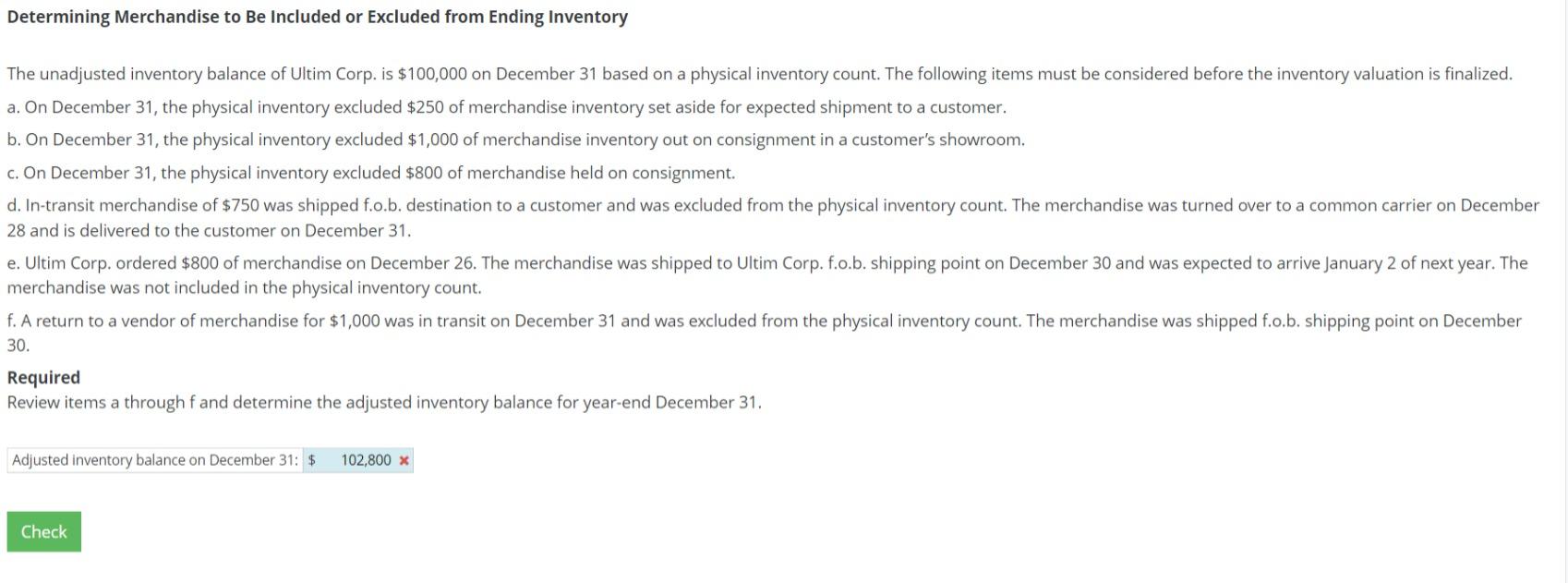

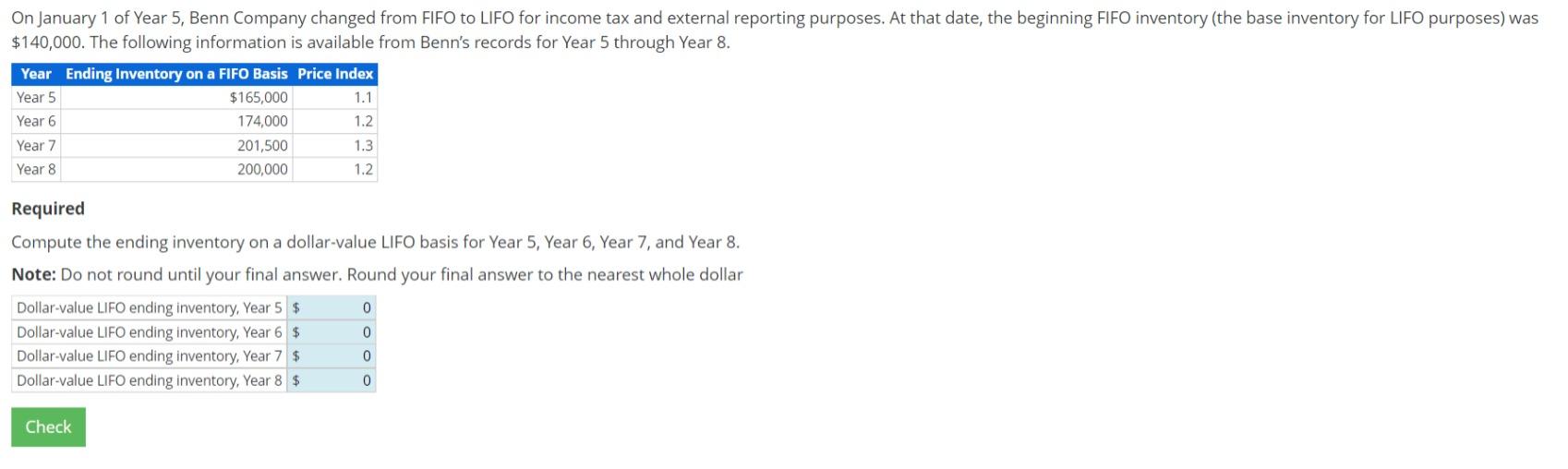

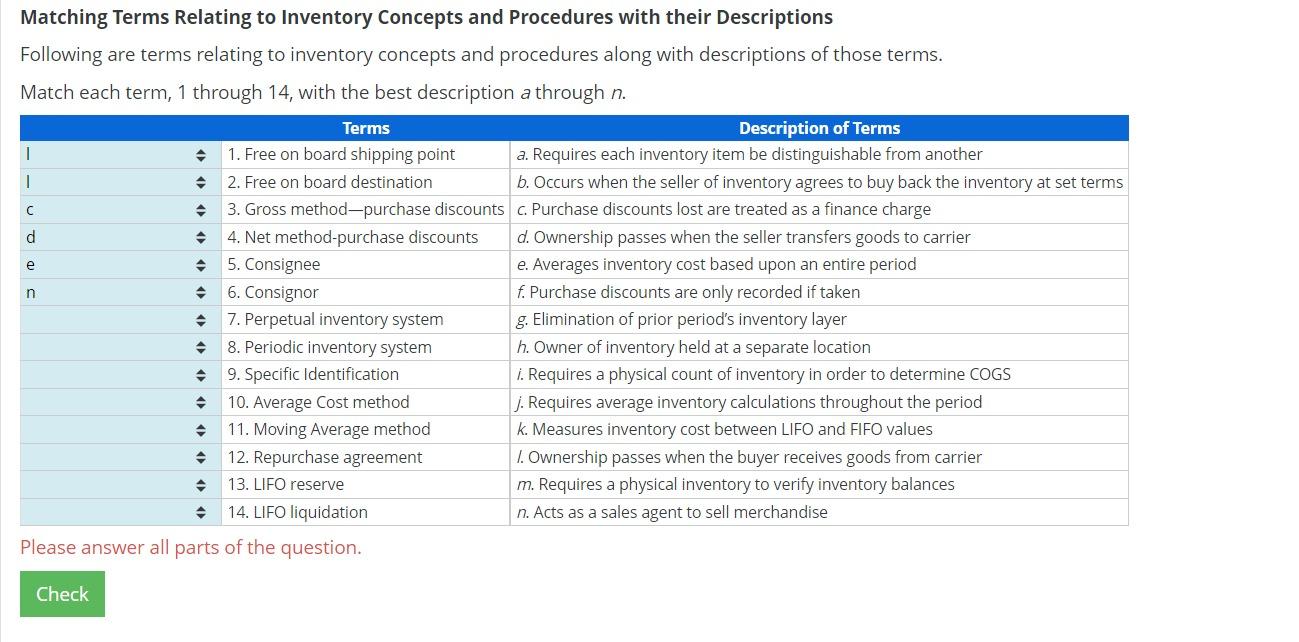

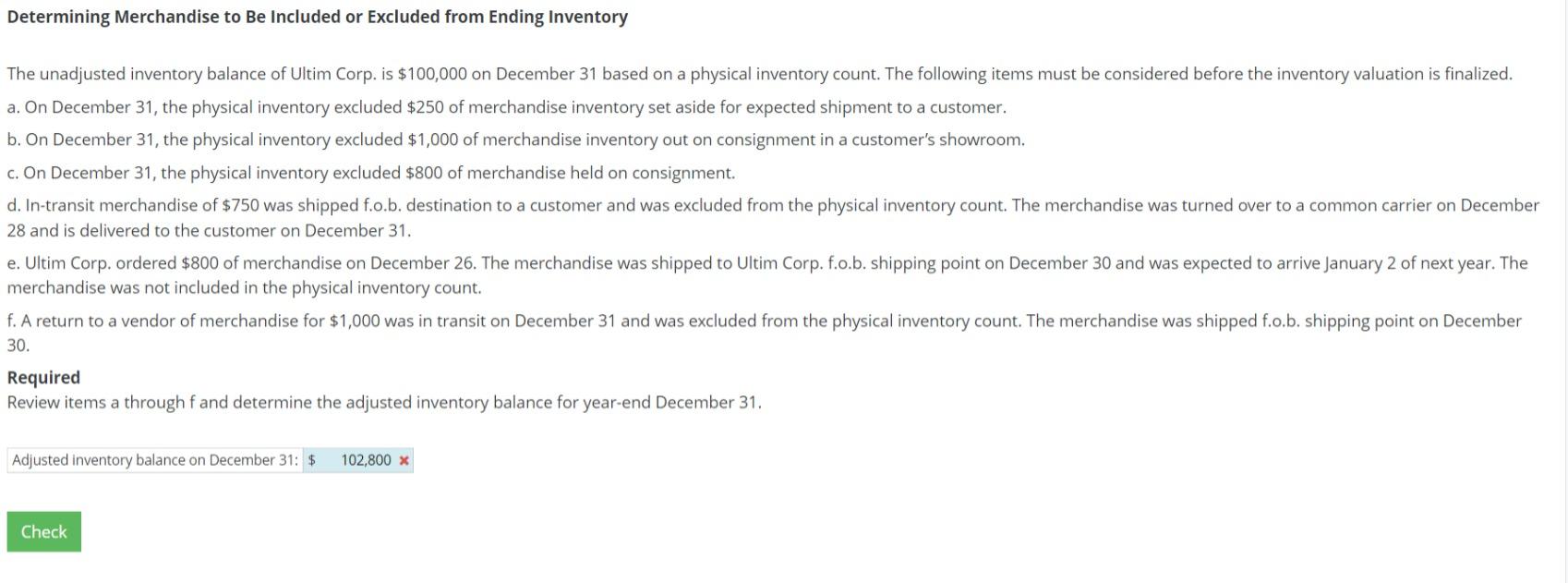

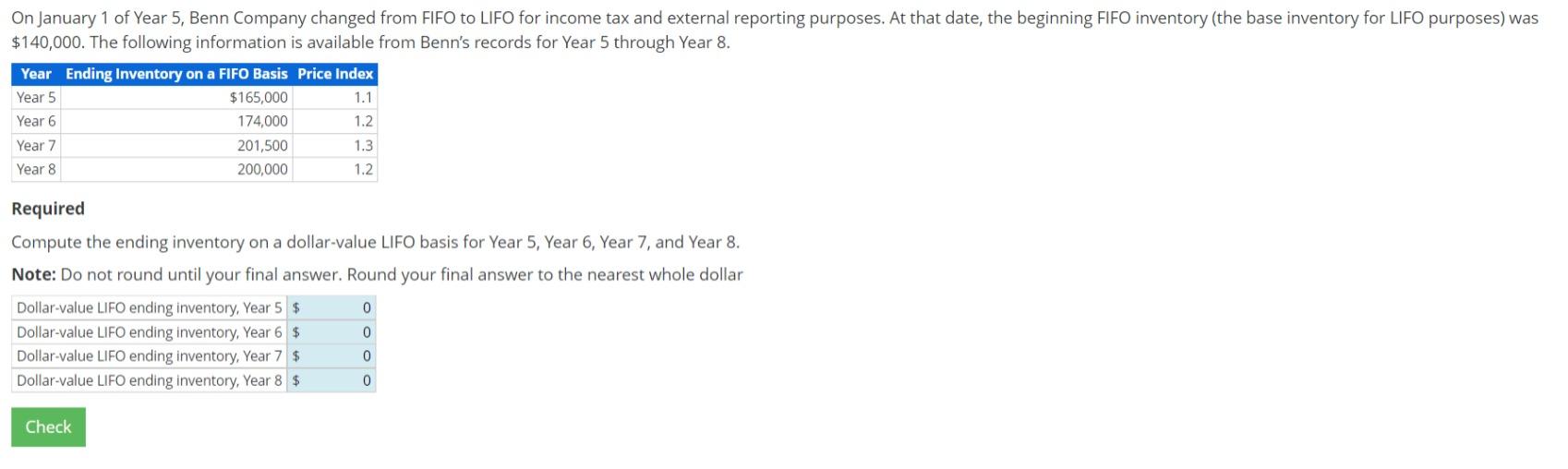

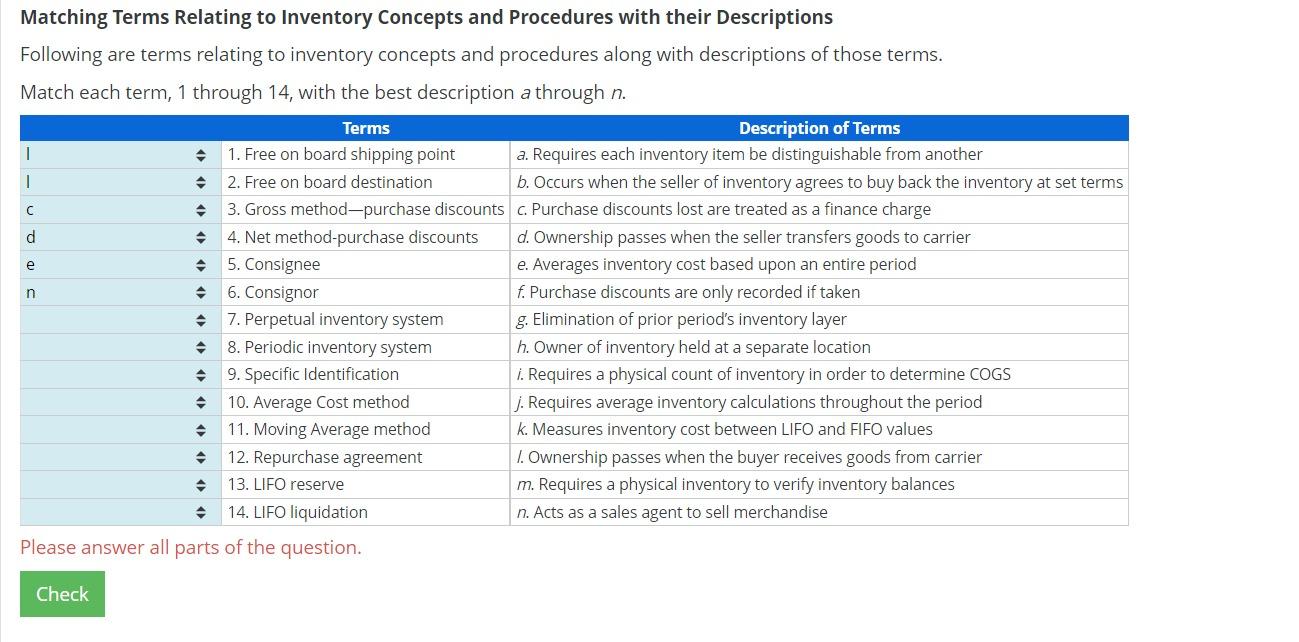

Determining Merchandise to Be Included or Excluded from Ending Inventory The unadjusted inventory balance of Ultim Corp. is $100,000 on December 31 based on a physical inventory count. The following items must be considered before the inventory valuation is finalized. a. On December 31 , the physical inventory excluded $250 of merchandise inventory set