Answered step by step

Verified Expert Solution

Question

1 Approved Answer

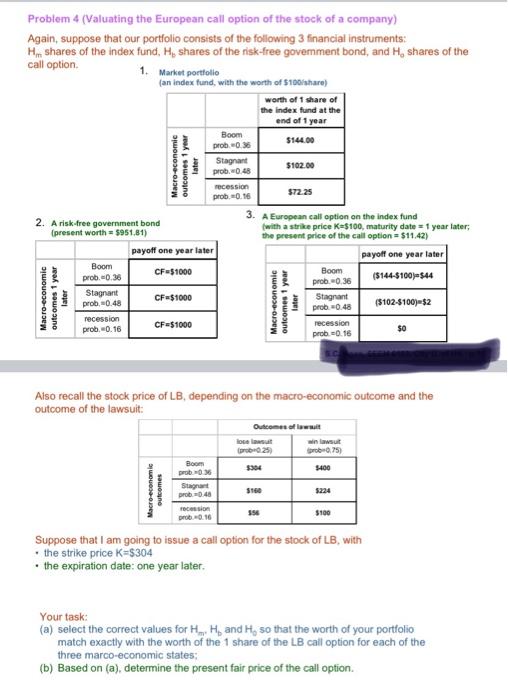

determine present price of call oprion Problem 4 (Valuating the European call option of the stock of a company) Again, suppose that our portfolio consists

determine present price of call oprion

Problem 4 (Valuating the European call option of the stock of a company) Again, suppose that our portfolio consists of the following 3 financial instruments: H, shares of the index fund, H, shares of the risk-free goverment bond, and H, shares of the call option 1. Market portfolio (an index fund, with the worth of S100share) worth of 1 share of the index fund at the end of 1 year Boom $144.00 prob-0% Stagnant prob.0.48 $102.00 ocession prob0.16 $72.25 2. A risk-free government bond 3. A European call option on the index fund (present worth = $951.81) with a strike price =$100, maturity date = 1 year later, the present price of the call option = $11.42) payoff one year later payoff one year later Boom CF-51000 Boom prob.-0.36 prob. -0,36 (5144-5100544 Stagnant CF $1000 Stagnant prob.0.48 prob0.48 (5102-100=52 recession prob.0.16 CF=$1000 recession $0 prob =0.16 Macro-economic outcomes 1 year later Macro-economic outcomes 1 year later Macro-economic outcomes 1 year later Also recall the stock price of LB, depending on the macro-economic outcome and the outcome of the lawsuit: Outcomes of losest (pra-025) winst prob075) 3304 5400 Macroeconomic outcomes Boom prob Stagnant prob0.48 cos 0.16 5224 558 $100 Suppose that I am going to issue a call option for the stock of LB, with . the strike price K=5304 . the expiration date: one year later. Your task: (a) select the correct values for H. H and H, so that the worth of your portfolio match exactly with the worth of the 1 share of the LB call option for each of the three marco-economic states: (b) Based on (a), determine the present fair price of the call option Problem 4 (Valuating the European call option of the stock of a company) Again, suppose that our portfolio consists of the following 3 financial instruments: H, shares of the index fund, H, shares of the risk-free goverment bond, and H, shares of the call option 1. Market portfolio (an index fund, with the worth of S100share) worth of 1 share of the index fund at the end of 1 year Boom $144.00 prob-0% Stagnant prob.0.48 $102.00 ocession prob0.16 $72.25 2. A risk-free government bond 3. A European call option on the index fund (present worth = $951.81) with a strike price =$100, maturity date = 1 year later, the present price of the call option = $11.42) payoff one year later payoff one year later Boom CF-51000 Boom prob.-0.36 prob. -0,36 (5144-5100544 Stagnant CF $1000 Stagnant prob.0.48 prob0.48 (5102-100=52 recession prob.0.16 CF=$1000 recession $0 prob =0.16 Macro-economic outcomes 1 year later Macro-economic outcomes 1 year later Macro-economic outcomes 1 year later Also recall the stock price of LB, depending on the macro-economic outcome and the outcome of the lawsuit: Outcomes of losest (pra-025) winst prob075) 3304 5400 Macroeconomic outcomes Boom prob Stagnant prob0.48 cos 0.16 5224 558 $100 Suppose that I am going to issue a call option for the stock of LB, with . the strike price K=5304 . the expiration date: one year later. Your task: (a) select the correct values for H. H and H, so that the worth of your portfolio match exactly with the worth of the 1 share of the LB call option for each of the three marco-economic states: (b) Based on (a), determine the present fair price of the call option Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started