Answered step by step

Verified Expert Solution

Question

1 Approved Answer

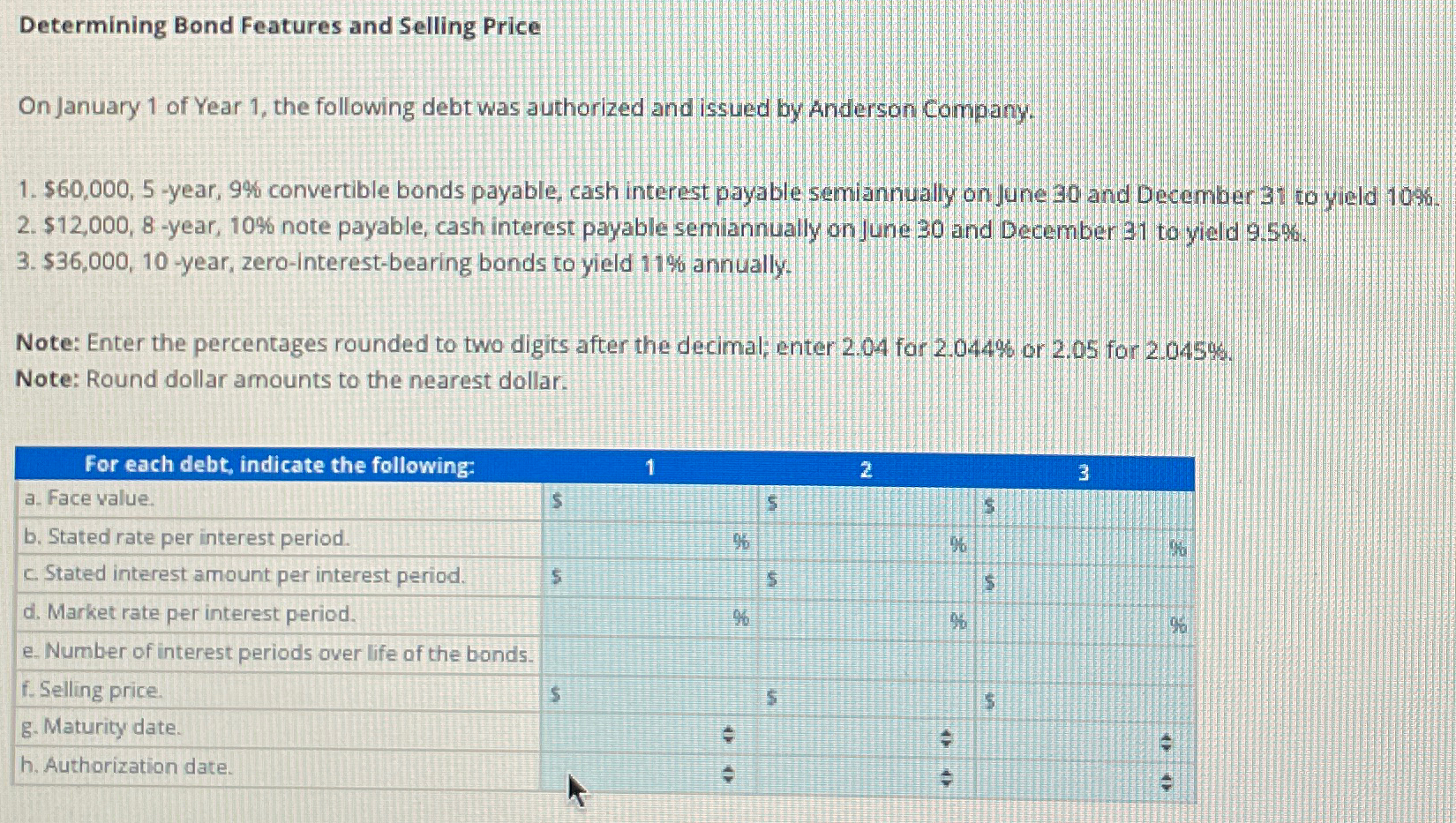

Determining Bond Features and Selling Price On January 1 of Year 1, the following debt was authorized and issued by Anderson Company. 1. $60,000,

Determining Bond Features and Selling Price On January 1 of Year 1, the following debt was authorized and issued by Anderson Company. 1. $60,000, 5-year, 9% convertible bonds payable, cash interest payable semiannually on June 30 and December 31 to yield 10%. 2. $12,000, 8-year, 10% note payable, cash interest payable semiannually on June 30 and December 31 to yield 9.5%. 3. $36,000, 10-year, zero-interest-bearing bonds to yield 11% annually. Note: Enter the percentages rounded to two digits after the decimal; enter 2.04 for 2.044% or 2.05 for 2.045%. Note: Round dollar amounts to the nearest dollar. For each debt, indicate the following: a. Face value. 1 $ 2 3 S S b. Stated rate per interest period. % 9% c. Stated interest amount per interest period. 5 S S d. Market rate per interest period. e. Number of interest periods over life of the bonds. % % 96 f. Selling price. g. Maturity date. h. Authorization date. S S 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To determine the bond features and selling price we need to calculate the following information for each debt 1 Convertible Bonds Payable a Fac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e6795dda10_956871.pdf

180 KBs PDF File

663e6795dda10_956871.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started