Answered step by step

Verified Expert Solution

Question

1 Approved Answer

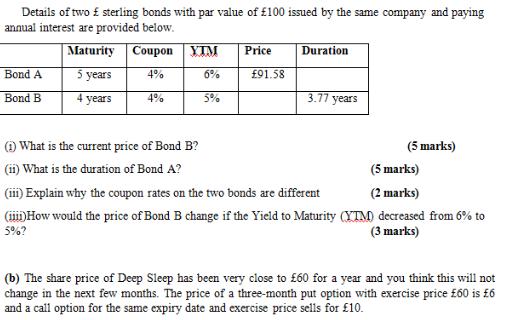

Details of two f sterling bonds with par value of 100 issued by the same company and paying annual interest are provided below. Maturity

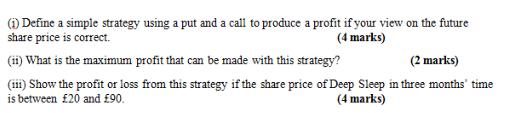

Details of two f sterling bonds with par value of 100 issued by the same company and paying annual interest are provided below. Maturity Coupon 5 years 4% 4 years 4% Bond A Bond B YTM (1) What is the current price of Bond B? (ii) What is the duration of Bond A? 6% 5% Price 91.58 Duration 3.77 years (5 marks) (5 marks) (2 marks) (iii) Explain why the coupon rates on the two bonds are different (iii) How would the price of Bond B change if the Yield to Maturity (YTM) decreased from 6% to 5%? (3 marks) (b) The share price of Deep Sleep has been very close to 60 for a year and you think this will not change in the next few months. The price of a three-month put option with exercise price 60 is 6 and a call option for the same expiry date and exercise price sells for 10. (1) Define a simple strategy using a put and a call to produce a profit if your view on the future share price is correct. (4 marks) (ii) What is the maximum profit that can be made with this strategy? (2 marks) (iii) Show the profit or loss from this strategy if the share price of Deep Sleep in three months' time is between 20 and 90. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started