Answered step by step

Verified Expert Solution

Question

1 Approved Answer

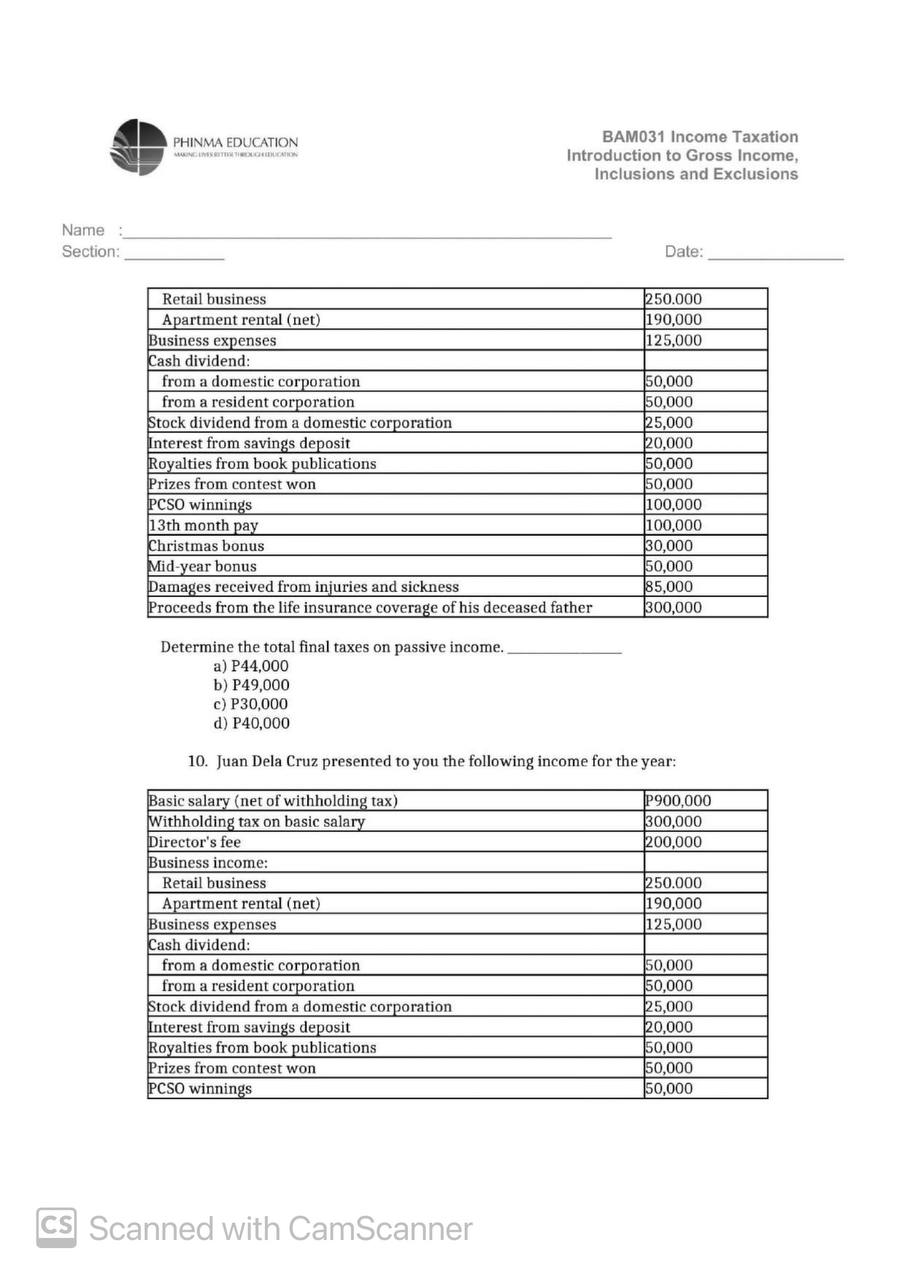

Determine the total final taxes on passive income. a) P44,000 b) P49,000 c) P30,000 d) P40,000 10. Juan Dela Cruz presented to you the following

