Answered step by step

Verified Expert Solution

Question

1 Approved Answer

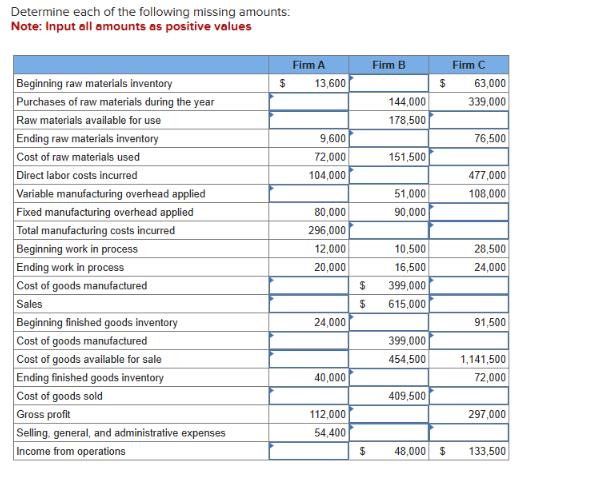

Determine each of the following missing amounts: Note: Input all amounts as positive values Firm A Firm B Firm C Beginning raw materials inventory

Determine each of the following missing amounts: Note: Input all amounts as positive values Firm A Firm B Firm C Beginning raw materials inventory $ 13,600 $ 63,000 Purchases of raw materials during the year 144,000 339,000 Raw materials available for use Ending raw materials inventory 178,500 9,600 76,500 Cost of raw materials used 72,000 151,500 Direct labor costs incurred 104,000 477,000 Variable manufacturing overhead applied 51,000 108,000 Fixed manufacturing overhead applied 80,000 90,000 Total manufacturing costs incurred 296,000 Beginning work in process 12,000 10,500 28,500 Ending work in process 20,000 16,500 24,000 Cost of goods manufactured $ 399,000 Sales $ 615,000 Beginning finished goods inventory 24,000 91,500 Cost of goods manufactured 399,000 Cost of goods available for sale 454,500 1,141,500 Ending finished goods inventory 40,000 72,000 Cost of goods sold 409,500 Gross profit 112,000 297,000 Selling, general, and administrative expenses 54,400 Income from operations $ 48,000 $ 133,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started