Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Detailed Analysis - Show your work/calculations. Mr Muffler Garage is developing an operating budget for the month ending June 30, 2024. They expect to

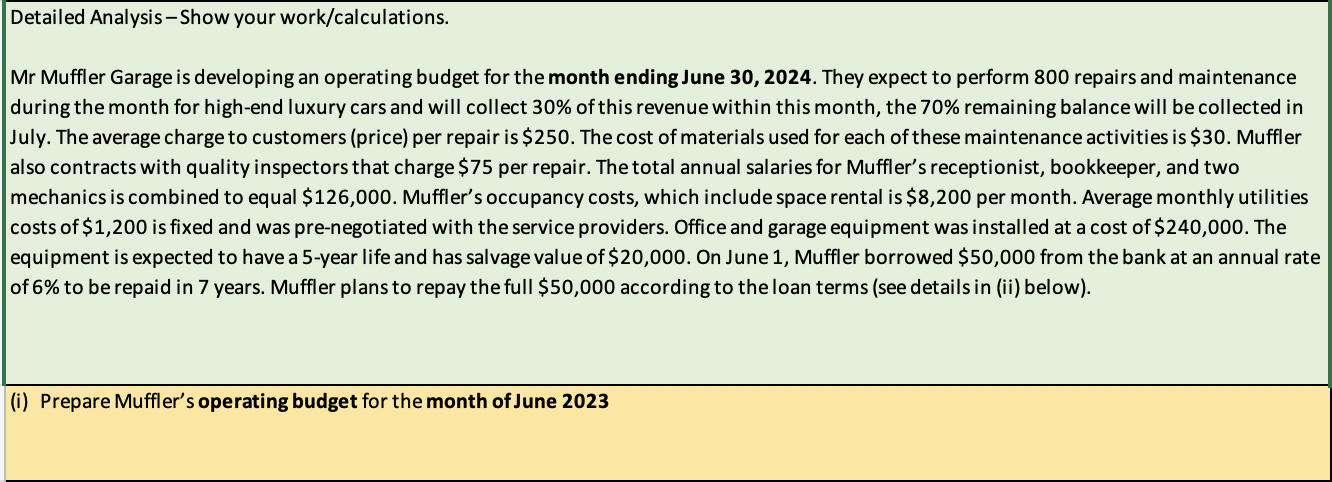

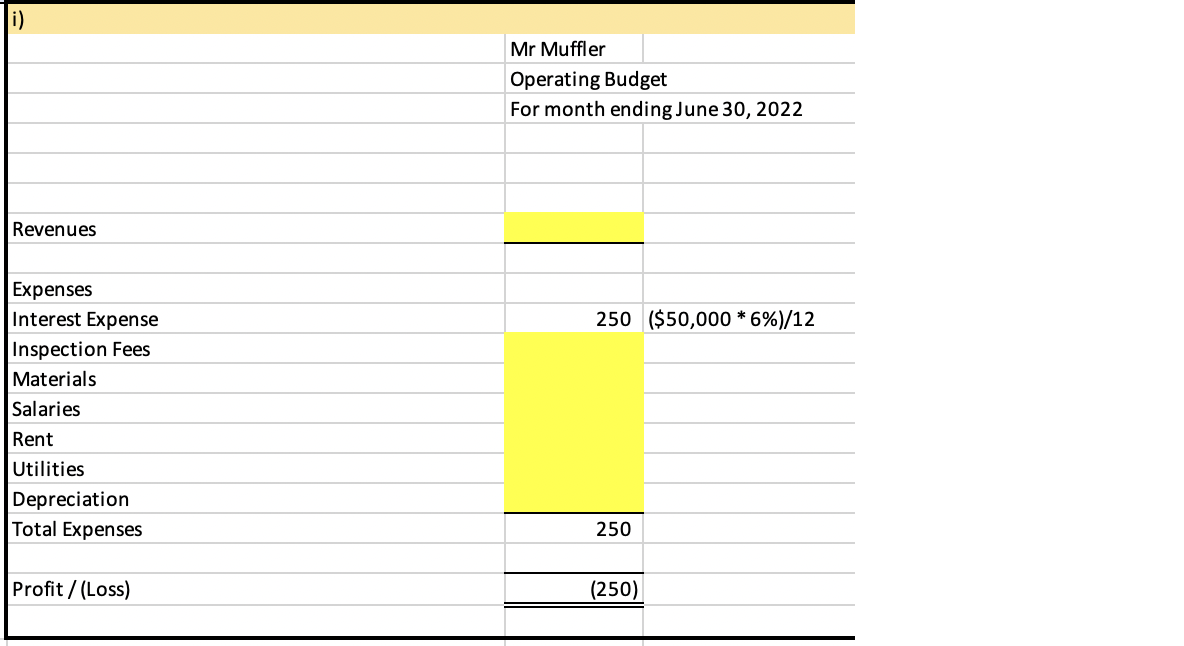

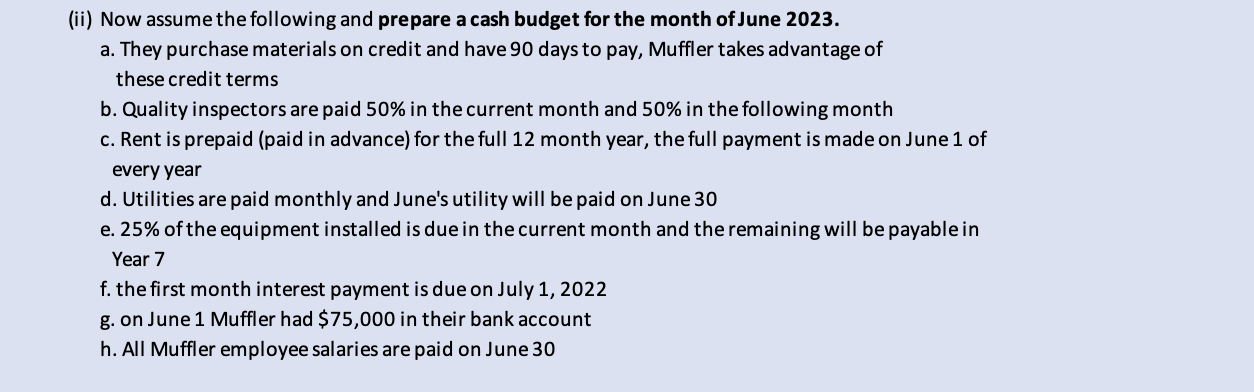

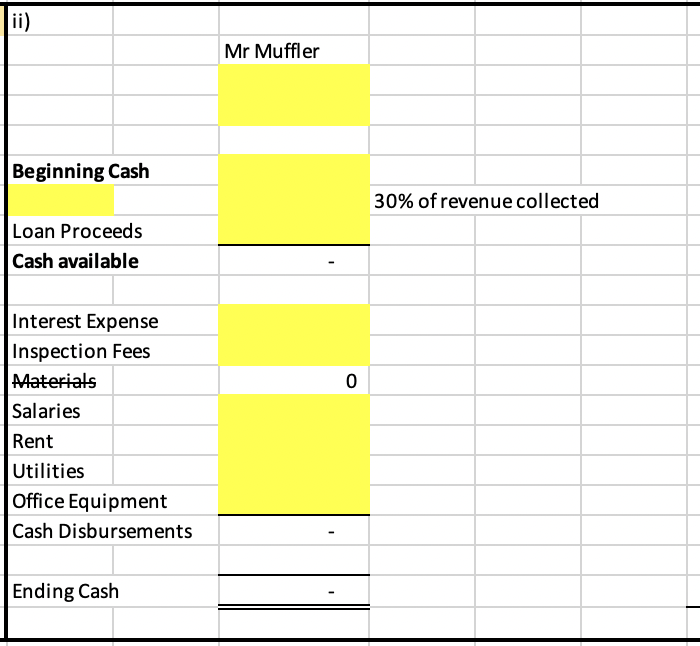

Detailed Analysis - Show your work/calculations. Mr Muffler Garage is developing an operating budget for the month ending June 30, 2024. They expect to perform 800 repairs and maintenance during the month for high-end luxury cars and will collect 30% of this revenue within this month, the 70% remaining balance will be collected in July. The average charge to customers (price) per repair is $250. The cost of materials used for each of these maintenance activities is $30. Muffler also contracts with quality inspectors that charge $75 per repair. The total annual salaries for Muffler's receptionist, bookkeeper, and two mechanics is combined to equal $126,000. Muffler's occupancy costs, which include space rental is $8,200 per month. Average monthly utilities costs of $1,200 is fixed and was pre-negotiated with the service providers. Office and garage equipment was installed at a cost of $240,000. The equipment is expected to have a 5-year life and has salvage value of $20,000. On June 1, Muffler borrowed $50,000 from the bank at an