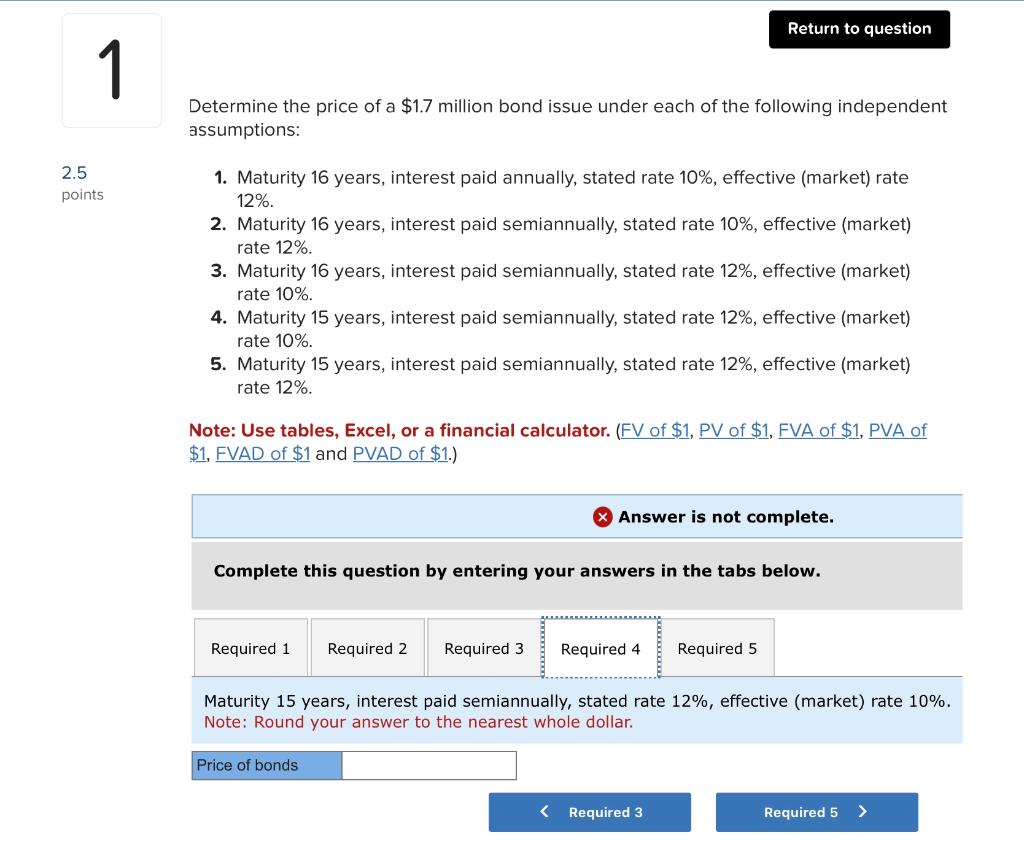

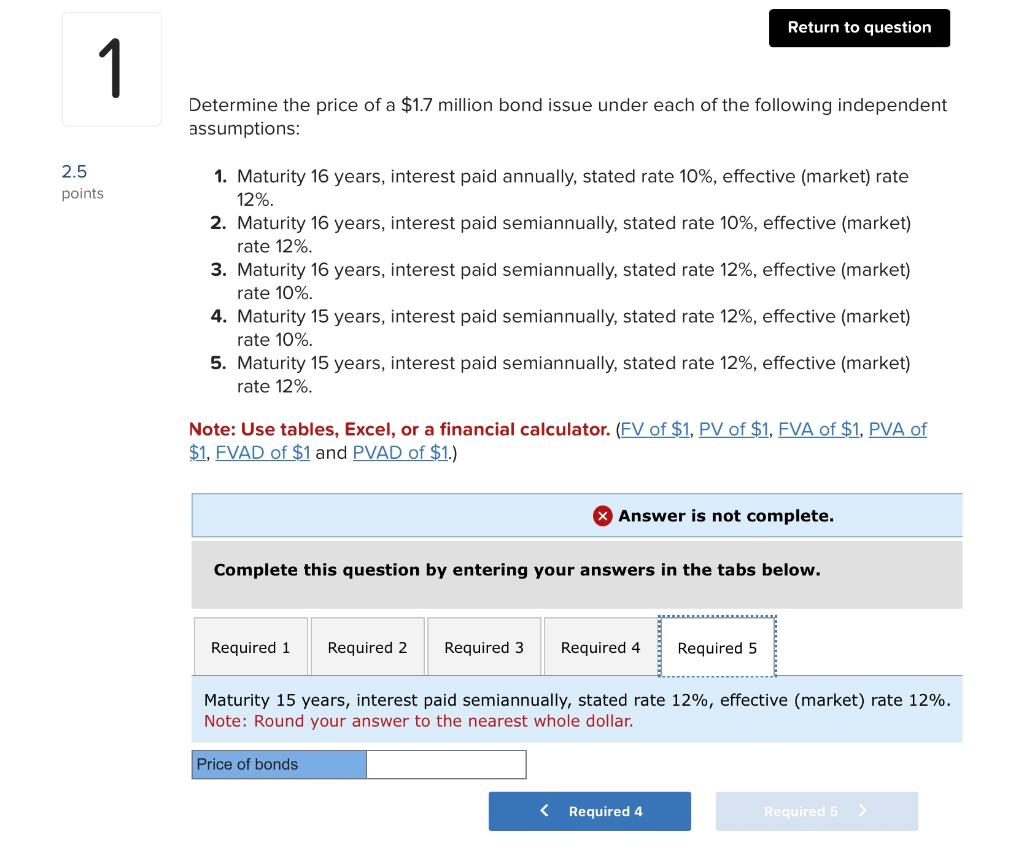

Determine the price of a $1.7 million bond issue under each of the following independent assumptions:

