Answered step by step

Verified Expert Solution

Question

1 Approved Answer

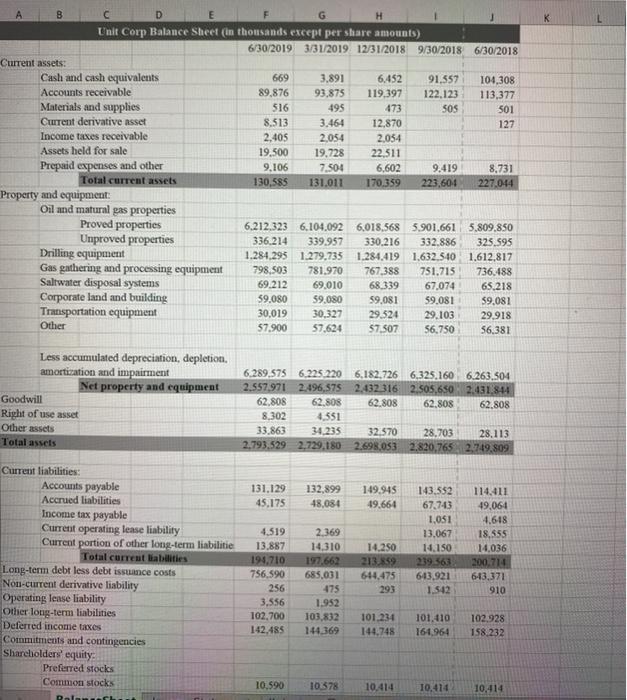

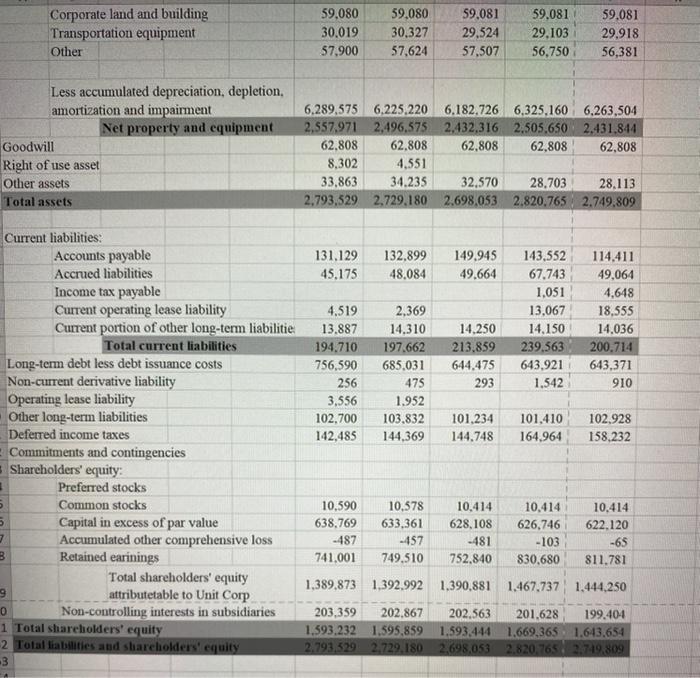

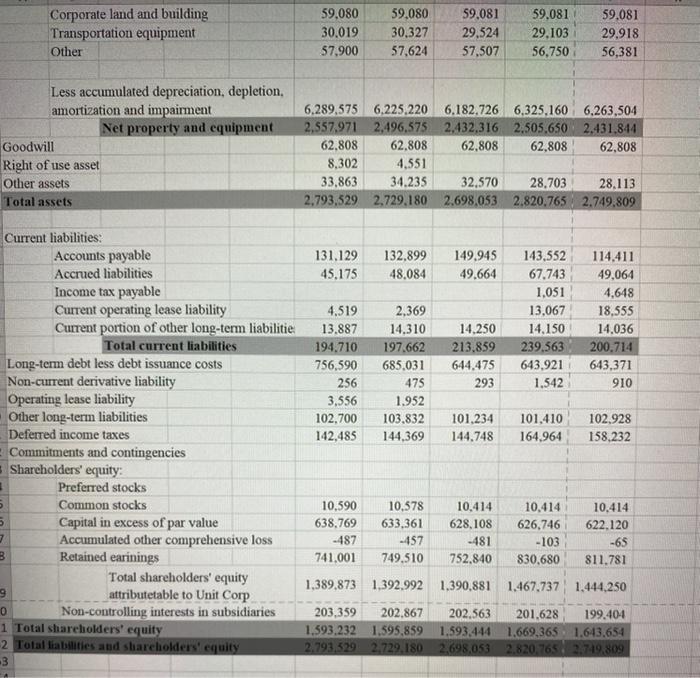

Develop a common size balance and common size income statement balance sheet income statement B D E F G H Unit Corp Balance Sheet (in

