Answered step by step

Verified Expert Solution

Question

1 Approved Answer

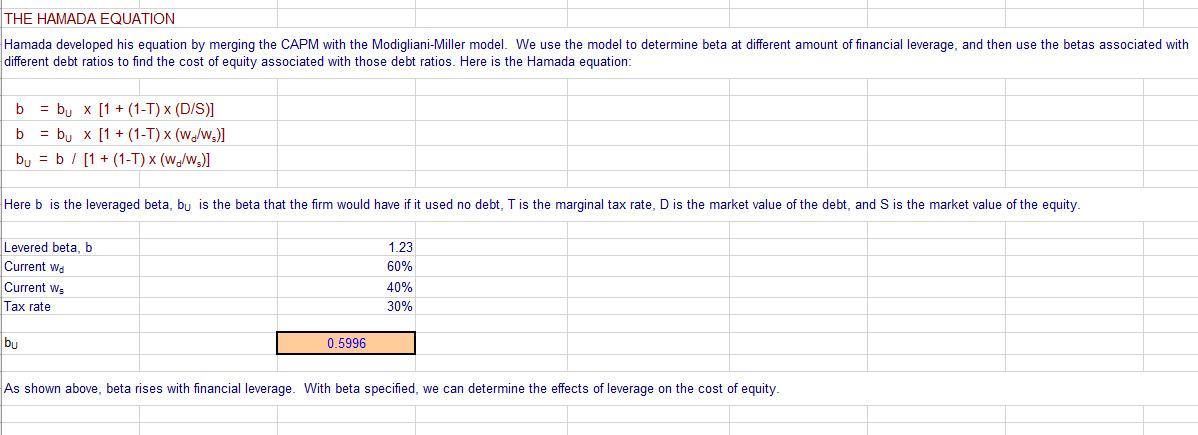

Determine what the optimum capital structure is for Delta Airlines. You will use Hamada's Equation to recalculate the levered betas based on the weights that

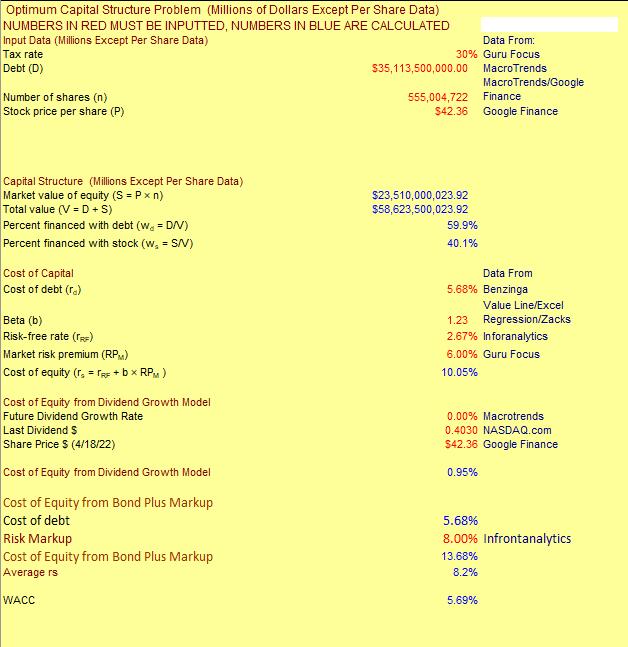

Determine what the optimum capital structure is for Delta Airlines.

You will use Hamada's Equation to recalculate the levered betas based on the weights that you choose.

Where can I find or how do I calculate the "RED" inputs in the following excel image?

I have to calculate the following:

I have to calculate the following:

Other possibly relevant info:

Other possibly relevant info:

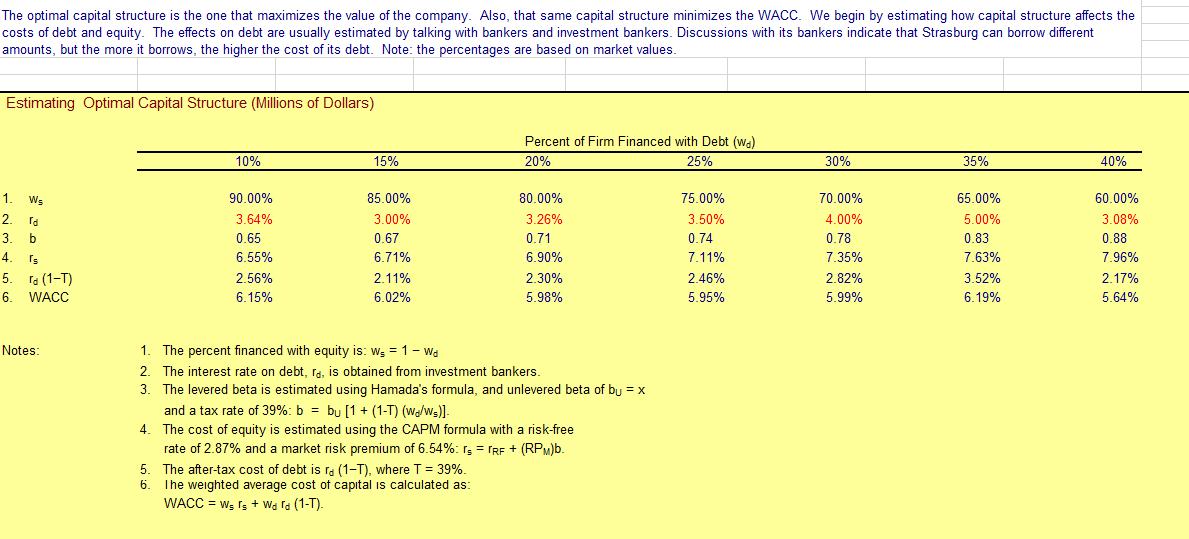

The optimal capital structure is the one that maximizes the value of the company. Also, that same capital structure minimizes the WACC. We begin by estimating how capital structure affects the costs of debt and equity. The effects on debt are usually estimated by talking with bankers and investment bankers. Discussions with its bankers indicate that Strasburg can borrow different amounts, but the more it borrows, the higher the cost of its debt. Note: the percentages are based on market values. Estimating Optimal Capital Structure (Millions of Dollars) 1. Ws 2. d 3. b 4. Ts 5. (1-T) 6. WACC Notes: 10% 90.00% 3.64% 0.65 6.55% 2.56% 6.15% 15% 85.00% 3.00% 0.67 6.71% 2.11% 6.02% Percent of Firm Financed with Debt (wa) 20% 25% 80.00% 3.26% 0.71 6.90% 5. The after-tax cost of debt is ra (1-T), where T = 39%. 6. The weighted average cost of capital is calculated as: WACC = Ws fs + Ward (1-T). 2.30% 5.98% 1. The percent financed with equity is: W = 1 - Wa 2. The interest rate on debt, rd, is obtained from investment bankers. 3. The levered beta is estimated using Hamada's formula, and unlevered beta of by = x and a tax rate of 39% : b = bu [1 + (1-T) (W/W)]- 4. The cost of equity is estimated using the CAPM formula with a risk-free rate of 2.87% and a market risk premium of 6.54%: rs = TRF + (RPM)b. 75.00% 3.50% 0.74 7.11% 2.46% 5.95% 30% 70.00% 4.00% 0.78 7.35% 2.82% 5.99% 35% 65.00% 5.00% 0.83 7.63% 3.52% 6.19% 40% 60.00% 3.08% 0.88 7.96% 2.17% 5.64%

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Without the specific data provided in the Excel image its challenging to determine the RED inputs required for Hamadas Equation to calculate the levered betas for Delta Airlines However I can guide yo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started