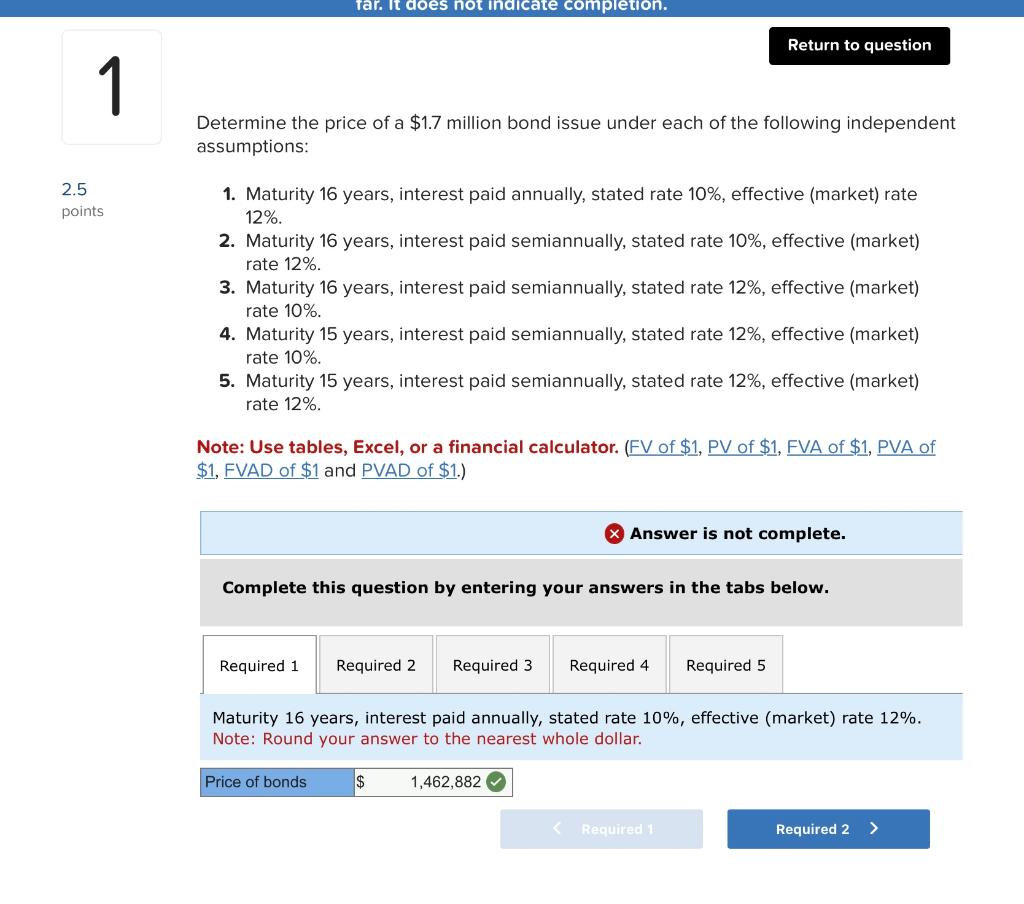

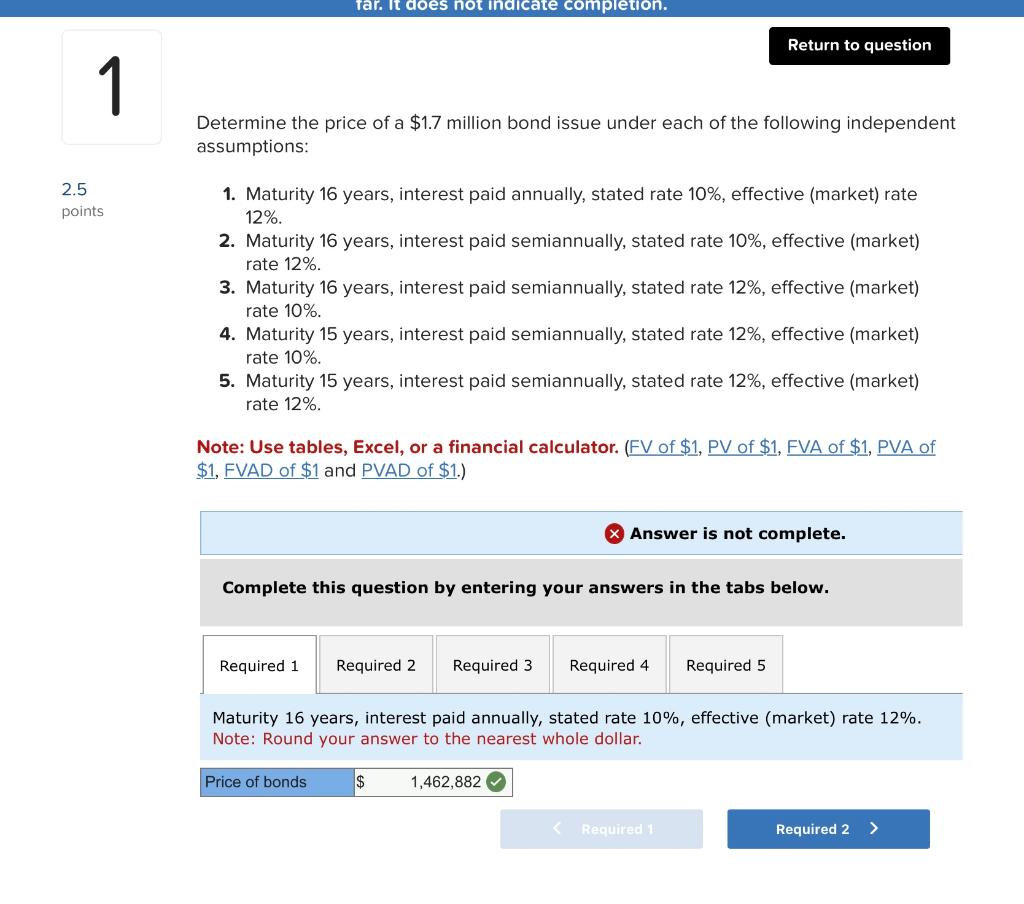

Maturity 16 years, interest paid annually, stated rate 10%, effective (market) rate 12%.

