Answered step by step

Verified Expert Solution

Question

1 Approved Answer

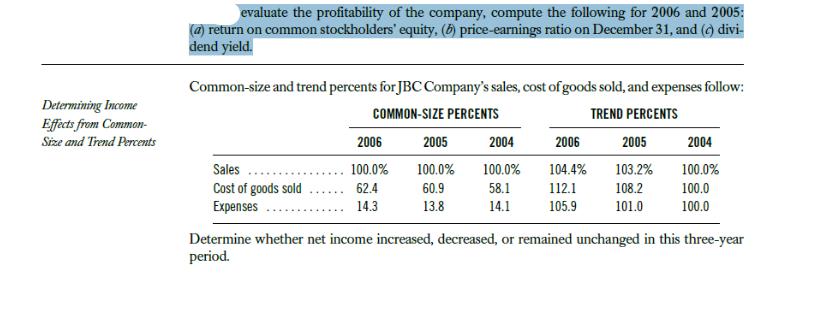

Determining Income Effects from Common- Size and Trend Percents evaluate the profitability of the company, compute the following for 2006 and 2005: (a) return

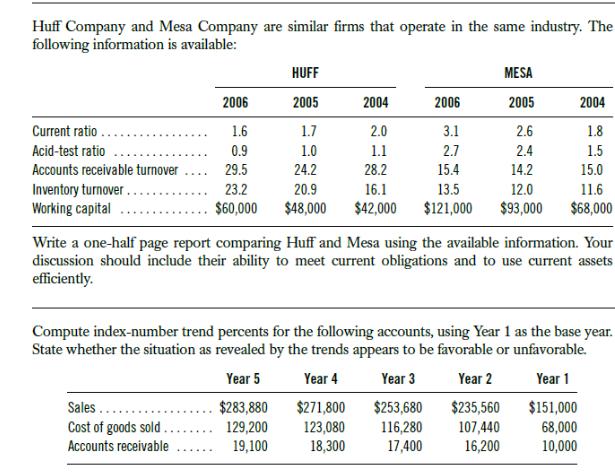

Determining Income Effects from Common- Size and Trend Percents evaluate the profitability of the company, compute the following for 2006 and 2005: (a) return on common stockholders' equity, (b) price-earnings ratio on December 31, and (c) divi- dend yield. Common-size and trend percents for JBC Company's sales, cost of goods sold, and expenses follow: COMMON-SIZE PERCENTS TREND PERCENTS Sales Cost of goods sold Expenses 2006 100.0% 62.4 14.3 2005 100.0% 60.9 13.8 2004 100.0% 58.1 14.1 2006 104.4% 112.1 105.9 2005 103.2% 108.2 101.0 2004 100.0% 100.0 100.0 Determine whether net income increased, decreased, or remained unchanged in this three-year period. Huff Company and Mesa Company are similar firms that operate in the same industry. The following information is available: Current ratio. Acid-test ratio Accounts receivable turnover Inventory turnover... Working capital HUFF 2006 2005 1.6 1.7 0.9 1.0 29.5 24.2 23.2 20.9 $60,000 $48,000 Write a one-half page report comparing Huff and Mesa using the available information. Your discussion should include their ability to meet current obligations and to use current assets efficiently. Sales... Cost of goods sold.. Accounts receivable Compute index-number trend percents for the following accounts, using Year 1 as the base year. State whether the situation as revealed by the trends appears to be favorable or unfavorable. Year 5 Year 4 Year 3 Year 2 Year 1 $283,880 $253,680 $235,560 $151,000 129,200 116,280 107,440 68,000 19,100 17,400 16,200 10,000 *****. MESA 2004 2006 2005 2004 2.0 3.1 2.6 1.8 1.1 2.7 2.4 1.5 28.2 15.4 14.2 15.0 16.1 13.5 12.0 11.6 $42,000 $121,000 $93,000 $68,000 $271,800 123,080 18,300

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer Return on Common Stockholders equity Choose nume...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started