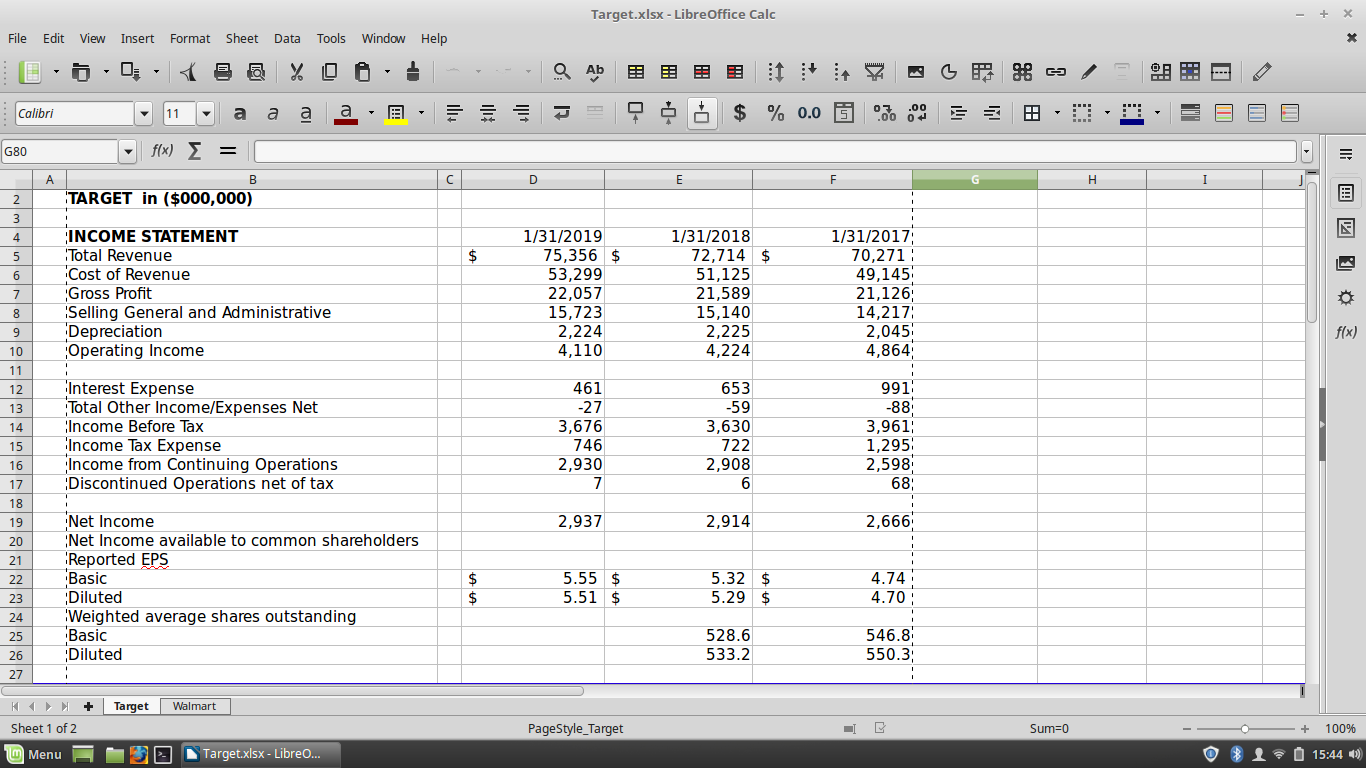

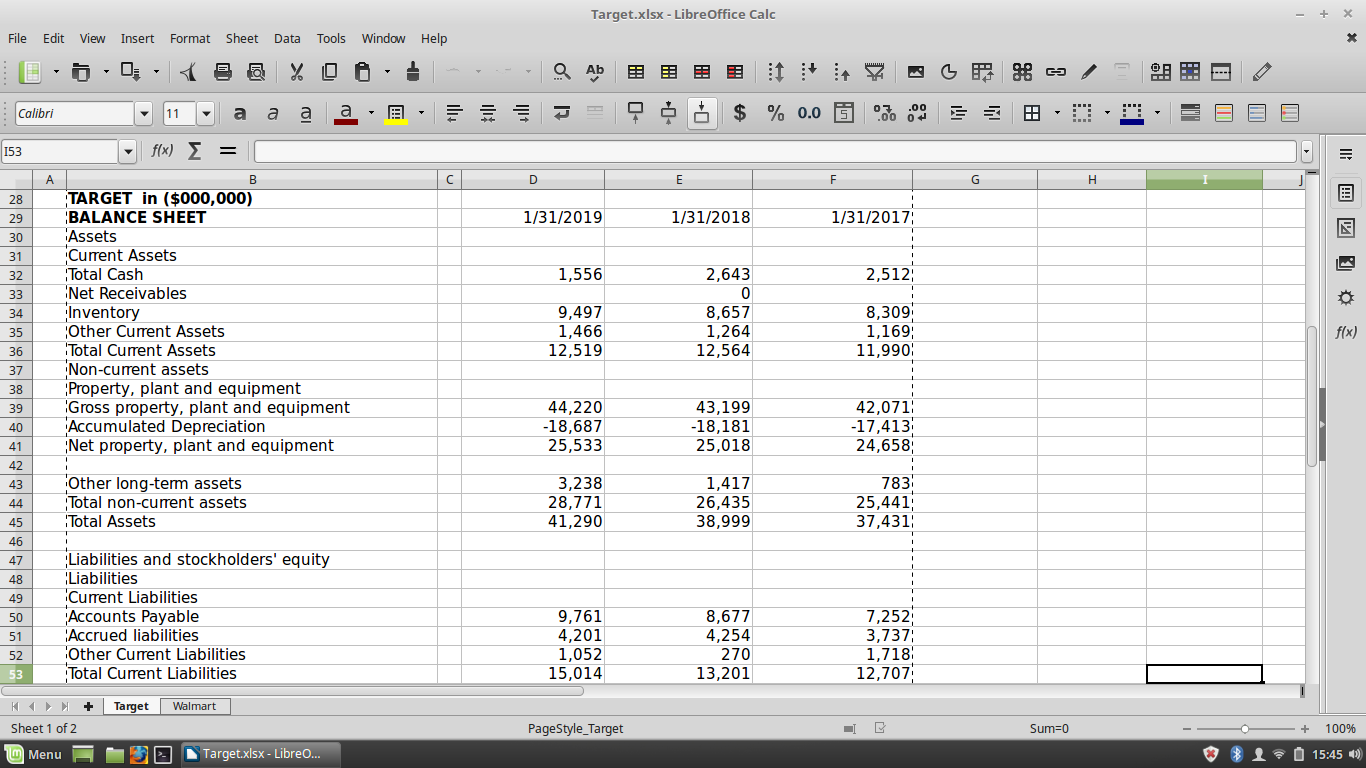

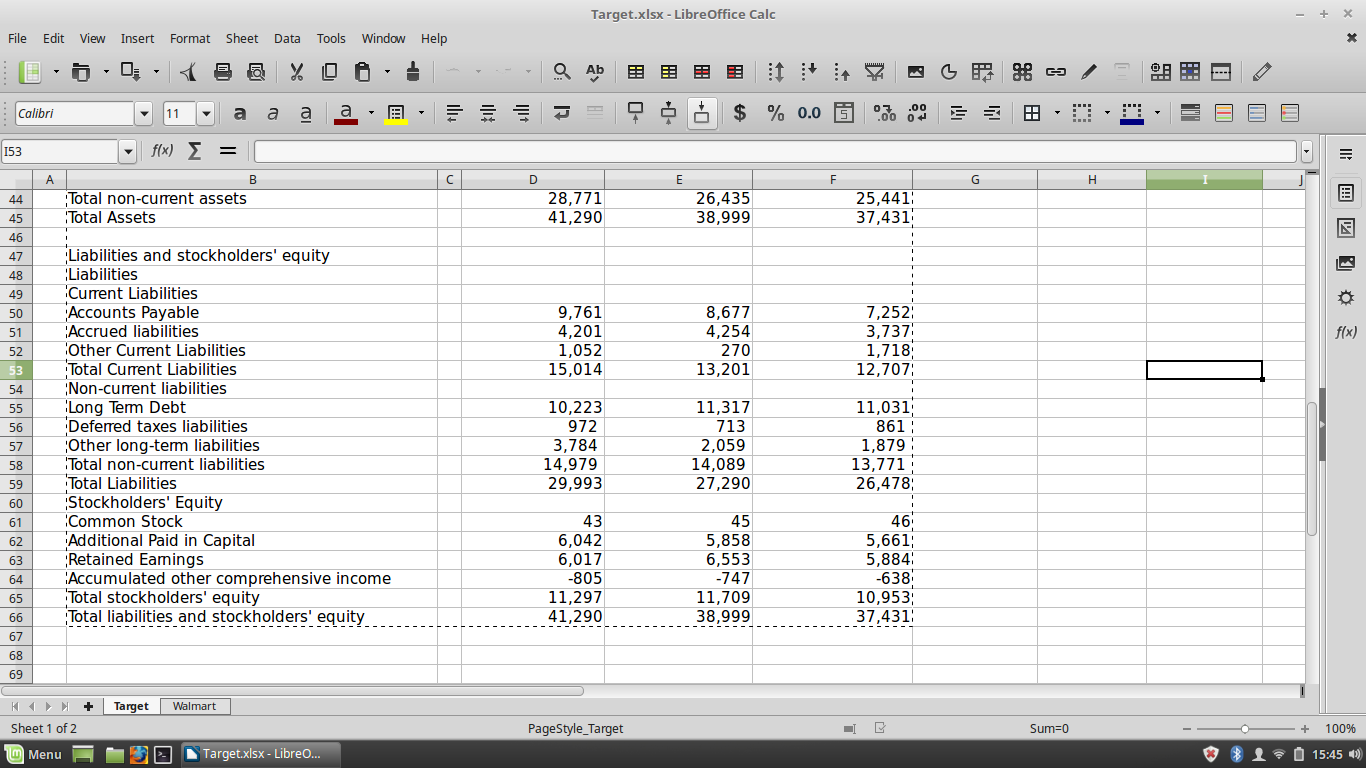

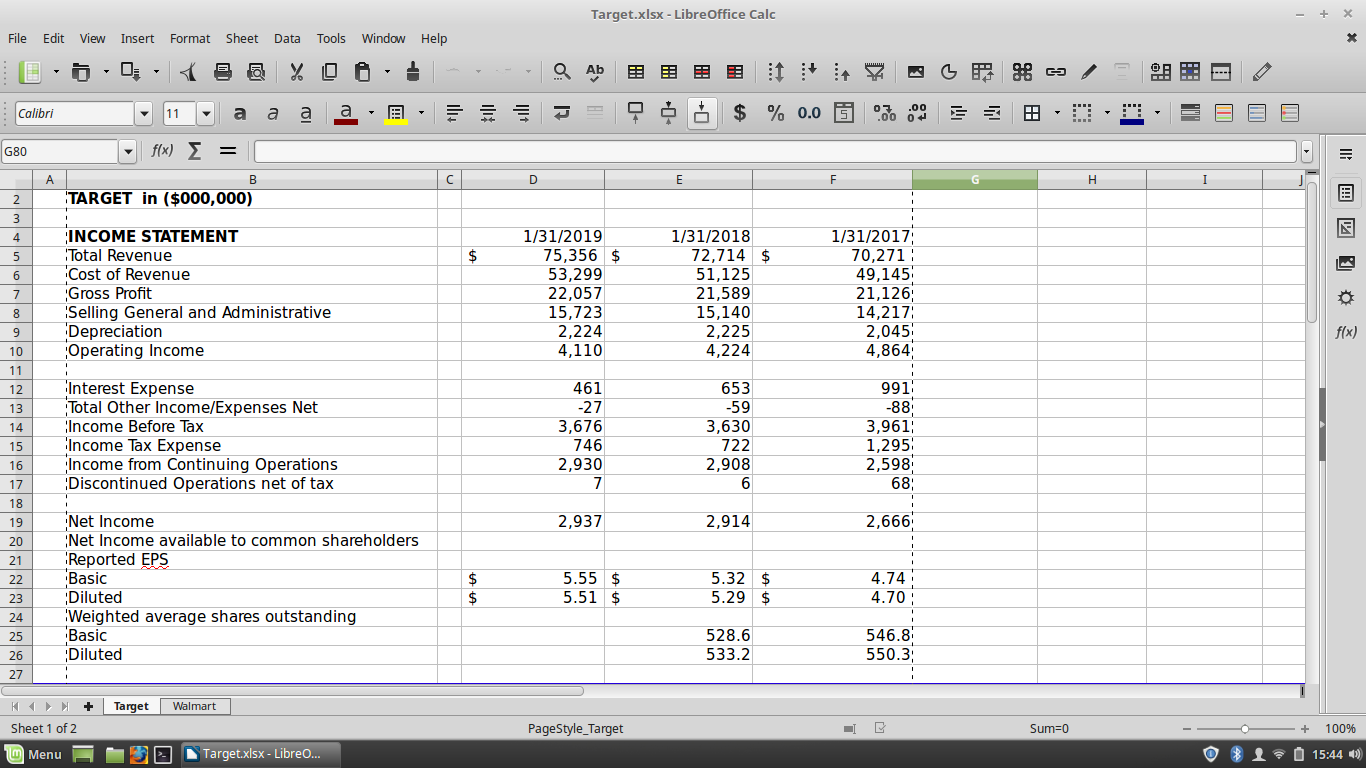

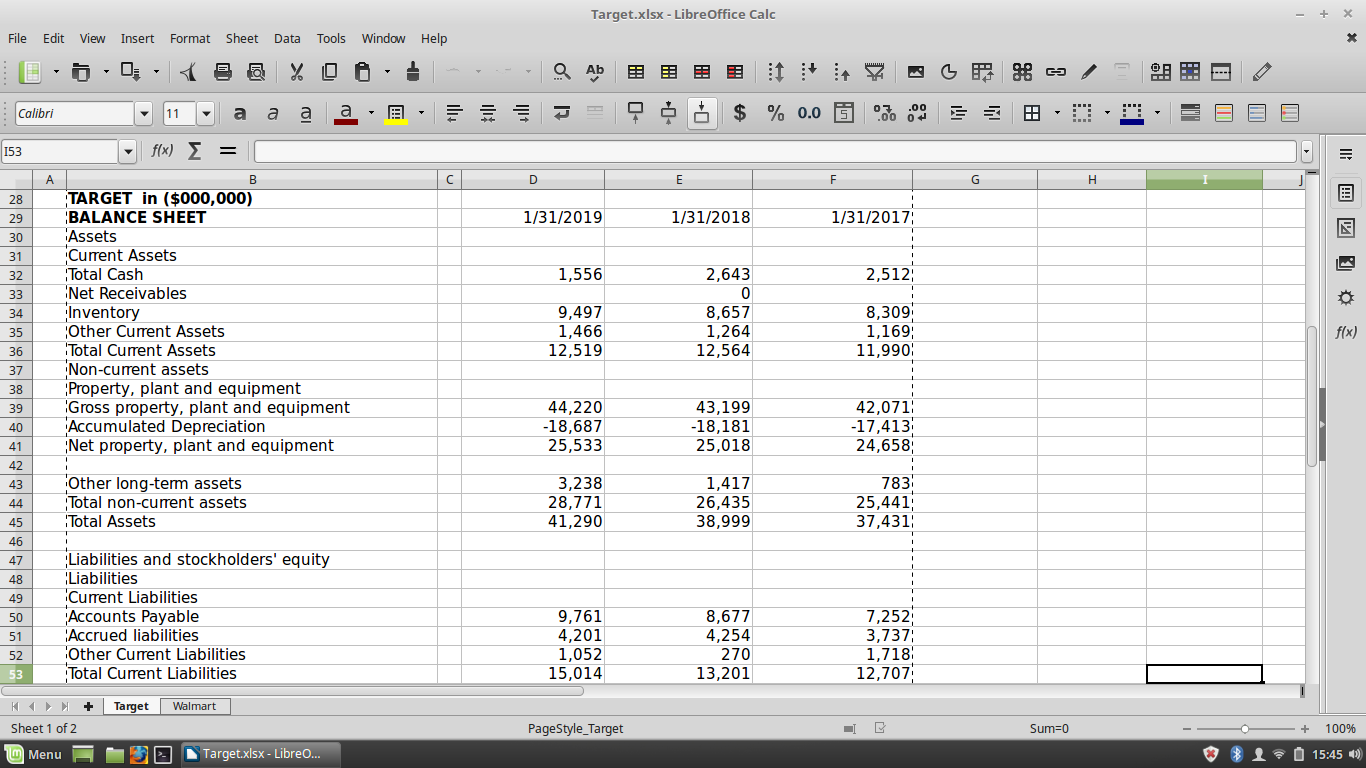

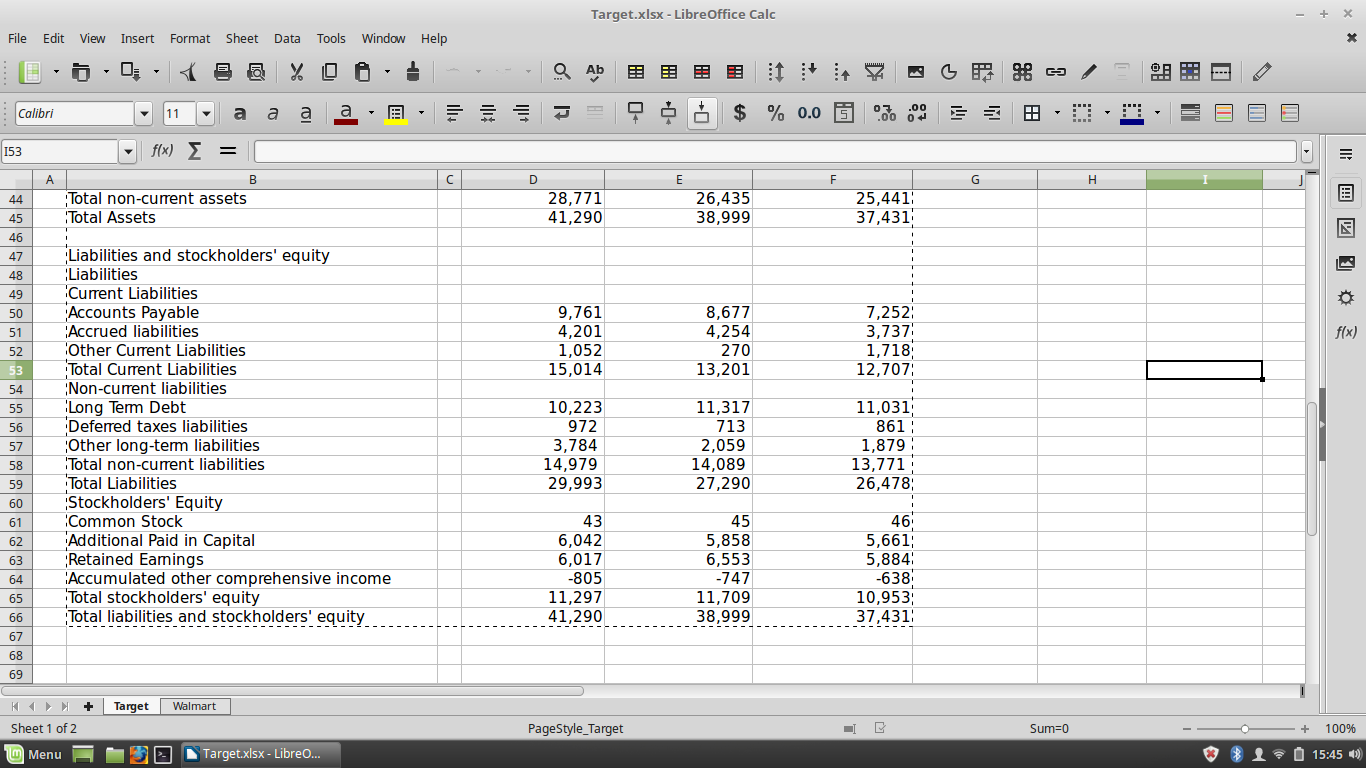

Determine the profit margin, total asset turnover, return on assets, equity multiplier and return on equity for the years 2017, 2018 and 2019 from the following data:

Target.xlsx - LibreOffice Calc File Edit View Insert Format Sheet Data Tools Window Help X Y O Ab OA Calibri 11 a a a $ % 0.0 .00 OS 680 f(x) E = D E F I TARGET in ($000,000) 2 3 4 5 6 7 $ INCOME STATEMENT