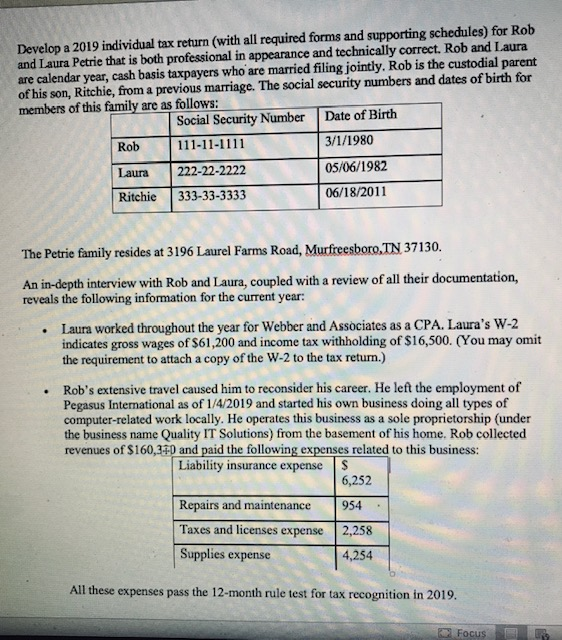

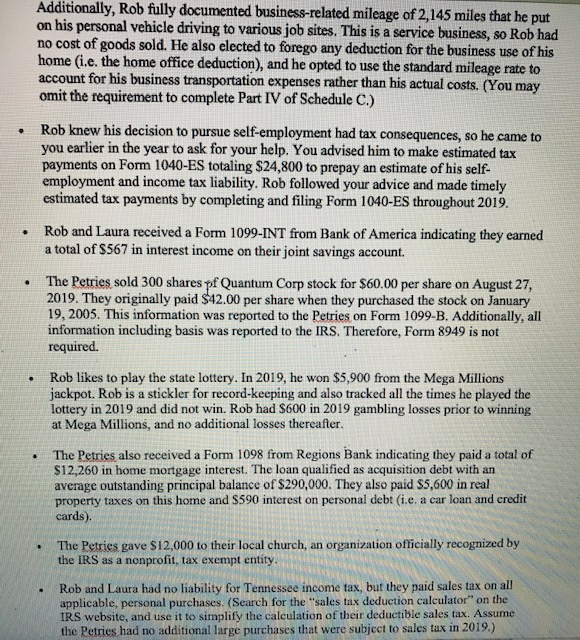

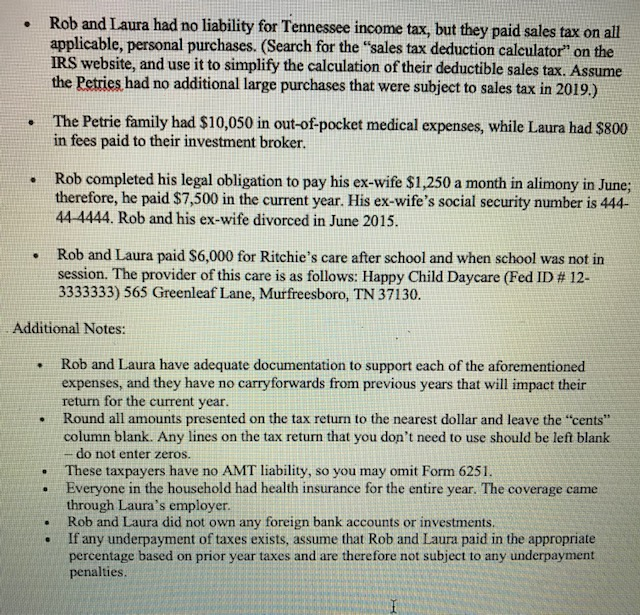

Develop a 2019 individual tax return (with all required forms and supporting schedules) for Rob and Laura Petrie that is both professional in appearance and technically correct. Rob and Laura are calendar year, cash basis taxpayers who are married filing jointly, Rob is the custodial parent of his son, Ritchie, from a previous marriage. The social security numbers and dates of birth for members of this family are as follows: Social Security Number Date of Birth 111-11-1111 3/1/1980 Laura 222-22-2222 05/06/1982 Ritchie 333-33-3333 06/18/2011 The Petrie family resides at 3196 Laurel Farms Road, Murfreesboro, TN 37130. An in-depth interview with Rob and Laura, coupled with a review of all their documentation, reveals the following information for the current year: Laura worked throughout the year for Webber and Associates as a CPA. Laura's W-2 indicates gross wages of $61,200 and income tax withholding of $16,500. (You may omit the requirement to attach a copy of the W-2 to the tax return.) Rob's extensive travel caused him to reconsider his career. He left the employment of Pegasus International as of 1/4/2019 and started his own business doing all types of computer-related work locally. He operates this business as a sole proprietorship (under the business name Quality IT Solutions) from the basement of his home. Rob collected revenues of $160,3--and paid the following expenses related to this business: Liability insurance expenses 6,252 Repairs and maintenance 954 Taxes and licenses expense 2,258 Supplies expense 4,254 All these expenses pass the 12-month rule test for tax recognition in 2019. Focus Additionally, Rob fully documented business-related mileage of 2,145 miles that he put on his personal vehicle driving to various job sites. This is a service business, so Rob had no cost of goods sold. He also elected to forego any deduction for the business use of his home (i.e. the home office deduction), and he opted to use the standard mileage rate to account for his business transportation expenses rather than his actual costs. (You may omit the requirement to complete Part IV of Schedule C.) Rob knew his decision to pursue self-employment had tax consequences, so he came to you earlier in the year to ask for your help. You advised him to make estimated tax payments on Form 1040-ES totaling $24,800 to prepay an estimate of his self- employment and income tax liability. Rob followed your advice and made timely estimated tax payments by completing and filing Form 1040-ES throughout 2019. Rob and Laura received a Form 1099-INT from Bank of America indicating they earned a total of $567 in interest income on their joint savings account. The Petries sold 300 shares of Quantum Corp stock for $60,00 per share on August 27, 2019. They originally paid $42.00 per share when they purchased the stock on January 19, 2005. This information was reported to the Petries on Form 1099-B. Additionally, all information including basis was reported to the IRS. Therefore, Form 8949 is not required. Rob likes to play the state lottery. In 2019, he won $5,900 from the Mega Millions jackpot. Rob is a stickler for record-keeping and also tracked all the times he played the lottery in 2019 and did not win. Rob had $600 in 2019 gambling losses prior to winning at Mega Millions, and no additional losses thereafter. The Petries also received a Form 1098 from Regions Bank indicating they paid a total of $12,260 in home mortgage interest. The loan qualified as acquisition debt with an average outstanding principal balance of $290,000. They also paid $5,600 in real property taxes on this home and $590 interest on personal debt (ie, a car loan and credit cards). The Petries gave $12,000 to their local church, an organization officially recognized by the IRS as a nonprofit, tax exempt entity. Rob and Laura had no liability for Tennessee income tax, but