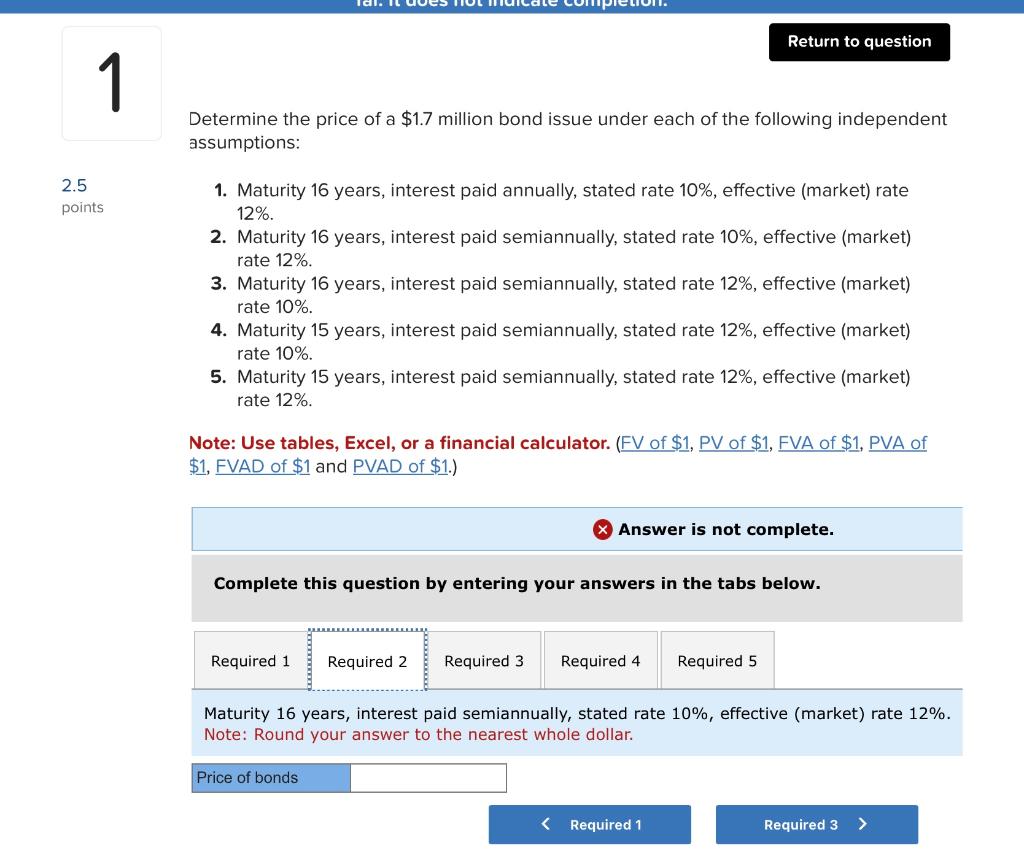

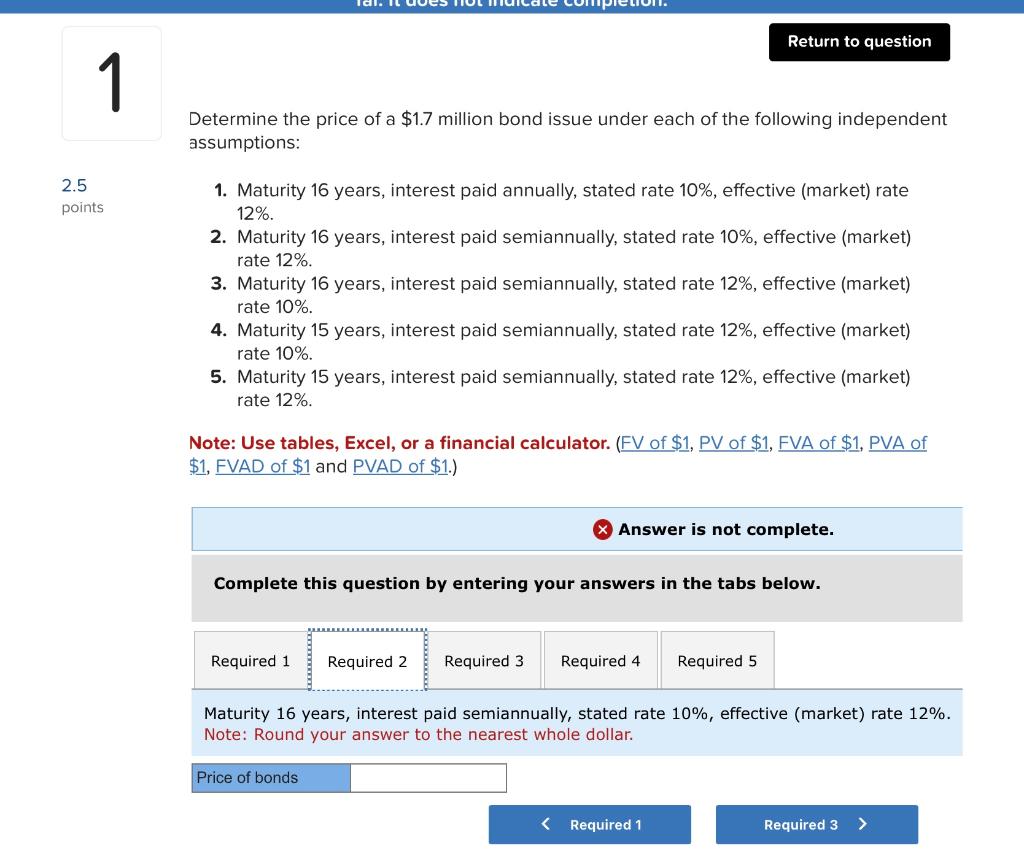

Maturity 16 years, interest paid semiannually, stated rate 10%, effective (market) rate 12%.

