Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the tax rate, tax due, and reg. line number. Manufacturing Problem Breakout You are the tax analyst for ABC Manufacturing Company. ABC's production facility

Determine the tax rate, tax due, and reg. line number.

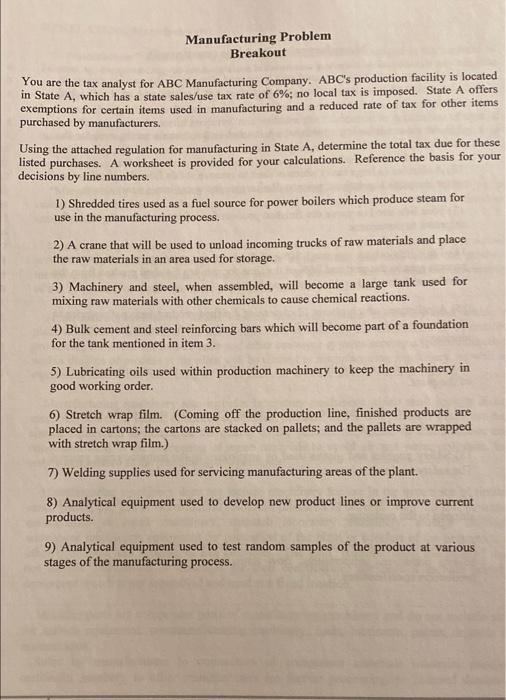

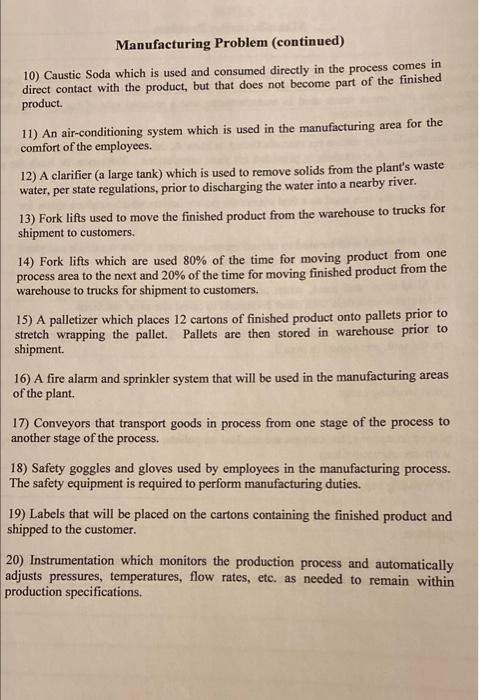

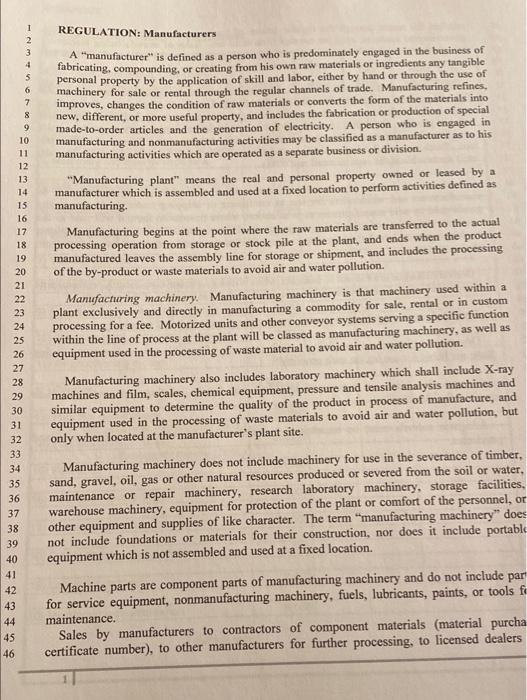

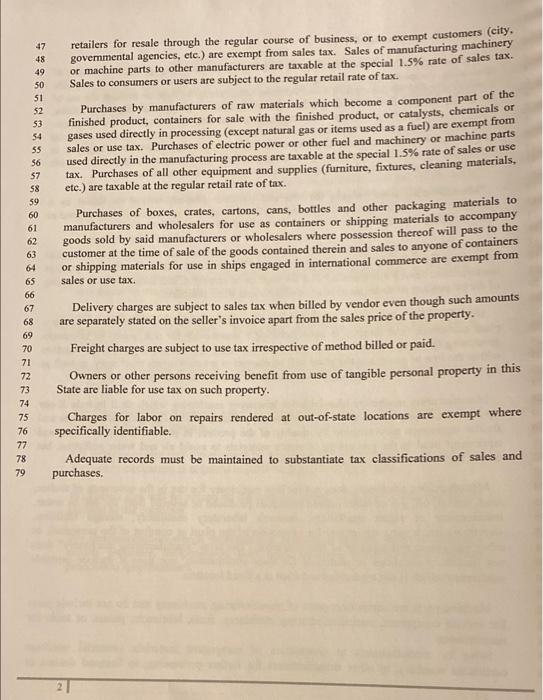

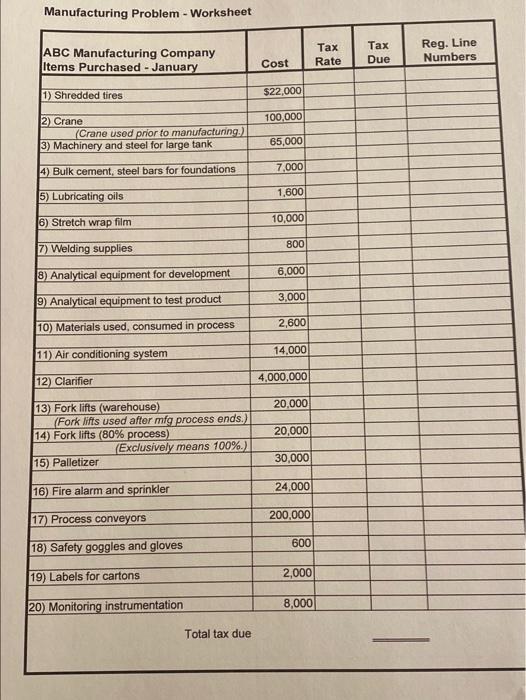

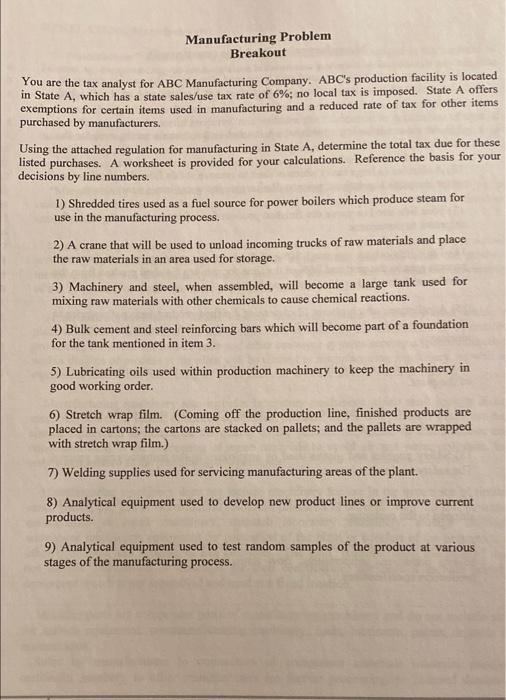

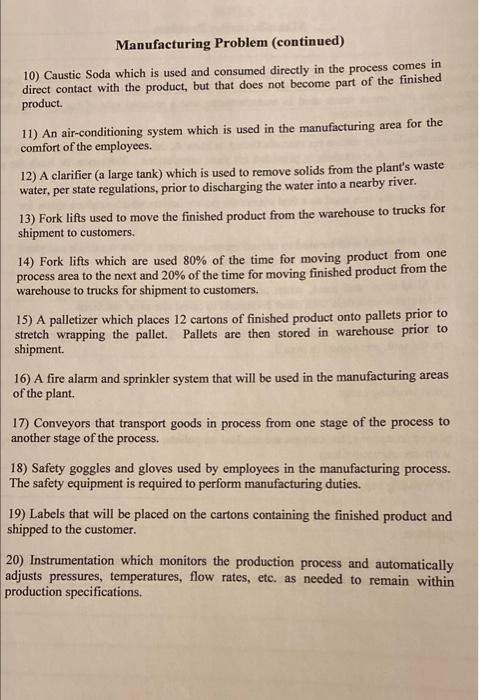

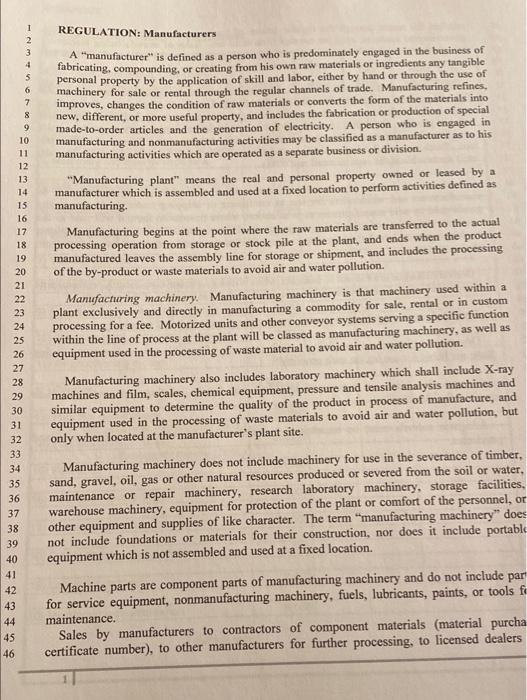

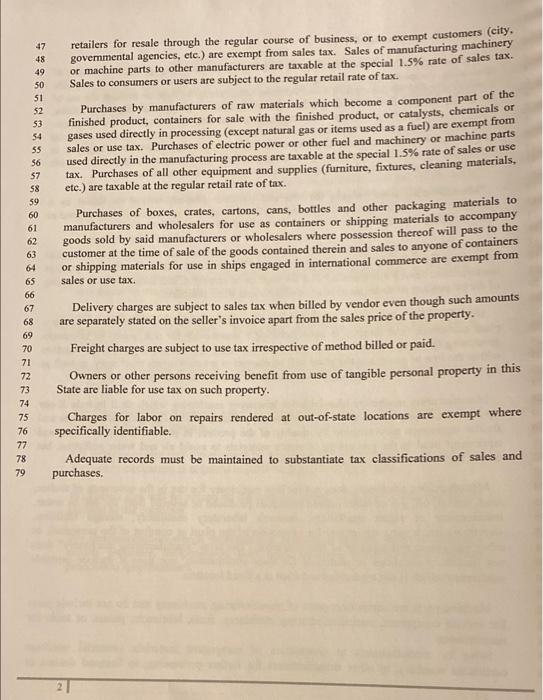

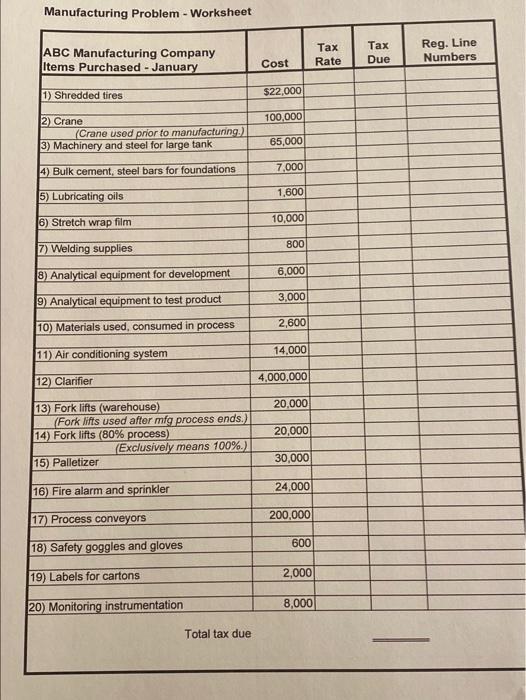

Manufacturing Problem Breakout You are the tax analyst for ABC Manufacturing Company. ABC's production facility is located in State A, which has a state sales/use tax rate of 6%; no local tax is imposed. State A offers exemptions for certain items used in manufacturing and a reduced rate of tax for other items purchased by manufacturers. Using the attached regulation for manufacturing in State A, determine the total tax due for these listed purchases. A worksheet is provided for your calculations. Reference the basis for your decisions by line numbers. 1) Shredded tires used as a fuel source for power boilers which produce steam for use in the manufacturing process. 2) A crane that will be used to unload incoming trucks of raw materials and place the raw materials in an area used for storage. 3) Machinery and steel, when assembled, will become a large tank used for mixing raw materials with other chemicals to cause chemical reactions. 4) Bulk cement and steel reinforcing bars which will become part of a foundation for the tank mentioned in item 3. 5) Lubricating oils used within production machinery to keep the machinery in good working order. 6) Stretch wrap film. (Coming off the production line, finished products are placed in cartons; the cartons are stacked on pallets; and the pallets are wrapped with stretch wrap film.) 7) Welding supplies used for servicing manufacturing areas of the plant 8) Analytical equipment used to develop new product lines or improve current products. 9) Analytical equipment used to test random samples of the product at various stages of the manufacturing process. Manufacturing Problem (continued) 10) Caustic Soda which is used and consumed directly in the process comes in direct contact with the product, but that does not become part of the finished product. 11) An air-conditioning system which is used in the manufacturing area for the comfort of the employees. 12) A clarifier (a large tank) which is used to remove solids from the plant's waste water, per state regulations, prior to discharging the water into a nearby river. 