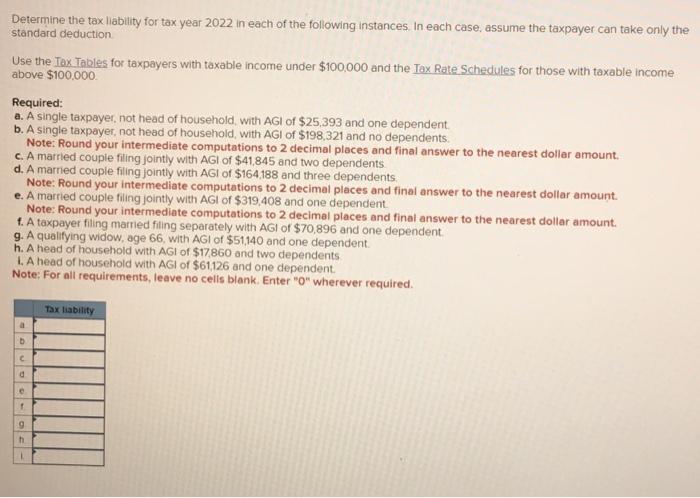

Determine the tax liability for tax year 2022 in each of the following instances. in each case assume the taxpayer can take only the standard deduction.

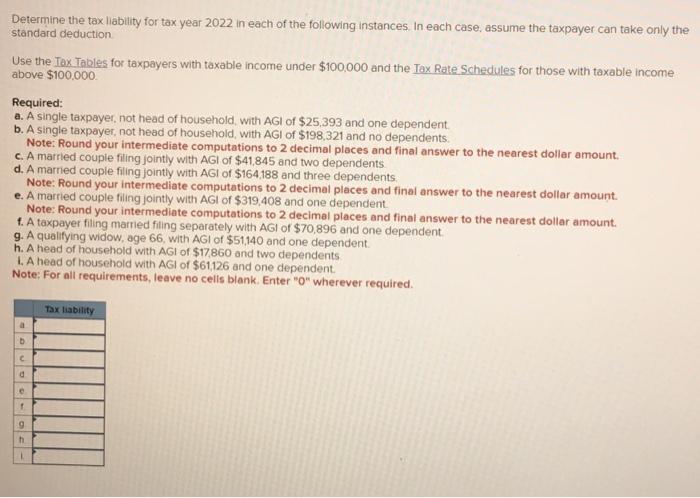

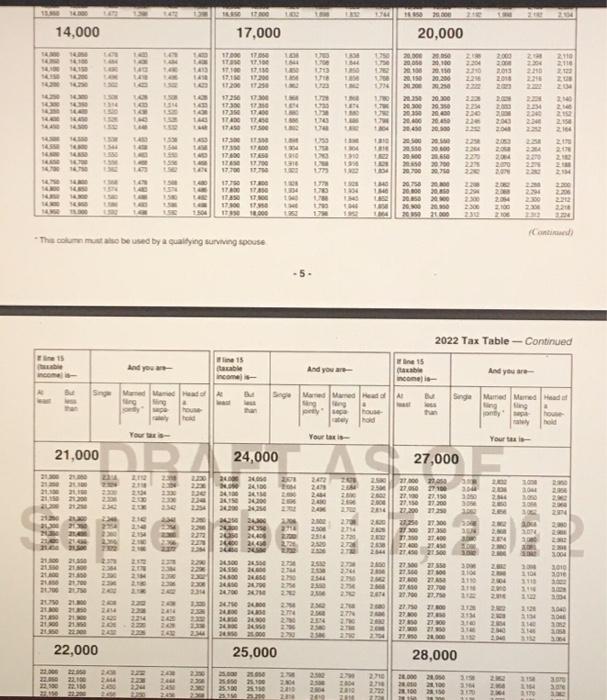

use the tax tables for taxpayers with taxable income under 100,000 and the tax rate scheduale for those with taxable income above 100,000.

read the picture below please for the full question

Determine the tax liability for tax year 2022 in each of the following instances. In each case, assume the taxpayer can take only the standard deduction. Use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000 Required: a. A single taxpayer, not head of household, with AGI of $25,393 and one dependent. b. A single taxpayer, not head of household, with AGI of \$198,321 and no dependents. Note: Round your intermediate computations to 2 decimal places and final answer to the nearest doller amount. c. A marrled couple filing jointly with AGI of $41,845 and two dependents d. A married couple filing jointly with AGI of $164,188 and three dependents Note: Round your intermediate computations to 2 decimal places and final answer to the nearest dollar amount. e. A married couple filing jointly with AG1 of $319,408 and one dependent. Note: Round your intermediate computations to 2 decimal places and final answer to the nearest dollar amount. f. A taxpayer filing married filing separately with AGI or $70,896 and one dependent. g. A qualifying widow, age 66 , with AGI of $51,140 and one dependent. h. A head of household with AGI of $17,860 and two dependents. 1. A head of household with AGI of \$61,126 and one dependent. Note: For all requirements, leave no cells blank. Enter "0" wherever required. - Tha colum must ake be used by a qualsing surving spouse (Cantinand) 5. Determine the tax liability for tax year 2022 in each of the following instances. In each case, assume the taxpayer can take only the standard deduction. Use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000 Required: a. A single taxpayer, not head of household, with AGI of $25,393 and one dependent. b. A single taxpayer, not head of household, with AGI of \$198,321 and no dependents. Note: Round your intermediate computations to 2 decimal places and final answer to the nearest doller amount. c. A marrled couple filing jointly with AGI of $41,845 and two dependents d. A married couple filing jointly with AGI of $164,188 and three dependents Note: Round your intermediate computations to 2 decimal places and final answer to the nearest dollar amount. e. A married couple filing jointly with AG1 of $319,408 and one dependent. Note: Round your intermediate computations to 2 decimal places and final answer to the nearest dollar amount. f. A taxpayer filing married filing separately with AGI or $70,896 and one dependent. g. A qualifying widow, age 66 , with AGI of $51,140 and one dependent. h. A head of household with AGI of $17,860 and two dependents. 1. A head of household with AGI of \$61,126 and one dependent. Note: For all requirements, leave no cells blank. Enter "0" wherever required. - Tha colum must ake be used by a qualsing surving spouse (Cantinand) 5