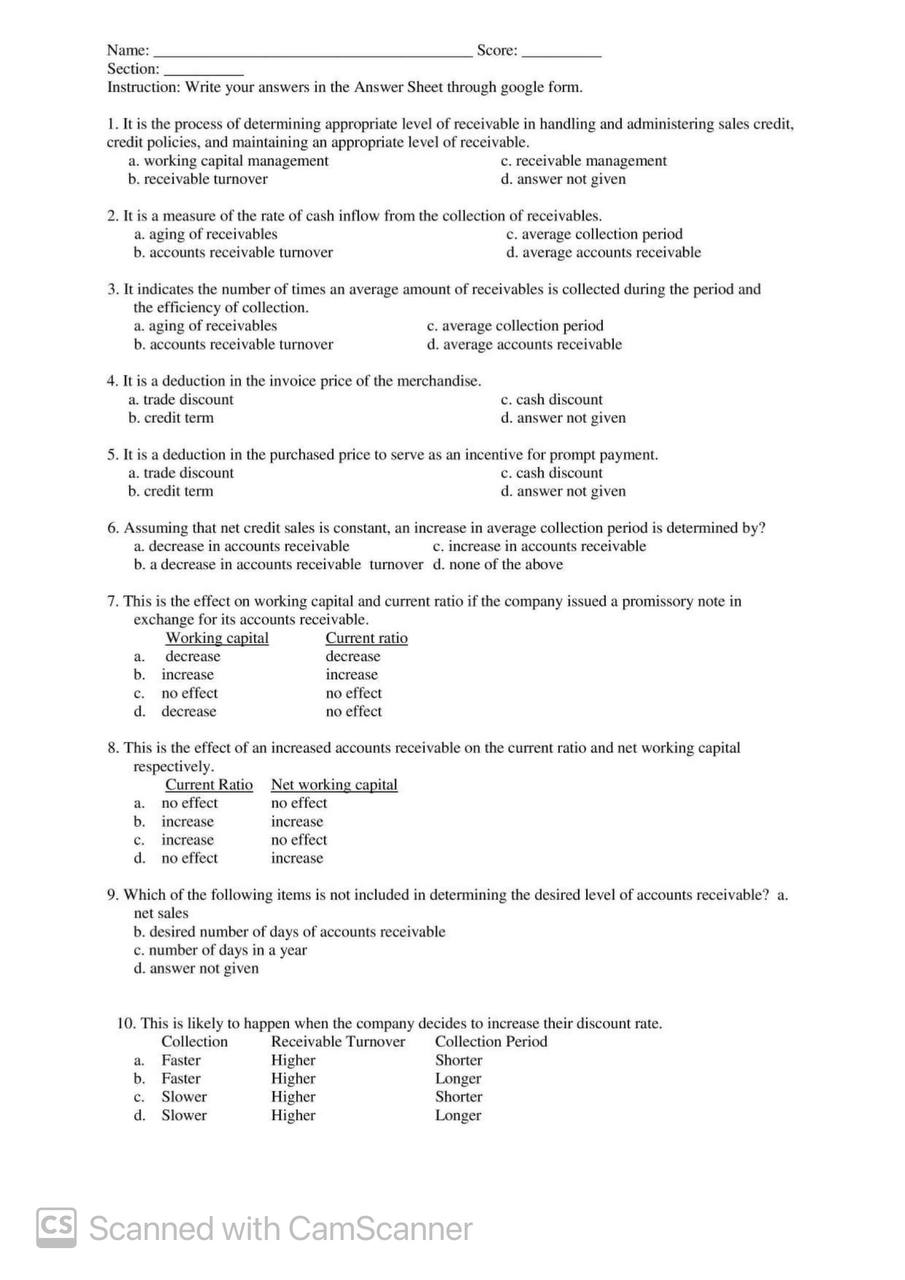

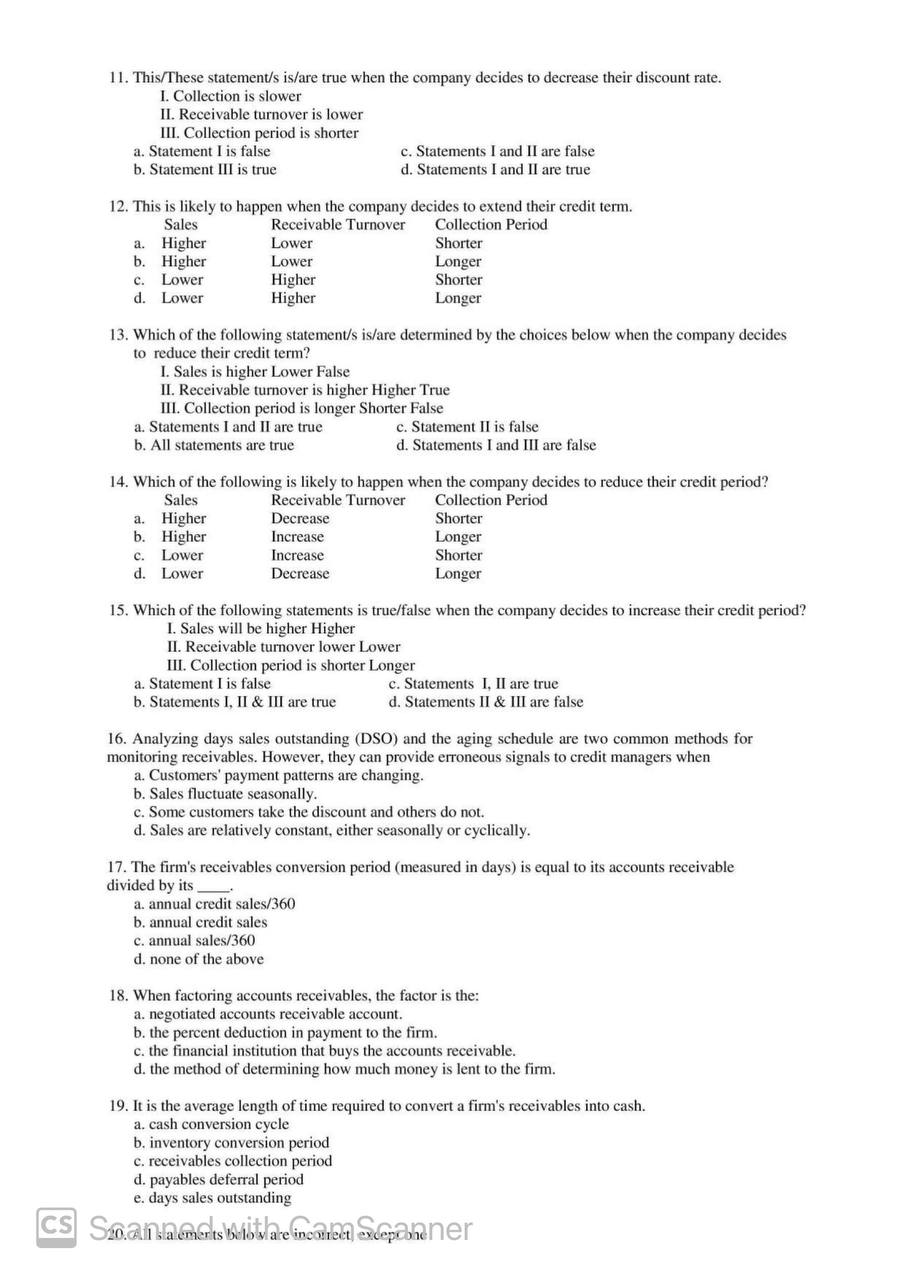

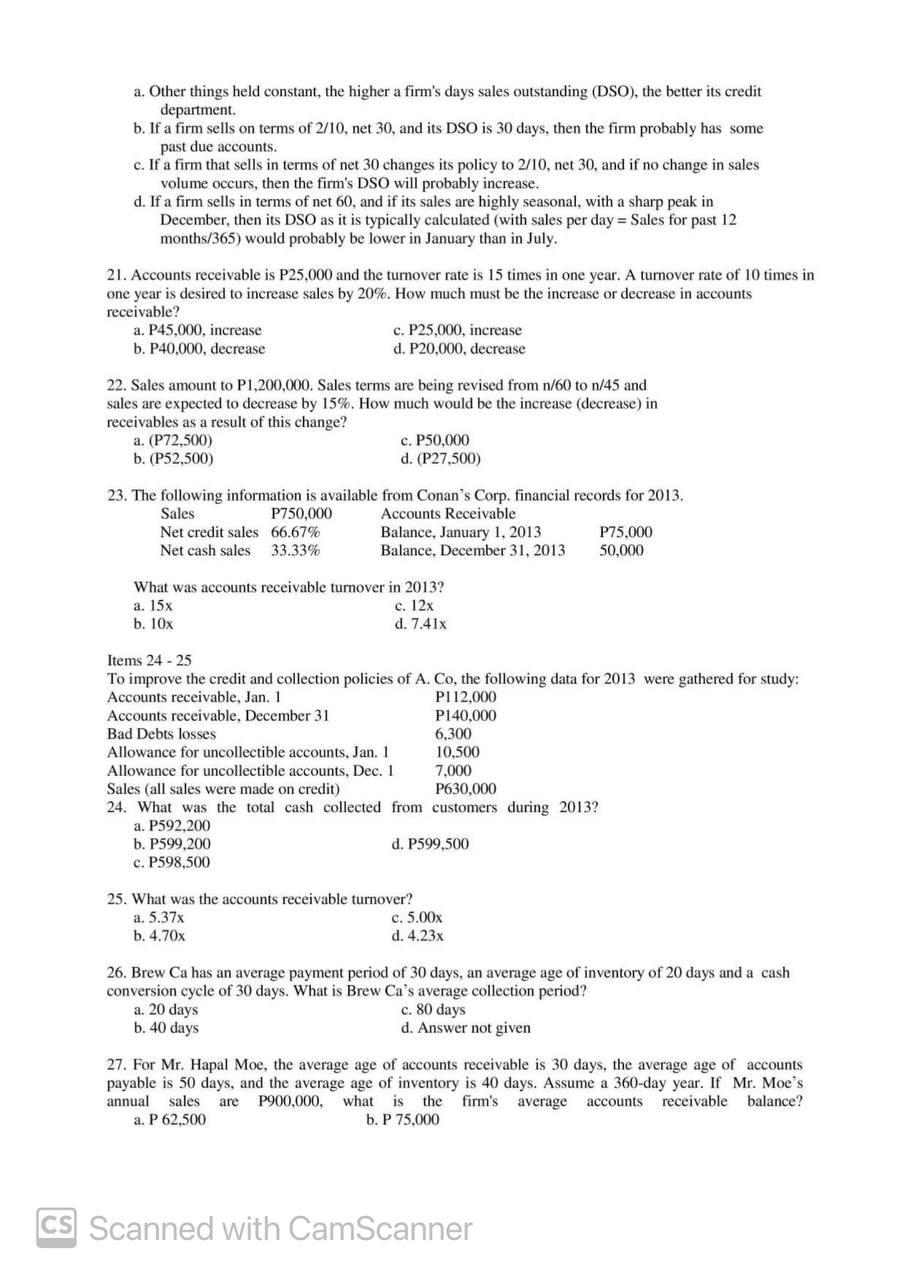

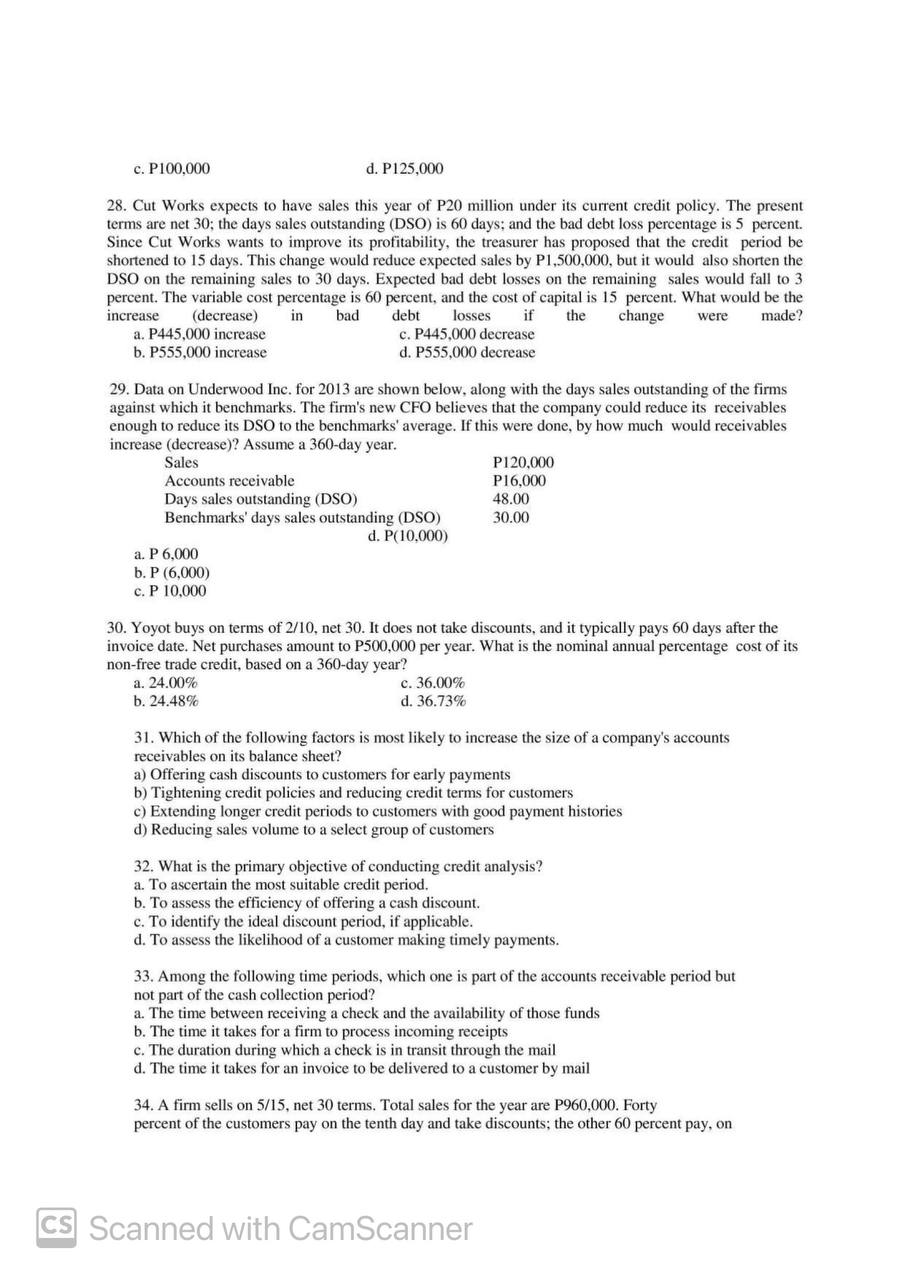

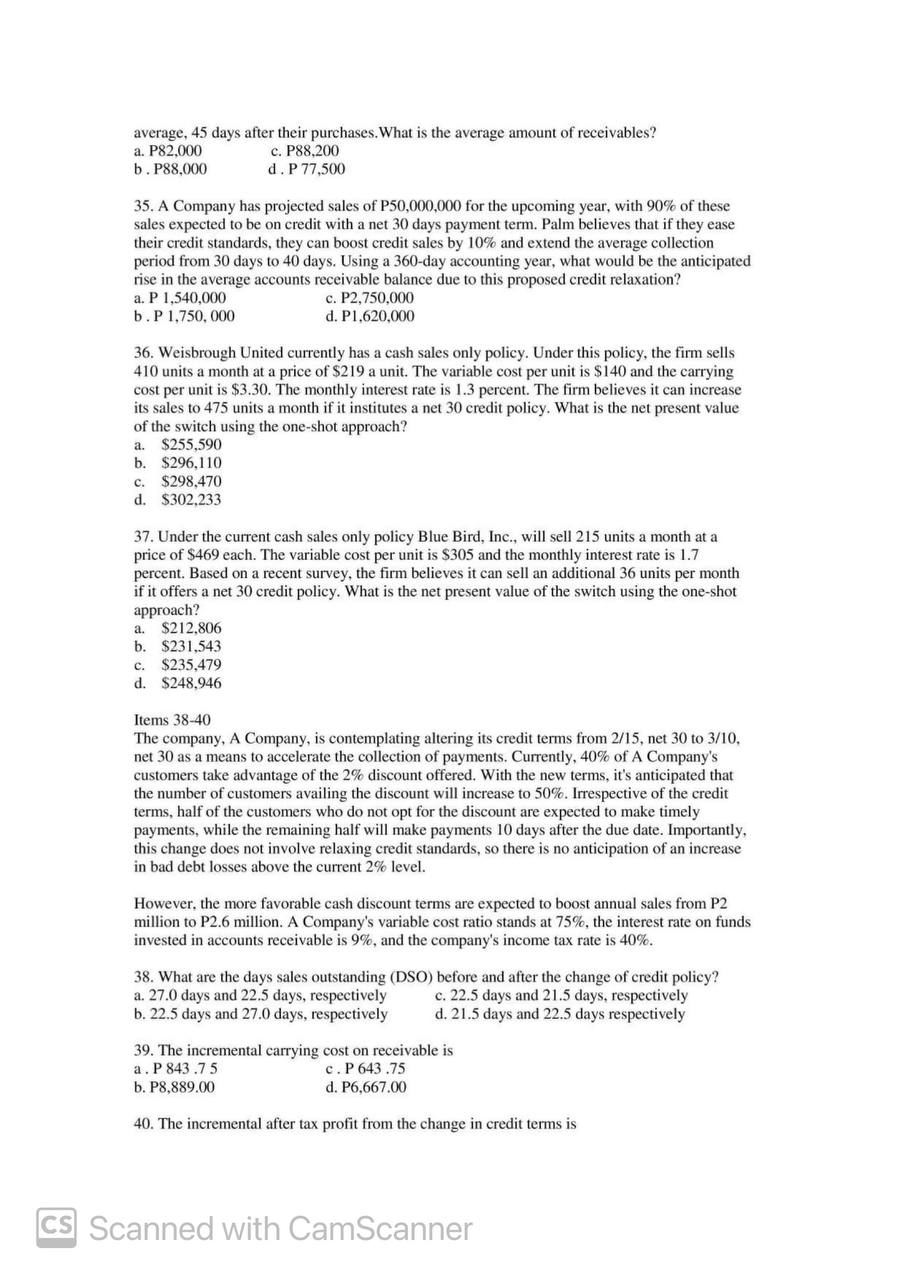

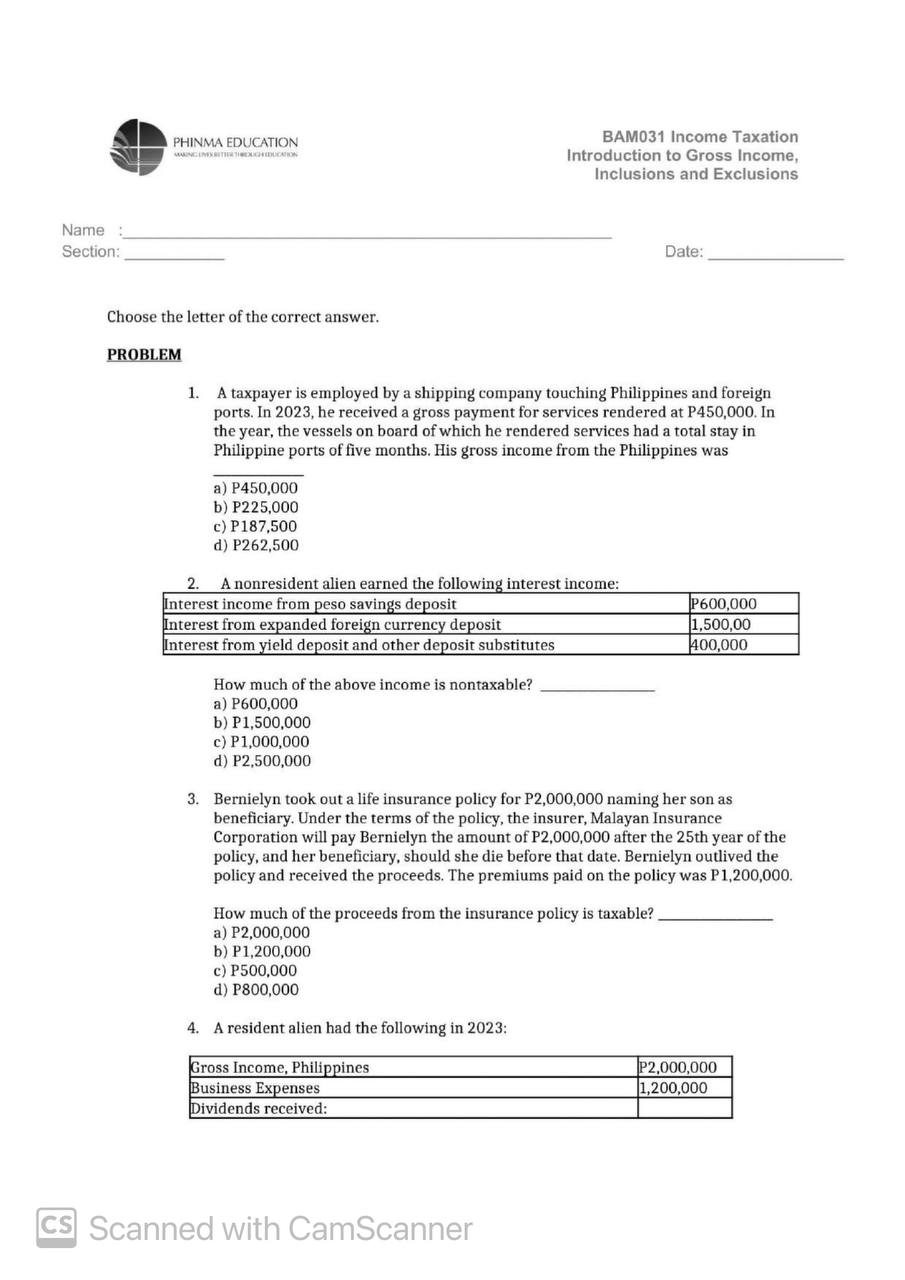

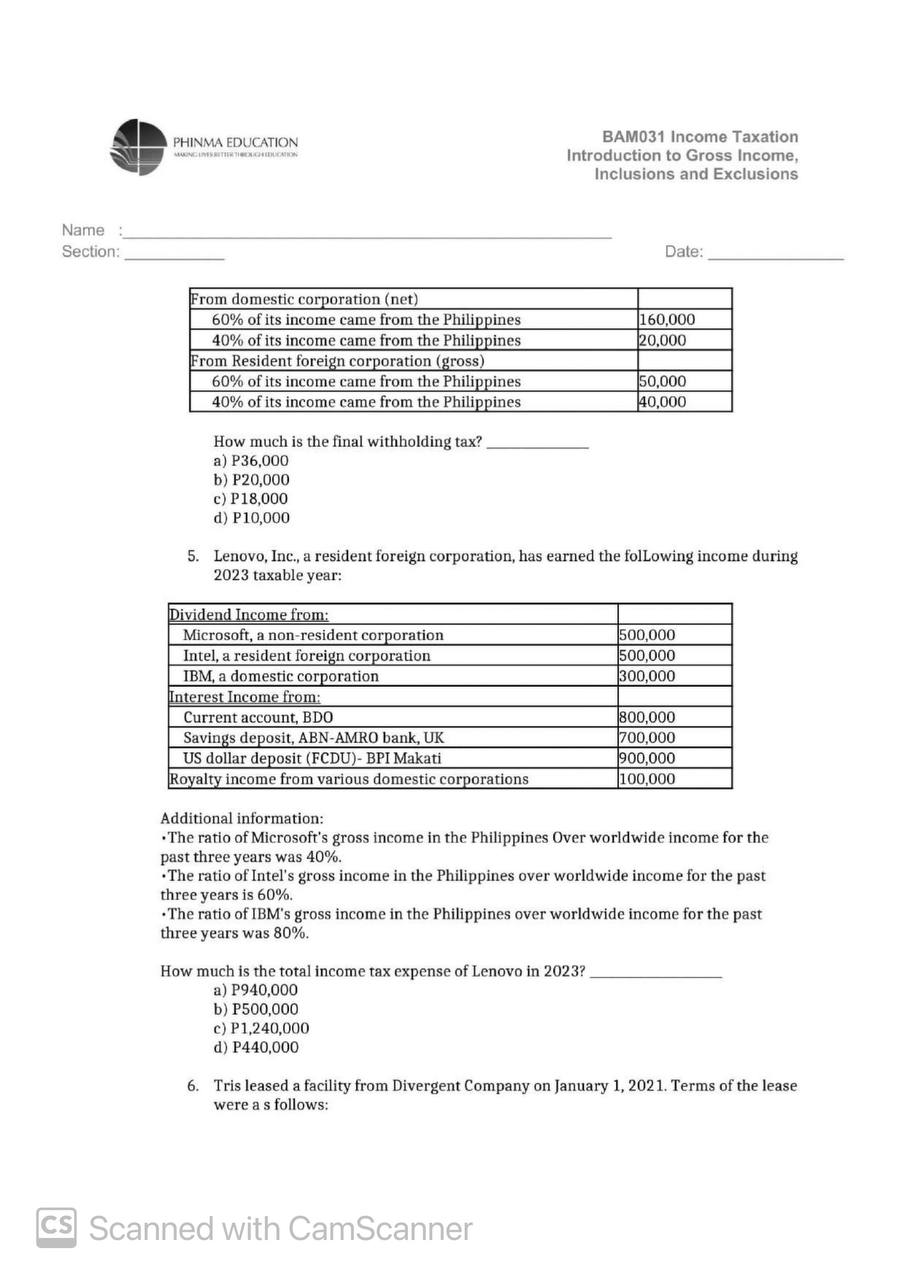

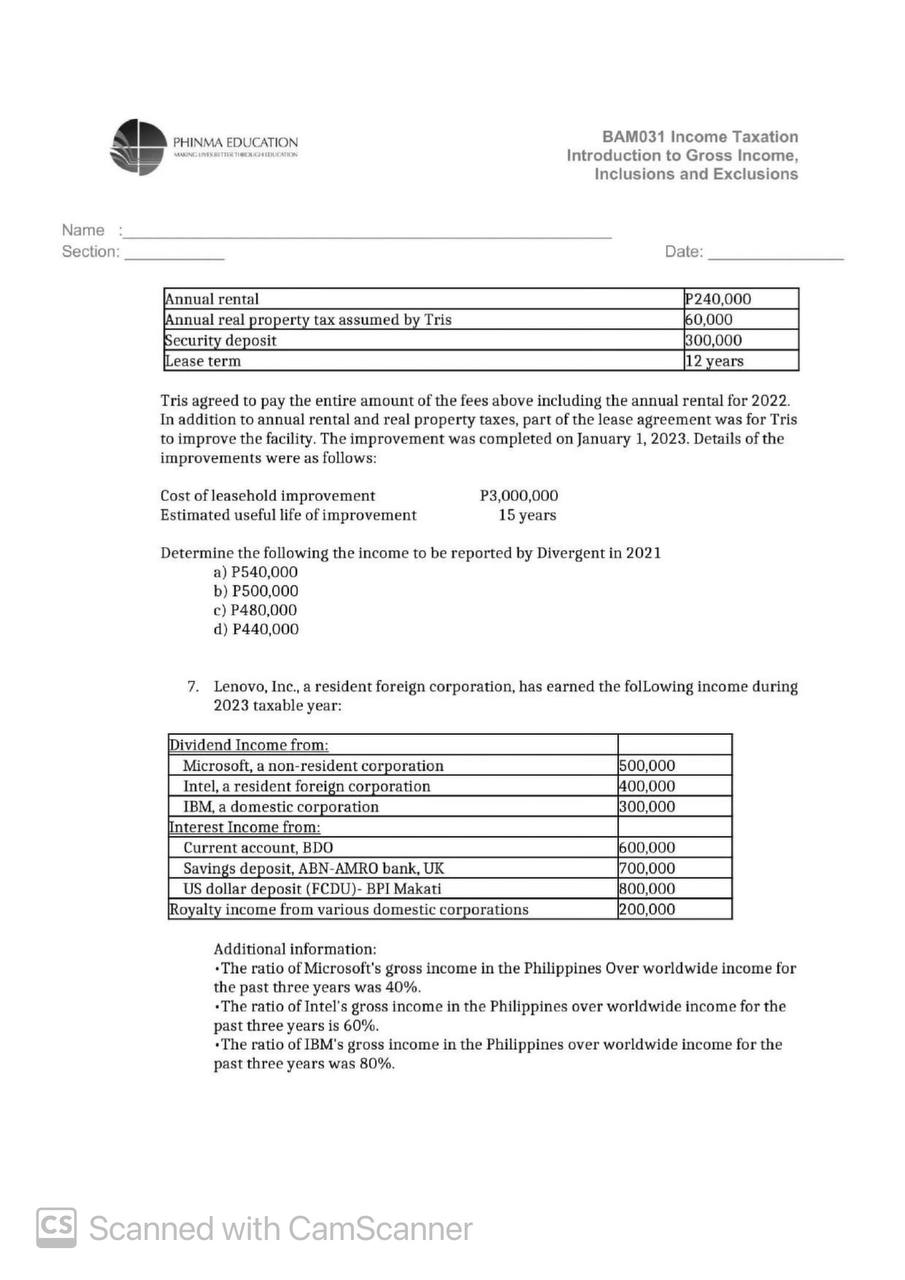

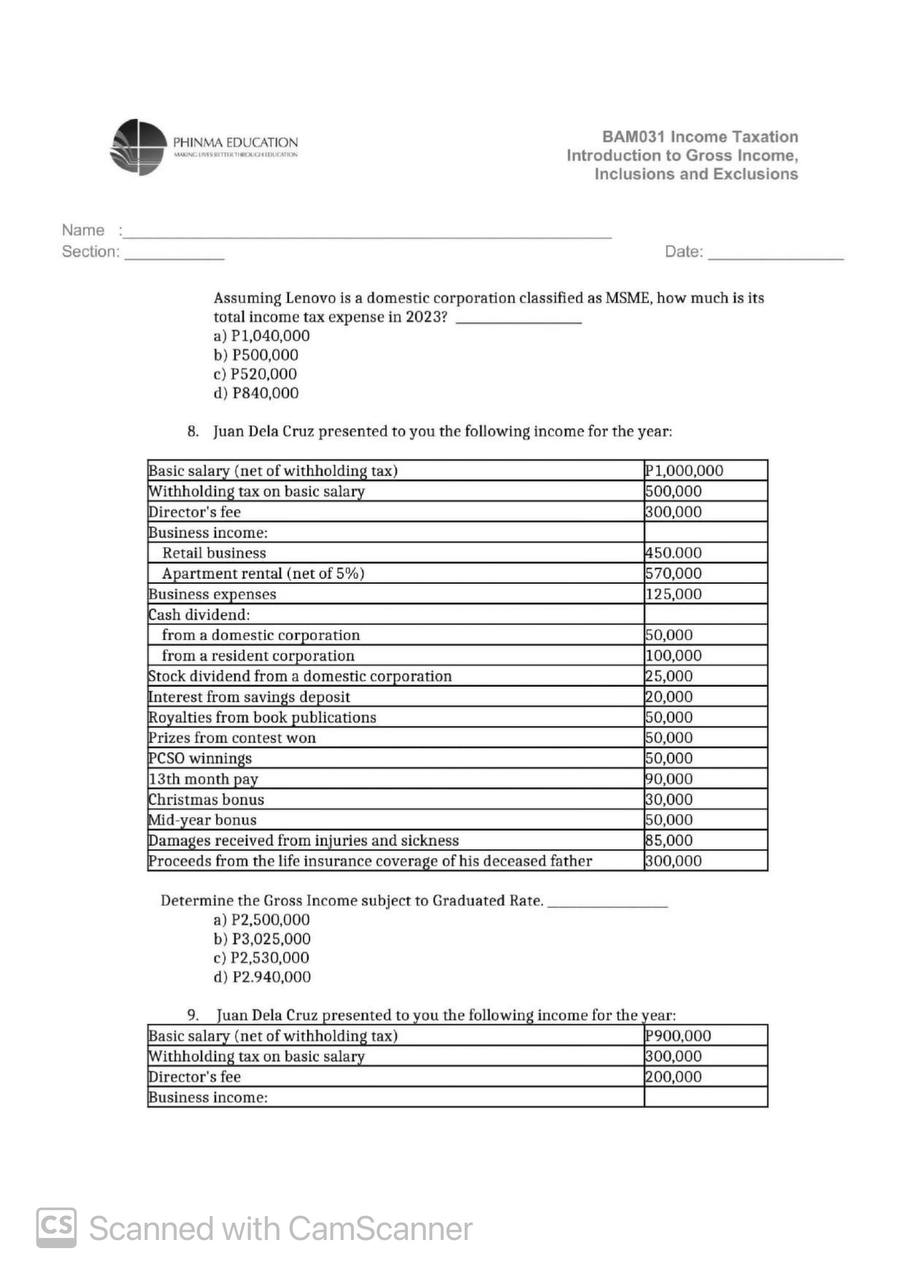

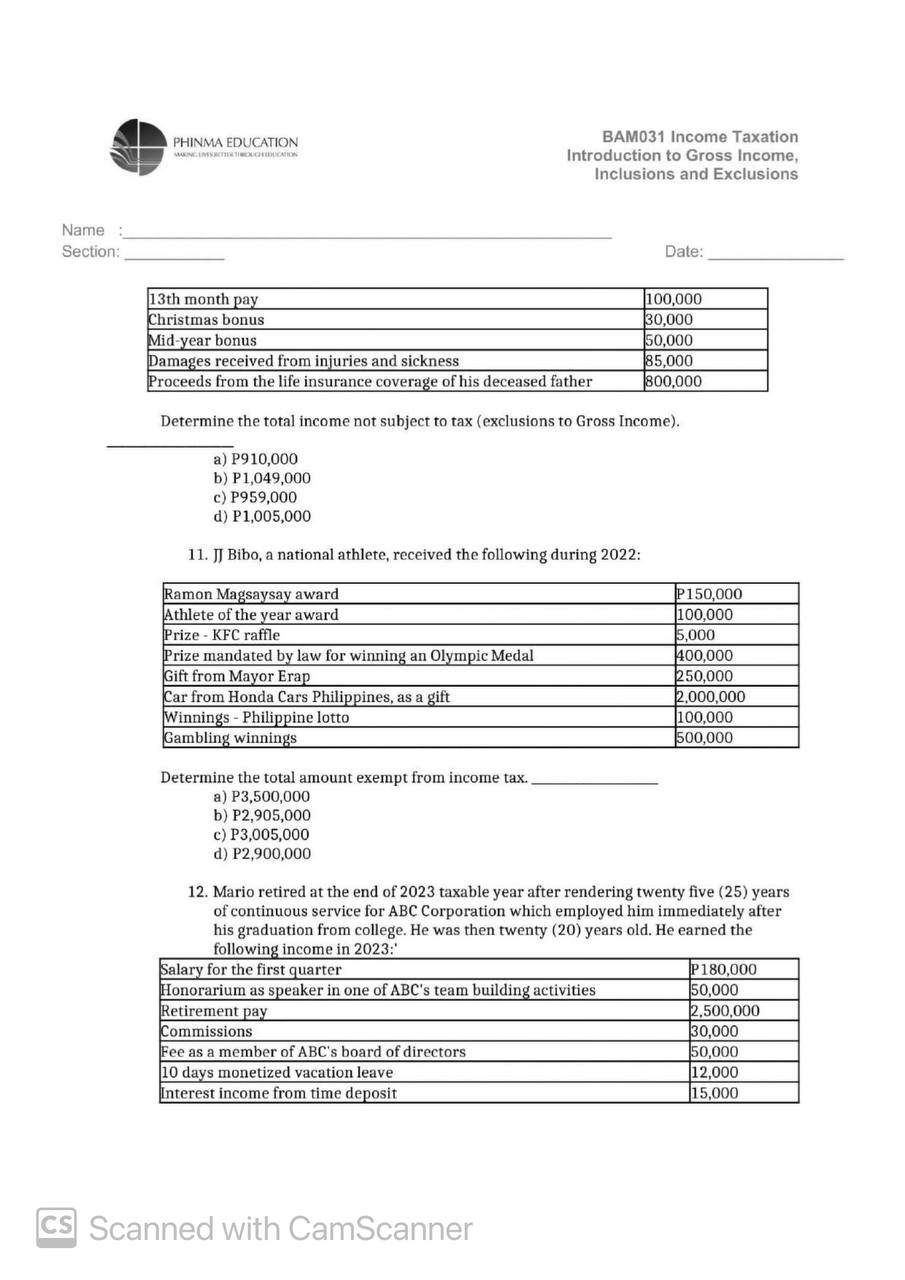

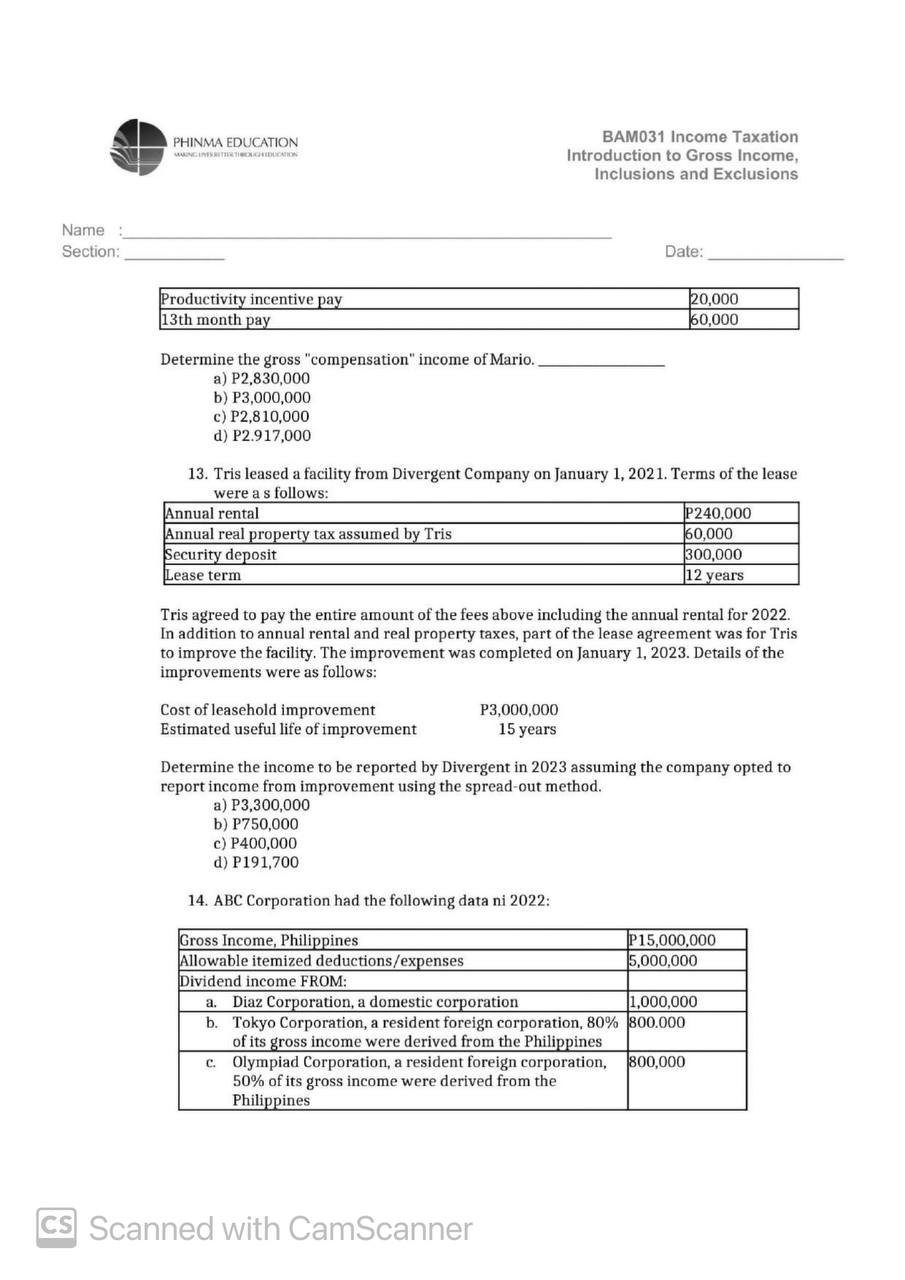

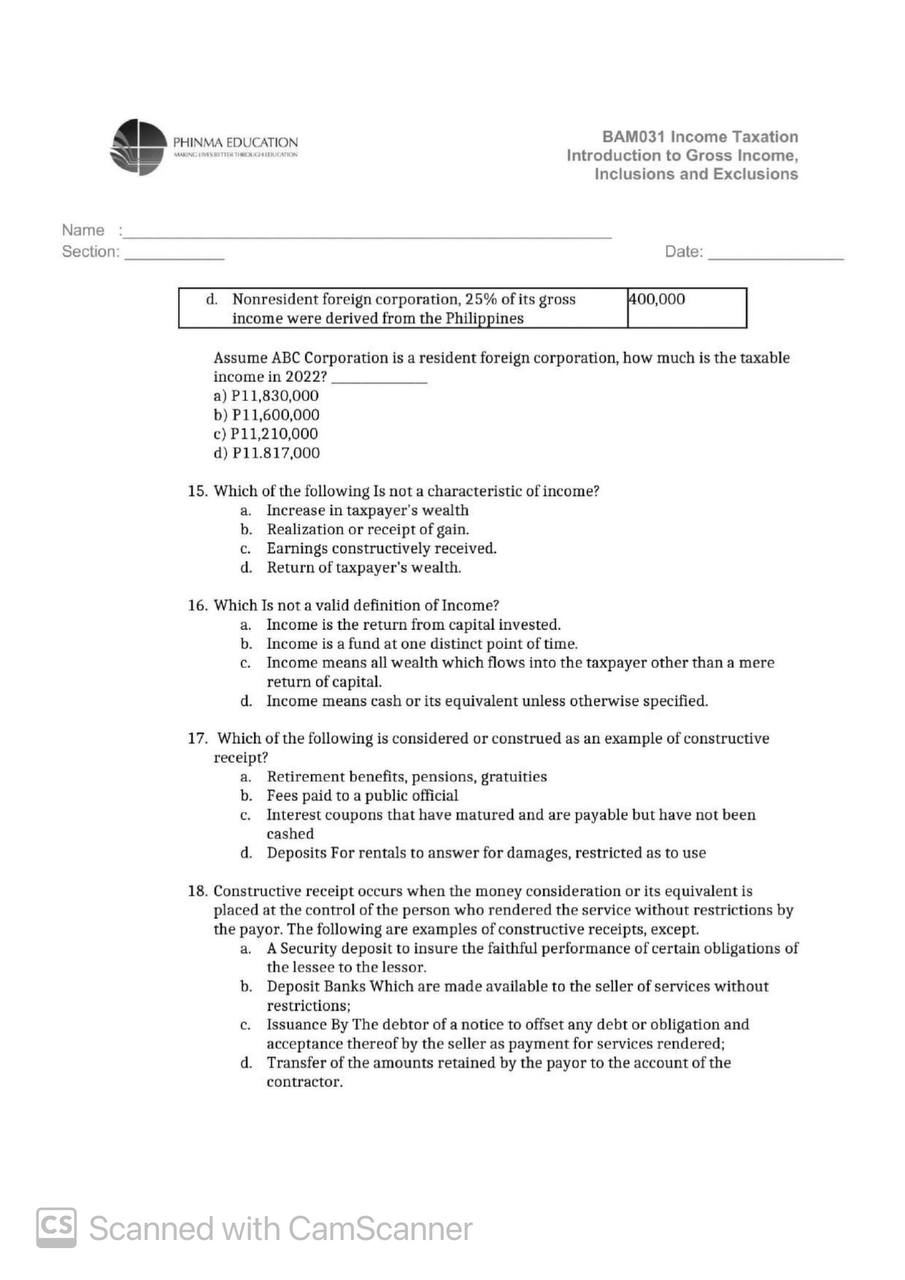

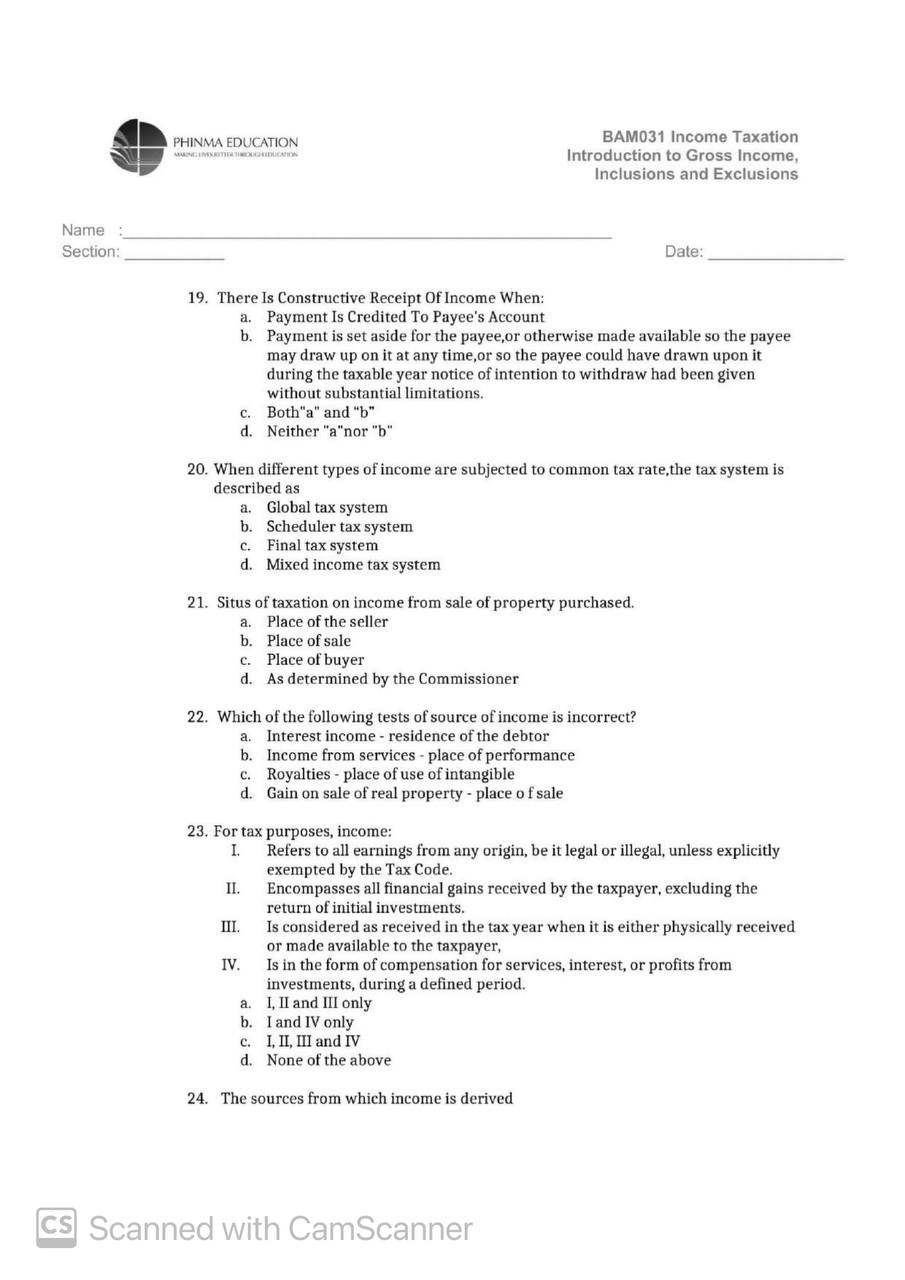

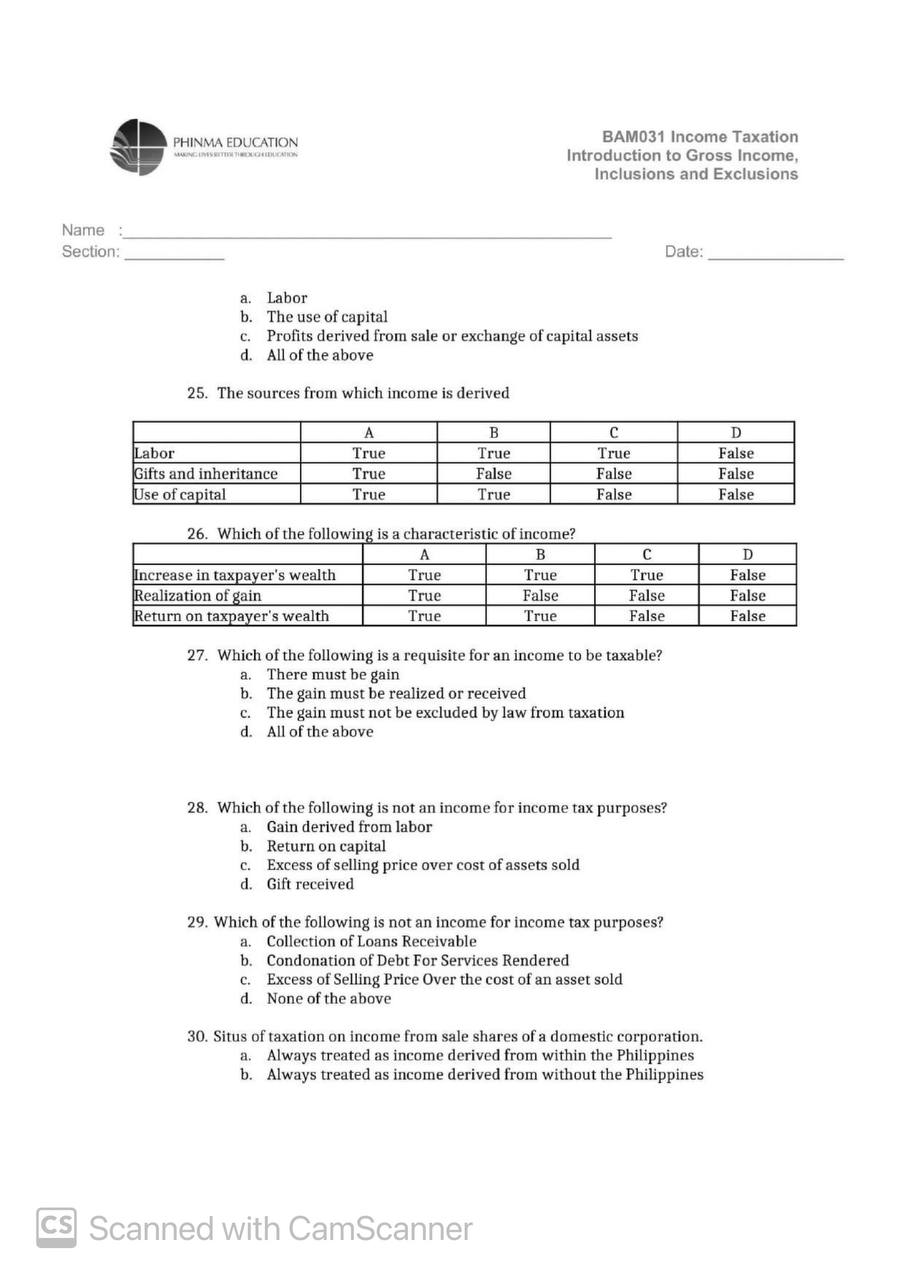

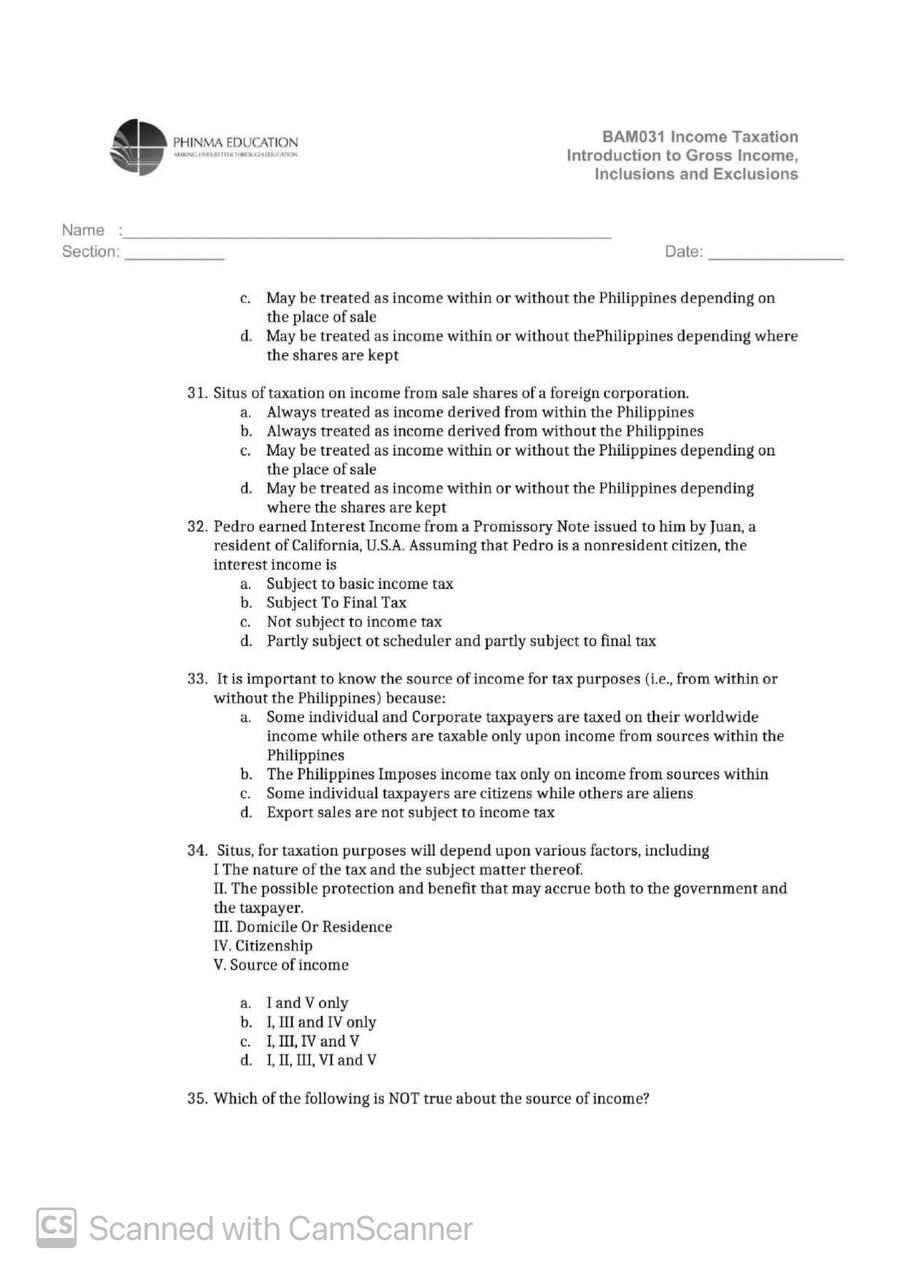

Determine the total final taxes on passive income. a) P44,000 b) P49,000 c) P30,000 d) P40,000 10. Juan Dela Cruz presented to you the following income for the year: How much is the final withholding tax? a) P36,000 b) P20,000 c) P18,000 d) P10,000 5. Lenovo, Inc., a resident foreign corporation, has earned the folLowing income during 2023 taxable year: Additional information: -The ratio of Microsoft's gross income in the Philippines Over worldwide income for the past three years was 40%. - The ratio of Intel's gross income in the Philippines over worldwide income for the past three years is 60%. -The ratio of IBM's gross income in the Philippines over worldwide income for the past three years was 80%. How much is the total income tax expense of Lenovo in 2023? a) P940,000 b) P500,000 c) P1,240,000 d) P440,000 6. Tris leased a facility from Divergent Company on January 1,2021. Terms of the lease were a s follows: 28. Cut Works expects to have sales this year of P20 million under its current credit policy. The present terms are net 30; the days sales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Since Cut Works wants to improve its profitability, the treasurer has proposed that the credit period be shortened to 15 days. This change would reduce expected sales by P1,500,000, but it would also shorten the DSO on the remaining sales to 30 days. Expected bad debt losses on the remaining sales would fall to 3 nerrent The variahle cost nercentace is 60 nercent and the sost of canital is 15 nerrent What would he the ? 29. Data on Underwood Inc. for 2013 are shown below, along with the days sales outstanding of the firms against which it benchmarks. The firm's new CFO believes that the company could reduce its receivables enough to reduce its DSO to the benchmarks' average. If this were done, by how much would receivables increase (decrease)? Assume a 360-dav vear. a. P6,000 b. P(6,000) c. P10,000 30 . Yoyot buys on terms of 2/10, net 30 . It does not take discounts, and it typically pays 60 days after the invoice date. Net purchases amount to P500,000 per year. What is the nominal annual percentage cost of its non-free trade credit, based on a 360-day year? a. 24.00% c. 36.00% b. 24.48% d. 36.73% 31. Which of the following factors is most likely to increase the size of a company's accounts receivables on its balance sheet? a) Offering cash discounts to customers for early payments b) Tightening credit policies and reducing credit terms for customers c) Extending longer credit periods to customers with good payment histories d) Reducing sales volume to a select group of customers 32. What is the primary objective of conducting credit analysis? a. To ascertain the most suitable credit period. b. To assess the efficiency of offering a cash discount. c. To identify the ideal discount period, if applicable. d. To assess the likelihood of a customer making timely payments. 