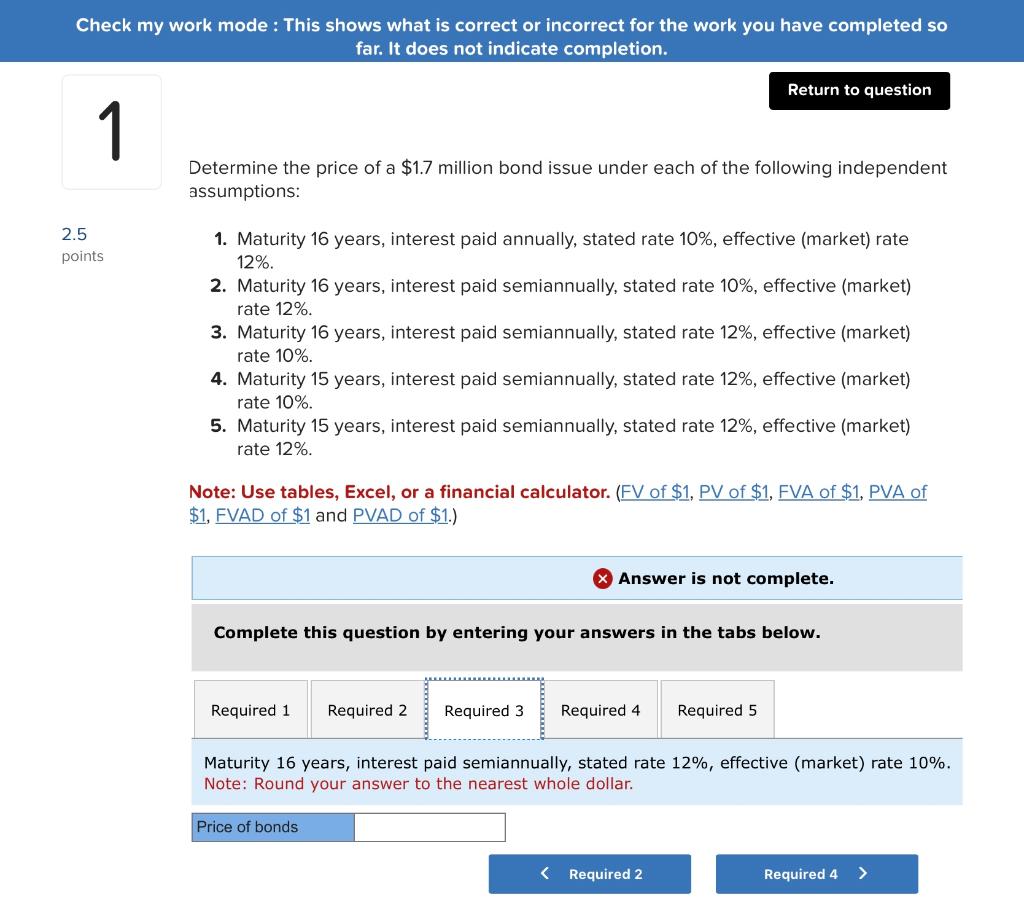

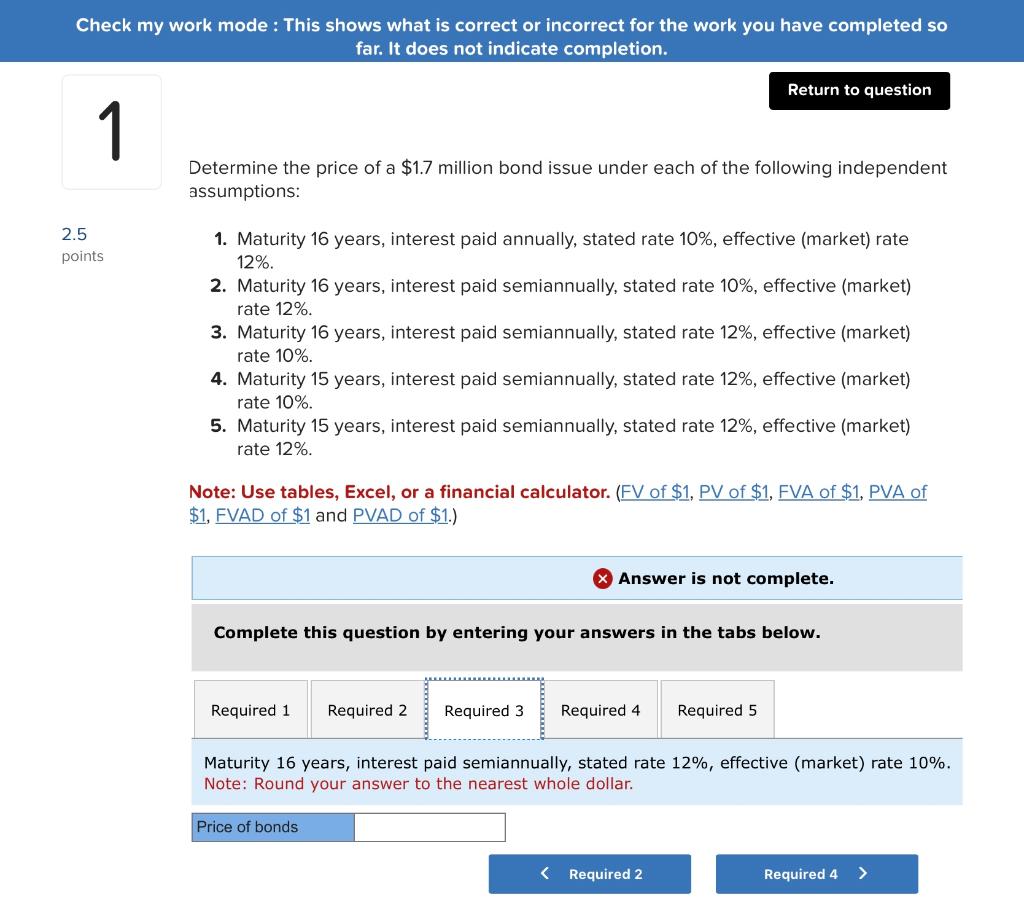

Maturity 16 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%.

