detailed answer please!

thank you

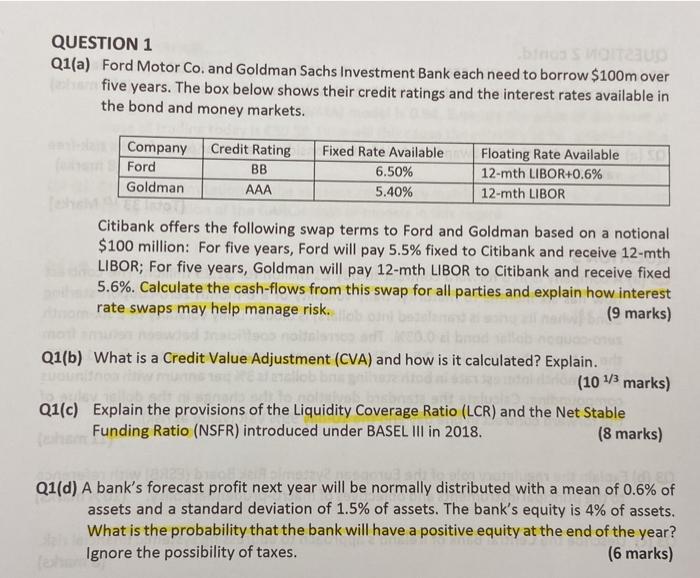

QUESTION 1 Q1(a) Ford Motor Co. and Goldman Sachs Investment Bank each need to borrow $100m over five years. The box below shows their credit ratings and the interest rates available in the bond and money markets. Company Ford Goldman Credit Rating BB AAA Fixed Rate Available 6.50% 5.40% Floating Rate Available 12-mth LIBOR+0.6% 12-mth LIBOR Citibank offers the following swap terms to Ford and Goldman based on a notional $100 million: For five years, Ford will pay 5.5% fixed to Citibank and receive 12-mth LIBOR; For five years, Goldman will pay 12-mth LIBOR to Citibank and receive fixed 5.6%. Calculate the cash-flows from this swap for all parties and explain how interest rate swaps may help manage risk. (9 marks) Q1(b) What is a Credit Value Adjustment (CVA) and how is it calculated? Explain. (10 1/3 marks) Q1(c) Explain the provisions of the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR) introduced under BASEL III in 2018. (8 marks) Q1(d) A bank's forecast profit next year will be normally distributed with a mean of 0.6% of assets and a standard deviation of 1.5% of assets. The bank's equity is 4% of assets, What is the probability that the bank will have a positive equity at the end of the year? Ignore the possibility of taxes. (6 marks) QUESTION 1 Q1(a) Ford Motor Co. and Goldman Sachs Investment Bank each need to borrow $100m over five years. The box below shows their credit ratings and the interest rates available in the bond and money markets. Company Ford Goldman Credit Rating BB AAA Fixed Rate Available 6.50% 5.40% Floating Rate Available 12-mth LIBOR+0.6% 12-mth LIBOR Citibank offers the following swap terms to Ford and Goldman based on a notional $100 million: For five years, Ford will pay 5.5% fixed to Citibank and receive 12-mth LIBOR; For five years, Goldman will pay 12-mth LIBOR to Citibank and receive fixed 5.6%. Calculate the cash-flows from this swap for all parties and explain how interest rate swaps may help manage risk. (9 marks) Q1(b) What is a Credit Value Adjustment (CVA) and how is it calculated? Explain. (10 1/3 marks) Q1(c) Explain the provisions of the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR) introduced under BASEL III in 2018. (8 marks) Q1(d) A bank's forecast profit next year will be normally distributed with a mean of 0.6% of assets and a standard deviation of 1.5% of assets. The bank's equity is 4% of assets, What is the probability that the bank will have a positive equity at the end of the year? Ignore the possibility of taxes. (6 marks)