33. Among the following time periods, which one is part of the accounts receivable period but not part of the cash collection period? a. The time between receiving a check and the availability of those funds b. The time it takes for a firm to process incoming receipts c. The duration during which a check is in transit through the mail d. The time it takes for an invoice to be delivered to a customer by mail 34. A firm sells on 5/15, net 30 terms. Total sales for the year are P960,000. Forty percent of the customers pay on the tenth day and take discounts; the other 60 percent pay, on a. P 68,493 b. P65,640 c. P 60,615 d. P57,615 - END - CS Scanned with CamScanner Tris agreed to pay the entire amount of the fees above including the annual rental for 2022. In addition to annual rental and real property taxes, part of the lease agreement was for Tris to improve the facility. The improvement was completed on January 1,2023. Details of the improvements were as follows: Cost of leasehold improvement Estimated useful life of improvement P3,000,00015years Determine the following the income to be reported by Divergent in 2021 a) P540,000 b) P500,000 c) P480,000 d) P440,000 7. Lenovo, Inc., a resident foreign corporation, has earned the folLowing income during 2023 taxable year: Additional information: -The ratio of Microsoft's gross income in the Philippines Over worldwide income for the past three years was 40%. - The ratio of Intel's gross income in the Philippines over worldwide income for the past three years is 60%. -The ratio of IBM's gross income in the Philippines over worldwide income for the past three years was 80%. d. Nonresident foreign corporation, 25% of its gross income were derived from the Philippines Assume ABC Corporation is a resident foreign corporation, how much is the taxable income in 2022? a) P11,830,000 b) P11,600,000 c) P11,210,000 d) P11.817,000 15. Which of the following Is not a characteristic of income? a. Increase in taxpayer's wealth b. Realization or receipt of gain. c. Earnings constructively received. d. Return of taxpayer's wealth. 16. Which Is not a valid definition of Income? a. Income is the return from capital invested. b. Income is a fund at one distinct point of time. c. Income means all wealth which flows into the taxpayer other than a mere return of capital. d. Income means cash or its equivalent unless otherwise specified. 17. Which of the following is considered or construed as an example of constructive receipt? a. Retirement benefits, pensions, gratuities b. Fees paid to a public official c. Interest coupons that have matured and are payable but have not been cashed d. Deposits For rentals to answer for damages, restricted as to use 18. Constructive receipt occurs when the money consideration or its equivalent is placed at the control of the person who rendered the service without restrictions by the payor. The following are examples of constructive receipts, except. a. A Security deposit to insure the faithful performance of certain obligations of the lessee to the lessor. b. Deposit Banks Which are made available to the seller of services without restrictions; c. Issuance By The debtor of a notice to offset any debt or obligation and acceptance thereof by the seller as payment for services rendered; d. Transfer of the amounts retained by the payor to the account of the contractor. Scanned with CamScanner Determine the total income not subject to tax (exclusions to Gross Income). a) P910,000 b) P1,049,000 c) P959,000 d) P1,005,000 11. JJ Bibo, a national athlete, received the following during 2022 : Determine the total amount exempt from income tax. a) P3,500,000 b) P2,905,000 c) P3,005,000 d) P2,900,000 12. Mario retired at the end of 2023 taxable year after rendering twenty five (25) years of continuous service for ABC Corporation which employed him immediately after his graduation from college. He was then twenty (20) years old. He earned the following income in 2023: Instruction: Write your answers in the Answer Sheet through google form. 1. It is the process of determining appropriate level of receivable in handling and administering sales credit, credit policies, and maintaining an appropriate level of receivable. a. working capital management c. receivable management b. receivable turnover d. answer not given 2. It is a measure of the rate of cash inflow from the collection of receivables. a. aging of receivables c. average collection period b. accounts receivable turnover d. average accounts receivable 3. It indicates the number of times an average amount of receivables is collected during the period and the efficiency of collection. a. aging of receivables c. average collection period b. accounts receivable turnover