Answered step by step

Verified Expert Solution

Question

1 Approved Answer

determine the relevant (after-tax) cash inflow each year of project operation? Sherry Li Inc. purchased a $650,000 machine to manufacture computer chips. Li expects to

determine the relevant (after-tax) cash inflow each year of project operation?

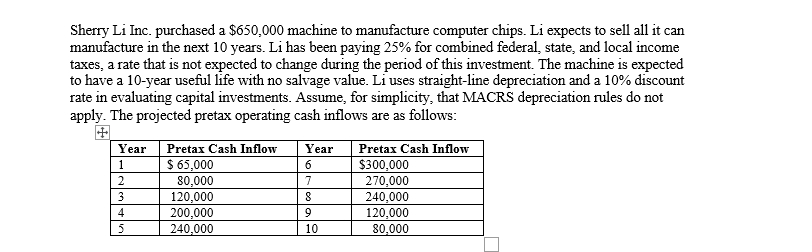

Sherry Li Inc. purchased a $650,000 machine to manufacture computer chips. Li expects to sell all it can manufacture in the next 10 years. Li has been paying 25% for combined federal, state, and local income taxes, a rate that is not expected to change during the period of this investment. The machine is expected to have a 10-year useful life with no salvage value. Li uses straight-line depreciation and a 10% discount rate in evaluating capital investments. Assume, for simplicity, that MACRS depreciation rules do not apply. The projected pretax operating cash inflows are as follows: Year 1 Pretax Cash Inflow $ 65,000 Year Pretax Cash Inflow 6 $300,000 2 80,000 7 270,000 3 120,000 8 240,000 4 200,000 9 120,000 5 240,000 10 80,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started