- Determine the inventory values CAT would report for the two most recent balance sheets if CAT had used the FIFO method instead of the LIFO method.

- Include a table with your calculations. To assist you with inserting a table, review Tables, Images, & AppendicesLinks to an external site..

- Determine CATs cost of goods sold for the two most recent years if CAT had used the FIFO method instead of LIFO.

- Include a table with your calculations.

- Determine CATs net income (profit) for the two most recent years if CAT had used the FIFO method instead of LIFO.

- Include a table with your calculations.

- Determine the income tax savings that CAT has generated through the most recent year by using the LIFO method instead of the FIFO method.

- Include a table with your calculations.

- Calculate and compare CATs gross profit margin and net profit margin under the LIFO and FIFO method.

- Include a table with your calculations.

- Pose one question about accounting for inventory, inventory valuation, or analyzing a companys inventory.

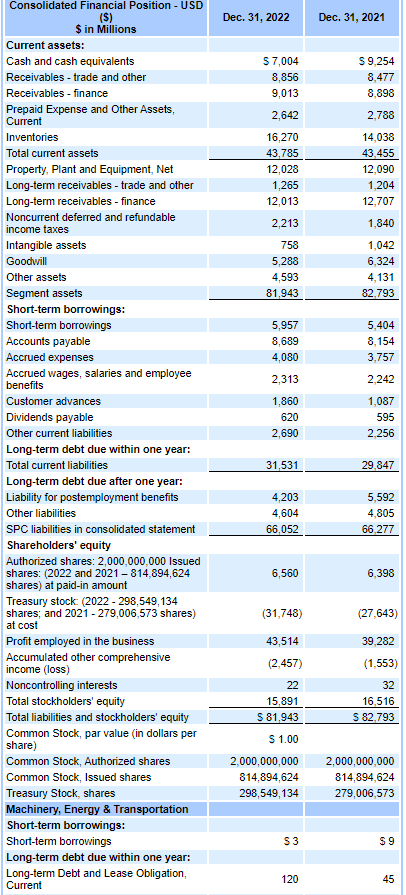

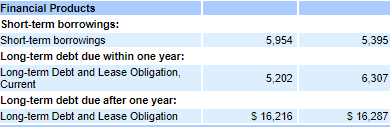

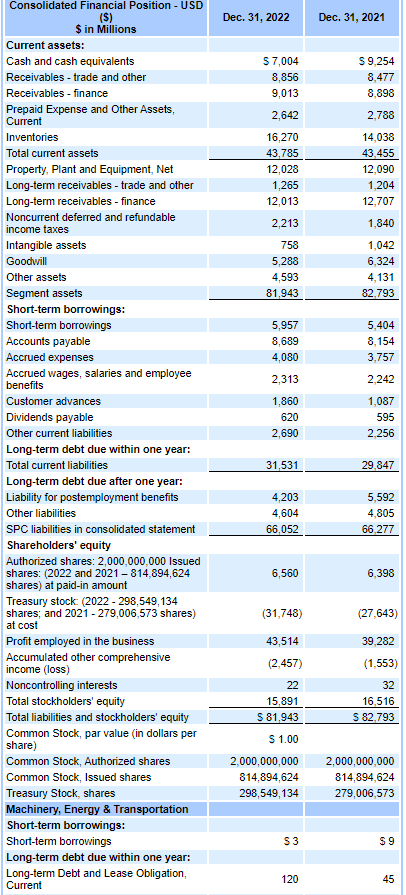

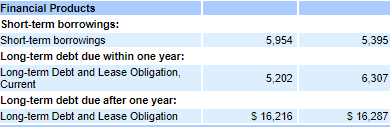

\begin{tabular}{|c|c|c|} \hline \begin{tabular}{c} Consolidated Financial Position - USD \\ (\$) \\ $ in Millions \end{tabular} & Dec. 31,2022 & Dec. 31, 2021 \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $7,004 & $9,254 \\ \hline Receivables - trade and other & 8,856 & 8,477 \\ \hline Receivables - finance & 9,013 & 8,898 \\ \hline \begin{tabular}{l} Prepaid Expense and Other Assets, \\ Current \end{tabular} & 2,642 & 2,788 \\ \hline Inventories & 16,270 & 14,038 \\ \hline Total current assets & 43,785 & 43,455 \\ \hline Property, Plant and Equipment, Net & 12,028 & 12,090 \\ \hline Long-term receivables - trade and other & 1,265 & 1,204 \\ \hline Long-term receivables - finance & 12,013 & 12,707 \\ \hline \begin{tabular}{l} Noncurrent deferred and refundable \\ income taxes \end{tabular} & 2,213 & 1,840 \\ \hline Intangible assets & 758 & 1,042 \\ \hline Goodwill & 5,288 & 6,324 \\ \hline Other assets & 4,593 & 4,131 \\ \hline Segment assets & 81,943 & 82,793 \\ \hline \multicolumn{3}{|l|}{ Short-term borrowings: } \\ \hline Short-term borrowings & 5,957 & 5,404 \\ \hline Accounts payable & 8,689 & 8,154 \\ \hline Accrued expenses & 4,080 & 3,757 \\ \hline \begin{tabular}{l} Accrued wages, salaries and employee \\ benefits \end{tabular} & 2,313 & 2,242 \\ \hline Customer advances & 1,860 & 1,087 \\ \hline Dividends payable & 620 & 595 \\ \hline Other current liabilities & 2,690 & 2,256 \\ \hline \multicolumn{3}{|l|}{ Long-term debt due within one year: } \\ \hline Total current liabilities & 31,531 & 29,847 \\ \hline \multicolumn{3}{|l|}{ Long-term debt due after one year: } \\ \hline Liability for postemployment benefits & 4,203 & 5,592 \\ \hline Other liabilities & 4,604 & 4,805 \\ \hline SPC liabilities in consolidated statement & 66,052 & 66,277 \\ \hline \multicolumn{3}{|l|}{ Shareholders' equity } \\ \hline \begin{tabular}{l} Authorized shares: 2,000,000,000 Issued \\ shares: ( 2022 and 2021814,894,624 \\ shares) at paid-in amount \end{tabular} & 6,560 & 6,398 \\ \hline \begin{tabular}{l} Treasury stock: (2022-298,549,134 \\ shares; and 2021279,006,573 shares) \\ at cost \end{tabular} & (31,748) & (27,643) \\ \hline Profit employed in the business & 43,514 & 39,282 \\ \hline \begin{tabular}{l} Accumulated other comprehensive \\ income (loss) \end{tabular} & (2,457) & (1,553) \\ \hline Noncontrolling interests & 22 & 32 \\ \hline Total stockholders' equity & 15,891 & 16,516 \\ \hline Total liabilities and stockholders' equity & $81,943 & $82,793 \\ \hline \begin{tabular}{l} Common Stock, par value (in dollars per \\ share) \end{tabular} & $1.00 & \\ \hline Common Stock, Authorized shares & 2,000,000,000 & 2,000,000,000 \\ \hline Common Stock, Issued shares & 814,894,624 & 814,894,624 \\ \hline Treasury Stock, shares & 298,549,134 & 279,006,573 \\ \hline \multicolumn{3}{|l|}{ Machinery, Energy \& Transportation } \\ \hline \multicolumn{3}{|l|}{ Short-term borrowings: } \\ \hline Short-term borrowings & $3 & $9 \\ \hline \multicolumn{3}{|l|}{ Long-term debt due within one year: } \\ \hline \begin{tabular}{l} Long-term Debt and Lease Obligation, \\ Current \end{tabular} & 120 & 45 \\ \hline \end{tabular} \begin{tabular}{l|r|r|} \begin{tabular}{l} Financial Products \\ Short-term borrowing: \end{tabular} & \\ Short-term borrowings \\ Long-term debt due within one year: \\ Long-term Debt and Lease Obligation, \\ Current \\ Long-term debt due after one year: \\ Long-term Debt and Lease Obligation \end{tabular}