Total Revenue Cost of Revenue Gross Profit Selling General and Administrative Depreciation Operating Income 1/31/2019 75,356 $ 53,299 22,057 15,723 2,224 4,110 1/31/2018 72,714 $ 51,125 21,589 15,140 2,225 4,224 1/31/2017 70,271: 49,145 21,126 14,217 2,045 4,864 8 f(x) Interest Expense Total Other Income/Expenses Net Income Before Tax Income Tax Expense Income from Continuing Operations Discontinued Operations net of tax 461 -27 3,676 746 2,930 7 653 -59 3,630 722 2,908 6 9911 -88 3,961 1,295 2,598 68: 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 2,937 2,914 2,666 4.74 Net Income Net Income available to common shareholders Reported EPS Basic Diluted Weighted average shares outstanding Basic Diluted $ $ 5.55 $ 5.51 $ 5.32 $ 5.29 $ 4.70 528.6 533.2 546.8 550.3 Target Walmart Sheet 1 of 2 PageStyle_Target Sum=0 100% * 1 15:44 :) Menu 1 Target.xlsx - Libreo... Target.xlsx - LibreOffice Calc File Edit View Insert Format Sheet Data Tools Window Help X - Y O Ab OA op Calibri 11 a a a 9 $ % 0.0 .00 153 f(x) = = B D E F G 1/31/2019 1/31/2018 1/31/2017 1,556 2,512 TARGET in ($000,000) BALANCE SHEET Assets Current Assets Total Cash Net Receivables Inventory Other Current Assets Total Current Assets Non-current assets