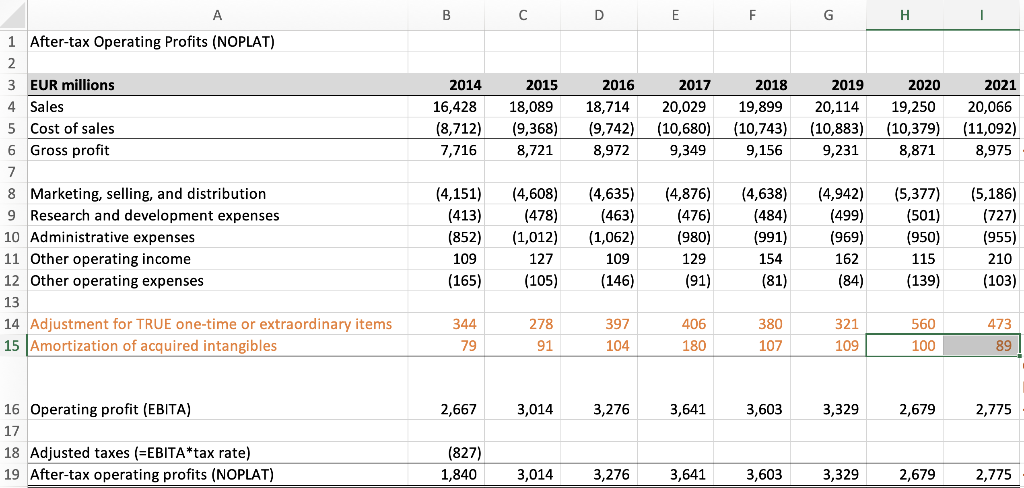

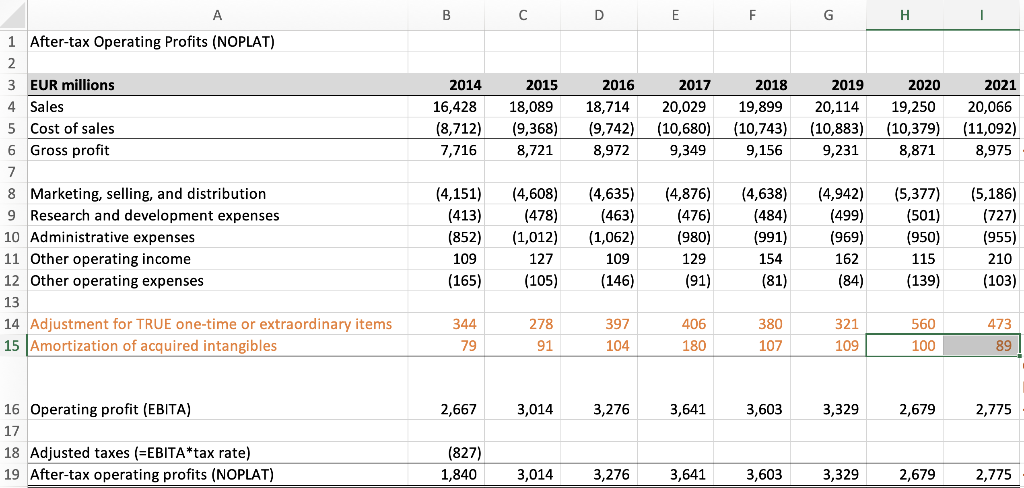

Determine EBITA. Since EBITA should be measured before amortization of acquired intangible, which is already included in marketing, selling and distribution expenses (e.g., page 254 in FY2020 annual report), we should add back that amortization to the adjusted operating profit computed above. For Henkel, amortization is not disclosed on the income statement, but rather in a note to the statements. You can find the amortization of acquired intangible in the sheet Supplement (row 18).

