Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the adjusted balances of 1. Land Improvements 2. Total expenses You noted during your audit of the Carranglan Company that the company carried out

Determine the adjusted balances of 1. Land Improvements 2. Total expenses

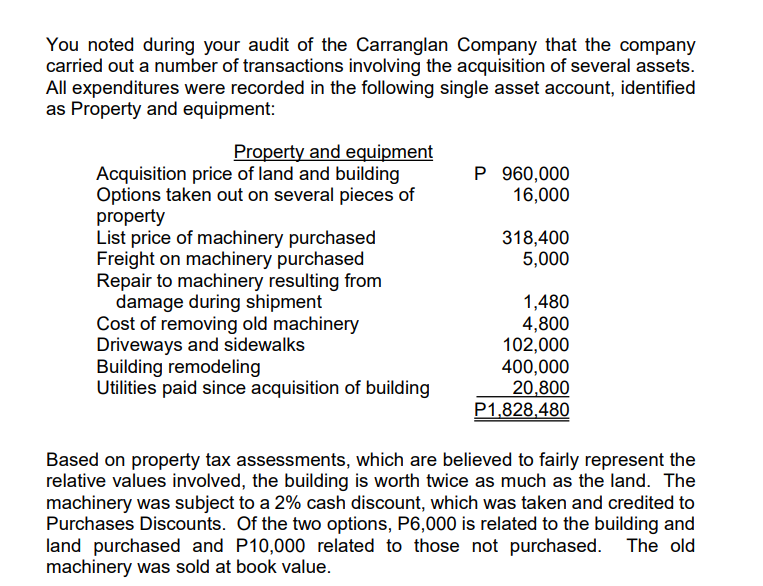

You noted during your audit of the Carranglan Company that the company carried out a number of transactions involving the acquisition of several assets. All expenditures were recorded in the following single asset account, identified as Property and equipment: Property and equipment Acquisition price of land and building Options taken out on several pieces of property List price of machinery purchased Freight on machinery purchased P 960,000 16,000 318,400 5,000 1,480 Cost of removing old machinery 4,800 Driveways and sidewalks 102,000 Building remodeling 400,000 Utilities paid since acquisition of building 20,800 P1,828,480 Repair to machinery resulting from damage during shipment Based on property tax assessments, which are believed to fairly represent the relative values involved, the building is worth twice as much as the land. The machinery was subject to a 2% cash discount, which was taken and credited to Purchases Discounts. Of the two options, P6,000 is related to the building and land purchased and P10,000 related to those not purchased. The old machinery was sold at book value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started