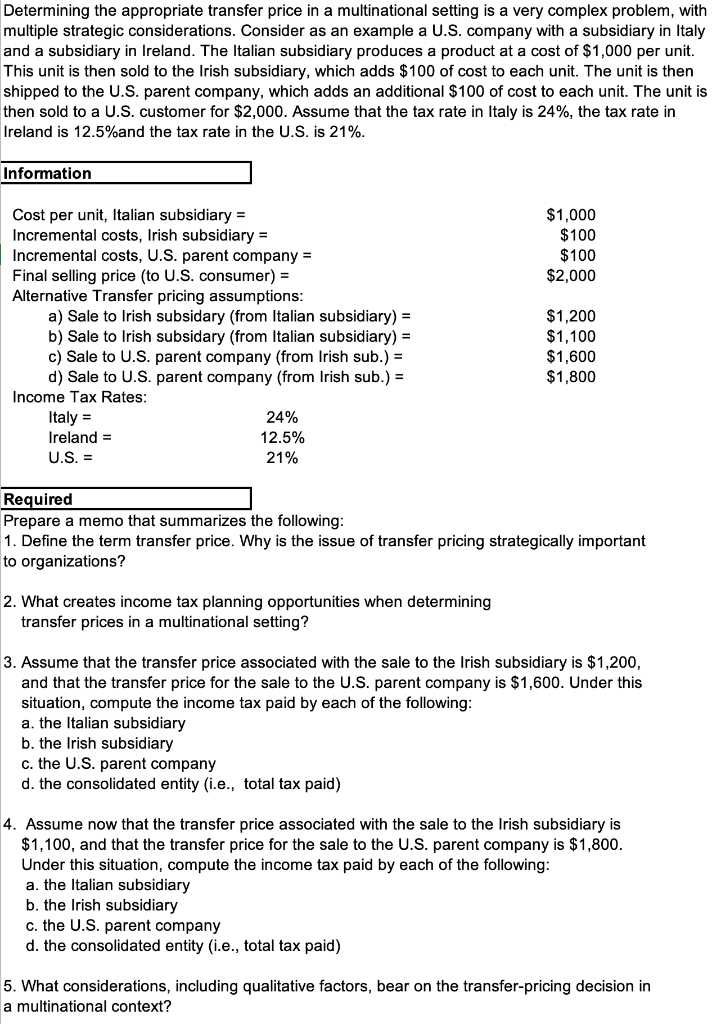

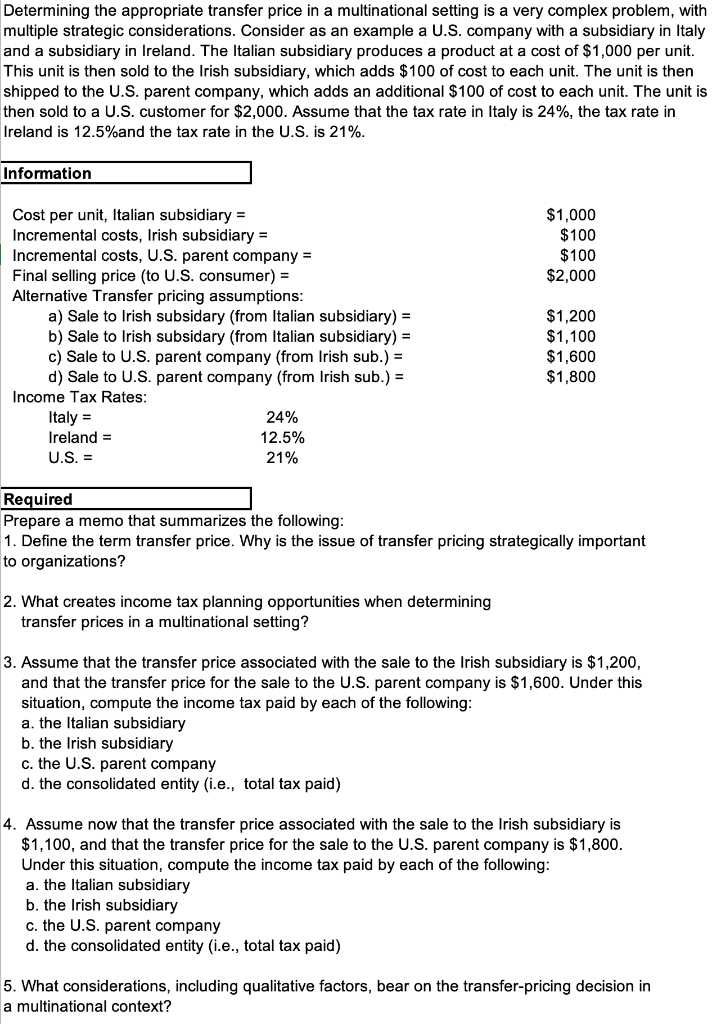

Determining the appropriate transfer price in a multinational setting is a very complex problem, with multiple strategic considerations. Consider as an example a U.S. company with a subsidiary in Italy and a subsidiary in Ireland. The Italian subsidiary produces a product at a cost of $1,000 per unit. This unit is then sold to the Irish subsidiary, which adds $100 of cost to each unit. The unit is then shipped to the U.S. parent company, which adds an additional $100 of cost to each unit. The unit is then sold to a U.S. customer for $2,000. Assume that the tax rate in Italy is 24%, the tax rate in Ireland is 12.5% and the tax rate in the U.S. is 21%. Information Cost per unit, Italian subsidiary = Incremental costs, Irish subsidiary = Incremental costs, U.S. parent company = Final selling price (to U.S. consumer) = Alternative Transfer pricing assumptions: a) Sale to Irish subsidary (from Italian subsidiary) =$1,200 b) Sale to Irish subsidary (from Italian subsidiary) =$1,100 c) Sale to U.S. parent company (from Irish sub.) =$1,600 d) Sale to U.S. parent company (from Irish sub.) =$1,800 Income Tax Rates: Italy=Ireland=U.S.=24%12.5%21% Required Prepare a memo that summarizes the following: 1. Define the term transfer price. Why is the issue of transfer pricing strategically important to organizations? 2. What creates income tax planning opportunities when determining transfer prices in a multinational setting? 3. Assume that the transfer price associated with the sale to the Irish subsidiary is $1,200, and that the transfer price for the sale to the U.S. parent company is $1,600. Under this situation, compute the income tax paid by each of the following: a. the Italian subsidiary b. the Irish subsidiary c. the U.S. parent company d. the consolidated entity (i.e., total tax paid) 4. Assume now that the transfer price associated with the sale to the Irish subsidiary is $1,100, and that the transfer price for the sale to the U.S. parent company is $1,800. Under this situation, compute the income tax paid by each of the following: a. the Italian subsidiary b. the Irish subsidiary c. the U.S. parent company d. the consolidated entity (i.e., total tax paid) 5. What considerations, including qualitative factors, bear on the transfer-pricing decision in a multinational context