Develop a common size balance and common size income statement

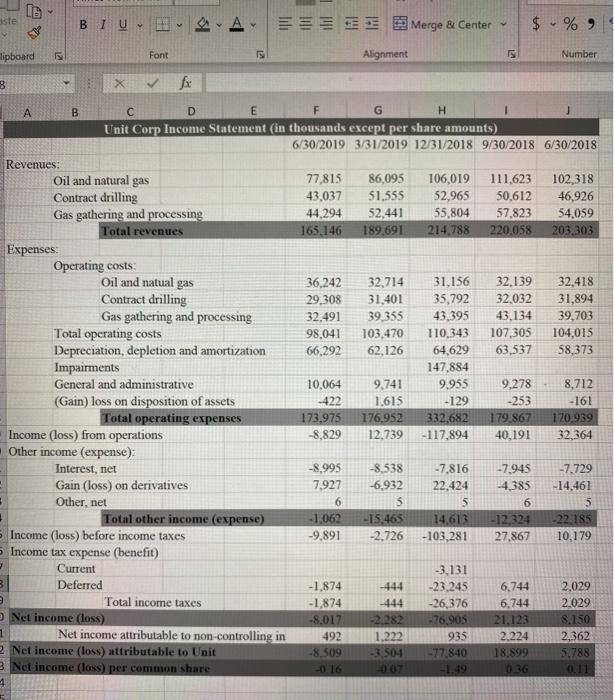

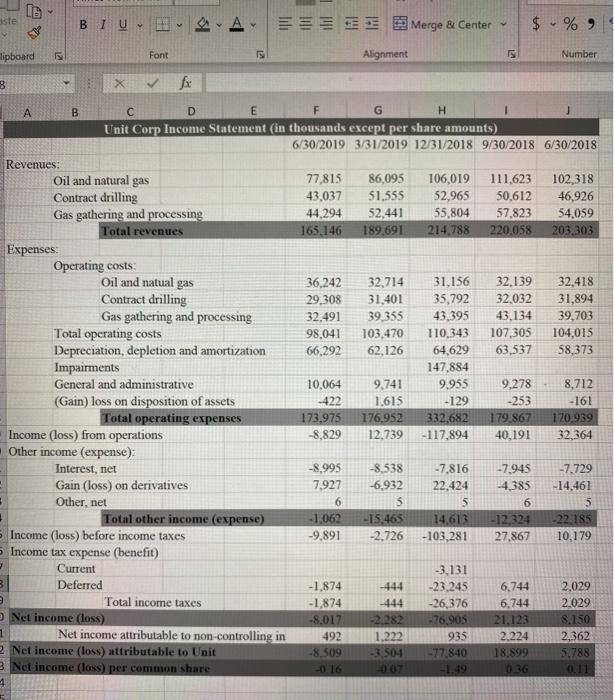

B D E F G H Unit Corp Balance Sheet (in thousands except per share amounts) 6/30/2019 3/31/2019 12/31/2018 9/30/2018 6/30/2018 Current assets: Cash and cash equivalents 669 3.891 6.452 91,557 104,308 Accounts receivable 89,876 93.875 119.397 122,123 113,377 Materials and supplies $16 495 473 SOS 501 Current derivative asset 8.513 3.464 12,870 127 Income taxes receivable 2,405 2,054 2,054 Assets held for sale 19.500 19,728 22.511 Prepaid expenses and other 9,106 7,504 6,602 9.419 8.731 Total current assets 130,585 131.011 170.359 223,604 227,044 Property and equipment: Oil and matural gas properties Proved properties 6.212.323 6.104.092 6,018.568 5.901.661 5.809.850 Unproved properties 336.214 339.957 330.216 332.886 325.595 Drilling equipment 1.284.295 1.279,735 1.284.419 1.632.540 1.612.817 Gas gathering and processing equipment 798,503 781.970 767,388 751.715 736.488 Saltwater disposal systems 69.212 69,010 68,339 67,074 65,218 Corporate land and building 59.080 59.080 59,081 59,081 59,081 Transportation equipment 30,019 30,327 29524 29.103 29,918 Other 57.900 57.624 57.507 56.750 56.381 Less accumulated depreciation, depletion. amortization and impairment Net property and equipment Goodwill Right of use asset Other assets Total assets 6.289,575 6.225.220 6.182,726 6.325.160 6.263.504 2.557,971 2.496,575 2.32316 2.505,650 2.431.844 62.808 62.808 62.808 62.808 62.808 8,302 4.551 33.863 34.235 32.570 28.703 28.113 2.793,5292,729,180 2.698,053 2.820,765 2,749,809 131.129 45.175 132,899 48,084 149.945 49,664 Current liabilities: Accounts payable Accrued liabilities Income tax payable Current operating lease liability Current portion of other long-term liabilitie Total current liabilities Long-term debt less debt issuance costs Nou-current derivative liability Operating lense liability Other long-term liabilities Deferred income taxes Commitments and contingencies Shareholders' equity Preferred stocks Common stocks 4,519 13.887 194,710 756,590 256 3,556 102.700 142.485 2.369 14,310 197,662 685,031 475 1.952 103,832 144.369 143.552 67,743 1,051 13.067 14.150 239563 643.921 1.542 114.411 49,064 4.618 18.555 14,036 200.714 643,371 910 14.250 213.859 644,475 293 101.234 144,748 101.410 161,964 102.928 158.232 10.590 10 578 10.414 10,414 10,414 Da Corporate land and building Transportation equipment Other 59.080 30.019 57,900 59,080 30.327 57.624 59,081 29,524 57,507 59,081 29.103 56,750 59,081 29,918 56,381 Less accumulated depreciation, depletion, amortization and impairment Net property and equipment Goodwill Right of use asset Other assets Total assets 6,289,575 6,225,220 6.182.726 6,325,160 6,263,504 2,557,971 2,496,575 2.432,316 2.505,650 2.431.844 62.808 62.808 62,808 62,808 62,808 8.302 4.551 33,863 34.235 32.570 28.703 28.113 2,793,529 2,729,180 2,698,053 2.820.765 2.749,809 131.129 45,175 132.899 48.084 149.945 49.664 4,519 13.887 194.710 756,590 256 3,556 102,700 142,485 