think Barry should select? Why? a. Alternative A's EAC at a discount rate of 8% is $1(Round to the nearest cent.) Alternative B's EAC at a discount rate of 8% is $ (Round to the nearest cent) b. Which of the alternatives do you think Barry should select? Why? (Select the best choice below.) O A. Alternative B should be selected because it has the highest NPV O B. Alternative A should be selected because its equivalent annual cost is less per year than the annual equivalent cost for Alternative B. OC. This cannot be determined from the information provided. Altarnative Rohould be colected horanca te ontvalant annual retic loce nervoar than the Question 22 of 25 Pom o) This question: 1 point(s) possible (Calculating IRR, payback, and a missing cash flow) The Merriweather Printing Company is trying to decide on the merits of constructing a new publishing facility. The project is expected to provide a series of positive cash flows for each of the next four years. The estimated cash flows associated with this project are as follows: Year Project Cash Flow 0 2 1 $760,000 2 410,000 3 280,000 510,000 (Click on the icon in order to copy its contents into a spreadsheet) 4 The IRR of the project is % (Round to two decimal places.) SA