13) Fork lifts used to move the finished product from the warehouse to trucks for shipment to customers. 14) Fork lifts which are used 80% of the time for moving product from one process area to the next and 20% of the time for moving finished product from the warehouse to trucks for shipment to customers. 15) A palletizer which places 12 cartons of finished product onto pallets prior to stretch wrapping the pallet . Pallets are then stored in warehouse prior to shipment 16) A fire alarm and sprinkler system that will be used in the manufacturing areas of the plant 17) Conveyors that transport goods in process from one stage of the process to another stage of the process. 18) Safety goggles and gloves used by employees in the manufacturing process. The safety equipment is required to perform manufacturing duties. 19) Labels that will be placed on the cartons containing the finished product and shipped to the customer. 20) Instrumentation which monitors the production process and automatically adjusts pressures, temperatures, flow rates, etc. as needed to remain within production specifications. REGULATION: Manufacturers 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 A "manufacturer" is defined as a person who is predominately engaged in the business of fabricating, compounding, or creating from his own raw materials or ingredients any tangible personal property by the application of skill and labor, either by hand or through the use of machinery for sale or rental through the regular channels of trade. Manufacturing refines, improves, changes the condition of raw materials or converts the form of the materials into new, different, or more useful property, and includes the fabrication or production of special made-to-order articles and the generation of electricity. A person who is engaged in manufacturing and nonmanufacturing activities may be classified as a manufacturer as to his manufacturing activities which are operated as a separate business or division. **Manufacturing plant" means the real and personal property owned or leased by a manufacturer which is assembled and used at a fixed location to perform activities defined as manufacturing Manufacturing begins at the point where the raw materials are transferred to the actual processing operation from storage or stock pile at the plant, and ends when the product manufactured leaves the assembly line for storage or shipment, and includes the processing of the by-product or waste materials to avoid air and water pollution. Manufacturing machinery Manufacturing machinery is that machinery used within a plant exclusively and directly in manufacturing a commodity for sale, rental or in custom processing for a fee. Motorized units and other conveyor systems serving a specific function within the line of process at