Question

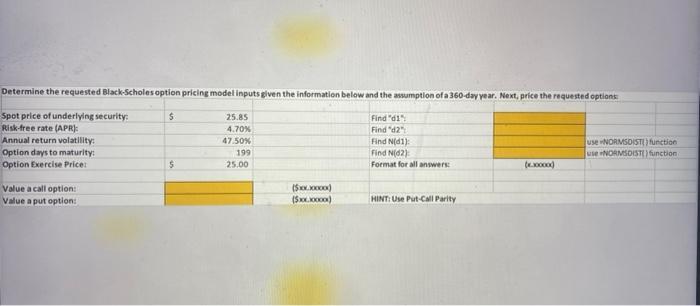

Determine the requested Black-Scholes option pricing model inputs given the information below and the assumption of a 360-day year. Next, price the requested options:

Determine the requested Black-Scholes option pricing model inputs given the information below and the assumption of a 360-day year. Next, price the requested options: $ Spot price of underlying security: Risk-free rate (APR): Annual return volatility: Option days to maturity: Option Exercise Price: Value a call option: Value a put option: $ 25.85 4.70% 47.50% 199 25.00 ($100.000000) ($xx.10000) Find "d1% Find "d2": Find N(1): Find N(62) Format for all answers: HINT: Use Put-Call Parity use NORMSDIST() function use NORMSDIST() function

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the requested BlackScholes option pricing model inputs and price the options well use t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

8th Edition

1260247848, 978-1260247848

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App