they paid sales tax on all applicable, personal purchases. (Search for the sales tax deduction calculator" on the IRS website, and use it to simplify the calculation of their deductible sales tax. Assume the Petries had no additional large purchases that were subject to sales tax in 2019.) Rob and Laura had no liability for Tennessee income tax, but they paid sales tax on all applicable, personal purchases. (Search for the sales tax deduction calculator" on the IRS website, and use it to simplify the calculation of their deductible sales tax. Assume the Petries had no additional large purchases that were subject to sales tax in 2019.) The Petrie family had $10,050 in out-of-pocket medical expenses, while Laura had $800 in fees paid to their investment broker. Rob completed his legal obligation to pay his ex-wife $1,250 a month in alimony in June; therefore, he paid $7,500 in the current year. His ex-wife's social security number is 444- 44-4444. Rob and his ex-wife divorced in June 2015. Rob and Laura paid $6,000 for Ritchie's care after school and when school was not in session. The provider of this care is as follows: Happy Child Daycare (Fed ID # 12- 3333333) 565 Greenleaf Lane, Murfreesboro, TN 37130. Additional Notes: Rob and Laura have adequate documentation to support each of the aforementioned expenses, and they have no carry forwards from previous years that will impact their return for the current year. Round all amounts presented on the tax return to the nearest dollar and leave the "cents" column blank. Any lines on the tax return that you don't need to use should be left blank - do not enter zeros. These taxpayers have no AMT liability, so you may omit Form 6251. Everyone in the household had health insurance for the entire year. The coverage came through Laura's employer. Rob and Laura did not own any foreign bank accounts or investments. If any underpayment of taxes exists, assume that Rob and Laura paid in the appropriate percentage based on prior year taxes and are therefore not subject to any underpayment penalties Develop a 2019 individual tax return (with all required forms and supporting schedules) for Rob and Laura Petrie that is both professional in appearance and technically correct. Rob and Laura are calendar year, cash basis taxpayers who are married filing jointly, Rob is the custodial parent of his son, Ritchie, from a previous marriage. The social security numbers and dates of birth for members of this family are as follows: Social Security Number Date of Birth 111-11-1111 3/1/1980 Laura 222-22-2222 05/06/1982 Ritchie 333-33-3333 06/18/2011 The Petrie family resides at 3196 Laurel Farms Road, Murfreesboro, TN 37130. An in-depth interview with Rob and Laura, coupled with a review of all their documentation, reveals the following information for the current year: Laura worked throughout the year for Webber and Associates as a CPA. Laura's W-2 indicates gross wages of $61,200 and income tax withholding of $16,500. (You may omit the requirement to attach a copy of the W-2 to the tax return.) Rob's extensive travel caused him to reconsider his career. He left the employment of Pegasus International as of 1/4/2019 and started his own business doing all types of computer-related work locally. He operates this business as a sole proprietorship (under the business name Quality IT Solutions) from the basement of his home. Rob collected revenues of $160,3--and paid the following expenses related to this business: Liability insurance expenses 6,252 Repairs and maintenance 954 Taxes and licenses expense 2,258 Supplies expense 4,254 All these expenses pass the 12-month rule test for tax recognition in 2019. Focus Additionally, Rob fully documented business-related mileage of 2,145 miles that he put on his personal vehicle driving to various job sites. This is a service business, so Rob had no cost of goods sold. He also elected to forego any deduction for the business use of his home (i.e. the home office deduction), and he