the plant will be classed as manufacturing machinery, as well as equipment used in the processing of waste material to avoid air and water pollution. Manufacturing machinery also includes laboratory machinery which shall include X-ray machines and film, scales, chemical equipment, pressure and tensile analysis machines and similar equipment to determine the quality of the product in process of manufacture, and equipment used in the processing of waste materials to avoid air and water pollution, but only when located at the manufacturer's plant site. Manufacturing machinery does not include machinery for use in the severance of timber, sand, gravel, oil, gas or other natural resources produced or severed from the soil or water. maintenance or repair machinery, research laboratory machinery, storage facilities, warehouse machinery, equipment for protection of the plant or comfort of the personnel, or other equipment and supplies of like character. The term "manufacturing machinery" does not include foundations or materials for their construction, nor does it include portable equipment which is not assembled and used at a fixed location. Machine parts are component parts of manufacturing machinery and do not include par for service equipment, nonmanufacturing machinery, fuels, lubricants, paints, or tools fo maintenance. Sales by manufacturers to contractors of component materials (material purcha certificate number), to other manufacturers for further processing, to licensed dealers 47 49 50 52 54 8898989%85 57 58 60 retailers for resale through the regular course of business, or to exempt customers (city. governmental agencies, etc.) are exempt from sales tax. Sales of manufacturing machinery or machine parts to other manufacturers are taxable at the special 1.5% rate of sales tax. Sales to consumers or users are subject to the regular retail rate of tax. Purchases by manufacturers of raw materials which become a component part of the finished product, containers for sale with the finished product, or catalysts, chemicals or gases used directly in processing (except natural gas or items used as a fuel) are exempt from sales or use tax. Purchases of electric power or other fuel and machinery or machine parts used directly in the manufacturing process are taxable at the special 1.5% rate of sales or use tax. Purchases of all other equipment and supplies (furniture, fixtures, cleaning materials, etc.) are taxable at the regular retail rate of tax. Purchases of boxes, crates, cartons, cans, bottles and other packaging materials to manufacturers and wholesalers for use as containers or shipping materials to accompany goods sold by said manufacturers or wholesalers where possession thereof will pass to the customer at the time of sale of the goods contained