d. average accounts receivable 4. It is a deduction in the invoice price of the merchandise. a. trade discount c. cash discount b. credit term d. answer not given 5. It is a deduction in the purchased price to serve as an incentive for prompt payment. a. trade discount c. cash discount b. credit term d. answer not given 6. Assuming that net credit sales is constant, an increase in average collection period is determined by? a. decrease in accounts receivable c. increase in accounts receivable b. a decrease in accounts receivable turnover d. none of the above 7. This is the effect on working capital and current ratio if the company issued a promissory note in exchange for its accounts receivable. Working capital a. decrease b. increase c. no effect d. decrease Current ratio decrease increase no effect no effect 8. This is the effect of an increased accounts receivable on the current ratio and net working capital respectively. Current Ratio Net working capital a. no effect no effect b. increase increase c. increase no effect d. no effect increase 9. Which of the following items is not included in determining the desired level of accounts receivable? a. net sales b. desired number of days of accounts receivable c. number of days in a year d. answer not given 10. This is likely to happen when the company decides to increase their discount rate. Collection Receivable Turnover Collection Period a. Faster Higher Shorter b. Faster Higher Longer c. Slower Higher Shorter d. Slower Higher Longer CS Scanned with CamScanner \begin{tabular}{|l|l|} \hline Productivity incentive pay & 20,000 \\ \hline 13 th month pay & 60,000 \\ \hline \end{tabular} Determine the gross "compensation" income of Mario. a) P2,830,000 b) P3,000,000 c) P2,810,000 d) P2.917,000 13. Tris leased a facility from Divergent Company on January 1, 2021. Terms of the lease ware a s follnws. Tris agreed to pay the entire amount of the fees above including the annual rental for 2022. In addition to annual rental and real property taxes, part of the lease agreement was for Tris to improve the facility. The improvement was completed on January 1, 2023. Details of the improvements were as follows: Cost of leasehold improvement Estimated useful life of improvement P3,000,00015years Determine the income to be reported by Divergent in 2023 assuming the company opted to report income from improvement using the spread-out method. a) P3,300,000 b) P750,000 c) P400,000 d) P191,700 14. ABC Corporation had the following data ni 2022: CS Scanned with CamScanner a. Labor b. The use of capital c. Profits derived from sale or exchange of capital assets d. All of the above 25. The sources from which income is derived 26 Which of the followind is a rharartarietic of ineme? 27. Which of the following is a requisite for an income to be taxable? a. There must be gain b. The gain must be realized or received c. The gain must not be excluded by law from taxation d. All of the above 28. Which of the following is not an income for income tax purposes? a. Gain derived from labor b. Return on capital c. Excess of selling price over cost of assets sold d. Gift received 29. Which of the following is not an income for income tax purposes? a. Collection of Loans Receivable b. Condonation of Debt For Services Rendered c. Excess of Selling Price Over the cost of an asset sold d. None of the above 30. Situs of taxation on income from sale shares of a domestic corporation. a. Always treated as income derived from within the Philippines b. Always treated as income derived from without the Philippines cS Scanned with CamScanner average, 45 days after their purchases. What is the average amount of receivables? a. P82,000 c. P88,200 b. P88,000 d. P 77,500 35. A Company has projected sales of P50,000,000 for the upcoming year, with 90% of these sales expected to be on credit with a net 30 days payment term. Palm believes that if they ease their credit standards, they can boost credit sales by 10% and extend the average collection period from 30 days to 40 days. Using a 360 -day accounting year, what would be the anticipated rise in the average accounts receivable