Answered step by step

Verified Expert Solution

Question

1 Approved Answer

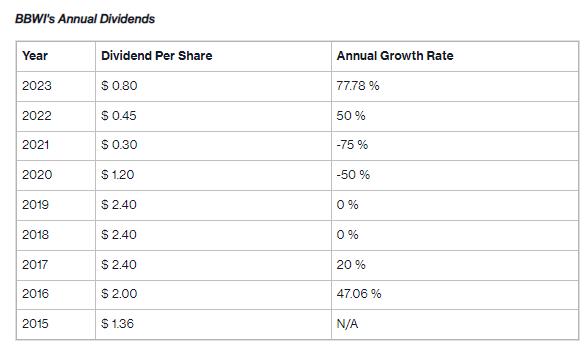

Determine two distinct estimates of the future dividend growth rate for this company: a high-end growth rate and a low-end growth rate. You are to

Determine two distinct estimates of the future dividend growth rate for this company: a high-end growth rate and a low-end growth rate. You are to choose these growth rates based on what is reasonable from the data you have on the company's dividend growth in prior years, as presented in your table. The two future dividend growth rates can be any of following:

- The most recent year growth rate;

- The average growth rate over the 8-year period;

- The average growth rate over the most recent 5 years;

- The average growth rate of the most recent 3 years; or

- A growth rate you select that is reasonable, given the 8-year, 5-year, and 3-year averages, as well as the recent year growth rates.

- NOTE: Both dividend growth rates must be lower than the required rate of return used in the constant growth formula. See Part 2 below for the required rate of return to use in the constant growth formula. The required rate of return from BBWI's in 12.0%.

BBWI's Annual Dividends Year 2023 2022 2021 2020 2019 2018 2017 2016 2015 Dividend Per Share $ 0.80 $ 0.45 $ 0.30 $1.20 $ 2.40 $2.40 $ 2.40 $ 2.00 $ 1.36 Annual Growth Rate 77.78% 50% -75 % -50 % 0% 0% 20% 47.06 % N/A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the highend and lowend growth rates for the future dividends of the company lets analyz...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started