therein and sales to anyone of containers or shipping materials for use in ships engaged in international commerce are exempt from sales or use tax. Delivery charges are subject to sales tax when billed by vendor even though such amounts are separately stated on the seller's invoice apart from the sales price of the property. Freight charges are subject to use tax irrespective of method billed or paid. Owners or other persons receiving benefit from use of tangible personal property in this State are liable for use tax on such property. Charges for labor on repairs rendered at out-of-state locations are exempt where specifically identifiable. 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 Adequate records must be maintained to substantiate tax classifications of sales and purchases. Manufacturing Problem - Worksheet ABC Manufacturing Company Items Purchased - January Tax Rate Tax Due Reg. Line Numbers Cost 1) Shredded tires $22.000 100,000 2) Crane (Crane used prior to manufacturing.) 3) Machinery and steel for large tank 65,000 7,000 4) Bulk cement, steel bars for foundations 5) Lubricating oils 1,600 6) Stretch wrap film 10,000 800 7) Welding supplies 8) Analytical equipment for development 6,000 9) Analytical equipment to test product 3,000 10) Materials used, consumed in process 2,6001 11) Air conditioning system 14.000 12) Clarifier 4,000,000 20,000 20,000 13) Fork lifts (warehouse) (Fork lifts used after mfg process ends.) 14) Fork lifts (80% process) (Exclusively means 100%. 15) Palletizer 30,000 16) Fire alarm and sprinkler 24,000 17) Process conveyors 200,000 18) Safety goggles and gloves 600 19) Labels for cartons 2,000 20) Monitoring instrumentation 8,000 Total tax due Manufacturing Problem Breakout You are the tax analyst for ABC Manufacturing Company. ABC's production facility is located in State A, which has a state sales/use tax rate of 6%; no local tax is imposed. State A offers exemptions for certain items used in manufacturing and a reduced rate of tax for other items purchased by manufacturers. Using the attached regulation for manufacturing in State A, determine the total tax due for these listed purchases. A worksheet is provided for your calculations. Reference the basis for your decisions by line numbers. 1) Shredded tires used as a fuel source for power boilers which produce steam for use in the manufacturing process. 2) A crane that will be used to unload incoming trucks of raw materials and place the raw materials in an area used for storage. 3) Machinery and steel, when assembled, will become a large tank used for mixing raw materials with other chemicals to cause chemical reactions. 4) Bulk cement and steel reinforcing bars which will become part of a foundation for the tank mentioned in item 3. 