Answered step by step

Verified Expert Solution

Question

1 Approved Answer

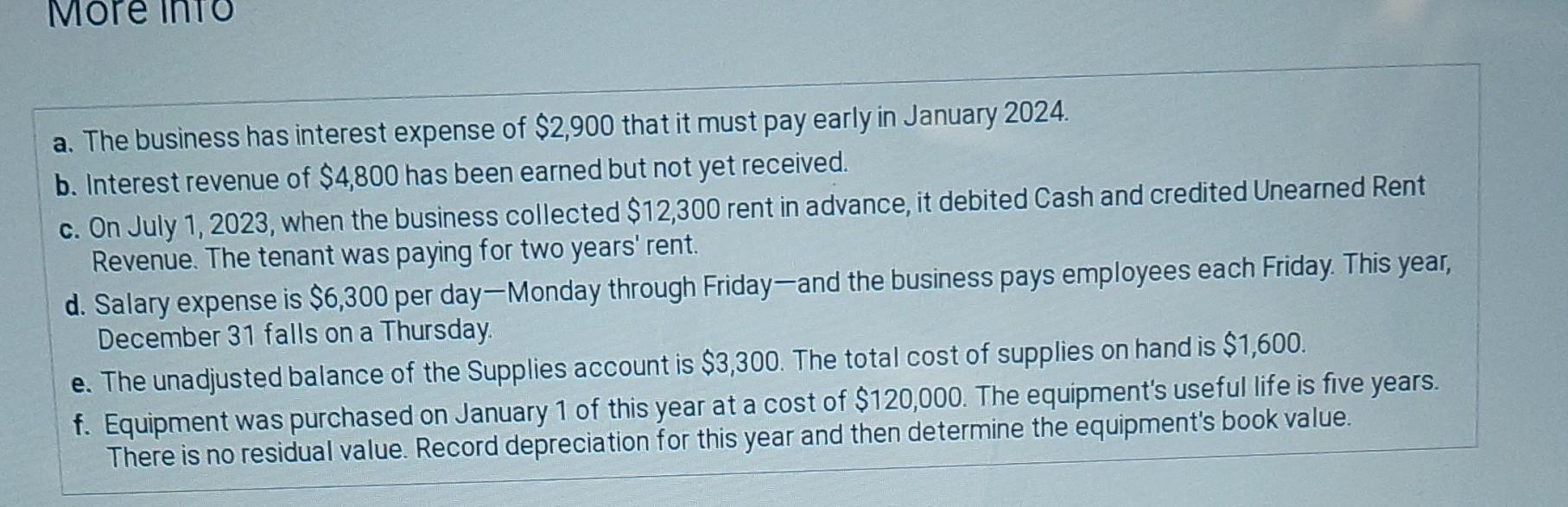

Determine the equipments book value More a. The business has interest expense of $2,900 that it must pay early in January 2024. b. Interest revenue

Determine the equipments book value

More a. The business has interest expense of $2,900 that it must pay early in January 2024. b. Interest revenue of $4,800 has been earned but not yet received. c. On July 1, 2023, when the business collected $12,300 rent in advance, it debited Cash and credited Unearned Rent Revenue. The tenant was paying for two years' rent. d. Salary expense is $6,300 per day-Monday through Friday-and the business pays employees each Friday. This year, December 31 falls on a Thursday. e. The unadjusted balance of the Supplies account is $3,300. The total cost of supplies on hand is $1,600. f. Equipment was purchased on January 1 of this year at a cost of $120,000. The equipment's useful life is five years. There is no residual value. Record depreciation for this year and then determine the equipment's book value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the additional information provided we can now proceed with recording the necessary transac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started