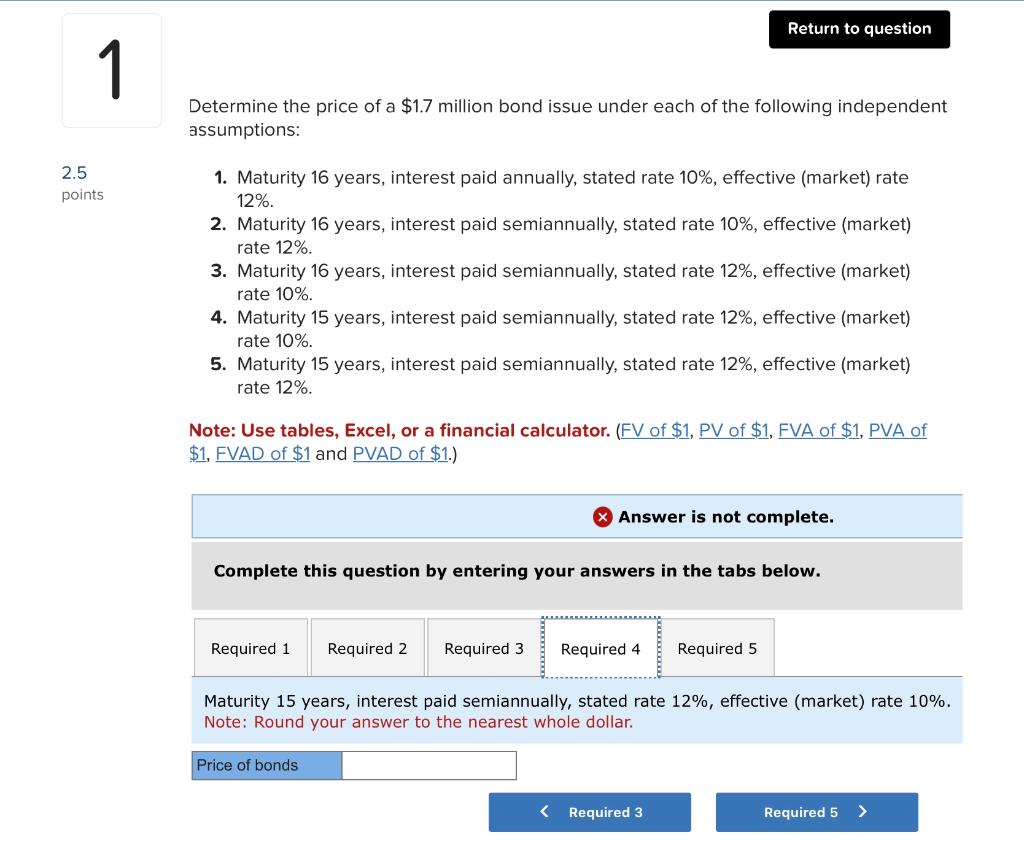

Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%.