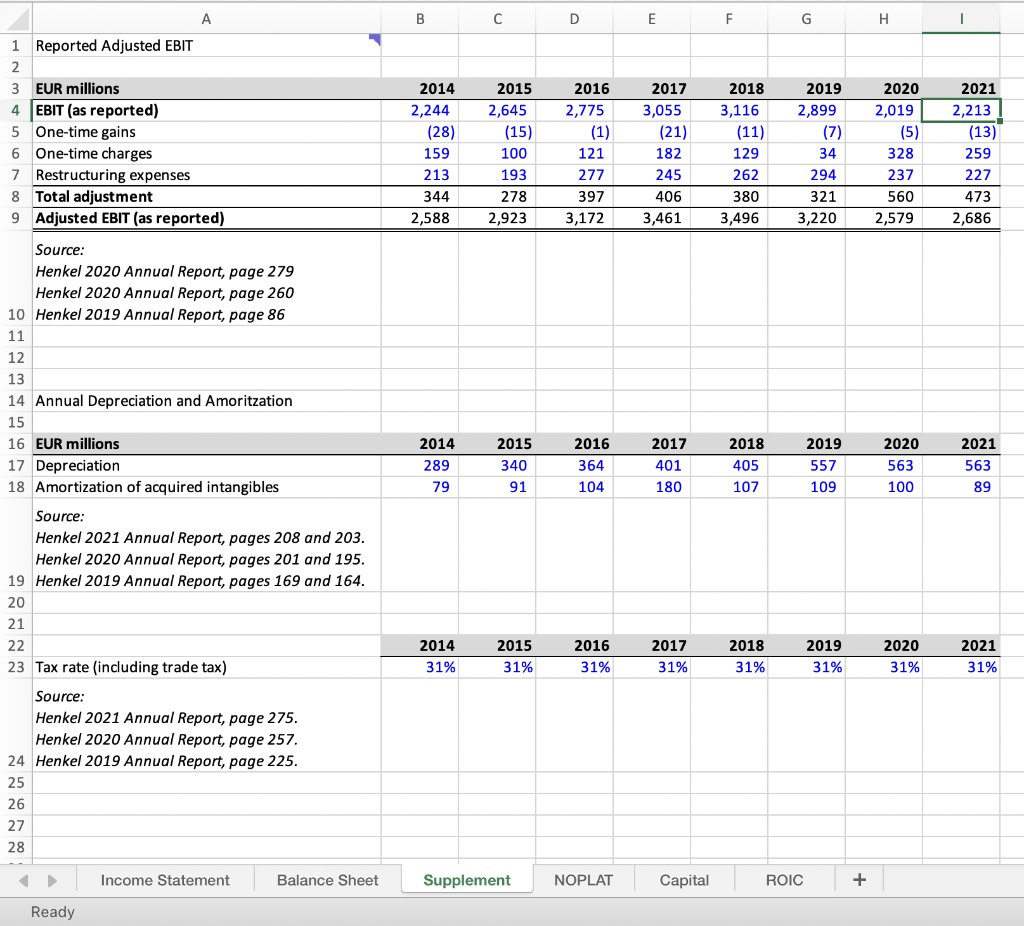

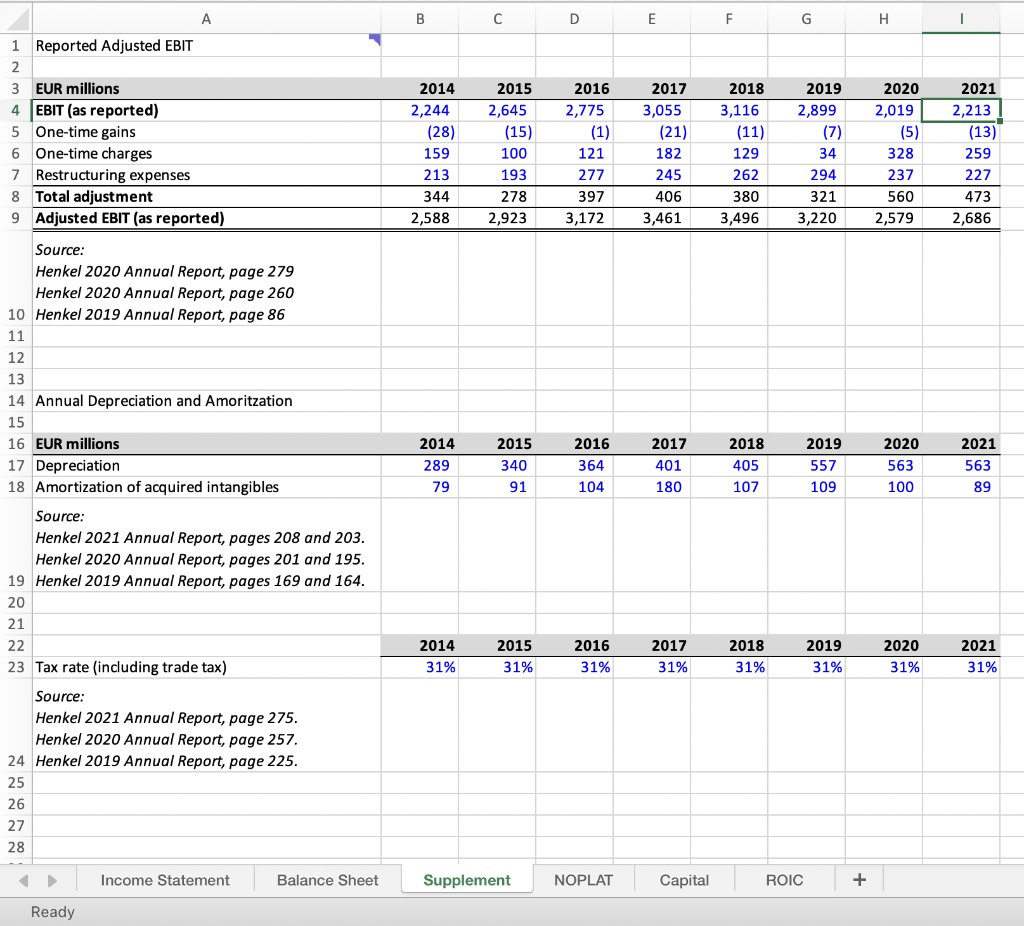

B c D E F G H 2014 16,428 (8,712) 2015 18,089 (9,368) 8,721 2016 18,714 (9,742) 8,972 2017 20,029 (10,680) 9,349 2018 19,899 (10,743) 9,156 2019 20,114 (10,883) 9,231 2020 19,250 (10,379) 8,871 2021 20,066 (11,092) 8,975 7,716 1 After-tax Operating profits (NOPLAT) 2 3 EUR millions 4 Sales 5 Cost of sales 6 Gross profit 7 8 Marketing, selling, and distribution 9 Research and development expenses 10 Administrative expenses 11 Other operating income 12 Other operating expenses 13 14 Adjustment for TRUE one-time or extraordinary items 15 Amortization of acquired intangibles (4,151) (4,876) (413) (476) (4,608) (478) (1,012) 127 (105) (4,635) (463) (1,062) 109 (852) 109 (165) (4,638) (484) (991) 154 (81) (5,377) (501) (950) 115 (980) 129 (91) (4,942) (499) (969) 162 (84) (5,186) (727) (955) 210 (103) (146) (139) 344 79 278 91 397 104 406 180 380 107 321 109 560 100 473 89 2,667 3,014 3,276 3,641 3,603 3,329 2,679 2,775 16 Operating profit (EBITA) 17 18 Adjusted taxes (=EBITA*tax rate) 19 After-tax operating profits (NOPLAT) (827) 1,840 3,014 3,276 3,641 3,603 3,329 2,679 2,775 A B D E F G H 1 Reported Adjusted EBIT 2 3 EUR millions 4 EBIT (as reported) 5 One-time gains 6 One-time charges 7 Restructuring expenses 8 Total adjustment 9 Adjusted EBIT (as reported) 2014 2,244 (28) 159 213 344 2,588 2015 2,645 (15) 100 193 278 2,923 2016 2,775 (1) 121 277 397 3,172 2017 3,055 (21) 182 245 406 3,461 2018 3,116 (11) 129 262 380 3,496 2019 2,899 (7) 34 294 321 3,220 2020 2,019 (5) 328 237 560 2,579 2021 