opted to use the standard mileage rate to account for his business transportation expenses rather than his actual costs. (You may omit the requirement to complete Part IV of Schedule C.) Rob knew his decision to pursue self-employment had tax consequences, so he came to you earlier in the year to ask for your help. You advised him to make estimated tax payments on Form 1040-ES totaling $24,800 to prepay an estimate of his self- employment and income tax liability. Rob followed your advice and made timely estimated tax payments by completing and filing Form 1040-ES throughout 2019. Rob and Laura received a Form 1099-INT from Bank of America indicating they earned a total of $567 in interest income on their joint savings account. The Petries sold 300 shares of Quantum Corp stock for $60,00 per share on August 27, 2019. They originally paid $42.00 per share when they purchased the stock on January 19, 2005. This information was reported to the Petries on Form 1099-B. Additionally, all information including basis was reported to the IRS. Therefore, Form 8949 is not required. Rob likes to play the state lottery. In 2019, he won $5,900 from the Mega Millions jackpot. Rob is a stickler for record-keeping and also tracked all the times he played the lottery in 2019 and did not win. Rob had $600 in 2019 gambling losses prior to winning at Mega Millions, and no additional losses thereafter. The Petries also received a Form 1098 from Regions Bank indicating they paid a total of $12,260 in home mortgage interest. The loan qualified as acquisition debt with an average outstanding principal balance of $290,000. They also paid $5,600 in real property taxes on this home and $590 interest on personal debt (ie, a car loan and credit cards). The Petries gave $12,000 to their local church, an organization officially recognized by the IRS as a nonprofit, tax exempt entity. Rob and Laura had no liability for Tennessee income tax, but they paid sales tax on all applicable, personal purchases. (Search for the sales tax deduction calculator" on the IRS website, and use it to simplify the calculation of their deductible sales tax. Assume the Petries had no additional large purchases that were subject to sales tax in 2019.) Rob and Laura had no liability for Tennessee income tax, but they paid sales tax on all applicable, personal purchases. (Search for the sales tax deduction calculator" on the IRS website, and use it to simplify the calculation of their deductible sales tax. Assume the Petries had no additional large purchases that were subject to sales tax in 2019.) The Petrie family had $10,050 in out-of-pocket medical expenses, while Laura had $800 in fees paid to their investment broker. Rob completed his legal obligation to pay his ex-wife $1,250 a month in alimony in June; therefore, he paid $7,500 in the current year. His ex-wife's social security number is 444- 44-4444. Rob and his ex-wife divorced in June 2015. Rob and Laura paid $6,000 for Ritchie's care after school and when school was not in session. The provider of this care is as follows: Happy Child Daycare (Fed ID # 12- 3333333) 565 Greenleaf Lane, Murfreesboro, TN 37130. Additional Notes: Rob and Laura have adequate documentation to support each of the aforementioned expenses, and they have no carry forwards from previous years that will impact their return for the current year. Round all amounts presented on the tax return to the nearest dollar and leave the "cents" column blank. Any lines on the tax return that you don't need to use should be left blank - do not enter zeros. These taxpayers have no AMT liability, so you may omit Form 6251. Everyone in the household had health insurance for the entire year. The coverage came through Laura's employer. Rob and Laura did not own any foreign bank accounts or investments. If any underpayment of taxes exists, assume that Rob and Laura paid in the appropriate percentage based on prior year taxes and are therefore not subject to any underpayment penalties