balance due to this proposed credit relaxation? a. P1,540,000 c. P2,750,000 b. P 1,750,000 d. P1,620,000 36. Weisbrough United currently has a cash sales only policy. Under this policy, the firm sells 410 units a month at a price of $219 a unit. The variable cost per unit is $140 and the carrying cost per unit is $3.30. The monthly interest rate is 1.3 percent. The firm believes it can increase its sales to 475 units a month if it institutes a net 30 credit policy. What is the net present value of the switch using the one-shot approach? a. $255,590 b. $296,110 c. $298,470 d. $302,233 37. Under the current cash sales only policy Blue Bird, Inc., will sell 215 units a month at a price of $469 each. The variable cost per unit is $305 and the monthly interest rate is 1.7 percent. Based on a recent survey, the firm believes it can sell an additional 36 units per month if it offers a net 30 credit policy. What is the net present value of the switch using the one-shot approach? a. $212,806 b. $231,543 c. $235,479 d. $248,946 Items 3840 The company, A Company, is contemplating altering its credit terms from 2/15, net 30 to 3/10, net 30 as a means to accelerate the collection of payments. Currently, 40% of A Company's customers take advantage of the 2% discount offered. With the new terms, it's anticipated that the number of customers availing the discount will increase to 50%. Irrespective of the credit terms, half of the customers who do not opt for the discount are expected to make timely payments, while the remaining half will make payments 10 days after the due date. Importantly, this change does not involve relaxing credit standards, so there is no anticipation of an increase in bad debt losses above the current 2% level. However, the more favorable cash discount terms are expected to boost annual sales from P2 million to P2.6 million. A Company's variable cost ratio stands at 75%, the interest rate on funds invested in accounts receivable is 9%, and the company's income tax rate is 40%. 38. What are the days sales outstanding (DSO) before and after the change of credit policy? a. 27.0 days and 22.5 days, respectively c. 22.5 days and 21.5 days, respectively b. 22.5 days and 27.0 days, respectively d. 21.5 days and 22.5 days respectively 39. The incremental carrying cost on receivable is a. P 843.75 c. P 643.75 b. P8,889.00 d. P6,667.00 40. The incremental after tax profit from the change in credit terms is CS Scanned with CamScanner 11. This/These statement/s is/are true when the company decides to decrease their discount rate. I. Collection is slower II. Receivable turnover is lower III. Collection period is shorter a. Statement I is false c. Statements I and II are false b. Statement III is true d. Statements I and II are true 12. This is likely to happen when the company decides to extend their credit term. Sales a. Higher b. Higher c. Lower d. Lower Receivable Turnover Lower Lower Higher Higher Collection Period Shorter Longer Shorter Longer 13. Which of the following statement/s is/are determined by the choices below when the company decides to reduce their credit term? I. Sales is higher Lower False II. Receivable turnover is higher Higher True III. Collection period is longer Shorter False a. Statements I and II are true c. Statement II is false b. All statements are true d. Statements I and III are false 14. Which of the following is likely to happen when the company decides to reduce their credit period? Sales a. Higher b. Higher c. Lower d. Lower Receivable Turnover Decrease Increase Increase Decrease Collection Period Shorter Longer Shorter Longer 15. Which of the following statements is true/false when the company decides to increase their credit period? I. Sales will be higher Higher II. Receivable turnover lower Lower III. Collection period is shorter Longer a. Statement I is false c. Statements I, II are true b. Statements I, II \& III are true d. Statements II \& III are false 16. Analyzing days sales outstanding (DSO) and the aging schedule are two common methods for monitoring receivables. However, they can provide erroneous signals to credit managers when a. Customers' payment patterns are changing. b. Sales fluctuate seasonally. c. Some customers take the discount and others do not. d. Sales are relatively constant, either seasonally or cyclically. 