2,213 (13) 259 227 473 2,686 Source: Henkel 2020 Annual Report, page 279 Henkel 2020 Annual Report, page 260 10 Henkel 2019 Annual Report, page 86 11 12 13 14 Annual Depreciation and Amoritzation 15 16 EUR millions 17 Depreciation 18 Amortization of acquired intangibles 2014 289 79 2015 340 91 2016 364 104 2017 401 180 2018 405 107 2019 557 109 2020 563 100 2021 563 89 Source: Henkel 2021 Annual Report, pages 208 and 203. Henkel 2020 Annual Report, pages 201 and 195. 19 Henkel 2019 Annual Report, pages 169 and 164. 20 21 22 23 Tax rate (including trade tax) 2014 31% 2015 31% 2016 31% 2017 31% 2018 31% 2019 31% 2020 31% 2021 31% Source: Henkel 2021 Annual Report, page 275. Henkel 2020 Annual Report, page 257. 24 Henkel 2019 Annual Report, page 225. 25 26 27 28 Income Statement Balance Sheet Supplement NOPLAT Capital ROIC + Ready B c D E F G H 2014 16,428 (8,712) 2015 18,089 (9,368) 8,721 2016 18,714 (9,742) 8,972 2017 20,029 (10,680) 9,349 2018 19,899 (10,743) 9,156 2019 20,114 (10,883) 9,231 2020 19,250 (10,379) 8,871 2021 20,066 (11,092) 8,975 7,716 1 After-tax Operating profits (NOPLAT) 2 3 EUR millions 4 Sales 5 Cost of sales 6 Gross profit 7 8 Marketing, selling, and distribution 9 Research and development expenses 10 Administrative expenses 11 Other operating income 12 Other operating expenses 13 14 Adjustment for TRUE one-time or extraordinary items 15 Amortization of acquired intangibles (4,151) (4,876) (413) (476) (4,608) (478) (1,012) 127 (105) (4,635) (463) (1,062) 109 (852) 109 (165) (4,638) (484) (991) 154 (81) (5,377) (501) (950) 115 (980) 129 (91) (4,942) (499) (969) 