Question

Detdet Corp. plans in invest in a four-year project that will cost P75,000. Detdet's cost of capital is 8%. Additional information on the project is

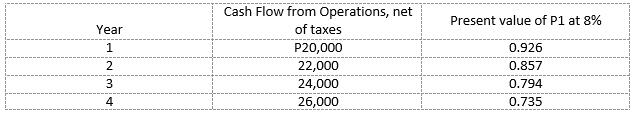

Detdet Corp. plans in invest in a four-year project that will cost P75,000. Detdet's cost of capital is 8%. Additional information on the project is as follows:

REQUIRED: Using the net present value method, determine whether the project is acceptable of not.

ABC wants to invest in a machine costing P80,000 with a useful life of six years and no salvage value. The machine will be depreciate using the straight-line method and is expected to produce annual cash inflow from operations, net of income taxes, of P22,000. The present value of an ordinary annuity of P1 for six periods at 10% is 4.355. The present value of P1 for six periods at 10% is 0.564.

Assuming that ABC wants a minimum rate of return of 10%, what is the net present value of this proposed investment? Is the proposal acceptable?

Year 1234 Cash Flow from Operations, net of taxes P20,000 22,000 24,000 26,000 Present value of P1 at 8% 0.926 0.857 0.794 0.735

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 NPV Sum of Cash Flow1COCtInitial Investment Plug in the values as follows P20000926P22000857P24000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started