Question

Develop a basic accounting equation (Assets= Liability + Owner's Equity) for the year 2018 & 2019. Calculate Net Profit of the company for the

Develop a basic "accounting equation" (Assets= Liability + Owner's Equity) for the year 2018 & 2019.

Calculate "Net Profit" of the company for the year 2018 & 2019 by using the "Simple Income Statement" format which you learned in the class?

"Company's net income appears directly on the income statement and the owner's equity statements, and it is included indirectly in the company's balance sheet". Do you agree? Explain how the net income is shown in Balance Sheet.

What is a total assets value of the company during 2018 and 2019? Provide calculation

What is a total Liability value of the company during 2018 and 2019? Provide calculation

What is a total Owner's Equity value of the company during 2018 and 2019? Provide calculation

What is the accounting period of the company?

Which method (periodic or perpetual) the company has used to calculate the Cost of Inventory? Explain briefly.

(if the company is service organization, then explain both methods briefly)

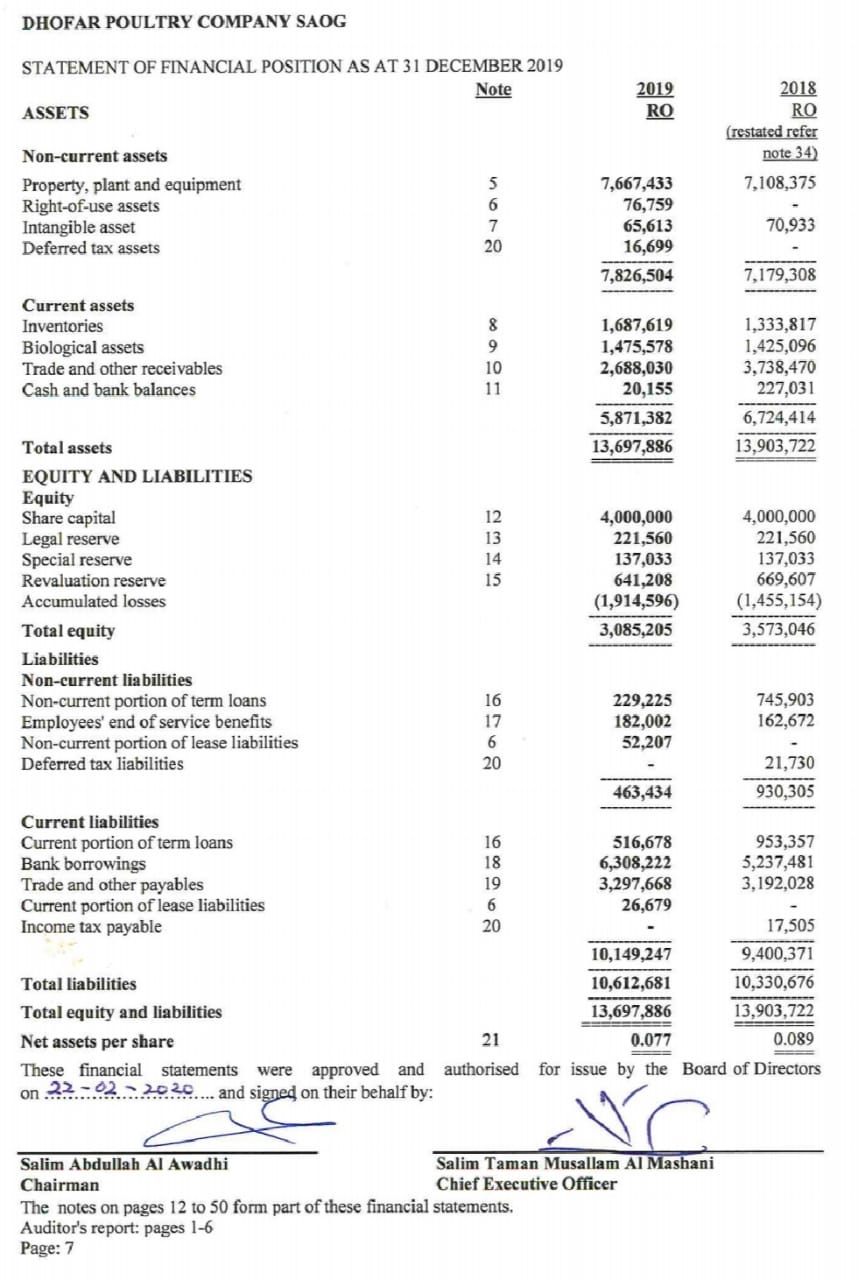

DHOFAR POULTRY COMPANY SAOG STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2019 Note 2019 ASSETS Non-current assets Property, plant and equipment Right-of-use assets Intangible asset RO 2018 RO (restated refer note 34) Deferred tax assets 3178 5 7,667,433 7,108,375 6 76,759 65,613 70,933 20 16,699 7,826,504 7,179,308 Current assets Inventories Biological assets Trade and other receivables Cash and bank balances 8963 1,687,619 1,333,817 1,475,578 1,425,096 10 2,688,030 3,738,470 11 20,155 227,031 5,871,382 6,724,414 13,697,886 13,903,722 Total assets EQUITY AND LIABILITIES Equity Share capital Legal reserve 13 Special reserve 14 Revaluation reserve 15 2345 12 4,000,000 4,000,000 221,560 221,560 137,033 137,033 641,208 669,607 Accumulated losses (1,914,596) (1,455,154) 3,085,205 3,573,046 Total equity Liabilities Non-current liabilities Non-current portion of term loans Employees' end of service benefits Non-current portion of lease liabilities Deferred tax liabilities 6262 16 229,225 745,903 17 182,002 162,672 52,207 20 21,730 463,434 930,305 Current liabilities Current portion of term loans Bank borrowings Trade and other payables Current portion of lease liabilities Income tax payable 68962 16 516,678 953,357 18 6,308,222 5,237,481 19 3,297,668 3,192,028 26,679 20 17,505 10,149,247 9,400,371 Total liabilities Total equity and liabilities Net assets per share 10,612,681 10,330,676 13,697,886 13,903,722 21 0.077 0.089 These financial statements were approved and authorised for issue by the Board of Directors on 22-02-2020... and signed on their behalf by: Salim Abdullah Al Awadhi Chairman Salim Taman Musallam Al Mashani Chief Executive Officer The notes on pages 12 to 50 form part of these financial statements. Auditor's report: pages 1-6 Page: 7

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions lets analyze the provided financial statements 1 Developing the accounting ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started