17. The firm's receivables conversion period (measured in days) is equal to its accounts receivable divided by its a. annual credit sales /360 b. annual credit sales c. annual sales /360 d. none of the above 18. When factoring accounts receivables, the factor is the: a. negotiated accounts receivable account. b. the percent deduction in payment to the firm. c. the financial institution that buys the accounts receivable. d. the method of determining how much money is lent to the firm. 19. It is the average length of time required to convert a firm's receivables into cash. a. cash conversion cycle b. inventory conversion period c. receivables collection period d. payables deferral period e. days sales outstanding S20.an Assuming Lenovo is a domestic corporation classified as MSME, how much is its total income tax expense in 2023 ? a) P1,040,000 b) P500,000 c) P520,000 d) P840,000 8. Juan Dela Cruz presented to you the following income for the year: Determine the Gross Income subject to Graduated Rate. a) P2,500,000 b) P3,025,000 c) P2,530,000 d) P2.940,000 19. There Is Constructive Receipt Of Income When: a. Payment Is Credited To Payee's Account b. Payment is set aside for the payee,or otherwise made available so the payee may draw up on it at any time,or so the payee could have drawn upon it during the taxable year notice of intention to withdraw had been given without substantial limitations. c. Both"a" and "b" d. Neither "a"nor "b" 20. When different types of income are subjected to common tax rate,the tax system is described as a. Global tax system b. Scheduler tax system c. Final tax system d. Mixed income tax system 21. Situs of taxation on income from sale of property purchased. a. Place of the seller b. Place of sale c. Place of buyer d. As determined by the Commissioner 22. Which of the following tests of source of income is incorrect? a. Interest income - residence of the debtor b. Income from services - place of performance c. Royalties - place of use of intangible d. Gain on sale of real property - place of sale 23. For tax purposes, income: I. Refers to all earnings from any origin, be it legal or illegal, unless explicitly exempted by the Tax Code. II. Encompasses all financial gains received by the taxpayer, excluding the return of initial investments. III. Is considered as received in the tax year when it is either physically received or made available to the taxpayer, IV. Is in the form of compensation for services, interest, or profits from investments, during a defined period. a. I, II and III only b. I and IV only c. I, II, III and IV d. None of the above 24. The sources from which income is derived c. May be treated as income within or without the Philippines depending on the place of sale d. May be treated as income within or without thePhilippines depending where the shares are kept 31. Situs of taxation on income from sale shares of a foreign corporation. a. Always treated as income derived from within the Philippines b. Always treated as income derived from without the Philippines c. May be treated as income within or without the Philippines depending on the place of sale d. May be treated as income within or without the Philippines depending where the shares are kept 32. Pedro earned Interest Income from a Promissory Note issued to him by Juan, a resident of California, U.S.A. Assuming that Pedro is a nonresident citizen, the interest income is a. Subject to basic income tax b. Subject To Final Tax c. Not subject to income tax d. Partly subject ot scheduler and partly subject to final tax 33. It is important to know the source of income for tax purposes (i.e., from within or without the Philippines) because: a. Some individual and Corporate taxpayers are taxed on their worldwide income while others are taxable only upon income from sources within the Philippines b. The Philippines Imposes income tax only on income from sources within c. Some individual taxpayers are citizens while others are aliens d. Export sales are not subject to income tax 34. Situs, for taxation purposes will depend upon various factors, including I The nature of the tax and the subject matter thereof. II. The possible protection and benefit that may accrue both to the government and the taxpayer. III. Domicile Or Residence IV. Citizenship V. Source of income a. I and V only b. I, III and IV only c. I, III, IV and V d. I, II, III, VI and V 35. Which of the following is NOT true about the source of income? 