2,369 14,310 197,662 685.031 475 1.952 103.832 144,369 143,552 67,743 1,051 13,067 14,150 239.563 643,921 1.542 114,411 49,064 4,648 18,555 14.036 200.714 643,371 910 14.250 213.839 644.475 293 101,234 144.748 101.410 164.964 102.928 158.232 Current liabilities: Accounts payable Accrued liabilities Income tax payable Current operating lease liability Current portion of other long-term liabilitie Total current liabilities Long-term debt less debt issuance costs Non-current derivative liability Operating lease liability Other long-term liabilities Deferred income taxes Commitments and contingencies Shareholders' equity: Preferred stocks Common stocks Capital in excess of par value Accumulated other comprehensive loss B Retained earnings Total shareholders' equity attributetable to Unit Corp Non-controlling interests in subsidiaries 1 Total shareholders' equity 2 Total liabilities and shareholders' equity 3 3 10,390 638,769 -487 741.001 10,578 633,361 -457 749,510 10,414 628,108 -481 752,840 7 10,414 626,746 -103 830,680 10.414 622.120 -65 811.781 1,389.873 1.392.992 1.390.881 1.467.737 1,444,250 0 203,359 202.867 202.563 201.628 199.404 1.593.232 1.595,859 1.593.444 1.669.365 1.643.654 2.793,529 2.729.180 2,698,053 2.820,765 2.749.809 iste BIU A EF Merge & Center $ %) lipboard Font 5 Alignment 5 Number 8 fx A B c D EF Unit Corp Income Statement (in thousands except per share amounts) 6/30/2019 3/31/2019 12/31/2018 9/30/2018 6/30/2018 Revenues: Oil and natural gas 77,815 86,095 106,019 111,623 102,318 Contract drilling 43,037 51,555 52,965 50,612 46,926 Gas gathering and processing 44.294 52,441 55,804 57,823 54,059 Total revenues 165,146 189,691 214.788 220.058 203.303 Expenses Operating costs Oil and natual gas 36,242 32,714 31,156 32,139 32,418 Contract drilling 29,308 31,401 35,792 32,032 31,894 Gas gathering and processing 32,491 39,355 43.395 43.134 39,703 Total operating costs 98,041 103,470 110,343 107,305 104,015 Depreciation, depletion and amortization 66,292 62,126 64,629 63,537 58,373 Impairments 147,884 General and administrative 10,064 9,741 9.955 9,278 8,712 (Gain) loss on disposition of assets -422 1.615 -129 -253 -161 Total operating expenses 173.975 176.952 332.682 179,867 120.939 Income (loss) from operations -8.829 12.739 -117.894 40.191 32,364 Other income (expense) Interest, net -8,995 -8,538 -7.816 -7.945 -7.729 Gain (loss) on derivatives 7.927 -6.932 22,424 4,385 -14.461 Other, net 6 5 5 6 5 Total other income (expense) -1.062 -15,465 14,613 -12 324 -22.185 Income (loss) before income taxes -9.891 -2,726 -103,281 27,867 10,179 Income tax expense (benefit) Current -3.131 Deferred -1,874 -23.245 6.744 2,029 Total income taxes -1,874 -444 -26,376 6.744 2,029 Net income (loss) -8,017 2.282 76,905 21.123 8.150 1 Net income attributable to non-controlling in 492 1.222 935 2.224 2,362 2 Net income (loss) attributable to Unit -8.509 -3 504 -77.840 18.899 5.788 3 Net income (loss) per common share -0.16 -0.07 -1.49 0.36 011 4 balance sheet

income statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started