Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the total overallocation or underallocation of manufacturing overhead during the year in the following independent situations. Actual manufacturing costs for the year for

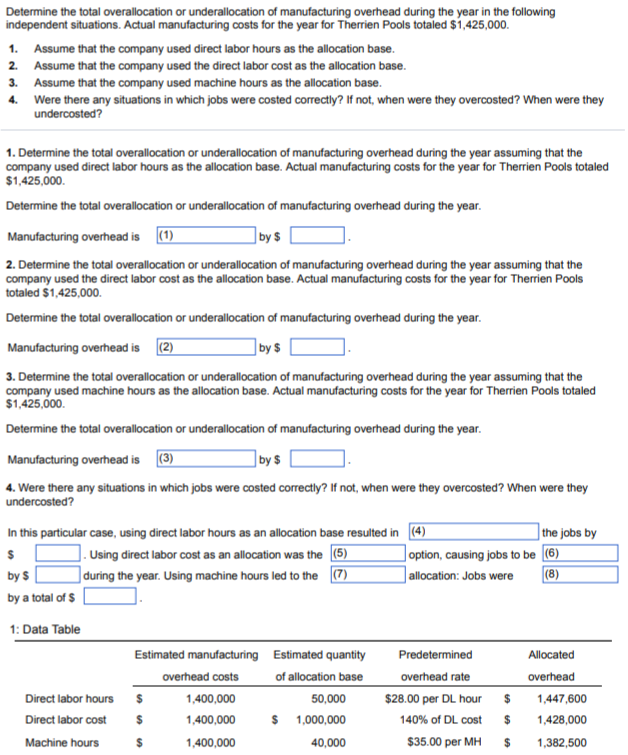

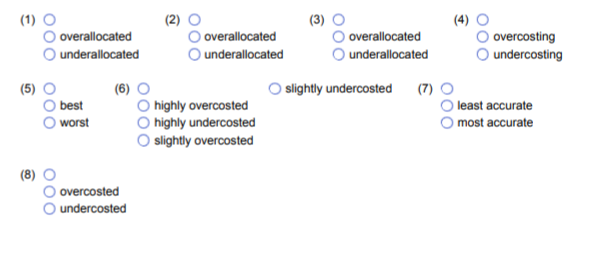

Determine the total overallocation or underallocation of manufacturing overhead during the year in the following independent situations. Actual manufacturing costs for the year for Therrien Pools totaled $1,425,000. 1. Assume that the company used direct labor hours as the allocation base. 2. Assume that the company used the direct labor cost as the allocation base. 3. Assume that the company used machine hours as the allocation base. 4. Were there any situations in which jobs were costed correctly? If not, when were they overcosted? When were they undercosted? 1. Determine the total overallocation or underallocation of manufacturing overhead during the year assuming that the company used direct labor hours as the allocation base. Actual manufacturing costs for the year for Therrien Pools totaled $1,425,000. Determine the total overallocation or underallocation of manufacturing overhead during the year. Manufacturing overhead is (1) by $ 2. Determine the total overallocation or underallocation of manufacturing overhead during the year assuming that the company used the direct labor cost as the allocation base. Actual manufacturing costs for the year for Therrien Pools totaled $1,425,000. Determine the total overallocation or underallocation of manufacturing overhead during the year. Manufacturing overhead is (2) by $ 3. Determine the total overallocation or underallocation of manufacturing overhead during the year assuming that the company used machine hours as the allocation base. Actual manufacturing costs for the year for Therrien Pools totaled $1,425,000. Determine the total overallocation or underallocation of manufacturing overhead during the year. Manufacturing overhead is (3) by $ 4. Were there any situations in which jobs were costed correctly? If not, when were they overcosted? When were they undercosted? In this particular case, using direct labor hours as an allocation base resulted in (4) $ Using direct labor cost as an allocation was the (5) by S during the year. Using machine hours led to the (7) by a total of $ 1: Data Table Direct labor hours Direct labor cost Machine hours Estimated manufacturing overhead costs $ $ $ 1,400,000 1,400,000 1,400,000 Estimated quantity of allocation base 50,000 $ 1,000,000 40,000 option, causing jobs to be (6) allocation: Jobs were (8) Predetermined overhead rate $28.00 per DL hour 140% of DL cost $35.00 per MH the jobs by $ $ $ Allocated overhead 1,447,600 1,428,000 1,382,500 (1) 8 000 000 000 overallocated underallocated best worst 6 overcosted undercosted 00 N overallocated underallocated highly overcosted O highly undercosted O slightly overcosted overallocated underallocated slightly undercosted (7) 000 overcosting undercosting least accurate most accurate

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Actual 1425000 Allocated 1447600 Manufacturer overhead ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started