1. A taxpayer is employed by a shipping company touching Philippines and foreign ports. In 2023, he received a gross payment for services rendered at P450,000. In the year, the vessels on board of which he rendered services had a total stay in Philippine ports of five months. His gross income from the Philippines was a) P450,000 b) P225,000 c) P187,500 d) P262,500 How much of the above income is nontaxable? a) P600,000 b) P1,500,000 c) P1,000,000 d) P2,500,000 3. Bernielyn took out a life insurance policy for P2,000,000 naming her son as beneficiary. Under the terms of the policy, the insurer, Malayan Insurance Corporation will pay Bernielyn the amount of P2,000,000 after the 25th year of the policy, and her beneficiary, should she die before that date. Bernielyn outlived the policy and received the proceeds. The premiums paid on the policy was P1,200,000. How much of the proceeds from the insurance policy is taxable? a) P2,000,000 b) P1,200,000 c) P500,000 d) P800,000 4. A resident alien had the following in 2023: cS Scanned with CamScanner a. Other things held constant, the higher a firm's days sales outstanding (DSO), the better its credit department. b. If a firm sells on terms of 2/10, net 30 , and its DSO is 30 days, then the firm probably has some past due accounts. c. If a firm that sells in terms of net 30 changes its policy to 2/10, net 30 , and if no change in sales volume occurs, then the firm's DSO will probably increase. d. If a firm sells in terms of net 60 , and if its sales are highly seasonal, with a sharp peak in December, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in January than in July. 21. Accounts receivable is P25,000 and the turnover rate is 15 times in one year. A turnover rate of 10 times in one year is desired to increase sales by 20%. How much must be the increase or decrease in accounts receivable? a. P45,000, increase c. P25,000, increase b. P40,000, decrease d. P20,000, decrease 22. Sales amount to P1,200,000. Sales terms are being revised from n/60 to n/45 and sales are expected to decrease by 15%. How much would be the increase (decrease) in receivables as a result of this change? a. (P72,500) c. P50,000 b. (P52,500) d. (P27,500) 23. The following information is available from Conan's Corp. financial records for 2013. Sales P750,000 Accounts Receivable Netcreditsales66.67%Balance,January1,2013P75,000 Net cash sales 33.33% Balance, December 31, 201350,000 What was accounts receivable turnover in 2013 ? a. 15x c. 12x b. 10x d. 7.41x Items 2425 To improve the credit and collection policies of A. Co, the following data for 2013 were gathered for study: Accounts receivable, Jan. 1 P 112,000 Accounts receivable, December 31 P 140,000 Bad Debts losses 6,300 Allowance for uncollectible accounts, Jan. 110,500 Allowance for uncollectible accounts, Dec. 17,000 Sales (all sales were made on credit) P630,000 24. What was the total cash collected from customers during 2013? a. P592,200 b. P599,200 d. P599,500 c. P598,500 25. What was the accounts receivable turnover? a. 5.37x c. 5.00x b. 4.70x d. 4.23x 26. Brew Ca has an average payment period of 30 days, an average age of inventory of 20 days and a cash conversion cycle of 30 days. What is Brew Ca's average collection period? a. 20 days c. 80 days b. 40 days d. Answer not given 27. For Mr. Hapal Moe, the average age of accounts receivable is 30 days, the average age of accounts payable is 50 days, and the average age of inventory is 40 days. Assume a 360-day year. If Mr. Moe's annual sales are P900,000, what is the firm's average accounts receivable balance? a. P62,500 b. P 75,000