5) Lubricating oils used within production machinery to keep the machinery in good working order. 6) Stretch wrap film. (Coming off the production line, finished products are placed in cartons; the cartons are stacked on pallets; and the pallets are wrapped with stretch wrap film.) 7) Welding supplies used for servicing manufacturing areas of the plant 8) Analytical equipment used to develop new product lines or improve current products. 9) Analytical equipment used to test random samples of the product at various stages of the manufacturing process. Manufacturing Problem (continued) 10) Caustic Soda which is used and consumed directly in the process comes in direct contact with the product, but that does not become part of the finished product. 11) An air-conditioning system which is used in the manufacturing area for the comfort of the employees. 12) A clarifier (a large tank) which is used to remove solids from the plant's waste water, per state regulations, prior to discharging the water into a nearby river. 13) Fork lifts used to move the finished product from the warehouse to trucks for shipment to customers. 14) Fork lifts which are used 80% of the time for moving product from one process area to the next and 20% of the time for moving finished product from the warehouse to trucks for shipment to customers. 15) A palletizer which places 12 cartons of finished product onto pallets prior to stretch wrapping the pallet . Pallets are then stored in warehouse prior to shipment 16) A fire alarm and sprinkler system that will be used in the manufacturing areas of the plant 17) Conveyors that transport goods in process from one stage of the process to another stage of the process. 18) Safety goggles and gloves used by employees in the manufacturing process. The safety equipment is required to perform manufacturing duties. 19) Labels that will be placed on the cartons containing the finished product and shipped to the customer. 20) Instrumentation which monitors the production process and automatically adjusts pressures, temperatures, flow rates, etc. as needed to remain within production specifications. REGULATION: Manufacturers 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 A "manufacturer" is defined as a person who is predominately engaged in the business of fabricating, compounding, or creating from his own raw materials or ingredients any tangible personal property by the application of skill and labor, either by hand or through the use of machinery for sale or rental through the regular channels of trade. Manufacturing refines, improves, changes the condition of raw materials or converts the form of the materials into new, different, or more useful property, and includes the fabrication or production of special made-to-order articles and the generation of