Question

Desmond Co. is considering the following alternative financing plans: Plan 1 Plan 2 Issue 10% bonds (at face value) $1,080,000 $540,000 Issue preferred $1

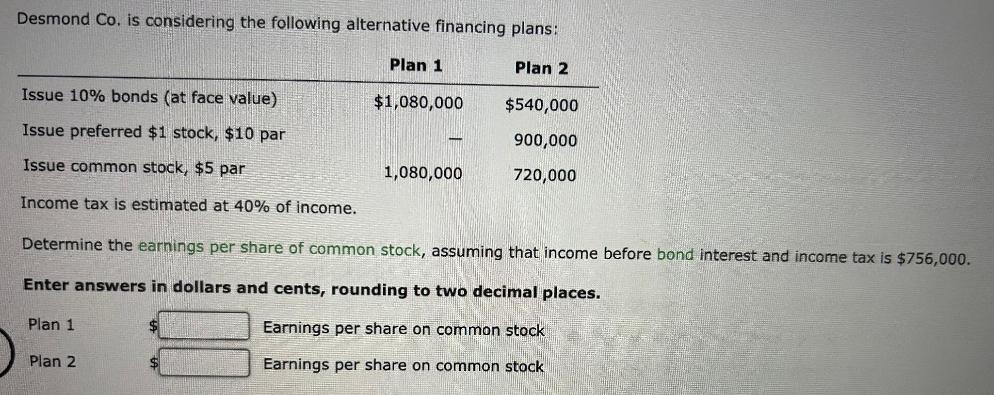

Desmond Co. is considering the following alternative financing plans: Plan 1 Plan 2 Issue 10% bonds (at face value) $1,080,000 $540,000 Issue preferred $1 stock, $10 par 900,000 Issue common stock, $5 par 1,080,000 720,000 Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that income before bond interest and income tax is $756,000. Enter answers in dollars and cents, rounding to two decimal places. Plan 1 Plan 2 Earnings per share on common stock Earnings per share on common stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Plan 1 Analysis Income after Tax Income before ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

11th Edition

9780538480901, 9781111525774, 538480890, 538480904, 1111525773, 978-0538480895

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App