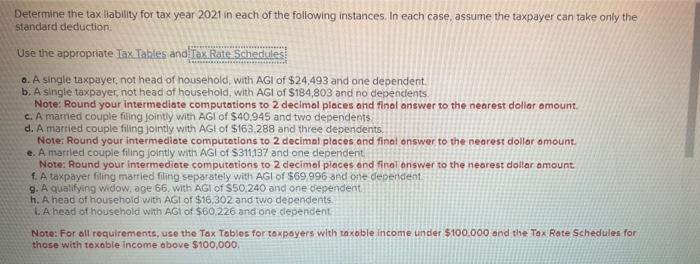

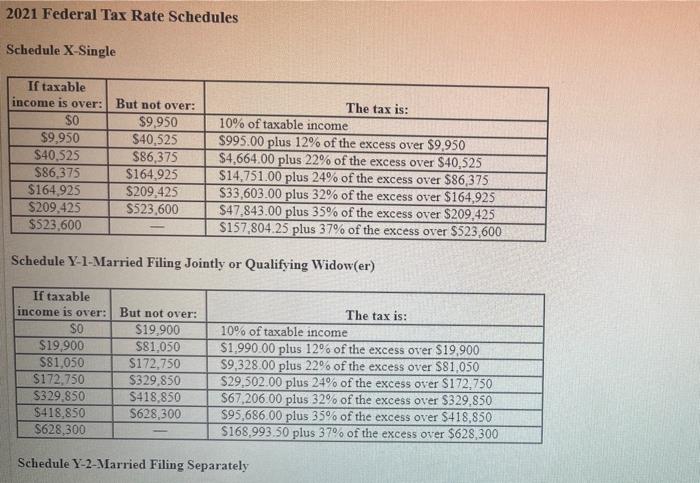

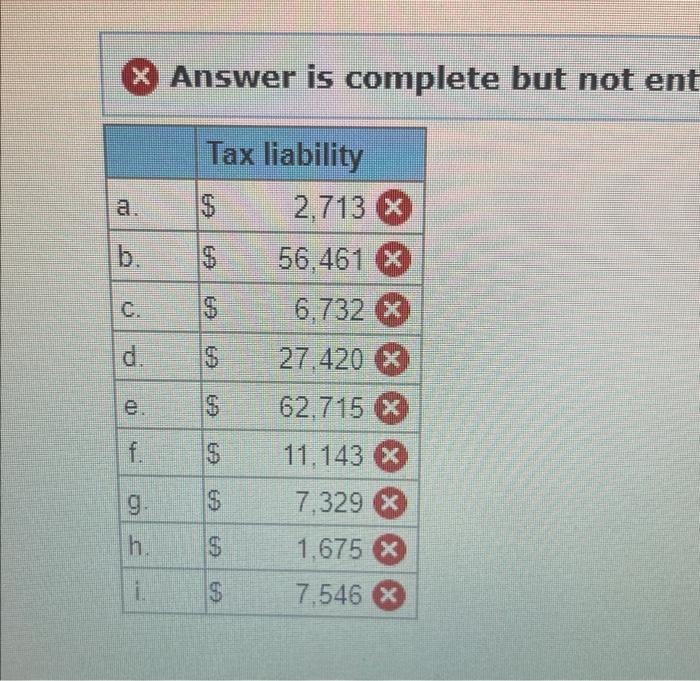

Determine the tax liability for tax year 2021 in each of the following instances. In each case, assume the taxpayer can take only the Standard deduction Use the appropriate Tax Tables and Tax Rate Schedules! o. A single taxpayer, not head of household, with AGI of $24.493 and one dependent b. A single taxpayer not head of household with AGI of $184,803 and no dependents Note: Round your intermediate computations to 2 decimal places and final answer to the nearest dollar amount. c. A married couple filing jointly with AGI of $40.945 and two dependents d. A married couple filing jointly with AGI of S163 288 and three dependents. Note: Round your intermediate computations to 2 decimal places and final onswer to the nearest doller amount e. A married couple filing jointly with AGI of S311137 and one dependent Note: Round your intermediate computations to 2 decimal places and final answer to the nearest dollar amount A taxpayer filing married filing separately with AGI of $69 996 and one dependent g. A qualifying widow.age 66. with AGI of S50,240 and one dependent h. A head of household with AGI of $16,302 and two dependents LA head of household with AGI of $60,226 and one dependent Note: For all requirements, use the Tax Tables for taxpayers with taxoble income under $100.000 and the Tax Rate Schedules for those with taxable income above $100,000 2021 Federal Tax Rate Schedules Schedule X-Single If taxable income is over: SO $9,950 $40.525 $86,375 $164.925 $209,425 $523,600 But not over: $9.950 $40.525 $86,375 $164.925 $209,425 S523,600 The tax is: 10% of taxable income $995.00 plus 12% of the excess over $9.950 $4,664.00 plus 22% of the excess over $40,525 $14.751.00 plus 24% of the excess over $86,375 $33,603.00 plus 32% of the excess over $164,925 $47,843.00 plus 35% of the excess over $209,425 $157,804.25 plus 37% of the excess over $523,600 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: SO $19,900 $81,050 $172,750 $329,850 $418,850 $628,300 But not over: $19.900 $81,050 S172,750 $329,850 S418,850 S628,300 The tax is: 10% of taxable income $1.990.00 plus 12 of the excess over $19,900 $9,328.00 plus 22% of the excess over $81,050 $29,502.00 plus 24% of the excess over $172.750 $67,206.00 plus 32% of the excess over $329.850 $95,686,00 plus 35% of the excess over $418,850 $168.993.50 plus 37% of the excess over $628,300 Schedule Y-2-Married Filing Separately X Answer is complete but not ent b. 69 Tax liability $ 2,713 X 56,461 X $ 6,732 X 27.420 X $ 62.715 X c . d. 02 e f. $ 11.143 x 7,329 X g. 69 h. 15 $ 1.675 X i 69 7,546 X