Answered step by step

Verified Expert Solution

Question

1 Approved Answer

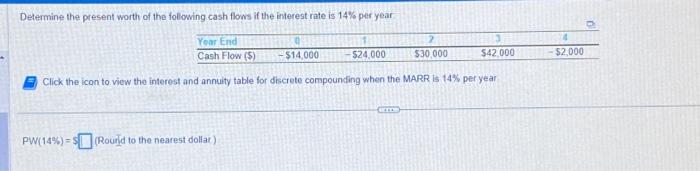

Determine the present worth of the following cash flows if the interest rate is 14% per year 2 Year End Cash Flow (5) $30,000

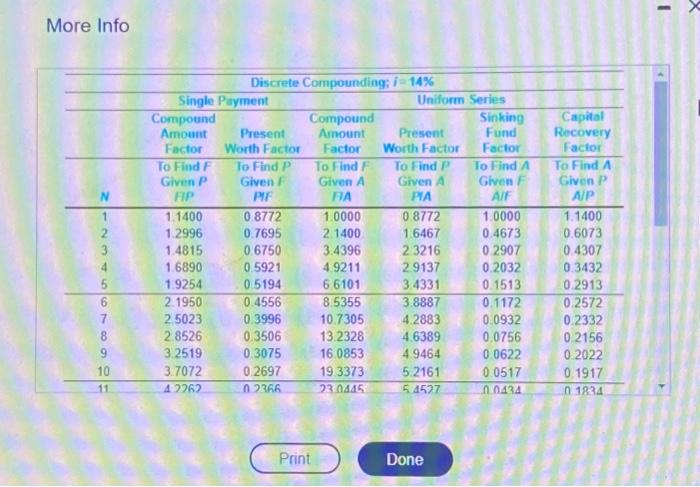

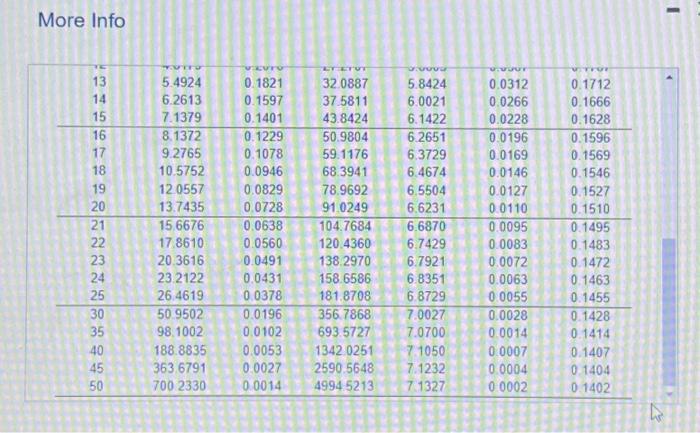

Determine the present worth of the following cash flows if the interest rate is 14% per year 2 Year End Cash Flow (5) $30,000 Click the icon to view the interest and annuity table for discrete compounding when the MARR is 14% per year PW(14%) = $(Rourid to the nearest dollar) $14,000 $24,000 $42.000 4 $2,000 More Info 8 9 10 11 Single Payment Compound Amount Factor Discrete Compounding; -14% To Find F Given P FIP 1.1400 1.2996 1.4815 1.6890 1.9254 2.1950 2.5023 2.8526 3.2519 3.7072 4.2262 Present Worth Factor To Find P Given F PIF 0.8772 0.7695 0.6750 0.5921 0.5194 0.4556 0.3996 0.3506 0.3075 0.2697 02366 Compound Amount Factor Print To Find F Given A FIA 1.0000 2.1400 3.4396 4.9211 6.6101 8.5355 10.7305 13.2328 16.0853 19.3373 23.0445 Uniform Series Present Worth Factor To Find P Given A PIA 0.8772 1.6467 2.3216 2.9137 3.4331 3.8887 4.2883 4.6389 4.9464 5.2161 5.4527 Done Sinking Fund Factor To Find A Given F AIF 1.0000 0.4673 0.2907 0.2032 0.1513 0.1172 0.0932 0,0756 0.0622 0.0517 00434 Capital Recovery Factor To Find A Given P A/P 1.1400 0.6073 0.4307 0.3432 0.2913 0.2572 0.2332 0.2156 0.2022 0.1917 01834 X More Info 13 14 15 16 17 18 19 20 21 22 23 24 25 30 35 40 45 50 TVIES 5.4924 6.2613 7.1379 8.1372 9.2765 10.5752 12.0557 13.7435 15.6676 17.8610 20.3616 23.2122 26.4619 50.9502 98,1002 188.8835 363.6791 700 2330 VEVO 0.1821 0.1597 0.1401 0.1229 0.1078 0.0946 0.0829 0.0728 0.0638 0.0560 0.0491 0.0431 0.0378 0.0196 0.0102 0.0053 0.0027 0.0014 ET ETUT 32.0887 37.5811 43.8424 50.9804 59.1176 68.3941 78.9692 91.0249 104.7684 120 4360 138.2970 158.6586 181.8708 356.7868 693.5727 1342 0251 2590.5648 NE 324 4994 5213 9.5000 5.8424 6.0021 6.1422 6.2651 6.3729 6.4674 6.5504 6.6231 6.6870 6.7429 6.7921 6.8351 6.8729 7.0027 7.0700 7.1050 7.1232 72 52 I 727 ** 7.1327 2 V.Vuur 0.0312 0.0266 0.0228 0.0196 0.0169 0.0146 0.0127 0.0110 0.0095 0.0083 0.0072 0.0063 0.0055 0.0028 0.0014 0.0007 0.0004 0.0002 O O TECH 722 TOP 0.1712 0.1666 0.1628 KOS 0.1596 0.1569 0.1546 0.1527 0.1510 0.1495 0.1483 0.1472 0.1463 0.1455 0.1428 0.1414 0.1407 0.1404 0.1402 OOA O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the present worth of the cash flows provided you will need to discount each cash flow b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started