Question

Following data relates to Shafaq Limited (SL): Supplies made with tax deduction u/s 153 Imports of raw material Exports made with tax deduction u/s

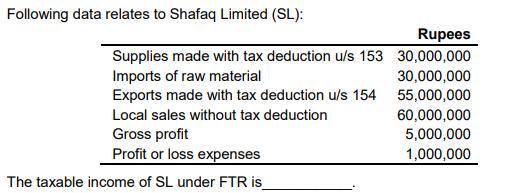

Following data relates to Shafaq Limited (SL): Supplies made with tax deduction u/s 153 Imports of raw material Exports made with tax deduction u/s 154 Local sales without tax deduction Gross profit Profit or loss expenses The taxable income of SL under FTR is Rupees 30,000,000 30,000,000 55,000,000 60,000,000 5,000,000 1,000,000

Step by Step Solution

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Answer The taxable income of SL under F TR is 4 000 000 Explanation This can be calculated by adding ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Survey of Accounting

Authors: Carl S. Warren

8th edition

1305961889, 978-1337517386, 1337517380, 978-1305961883

Students also viewed these Civil Engineering questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App