Answered step by step

Verified Expert Solution

Question

1 Approved Answer

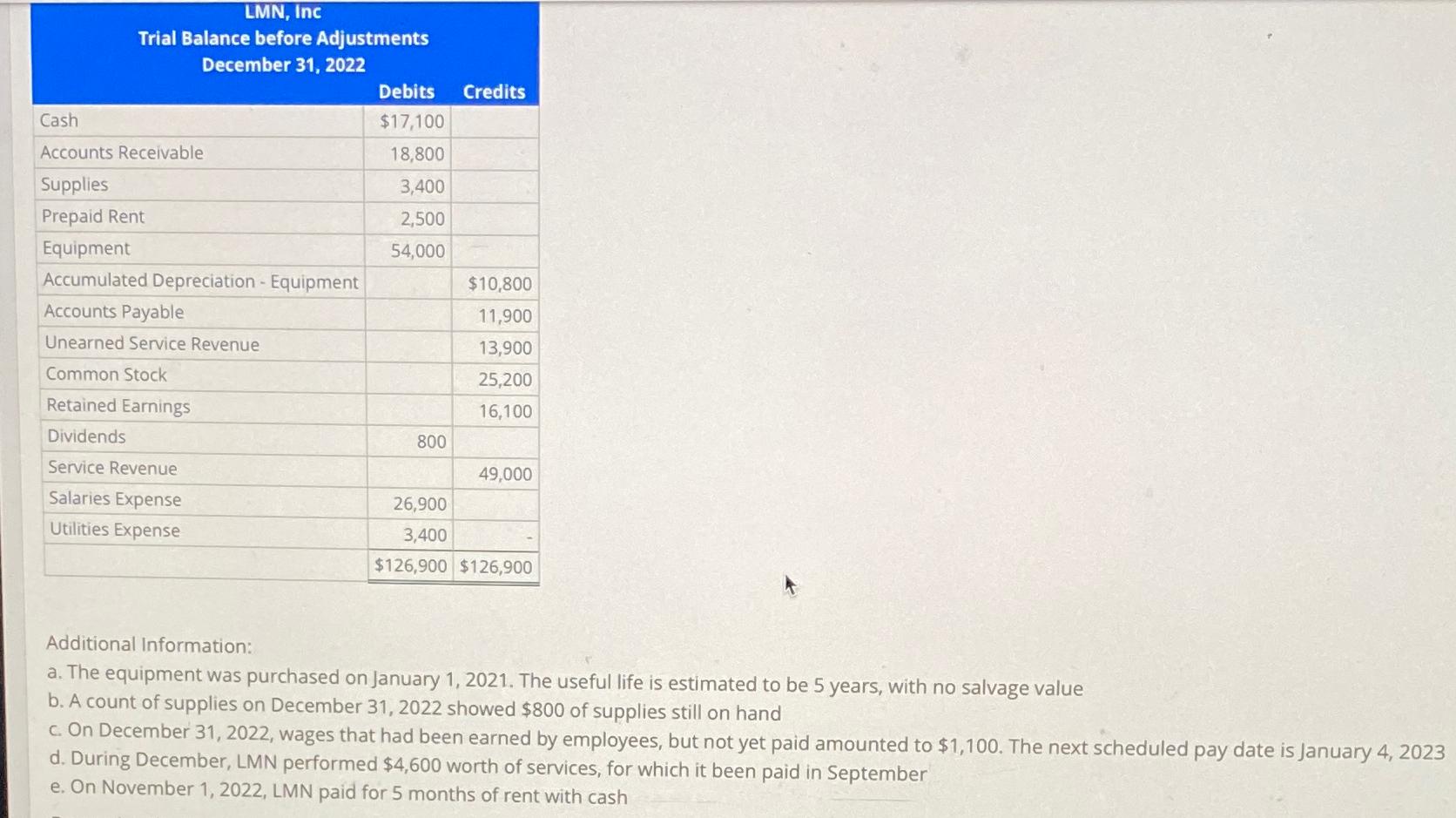

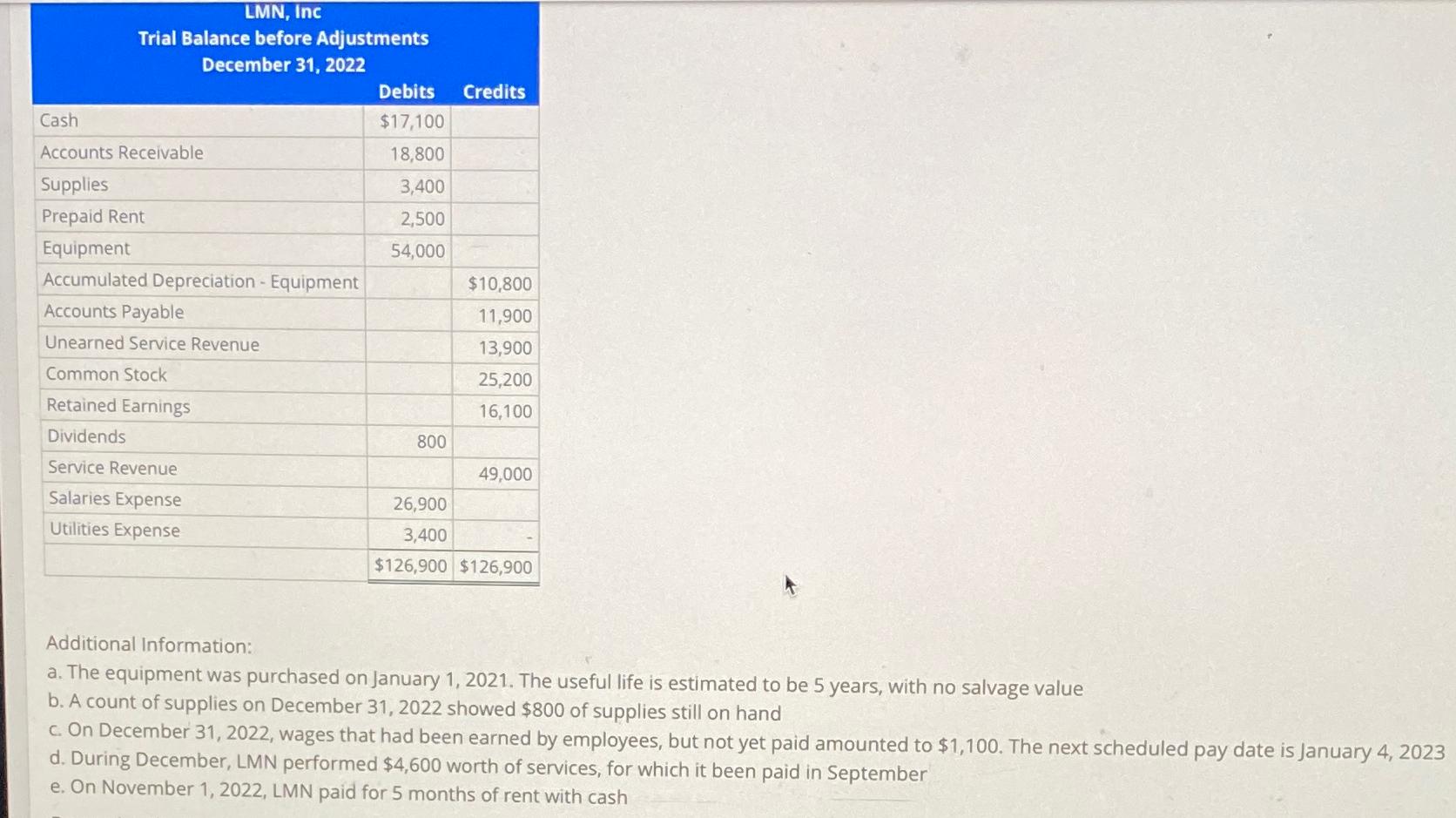

Determine the Net Income for the year ending December 31, 2022, after all adjusting entries have been made LMN, Inc Trial Balance before Adjustments December

Determine the Net Income for the year ending December 31, 2022, after all adjusting entries have been made

LMN, Inc Trial Balance before Adjustments December 31, 2022 Debits Credits Cash Accounts Receivable Supplies Prepaid Rent Equipment $17,100 18,800 3,400 2,500 54,000 Accumulated Depreciation - Equipment $10,800 Accounts Payable 11,900 Unearned Service Revenue 13,900 Common Stock 25,200 Retained Earnings 16,100 Dividends 800 Service Revenue 49,000 Salaries Expense 26,900 Utilities Expense 3,400 $126,900 $126,900 Additional Information: a. The equipment was purchased on January 1, 2021. The useful life is estimated to be 5 years, with no salvage value b. A count of supplies on December 31, 2022 showed $800 of supplies still on hand c. On December 31, 2022, wages that had been earned by employees, but not yet paid amounted to $1,100. The next scheduled pay date is January 4, 2023 d. During December, LMN performed $4,600 worth of services, for which it been paid in September e. On November 1, 2022, LMN paid for 5 months of rent with cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the net income for the year ending December 31 2022 we need to make adjusting entries for the following 1 Depreciation expense for the eq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started