annual rate of 6% to be repaid in 7 years. Muffler plans to repay the full $50,000 according to the loan terms (see details in (ii) below). (i) Prepare Muffler's operating budget for the month of June 2023 i) Mr Muffler Operating Budget For month ending June 30, 2022 Revenues Expenses Interest Expense Inspection Fees Materials Salaries 250 ($50,000 * 6%)/12 Rent Utilities Depreciation Total Expenses Profit/(Loss) 250 (250) (ii) Now assume the following and prepare a cash budget for the month of June 2023. a. They purchase materials on credit and have 90 days to pay, Muffler takes advantage of these credit terms b. Quality inspectors are paid 50% in the current month and 50% in the following month c. Rent is prepaid (paid in advance) for the full 12 month year, the full payment is made on June 1 of every year d. Utilities are paid monthly and June's utility will be paid on June 30 e. 25% of the equipment installed is due in the current month and the remaining will be payable in Year 7 f. the first month interest payment is due on July 1, 2022 g. on June 1 Muffler had $75,000 in their bank account h. All Muffler employee salaries are paid on June 30 ii) Mr Muffler Beginning Cash Loan Proceeds Cash available Interest Expense Inspection Fees Materials 0 30% of revenue collected Salaries Rent Utilities Office Equipment Cash Disbursements Ending Cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started