aside for expected shipment to a customer. b. On December 31, the physical inventory excluded $1,000 of merchandise inventory out on consignment in a customer's showroom. c. On December 31 , the physical inventory excluded $800 of merchandise held on consignment. d. In-transit merchandise of $750 was shipped f.o.b. destination to a customer and was excluded from the physical inventory count. The merchandise was turned over to a common carrier on December 28 and is delivered to the customer on December 31. e. Ultim Corp. ordered $800 of merchandise on December 26. The merchandise was shipped to Ultim Corp. f.o.b. shipping point on December 30 and was expected to arrive January 2 of next year. The merchandise was not included in the physical inventory count. f. A return to a vendor of merchandise for $1,000 was in transit on December 31 and was excluded from the physical inventory count. The merchandise was shipped f.o.b. shipping point on December 30. Required Review items a through f and determine the adjusted inventory balance for year-end December 31. On January 1 of Year 5, Benn Company changed from FIFO to LIFO for income tax and external reporting purposes. At that date, the beginning FIFO inventory (the base inventory for LIFO purposes) was $140,000. The following information is available from Benn's records for Year 5 through Year 8 . Required Compute the ending inventory on a dollar-value LIFO basis for Year 5, Year 6, Year 7, and Year 8. Note: Do not round until your final answer. Round your final answer to the nearest whole dollar Matching Terms Relating to Inventory Concepts and Procedures with their Descriptions Following are terms relating to inventory concepts and procedures along with descriptions of those terms. Match each term, 1 through 14 , with the best description a through n