Property, plant and equipment Gross property, plant and equipment Accumulated Depreciation Net property, plant and equipment 9,497 1,466 12,519 2,643 0 8,657 1,264 12,564 8,309 1,169 11,990 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 f(x) 44,220 -18,687 25,533 43,199 -18,181 25,018 42,071 -17,413 24,658 Other long-term assets Total non-current assets Total Assets 3,238 28,771 41,290 1,417 26,435 38,999 7831 25,441 37,431) Liabilities and stockholders' equity Liabilities Current Liabilities Accounts Payable Accrued liabilities Other Current Liabilities Total Current Liabilities 9,761 4,201 1,052 15,014 8,677 4,254 270 13,201 7,252 3,737 1,718 12,707 Target Walmart Sheet 1 of 2 PageStyle_Target Sum=0 100% Menu 1 Target.xlsx - Libreo... 115:45 0) Target.xlsx - LibreOffice Calc File Edit View Insert Format Sheet Data Tools Window Help X Y O Ab OA on Calibri 11 a a a a 9. $ % 0.0 .00 153 f(x) = = A B D E F Total non-current assets Total Assets 28,771 41,290 26,435 38,999 25,441 37,431 f(x) 9,761 4,201 1,052 15,014 8,677 4,254 270 13,201 7,252 3,737; 1,718 12,707; 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 Liabilities and stockholders' equity Liabilities Current Liabilities Accounts Payable Accrued liabilities Other Current Liabilities Total Current Liabilities Non-current liabilities Long Term Debt Deferred taxes liabilities Other long-term liabilities Total non-current liabilities Total Liabilities Stockholders' Equity Common Stock Additional Paid in Capital Retained Eamings Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity 10,223 972 3,784 14,979 29,993 11,317 713 2,059 14,089 27,290 11,031 861: 1,879 13,771) 26,478 43 6,042 6,017 -805 11,297 41,290 45 5,858 6,553 -747 11,709 38,999 46 5,661 5,884 -638 10,953 37,431 Target Walmart Sheet 1 of 2 PageStyle_Target Sum=0 + 100% Menu >| Target.xlsx - LibreO... * 1915:45 )