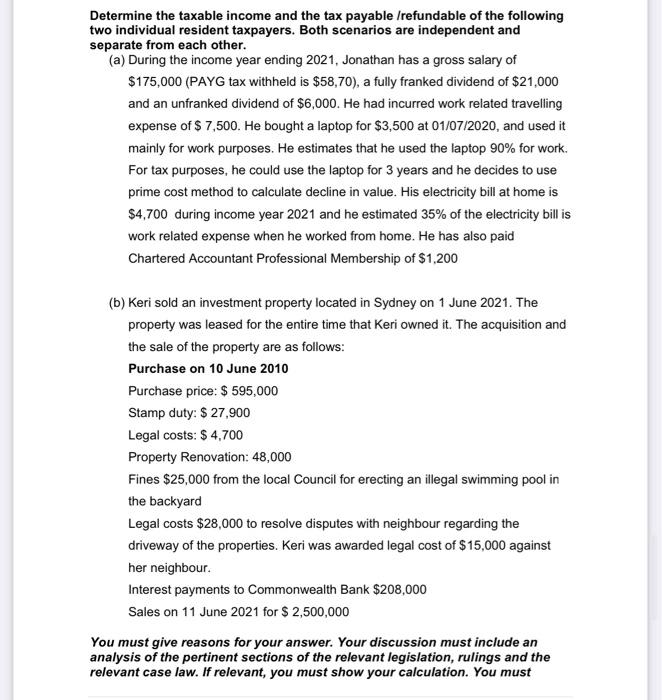

Determine the taxable income and the tax payable /refundable of the following two individual resident taxpayers. Both scenarios are independent and separate from each other. (a) During the income year ending 2021, Jonathan has a gross salary of $175,000 (PAYG tax withheld is $58,70), a fully franked dividend of $21,000 and an unfranked dividend of $6,000. He had incurred work related travelling expense of $ 7,500. He bought a laptop for $3,500 at 01/07/2020, and used it mainly for work purposes. He estimates that he used the laptop 90% for work. For tax purposes, he could use the laptop for 3 years and he decides to use prime cost method to calculate decline in value. His electricity bill at home is $4,700 during income year 2021 and he estimated 35% of the electricity bill is work related expense when he worked from home. He has also paid Chartered Accountant Professional Membership of $1,200 (b) Keri sold an investment property located in Sydney on 1 June 2021. The property was leased for the entire time that Keri owned it. The acquisition and the sale of the property are as follows: Purchase on 10 June 2010 Purchase price: $ 595,000 Stamp duty: $ 27,900 Legal costs: $4,700 Property Renovation: 48,000 Fines $25,000 from the local Council for erecting an illegal swimming pool in the backyard Legal costs $28,000 to resolve disputes with neighbour regarding the driveway of the properties. Keri was awarded legal cost of $15,000 against her neighbour. Interest payments to Commonwealth Bank $208,000 Sales on 11 June 2021 for $ 2,500,000 You must give reasons for your answer. Your discussion must include an analysis of the pertinent sections of the relevant legislation, rulings and the relevant case law. If relevant, you must show your calculation. You must Determine the taxable income and the tax payable /refundable of the following two individual resident taxpayers. Both scenarios are independent and separate from each other. (a) During the income year ending 2021, Jonathan has a gross salary of $175,000 (PAYG tax withheld is $58,70), a fully franked dividend of $21,000 and an unfranked dividend of $6,000. He had incurred work related travelling expense of $ 7,500. He bought a laptop for $3,500 at 01/07/2020, and used it mainly for work purposes. He estimates that he used the laptop 90% for work. For tax purposes, he could use the laptop for 3 years and he decides to use prime cost method to calculate decline in value. His electricity bill at home is $4,700 during income year 2021 and he estimated 35% of the electricity bill is work related expense when he worked from home. He has also paid Chartered Accountant Professional Membership of $1,200 (b) Keri sold an investment property located in Sydney on 1 June 2021. The property was leased for the entire time that Keri owned it. The acquisition and the sale of the property are as follows: Purchase on 10 June 2010 Purchase price: $ 595,000 Stamp duty: $ 27,900 Legal costs: $4,700 Property Renovation: 48,000 Fines $25,000 from the local Council for erecting an illegal swimming pool in the backyard Legal costs $28,000 to resolve disputes with neighbour regarding the driveway of the properties. Keri was awarded legal cost of $15,000 against her neighbour. Interest payments to Commonwealth Bank $208,000 Sales on 11 June 2021 for $ 2,500,000 You must give reasons for your answer. Your discussion must include an analysis of the pertinent sections of the relevant legislation, rulings and the relevant case law. If relevant, you must show your calculation. You must