electricity. A person who is engaged in manufacturing and nonmanufacturing activities may be classified as a manufacturer as to his manufacturing activities which are operated as a separate business or division. **Manufacturing plant" means the real and personal property owned or leased by a manufacturer which is assembled and used at a fixed location to perform activities defined as manufacturing Manufacturing begins at the point where the raw materials are transferred to the actual processing operation from storage or stock pile at the plant, and ends when the product manufactured leaves the assembly line for storage or shipment, and includes the processing of the by-product or waste materials to avoid air and water pollution. Manufacturing machinery Manufacturing machinery is that machinery used within a plant exclusively and directly in manufacturing a commodity for sale, rental or in custom processing for a fee. Motorized units and other conveyor systems serving a specific function within the line of process at the plant will be classed as manufacturing machinery, as well as equipment used in the processing of waste material to avoid air and water pollution. Manufacturing machinery also includes laboratory machinery which shall include X-ray machines and film, scales, chemical equipment, pressure and tensile analysis machines and similar equipment to determine the quality of the product in process of manufacture, and equipment used in the processing of waste materials to avoid air and water pollution, but only when located at the manufacturer's plant site. Manufacturing machinery does not include machinery for use in the severance of timber, sand, gravel, oil, gas or other natural resources produced or severed from the soil or water. maintenance or repair machinery, research laboratory machinery, storage facilities, warehouse machinery, equipment for protection of the plant or comfort of the personnel, or other equipment and supplies of like character. The term "manufacturing machinery" does not include foundations or materials for their construction, nor does it include portable equipment which is not assembled and used at a fixed location. Machine parts are component parts of manufacturing machinery and do not include par for service equipment, nonmanufacturing machinery, fuels, lubricants, paints, or tools fo maintenance. Sales by manufacturers to contractors of component materials (material purcha certificate number), to other manufacturers for further processing, to licensed dealers 47 49 50 52 54 8898989%85 57 58 60 retailers for resale through the regular course of business, or to exempt customers (city. governmental agencies, etc.) are exempt from sales tax. Sales of manufacturing machinery or machine parts to other manufacturers are taxable at