Determine the total final taxes on passive income. a) P44,000 b) P49,000 c) P30,000 d) P40,000 10. Juan Dela Cruz presented to you the following income for the year: How much is the final withholding tax? a) P36,000 b) P20,000 c) P18,000 d) P10,000 5. Lenovo, Inc., a resident foreign corporation, has earned the folLowing income during 2023 taxable year: Additional information: -The ratio of Microsoft's gross income in the Philippines Over worldwide income for the past three years was 40%. - The ratio of Intel's gross income in the Philippines over worldwide income for the past three years is 60%. -The ratio of IBM's gross income in the Philippines over worldwide income for the past three years was 80%. How much is the total income tax expense of Lenovo in 2023? a) P940,000 b) P500,000 c) P1,240,000 d) P440,000 6. Tris leased a facility from Divergent Company on January 1,2021. Terms of the lease were a s follows: 28. Cut Works expects to have sales this year of P20 million under its current credit policy. The present terms are net 30; the days sales outstanding (DSO) is 60 days; and the bad debt loss percentage is 5 percent. Since Cut Works wants to improve its profitability, the treasurer has proposed that the credit period be shortened to 15 days. This change would reduce expected sales by P1,500,000, but it would also shorten the DSO on the remaining sales to 30 days. Expected bad debt losses on the remaining sales would fall to 3 nerrent The variahle cost nercentace is 60 nercent and the sost of canital is 15 nerrent What would he the ? 29. Data on Underwood Inc. for 2013 are shown below, along with the days sales outstanding of the firms against which it benchmarks. The firm's new CFO believes that the company could reduce its receivables enough to reduce its DSO to the benchmarks' average. If this were done, by how much would receivables increase (decrease)? Assume a 360-dav vear. a. P6,000 b. P(6,000) c. P10,000 30 . Yoyot buys on terms of 2/10, net 30 . It does not take discounts, and it typically pays 60 days after the invoice date. Net purchases amount to P500,000 per year. What is the nominal annual percentage cost of its non-free trade credit, based on a 360-day year? a. 24.00% c. 36.00% b. 24.48% d. 36.73% 31. Which of the following factors is most likely to increase the size of a company's accounts receivables on its balance sheet? a) Offering cash discounts to customers for early payments b) Tightening credit policies and reducing credit terms for customers c) Extending longer credit periods to customers with good payment histories d) Reducing sales volume to a select group of customers 32. What is the primary objective of conducting credit analysis? a. To ascertain the most suitable credit period. b. To assess the efficiency of offering a cash discount. c. To identify the ideal discount period, if applicable. d. To assess the likelihood of a customer making timely payments. 33. Among the following time periods, which one is part of the accounts receivable period but not part of the cash collection period? a. The time between receiving a check and the availability of those funds b. The time it takes for a firm to process incoming receipts c. The duration during which a check is in transit through the mail d. The time it takes for an invoice to be delivered to a customer by mail 34. A firm sells on 5/15, net 30 terms. Total sales for the year are P960,000. Forty percent of the customers pay on the tenth day and take discounts; the other 60 percent pay, on a. P 68,493 b. P65,640 c. P 60,615 d. P57,615 - END - CS Scanned with CamScanner Tris agreed to pay the entire amount of the fees above including the annual rental for 2022. In addition to annual rental and real property taxes, part of the lease agreement was for Tris to improve the facility. The improvement was completed on January 1,2023. Details of the improvements were as follows: Cost of leasehold improvement Estimated useful life of improvement P3,000,00015years Determine the following the income to be reported by Divergent in 2021 a) P540,000 b) P500,000 c) P480,000 d) P440,000 7. Lenovo, Inc., a resident foreign corporation, has earned the folLowing income during 2023 taxable year: Additional information: -The ratio of Microsoft's gross income in the Philippines Over worldwide income for the past three years was 40%. - The ratio of Intel's gross income in the Philippines over worldwide income for the past three years is 60%. -The ratio of IBM's gross income in the Philippines over worldwide income for the past three years was 80%. d. Nonresident foreign corporation, 25% of its gross income were derived from the Philippines Assume ABC Corporation is a resident foreign corporation, how much is the taxable income in 2022? a) P11,830,000 b) P11,600,000 c) P11,210,000 d) P11.817,000 15. Which of the following Is not a characteristic of income? a. Increase in taxpayer's wealth b. Realization or receipt of gain. c. Earnings constructively received. d. Return of taxpayer's wealth. 16. Which Is not a valid definition of Income? a. Income is the return from capital invested. b. Income is a fund at one distinct point of time. c. Income means all wealth which flows into the taxpayer other than a mere return of capital. d. Income means cash or its equivalent unless otherwise specified. 17. Which of the following is considered or construed as an example of constructive receipt? a. Retirement benefits, pensions, gratuities b. Fees paid to a public official c. Interest coupons that have matured and are payable but have not been cashed d. Deposits For rentals to answer for damages, restricted as to use 18. Constructive receipt occurs when the money consideration or its equivalent is placed at the control of the person who rendered the service without restrictions by the payor. The following are examples of constructive receipts, except. a. A Security deposit to insure the faithful performance of certain obligations of the lessee to the lessor. b. Deposit Banks Which are made available to the seller of services without restrictions; c. Issuance By The debtor of a notice to offset any debt or obligation and acceptance thereof by the seller as payment for services rendered; d. Transfer of the amounts retained by the payor to the account of the contractor. Scanned with CamScanner Determine the total income not subject to tax (exclusions to Gross Income). a) P910,000 b) P1,049,000 c) P959,000 d) P1,005,000 11. JJ Bibo, a national athlete, received the following during 2022 : Determine the total amount exempt from income tax. a) P3,500,000 b) P2,905,000 c) P3,005,000 d) P2,900,000 12. Mario retired at the end of 2023 taxable year after rendering twenty five (25) years of continuous service for ABC Corporation which employed him immediately after his graduation from college. He was then twenty (20) years old. He earned the following income in 2023: Instruction: Write your answers in the Answer Sheet through google form. 1. It is the process of determining appropriate level of receivable in handling and administering sales credit, credit policies, and maintaining an appropriate level of receivable. a. working capital management c. receivable management b. receivable turnover d. answer not given 2. It is a measure of the rate of cash inflow from the collection of receivables. a. aging of receivables c. average collection period b. accounts receivable turnover d. average accounts receivable 3. It indicates the number of times an average amount of receivables is collected during the period and the efficiency of collection. a. aging of receivables c. average collection period b. accounts receivable turnover d. average accounts receivable 4. It is a deduction in the invoice price of the merchandise. a. trade discount c. cash discount b. credit term d. answer not given 5. It is a deduction in the purchased price to serve as an incentive for prompt payment. a. trade discount c. cash discount b. credit term d. answer not given 6. Assuming that net credit sales is constant, an increase in average collection period is determined by? a. decrease in accounts receivable c. increase in accounts receivable b. a decrease in accounts receivable turnover d. none of the above 7. This is the effect on working capital and current ratio if the company issued a promissory note in exchange for its accounts receivable. Working capital a. decrease b. increase c. no effect d. decrease Current ratio decrease increase no effect no effect 8. This is the effect of an increased accounts receivable on the current ratio and net working capital respectively. Current Ratio Net working capital a. no effect no effect b. increase increase c. increase no effect d. no effect increase 9. Which of the following items is not included in determining the desired level of accounts receivable? a. net sales b. desired number of days of accounts receivable c. number of days in a year d. answer not given 10. This is likely to happen when the company decides to increase their discount rate. Collection Receivable Turnover Collection Period a. Faster Higher Shorter b. Faster Higher Longer c. Slower Higher Shorter d. Slower Higher Longer CS Scanned with CamScanner \begin{tabular}{|l|l|} \hline Productivity incentive pay & 20,000 \\ \hline 13 th month pay & 60,000 \\ \hline \end{tabular} Determine the gross "compensation" income of Mario. a) P2,830,000 b) P3,000,000 c) P2,810,000 d) P2.917,000 13. Tris leased a facility from Divergent Company on January 1, 2021. Terms of the lease ware a s follnws. Tris agreed to pay the entire amount of the fees above including the annual rental for 2022. In addition to annual rental and real property taxes, part of the lease agreement was for Tris to improve the facility. The improvement was completed on January 1, 2023. Details of the improvements were as follows: Cost of leasehold improvement Estimated useful life of improvement P3,000,00015years Determine the income to be reported by Divergent in 2023 assuming the company opted to report income from improvement using the spread-out method. a) P3,300,000 b) P750,000 c) P400,000 d) P191,700 14. ABC Corporation had the following data ni 2022: CS Scanned with CamScanner a. Labor b. The use of capital c. Profits derived from sale or exchange of capital assets d. All of the above 25. The sources from which income is derived 26 Which of the followind is a rharartarietic of ineme? 27. Which of the following is a requisite for an income to be taxable? a. There must be gain b. The gain must be realized or received c. The gain must not be excluded by law from taxation d. All of the above 28. Which of the following is not an income for income tax purposes? a. Gain derived from labor b. Return on capital c. Excess of selling price over cost of assets sold d. Gift received 29. Which of the following is not an income for income tax purposes? a. Collection of Loans Receivable b. Condonation of Debt For Services Rendered c. Excess of Selling Price Over the cost of an asset sold d. None of the above 30. Situs of taxation on income from sale shares of a domestic corporation. a. Always treated as income derived from within the Philippines b. Always treated as income derived from without the Philippines cS Scanned with CamScanner average, 45 days after their purchases. What is the average amount of receivables? a. P82,000 c. P88,200 b. P88,000 d. P 77,500 35. A Company has projected sales of P50,000,000 for the upcoming year, with 90% of these sales expected to be on credit with a net 30 days payment term. Palm believes that if they ease their credit standards, they can boost credit sales by 10% and extend the average collection period from 30 days to 40 days. Using a 360 -day accounting year, what would be the anticipated rise in the average accounts receivable balance due to this proposed credit relaxation? a. P1,540,000 c. P2,750,000 b. P 1,750,000 d. P1,620,000 36. Weisbrough United currently has a cash sales only policy. Under this policy, the firm sells 410 units a month at a price of $219 a unit. The variable cost per unit is $140 and the carrying cost per unit is $3.30. The monthly interest rate is 1.3 percent. The firm believes it can increase its sales to 475 units a month if it institutes a net 30 credit policy. What is the net present value of the switch using the one-shot approach? a. $255,590 b. $296,110 c. $298,470 d. $302,233 37. Under the current cash sales only policy Blue Bird, Inc., will sell 215 units a month at a price of $469 each. The variable cost per unit is $305 and the monthly interest rate is 1.7 percent. Based on a recent survey, the firm believes it can sell an additional 36 units per month if it offers a net 30 credit policy. What is the net present value of the switch using the one-shot approach? a. $212,806 b. $231,543 c. $235,479 d. $248,946 Items 3840 The company, A Company, is contemplating altering its credit terms from 2/15, net 30 to 3/10, net 30 as a means to accelerate the collection of payments. Currently, 40% of A Company's customers take advantage of the 2% discount offered. With the new terms, it's anticipated that the number of customers availing the discount will increase to 50%. Irrespective of the credit terms, half of the customers who do not opt for the discount are expected to make timely payments, while the remaining half will make payments 10 days after the due date. Importantly, this change does not involve relaxing credit standards, so there is no anticipation of an increase in bad debt losses above the current 2% level. However, the more favorable cash discount terms are expected to boost annual sales from P2 million to P2.6 million. A Company's variable cost ratio stands at 75%, the interest rate on funds invested in accounts receivable is 9%, and the company's income tax rate is 40%. 38. What are the days sales outstanding (DSO) before and after the change of credit policy? a. 27.0 days and 22.5 days, respectively c. 22.5 days and 21.5 days, respectively b. 22.5 days and 27.0 days, respectively d. 21.5 days and 22.5 days respectively 39. The incremental carrying cost on receivable is a. P 843.75 c. P 643.75 b. P8,889.00 d. P6,667.00 40. The incremental after tax profit from the change in credit terms is CS Scanned with CamScanner 11. This/These statement/s is/are true when the company decides to decrease their discount rate. I. Collection is slower II. Receivable turnover is lower III. Collection period is shorter a. Statement I is false c. Statements I and II are false b. Statement III is true d. Statements I and II are true 12. This is likely to happen when the company decides to extend their credit term. Sales a. Higher b. Higher c. Lower d. Lower Receivable Turnover Lower Lower Higher Higher Collection Period Shorter Longer Shorter Longer 13. Which of the following statement/s is/are determined by the choices below when the company decides to reduce their credit term? I. Sales is higher Lower False II. Receivable turnover is higher Higher True III. Collection period is longer Shorter False a. Statements I and II are true c. Statement II is false b. All statements are true d. Statements I and III are false 14. Which of the following is likely to happen when the company decides to reduce their credit period? Sales a. Higher b. Higher c. Lower d. Lower Receivable Turnover Decrease Increase Increase Decrease Collection Period Shorter Longer Shorter Longer 15. Which of the following statements is true/false when the company decides to increase their credit period? I. Sales will be higher Higher II. Receivable turnover lower Lower III. Collection period is shorter Longer a. Statement I is false c. Statements I, II are true b. Statements I, II \& III are true d. Statements II \& III are false 16. Analyzing days sales outstanding (DSO) and the aging schedule are two common methods for monitoring receivables. However, they can provide erroneous signals to credit managers when a. Customers' payment patterns are changing. b. Sales fluctuate seasonally. c. Some customers take the discount and others do not. d. Sales are relatively constant, either seasonally or cyclically. 17. The firm's receivables conversion period (measured in days) is equal to its accounts receivable divided by its a. annual credit sales /360 b. annual credit sales c. annual sales /360 d. none of the above 18. When factoring accounts receivables, the factor is the: a. negotiated accounts receivable account. b. the percent deduction in payment to the firm. c. the financial institution that buys the accounts receivable. d. the method of determining how much money is lent to the firm. 19. It is the average length of time required to convert a firm's receivables into cash. a. cash conversion cycle b. inventory conversion period c. receivables collection period d. payables deferral period e. days sales outstanding S20.an Assuming Lenovo is a domestic corporation classified as MSME, how much is its total income tax expense in 2023 ? a) P1,040,000 b) P500,000 c) P520,000 d) P840,000 8. Juan Dela Cruz presented to you the following income for the year: Determine the Gross Income subject to Graduated Rate. a) P2,500,000 b) P3,025,000 c) P2,530,000 d) P2.940,000 19. There Is Constructive Receipt Of Income When: a. Payment Is Credited To Payee's Account b. Payment is set aside for the payee,or otherwise made available so the payee may draw up on it at any time,or so the payee could have drawn upon it during the taxable year notice of intention to withdraw had been given without substantial limitations. c. Both"a" and "b" d. Neither "a"nor "b" 20. When different types of income are subjected to common tax rate,the tax system is described as a. Global tax system b. Scheduler tax system c. Final tax system d. Mixed income tax system 21. Situs of taxation on income from sale of property purchased. a. Place of the seller b. Place of sale c. Place of buyer d. As determined by the Commissioner 22. Which of the following tests of source of income is incorrect? a. Interest income - residence of the debtor b. Income from services - place of performance c. Royalties - place of use of intangible d. Gain on sale of real property - place of sale 23. For tax purposes, income: I. Refers to all earnings from any origin, be it legal or illegal, unless explicitly exempted by the Tax Code. II. Encompasses all financial gains received by the taxpayer, excluding the return of initial investments. III. Is considered as received in the tax year when it is either physically received or made available to the taxpayer, IV. Is in the form of compensation for services, interest, or profits from investments, during a defined period. a. I, II and III only b. I and IV only c. I, II, III and IV d. None of the above 24. The sources from which income is derived c. May be treated as income within or without the Philippines depending on the place of sale d. May be treated as income within or without thePhilippines depending where the shares are kept 31. Situs of taxation on income from sale shares of a foreign corporation. a. Always treated as income derived from within the Philippines b. Always treated as income derived from without the Philippines c. May be treated as income within or without the Philippines depending on the place of sale d. May be treated as income within or without the Philippines depending where the shares are kept 32. Pedro earned Interest Income from a Promissory Note issued to him by Juan, a resident of California, U.S.A. Assuming that Pedro is a nonresident citizen, the interest income is a. Subject to basic income tax b. Subject To Final Tax c. Not subject to income tax d. Partly subject ot scheduler and partly subject to final tax 33. It is important to know the source of income for tax purposes (i.e., from within or without the Philippines) because: a. Some individual and Corporate taxpayers are taxed on their worldwide income while others are taxable only upon income from sources within the Philippines b. The Philippines Imposes income tax only on income from sources within c. Some individual taxpayers are citizens while others are aliens d. Export sales are not subject to income tax 34. Situs, for taxation purposes will depend upon various factors, including I The nature of the tax and the subject matter thereof. II. The possible protection and benefit that may accrue both to the government and the taxpayer. III. Domicile Or Residence IV. Citizenship V. Source of income a. I and V only b. I, III and IV only c. I, III, IV and V d. I, II, III, VI and V 35. Which of the following is NOT true about the source of income? 1. A taxpayer is employed by a shipping company touching Philippines and foreign ports. In 2023, he received a gross payment for services rendered at P450,000. In the year, the vessels on board of which he rendered services had a total stay in Philippine ports of five months. His gross income from the Philippines was a) P450,000 b) P225,000 c) P187,500 d) P262,500 How much of the above income is nontaxable? a) P600,000 b) P1,500,000 c) P1,000,000 d) P2,500,000 3. Bernielyn took out a life insurance policy for P2,000,000 naming her son as beneficiary. Under the terms of the policy, the insurer, Malayan Insurance Corporation will pay Bernielyn the amount of P2,000,000 after the 25th year of the policy, and her beneficiary, should she die before that date. Bernielyn outlived the policy and received the proceeds. The premiums paid on the policy was P1,200,000. How much of the proceeds from the insurance policy is taxable? a) P2,000,000 b) P1,200,000 c) P500,000 d) P800,000 4. A resident alien had the following in 2023: cS Scanned with CamScanner a. Other things held constant, the higher a firm's days sales outstanding (DSO), the better its credit department. b. If a firm sells on terms of 2/10, net 30 , and its DSO is 30 days, then the firm probably has some past due accounts. c. If a firm that sells in terms of net 30 changes its policy to 2/10, net 30 , and if no change in sales volume occurs, then the firm's DSO will probably increase. d. If a firm sells in terms of net 60 , and if its sales are highly seasonal, with a sharp peak in December, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in January than in July. 21. Accounts receivable is P25,000 and the turnover rate is 15 times in one year. A turnover rate of 10 times in one year is desired to increase sales by 20%. How much must be the increase or decrease in accounts receivable? a. P45,000, increase c. P25,000, increase b. P40,000, decrease d. P20,000, decrease 22. Sales amount to P1,200,000. Sales terms are being revised from n/60 to n/45 and sales are expected to decrease by 15%. How much would be the increase (decrease) in receivables as a result of this change? a. (P72,500) c. P50,000 b. (P52,500) d. (P27,500) 23. The following information is available from Conan's Corp. financial records for 2013. Sales P750,000 Accounts Receivable Netcreditsales66.67%Balance,January1,2013P75,000 Net cash sales 33.33% Balance, December 31, 201350,000 What was accounts receivable turnover in 2013 ? a. 15x c. 12x b. 10x d. 7.41x Items 2425 To improve the credit and collection policies of A. Co, the following data for 2013 were gathered for study: Accounts receivable, Jan. 1 P 112,000 Accounts receivable, December 31 P 140,000 Bad Debts losses 6,300 Allowance for uncollectible accounts, Jan. 110,500 Allowance for uncollectible accounts, Dec. 17,000 Sales (all sales were made on credit) P630,000 24. What was the total cash collected from customers during 2013? a. P592,200 b. P599,200 d. P599,500 c. P598,500 25. What was the accounts receivable turnover? a. 5.37x c. 5.00x b. 4.70x d. 4.23x 26. Brew Ca has an average payment period of 30 days, an average age of inventory of 20 days and a cash conversion cycle of 30 days. What is Brew Ca's average collection period? a. 20 days c. 80 days b. 40 days d. Answer not given 27. For Mr. Hapal Moe, the average age of accounts receivable is 30 days, the average age of accounts payable is 50 days, and the average age of inventory is 40 days. Assume a 360-day year. If Mr. Moe's annual sales are P900,000, what is the firm's average accounts receivable balance? a. P62,500 b. P 75,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started