Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the appropriate adjustments needed to account for Bad Debts. Be sure to show all work. It's the end of August, 2020 and you

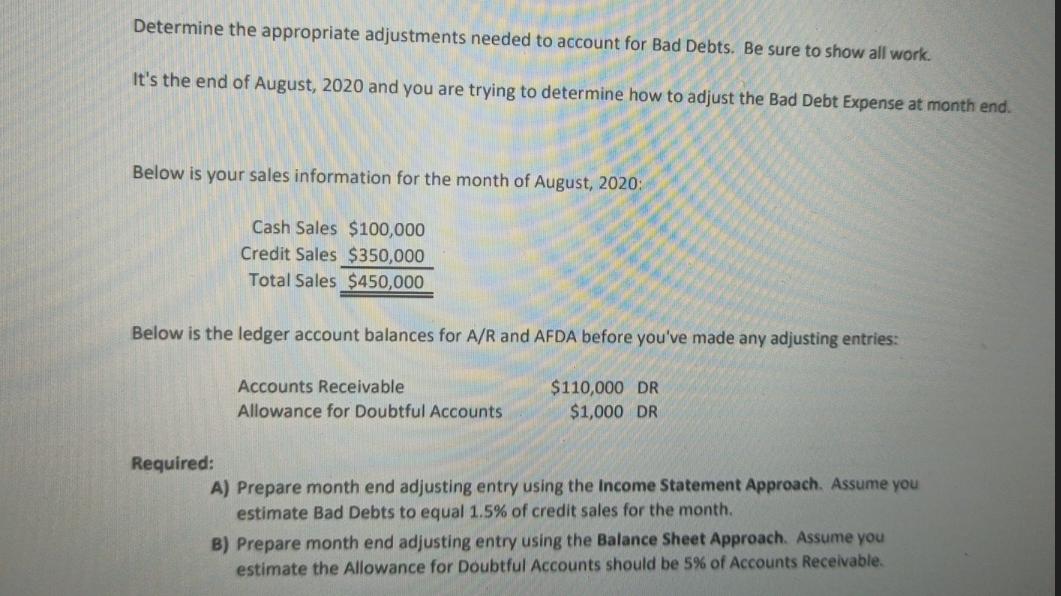

Determine the appropriate adjustments needed to account for Bad Debts. Be sure to show all work. It's the end of August, 2020 and you are trying to determine how to adjust the Bad Debt Expense at month end. Below is your sales information for the month of August, 2020: Cash Sales $100,000 Credit Sales $350,000 Total Sales $450,000 Below is the ledger account balances for A/R and AFDA before you've made any adjusting entries: $110,000 DR $1,000 DR Required: Accounts Receivable Allowance for Doubtful Accounts A) Prepare month end adjusting entry using the Income Statement Approach. Assume you estimate Bad Debts to equal 1.5% of credit sales for the month. B) Prepare month end adjusting entry using the Balance Sheet Approach. Assume you estimate the Allowance for Doubtful Accounts should be 5% of Accounts Receivable.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer A Using income statement approach we have to estimate bad debts upto 15 of credit s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started