the special 1.5% rate of sales tax. Sales to consumers or users are subject to the regular retail rate of tax. Purchases by manufacturers of raw materials which become a component part of the finished product, containers for sale with the finished product, or catalysts, chemicals or gases used directly in processing (except natural gas or items used as a fuel) are exempt from sales or use tax. Purchases of electric power or other fuel and machinery or machine parts used directly in the manufacturing process are taxable at the special 1.5% rate of sales or use tax. Purchases of all other equipment and supplies (furniture, fixtures, cleaning materials, etc.) are taxable at the regular retail rate of tax. Purchases of boxes, crates, cartons, cans, bottles and other packaging materials to manufacturers and wholesalers for use as containers or shipping materials to accompany goods sold by said manufacturers or wholesalers where possession thereof will pass to the customer at the time of sale of the goods contained therein and sales to anyone of containers or shipping materials for use in ships engaged in international commerce are exempt from sales or use tax. Delivery charges are subject to sales tax when billed by vendor even though such amounts are separately stated on the seller's invoice apart from the sales price of the property. Freight charges are subject to use tax irrespective of method billed or paid. Owners or other persons receiving benefit from use of tangible personal property in this State are liable for use tax on such property. Charges for labor on repairs rendered at out-of-state locations are exempt where specifically identifiable. 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 Adequate records must be maintained to substantiate tax classifications of sales and purchases. Manufacturing Problem - Worksheet ABC Manufacturing Company Items Purchased - January Tax Rate Tax Due Reg. Line Numbers Cost 1) Shredded tires $22.000 100,000 2) Crane (Crane used prior to manufacturing.) 3) Machinery and steel for large tank 65,000 7,000 4) Bulk cement, steel bars for foundations 5) Lubricating oils 1,600 6) Stretch wrap film 10,000 800 7) Welding supplies 8) Analytical equipment for development 6,000 9) Analytical equipment to test product 3,000 10) Materials used, consumed in process 2,6001 11) Air conditioning system 14.000 12) Clarifier 4,000,000 20,000 20,000 13) Fork lifts (warehouse) (Fork lifts used after mfg process ends.) 14) Fork lifts (80% process) (Exclusively means 100%. 15) Palletizer 30,000 16) Fire alarm and sprinkler 24,000 17) Process conveyors 200,000 18) Safety goggles and gloves 600 19) Labels for cartons 2,000 20) Monitoring instrumentation 8,000 Total tax due

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started