Answered step by step

Verified Expert Solution

Question

1 Approved Answer

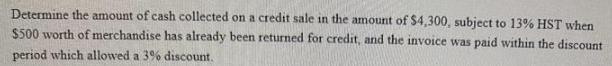

Determine the amount of cash collected on a credit sale in the amount of $4,300, subject to 13% HST when $500 worth of merchandise

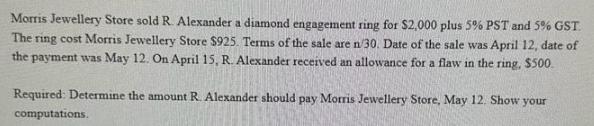

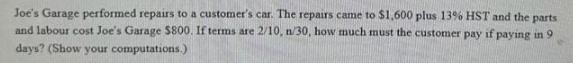

Determine the amount of cash collected on a credit sale in the amount of $4,300, subject to 13% HST when $500 worth of merchandise has already been returned for credit, and the invoice was paid within the discount period which allowed a 3% discount. Morris Jewellery Store sold R. Alexander a diamond engagement ring for $2,000 plus 5% PST and 5% GST. The ring cost Morris Jewellery Store $925. Terms of the sale are n/30. Date of the sale was April 12, date of the payment was May 12. On April 15, R. Alexander received an allowance for a flaw in the ring, $500. Required: Determine the amount R. Alexander should pay Morris Jewellery Store, May 12. Show your computations. Joe's Garage performed repairs to a customer's car. The repairs came to $1,600 plus 13% HST and the parts and labour cost Joe's Garage $800. If terms are 2/10, n/30, how much must the customer pay if paying in 9 days? (Show your computations.)

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started