Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the amount of goodwill or gain on bargain purchase from the above transaction. b. Give the adjusting entry assuming that the company determined on

Determine the amount of goodwill or gain on bargain purchase from the above transaction.

b. Give the adjusting entry assuming that the company determined on September 30, 202X that there is an 80% probability that the estimated average income will be achieved.

c. Give the adjusting entry assuming that the company determined on March 31, 202Y that there is a 90% probability that the estimated average income will be achieved.

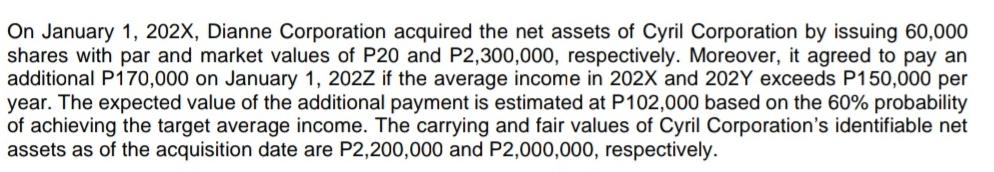

On January 1, 202X, Dianne Corporation acquired the net assets of Cyril Corporation by issuing 60,000 shares with par and market values of P20 and P2,300,000, respectively. Moreover, it agreed to pay an additional P170,000 on January 1, 202Z if the average income in 202X and 202Y exceeds P150,000 per year. The expected value of the additional payment is estimated at P102,000 based on the 60% probability of achieving the target average income. The carrying and fair values of Cyril Corporation's identifiable net assets as of the acquisition date are P2,200,000 and P2,000,000, respectively.

Step by Step Solution

★★★★★

3.40 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of Goodwill or Gain on Bargain Purchase The formula for calculating goodwill in a business combination is Goodwill Fair value of conside...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started