162 (84) (5,186) (727) (955) 210 (103) (146) (139) 344 79 278 91 397 104 406 180 380 107 321 109 560 100 473 89 2,667 3,014 3,276 3,641 3,603 3,329 2,679 2,775 16 Operating profit (EBITA) 17 18 Adjusted taxes (=EBITA*tax rate) 19 After-tax operating profits (NOPLAT) (827) 1,840 3,014 3,276 3,641 3,603 3,329 2,679 2,775 A B D E F G H 1 Reported Adjusted EBIT 2 3 EUR millions 4 EBIT (as reported) 5 One-time gains 6 One-time charges 7 Restructuring expenses 8 Total adjustment 9 Adjusted EBIT (as reported) 2014 2,244 (28) 159 213 344 2,588 2015 2,645 (15) 100 193 278 2,923 2016 2,775 (1) 121 277 397 3,172 2017 3,055 (21) 182 245 406 3,461 2018 3,116 (11) 129 262 380 3,496 2019 2,899 (7) 34 294 321 3,220 2020 2,019 (5) 328 237 560 2,579 2021 2,213 (13) 259 227 473 2,686 Source: Henkel 2020 Annual Report, page 279 Henkel 2020 Annual Report, page 260 10 Henkel 2019 Annual Report, page 86 11 12 13 14 Annual Depreciation and Amoritzation 15 16 EUR millions 17 Depreciation 18 Amortization of acquired intangibles 2014 289 79 2015 340 91 2016 364 104 2017 401 180 2018 405 107 2019 557 109 2020 563 100 2021 563 89 Source: Henkel 2021 Annual Report, pages 208 and 203. Henkel 2020 Annual Report, pages 201 and 195. 19 Henkel 2019 Annual Report, pages 169 and 164. 20 21 22 23 Tax rate (including trade tax) 2014 31% 2015 31% 2016 31% 2017 31% 2018 31% 2019 31% 2020 31% 2021 31% Source: Henkel 2021 Annual Report, page 275. Henkel 2020 Annual Report, page 257. 24 Henkel 2019 Annual Report, page 225. 25 26 27 28 Income Statement Balance Sheet Supplement NOPLAT Capital ROIC + Ready