Answered step by step

Verified Expert Solution

Question

1 Approved Answer

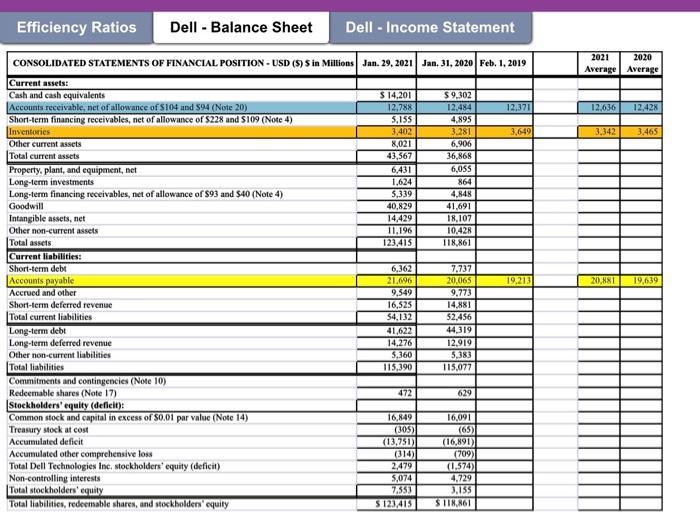

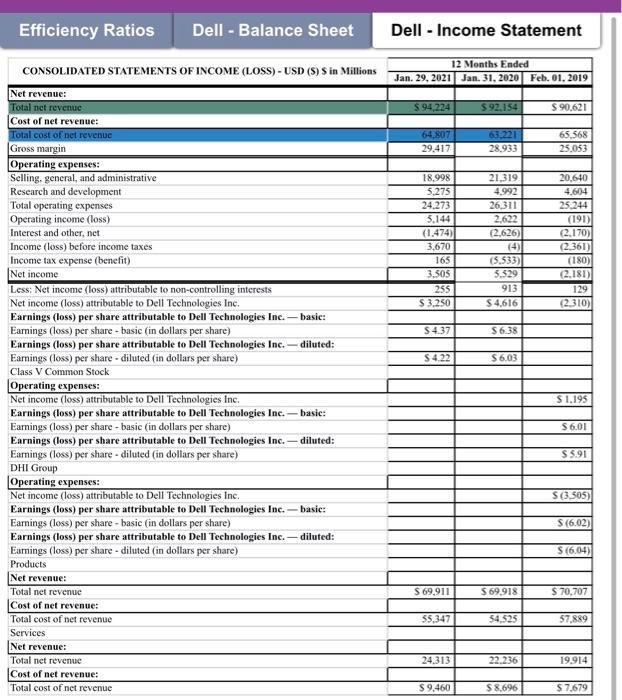

Determine the efficiency ratios and cash conversion cycle for Dell Technologies, Inc. for the years 2021 and 2020? use the below excel sheets to figure

Determine the efficiency ratios and cash conversion cycle for Dell Technologies, Inc. for the years 2021 and 2020?

use the below excel sheets to figure out the ratios

Efficiency Ratios CONSOLIDATED STATEMENTS OF FINANCIAL POSITION - USD ($) 5 in Millions Jan. 29, 2021 Jan. 31, 2020 Feb. 1, 2019 Current assets: Cash and cash equivalents Accounts receivable, net of allowance of $104 and 594 (Note 20) Short-term financing receivables, net of allowance of $228 and $109 (Note 4) Inventories Other current assets Total current assets Property, plant, and equipment, net Long-term investments Long-term financing receivables, net of allowance of $93 and $40 (Note 4) Goodwill Intangible assets, net Dell - Balance Sheet Other non-current assets Total assets Current liabilities: Short-term debt Accounts payable Accrued and other Short-term deferred revenue Total current liabilities Long-term debt Long-term deferred revenue Other non-current liabilities Total liabilities Commitments and contingencies (Note 10) Redeemable shares (Note 17). Stockholders' equity (deficit): Common stock and capital in excess of $0.01 par value (Note 14) Treasury stock at cost Dell - Income Statement Accumulated deficit Accumulated other comprehensive loss Total Dell Technologies Inc. stockholders' equity (deficit) Non-controlling interests Total stockholders' equity Total liabilities, redeemable shares, and stockholders' equity $ 14,201 12,788 5,155 3,402 8,021 43,567 6,431 1,624 5,339 40,829 14,429 11,196 123,415 6,362 21,696 9,549 16,525 54,132 41,622 14,276 5,360 115,390 472 16,849 (305) (13,751) (314) 2,479 5,074 7,553 $ 123,415 $9,302 12,484 4,895 3.281 6,906 36,868 6,055 864 4,848 41,691 18,107 10,428 118,861 7,737 20,065 9,773 14,881 52,456 44,319 12,919 5,383 115,077 629 16,091 (65) (16,891) (709) (1.574) 4,729 3,155 $118,861 12,371 3,649 19,213 2020 2021 Average Average 12,636 12,428 3,342 20,881 3,465 19,639

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started