Answered step by step

Verified Expert Solution

Question

1 Approved Answer

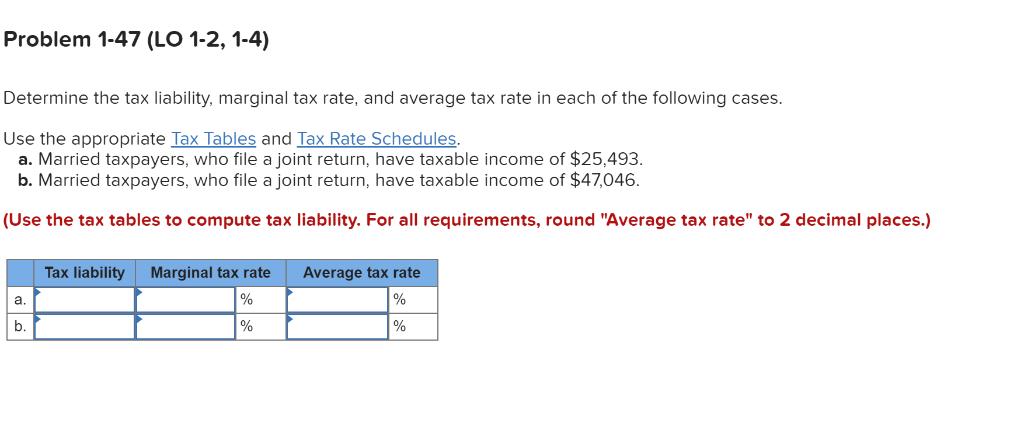

Problem 1-47 (LO 1-2, 1-4) Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the