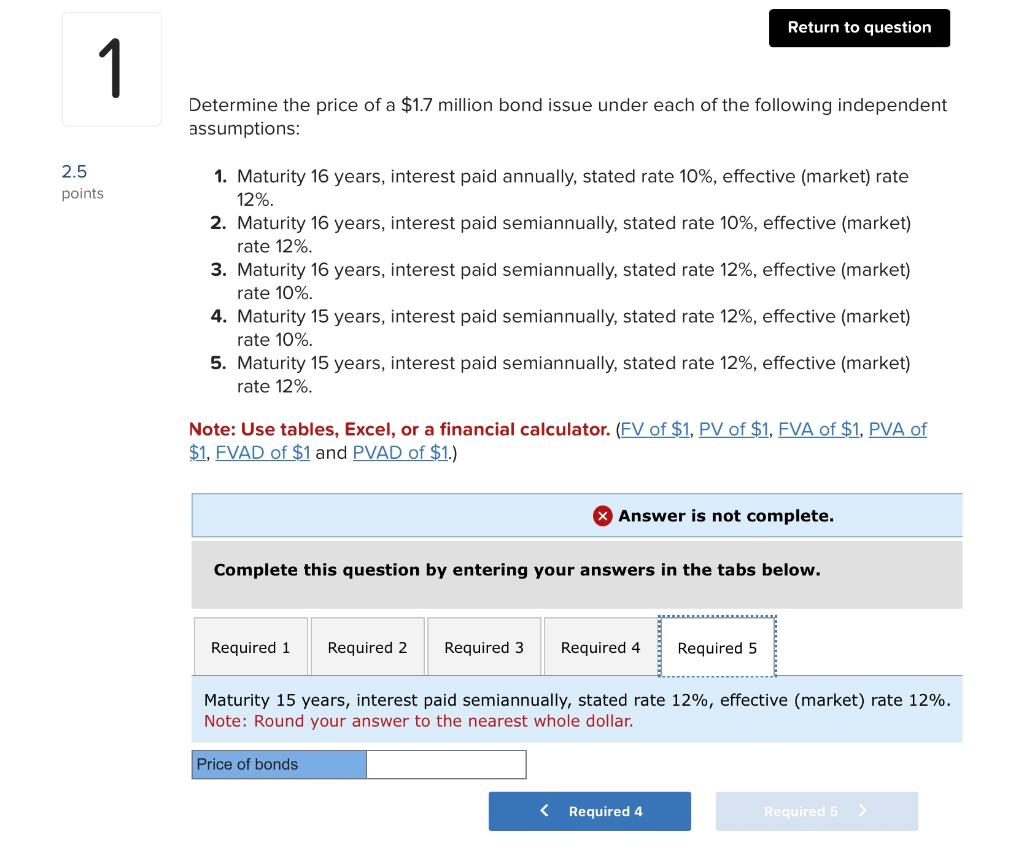

Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%.

Determine the price of a $1.7 million bond issue under each of the following independent assumptions: 1. Maturity 16 years, interest paid annually, stated rate 10%, effective (market) rate 12%. 2. Maturity 16 years, interest paid semiannually, stated rate 10%, effective (market) rate 12%. 3. Maturity 16 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 4. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 5. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%. Note: Use tables, Excel, or a financial calculator. (FV of $1,PV of $1, FVA of $1,PVA of $1, FVAD of $1 and PVAD of $1.) Answer is not complete. Complete this question by entering your answers in the tabs below. Maturity 16 years, interest paid annually, stated rate 10%, effective (market) rate 12%. Note: Round your answer to the nearest whole dollar. Determine the price of a $1.7 million bond issue under each of the following independent assumptions: 1. Maturity 16 years, interest paid annually, stated rate 10%, effective (market) rate 12%. 2. Maturity 16 years, interest paid semiannually, stated rate 10%, effective (market) rate 12%. 3. Maturity 16 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 4. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 5. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1. Answer is not complete. Complete this question by entering your answers in the tabs below. Maturity 16 years, interest paid semiannually, stated rate 10%, effective (market) rate 12%. Note: Round your answer to the nearest whole dollar. Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Determine the price of a $1.7 million bond issue under each of the following independent assumptions: 2.5 1. Maturity 16 years, interest paid annually, stated rate 10%, effective (market) rate 12%. 2. Maturity 16 years, interest paid semiannually, stated rate 10%, effective (market) rate 12%. 3. Maturity 16 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 4. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 5. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1. .) Answer is not complete. Complete this question by entering your answers in the tabs below. Maturity 16 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. Note: Round your answer to the nearest whole dollar. Determine the price of a $1.7 million bond issue under each of the following independent assumptions: 1. Maturity 16 years, interest paid annually, stated rate 10%, effective (market) rate 12%. 2. Maturity 16 years, interest paid semiannually, stated rate 10%, effective (market) rate 12%. 3. Maturity 16 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 4. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 5. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%. Note: Use tables, Excel, or a financial calculator. (FV of $1,PV of $1,FVA of $1,PVA of $1. FVAD of $1 and PVAD of $1.) Answer is not complete. Complete this question by entering your answers in the tabs below. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. Note: Round your answer to the nearest whole dollar. Determine the price of a $1.7 million bond issue under each of the following independent assumptions: 1. Maturity 16 years, interest paid annually, stated rate 10%, effective (market) rate 12%. 2. Maturity 16 years, interest paid semiannually, stated rate 10%, effective (market) rate 12%. 3. Maturity 16 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 4. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 5. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%. Note: Use tables, Excel, or a financial calculator. (FV of $1,PV of $1,FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1.) Answer is not complete. Complete this question by entering your answers in the tabs below. Maturity 15 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%. Note: Round your answer to the nearest whole dollar