Answered step by step

Verified Expert Solution

Question

1 Approved Answer

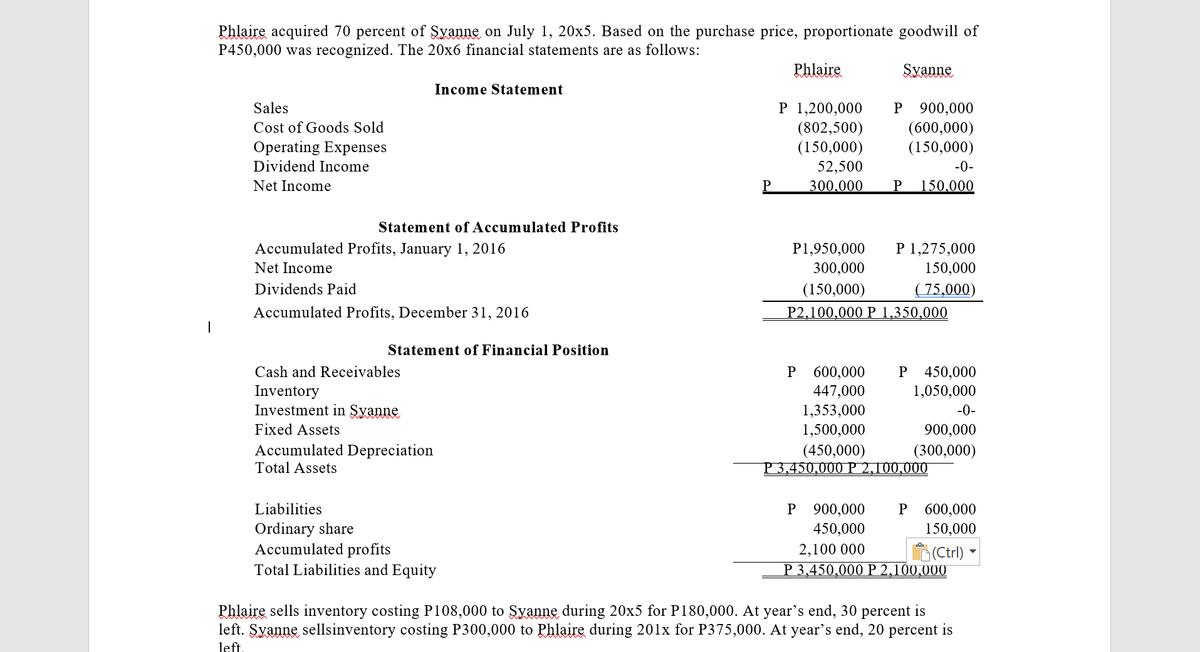

Determine the consolidated balances of NON-CONTROLLING INTEREST IN NET ASSESTS SUBSIDIARY in the year 20x6. Phlaire acquired 70 percent of Syanne on July 1, 20x5.

Determine the consolidated balances of NON-CONTROLLING INTEREST IN NET ASSESTS SUBSIDIARY in the year 20x6.

Phlaire acquired 70 percent of Syanne on July 1, 20x5. Based on the purchase price, proportionate goodwill of P450,000 was recognized. The 20x6 financial statements are as follows: Phlaire Syanne Income Statement Sales P 1,200,000 P 900,000 Cost of Goods Sold Operating Expenses Dividend Income (600,000) (150,000) (802,500) (150,000) 52,500 -0- Net Income 300.000 150.000 Statement of Accumulated Profits Accumulated Profits, January 1, 2016 P1,950,000 300,000 P 1,275,000 150,000 Net Income Dividends Paid (150,000) (75,000) Accumulated Profits, December 31, 2016 P2,100,000 P 1,350,000 Statement of Financial Position Cash and Receivables P 600,000 P 450,000 Inventory Investment in Syanne Fixed Assets 447,000 1,050,000 1,353,000 -0- 1,500,000 900,000 Accumulated Depreciation Total Assets (450,000) P3,450,000 P 2,100,000 (300,000) P 900,000 450,000 Liabilities P 600,000 Ordinary share Accumulated profits Total Liabilities and Equity 150,000 2,100 000 (Ctrl) - P 3,450,000 P 2,100,000 Phlaire sells inventory costing P108,000 to Syanne during 20x5 for P180,000. At year's end, 30 percent is left. Syanne sellsinventory costing P300,000 to Phlaire during 201x for P375,000. At year's end, 20 percent is left

Step by Step Solution

★★★★★

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Amount Cost of goods sold of Parent Company 8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

608c00a37fb05_208245.pdf

180 KBs PDF File

608c00a37fb05_208245.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started