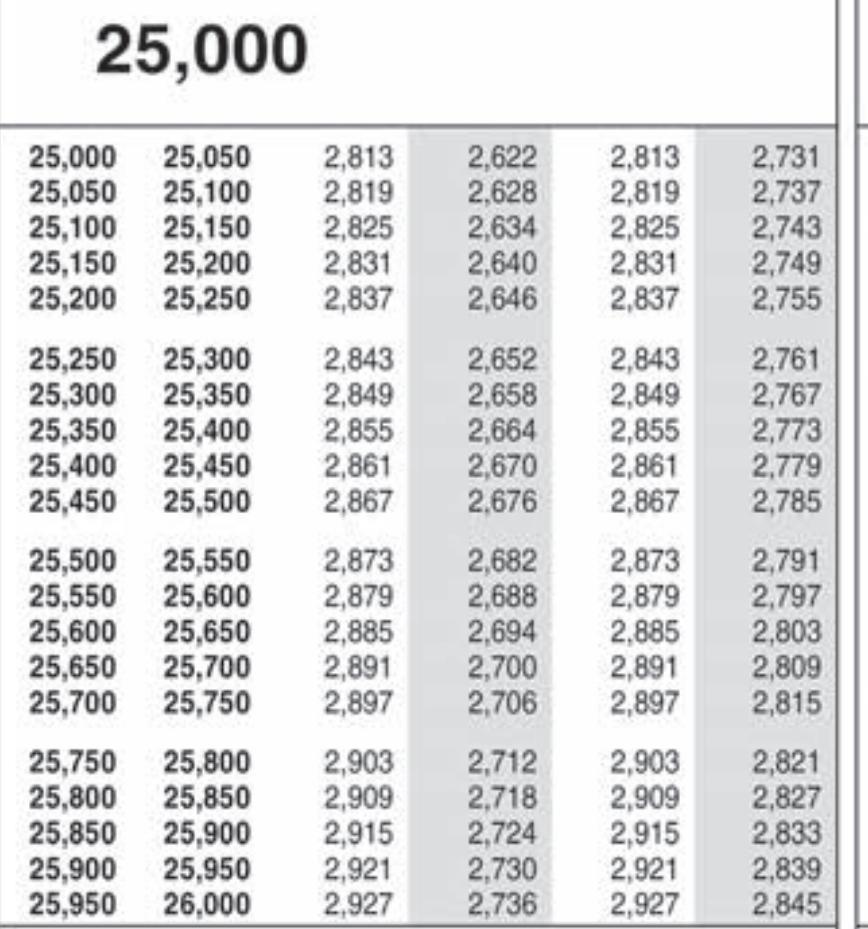

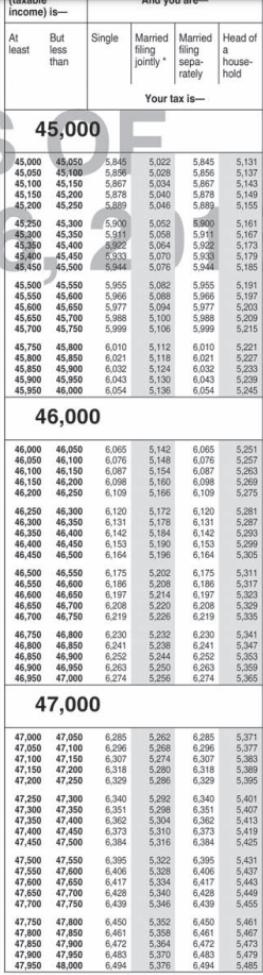

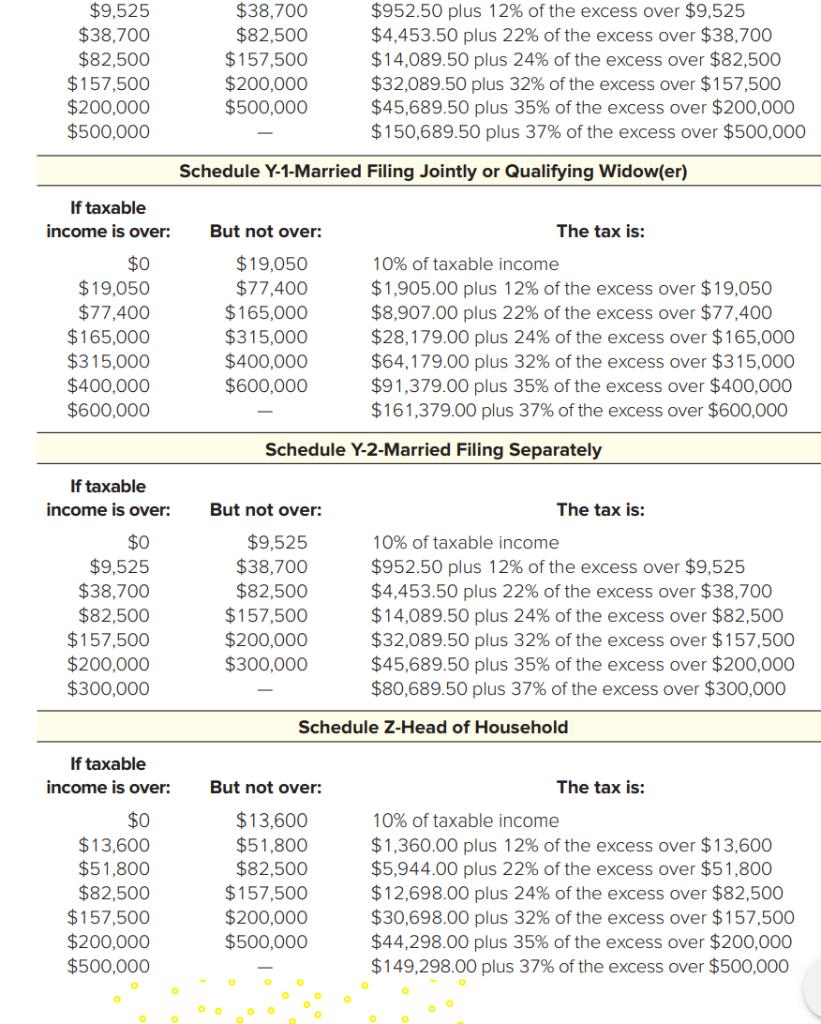

Problem 1-47 (LO 1-2, 1-4) Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax Tables and Tax Rate Schedules. a. Married taxpayers, who file a joint return, have taxable income of $25,493. b. Married taxpayers, who file a joint return, have taxable income of $47,046. (Use the tax tables to compute tax liability. For all requirements, round "Average tax rate" to 2 decimal places.) a. b. Tax liability Marginal tax rate % % Average tax rate % % 25,000 2,813 2,622 2,628 2,634 2,640 2,831 2,646 2,837 25,000 25,050 25,050 25,100 2,819 25,100 25,150 2,825 25,150 25,200 2,831 25,200 25,250 2,837 25,250 25,300 2,843 2,652 25,300 25,350 2,849 2,658 25,350 25,400 2,855 2,664 25,400 25,450 2,861 2,670 25,450 25,500 2,867 2,676 25,500 25,550 2,873 2,682 25,550 25,600 2,879 25,600 25,650 2,885 25,650 25,700 2,891 25,700 25,750 2,897 2,813 2,819 2,825 2,712 25,750 25,800 2,903 25,800 25,850 2,909 2,718 25,850 25,900 2,915 2,724 25,900 25,950 2,921 25,950 26,000 2,927 2,730 2,736 2,843 2,849 2,855 2,861 2,867 2,873 2,688 2,879 2,694 2,885 2,700 2,891 2,706 2,897 2,903 2,909 2,915 2,921 2,927 2,731 2,737 2,743 2,749 2,755 2,761 2,767 2,773 2,779 2,785 2,791 2,797 2,803 2,809 2,815 2,821 2,827 2,833 2,839 2,845 na 36 47,000 ( 36 46,000 201998 Unu man Sh 388 | 45,000 Single Married Married en $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 If taxable income is over: $0 $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 If taxable income is over: $0 $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 If taxable income is over: $0 $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 $38,700 $82,500 $157,500 $200,000 $500,000 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) But not over: $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 $952.50 plus 12% of the excess over $9,525 $4,453.50 plus 22% of the excess over $38,700 $14,089.50 plus 24% of the excess over $82,500 $32,089.50 plus 32% of the excess over $157,500 $45,689.50 plus 35% of the excess over $200,000 $150,689.50 plus 37% of the excess over $500,000 But not over: $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 The tax is: Schedule Y-2-Married Filing Separately But not over: $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 10% of taxable income $1,905.00 plus 12% of the excess over $19,050 $8,907.00 plus 22% of the excess over $77,400 $28,179.00 plus 24% of the excess over $165,000 $64,179.00 plus 32% of the excess over $315,000 $91,379.00 plus 35% of the excess over $400,000 $161,379.00 plus 37% of the excess over $600,000 The tax is: 10% of taxable income $952.50 plus 12% of the excess over $9,525 $4,453.50 plus 22% of the excess over $38,700 $14,089.50 plus 24% of the excess over $82,500 $32,089.50 plus 32% of the excess over $157,500 $45,689.50 plus 35% of the excess over $200,000 $80,689.50 plus 37% of the excess over $300,000 Schedule Z-Head of Household The tax is: 10% of taxable income $1,360.00 plus 12% of the excess over $13,600 $5,944.00 plus 22% of the excess over $51,800 $12,698.00 plus 24% of the excess over $82,500 $30,698.00 plus 32% of the excess over $157,500 $44,298.00 plus 35% of the excess over $200,000 $149,298.00 plus 37% of the excess over $500,000

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Schedule Y1Married Filing Jointly of Qualifying Widower Married Filing jointly If taxable inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started