Develop a pro forma income statement for 1996. You may assume that depreciation equals the 1995 amount plus one-sixth of 1996 capital spending. The relevant tax rate is 40 percent.

Estimate purchases in 1996. (Hint: Cost of goods equals purchases plus beginning inventory minus ending inventory.)

Use the percent of sales method to estimate funds needed in 1996 using the 1995 percentages.

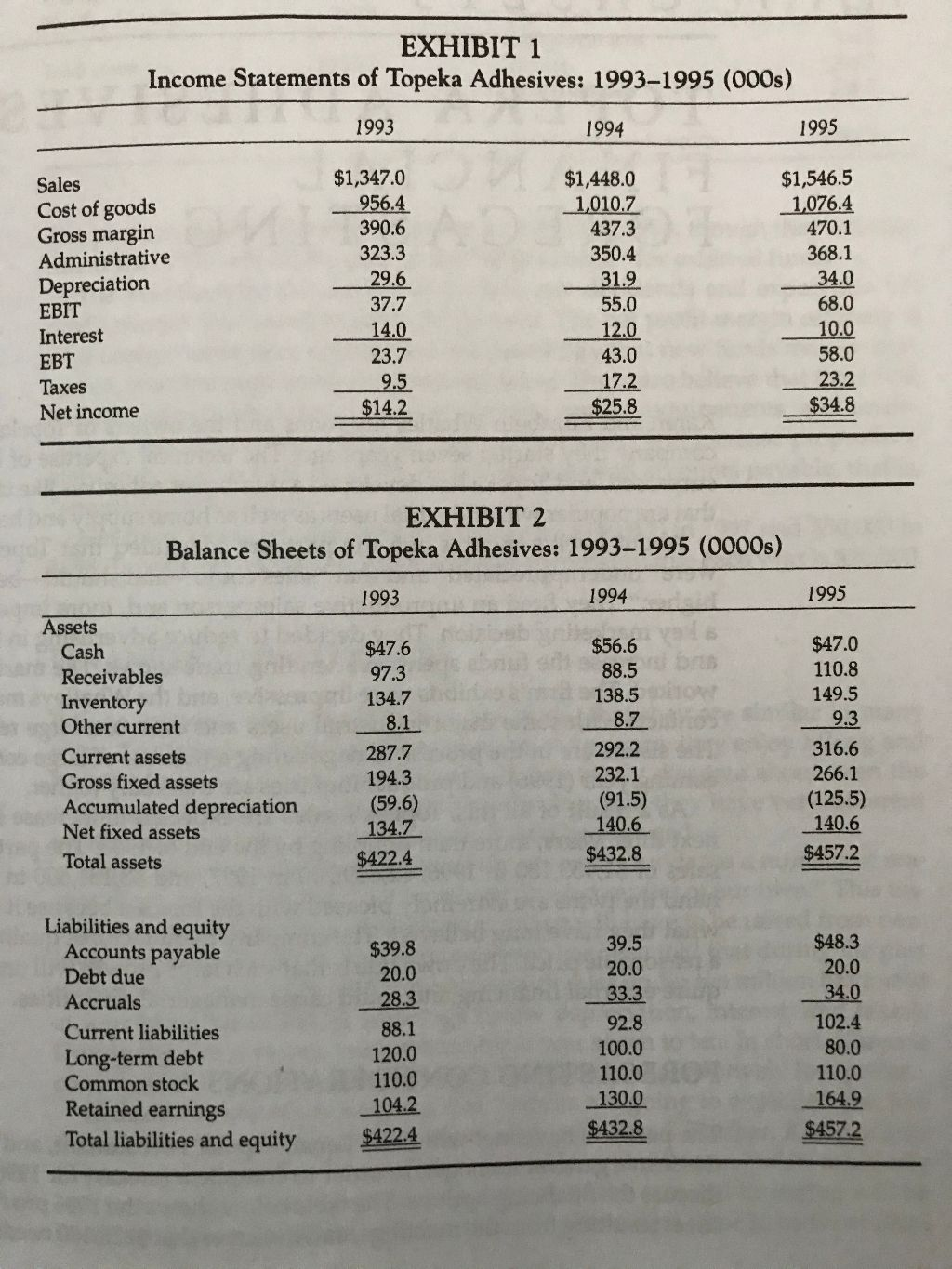

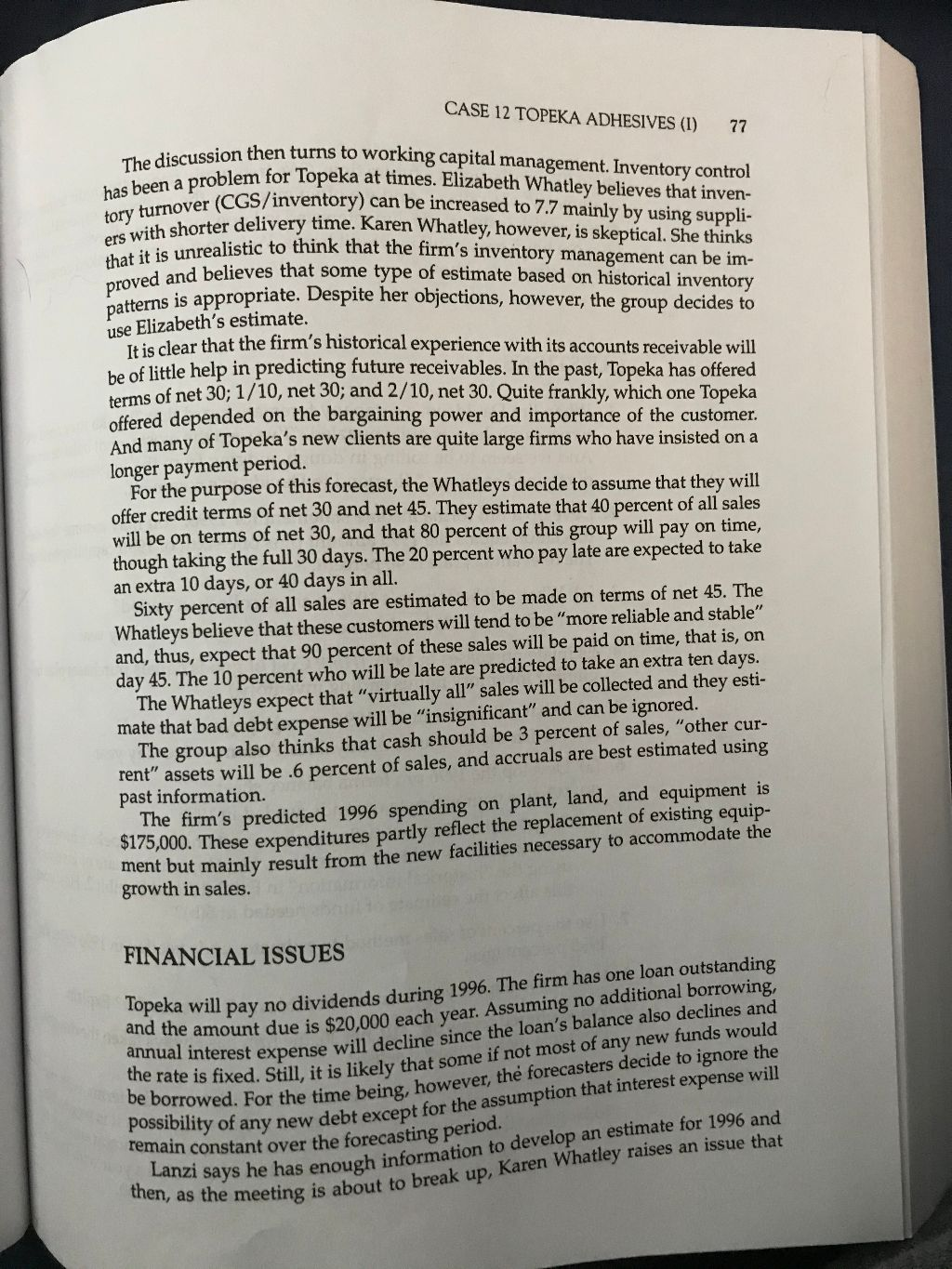

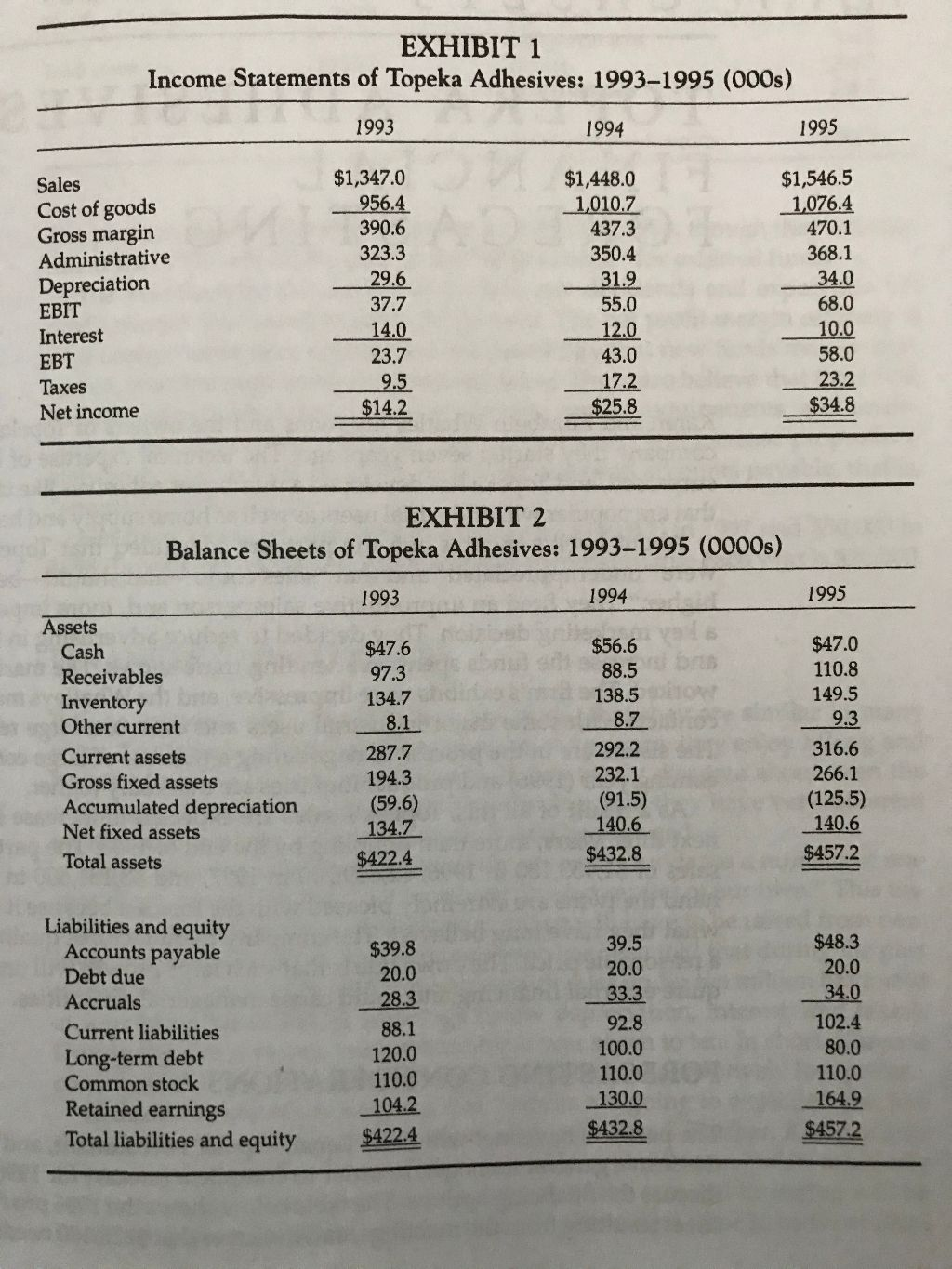

er. Spears. The sis s for the coming PART III FINANCIAL PLANNING contacts with some industrial users and even one national retailer ters are in the process of negotiating a number of large contracts year (1996) and product inquiries are markedly higher. As a result of all this, Topeka's sales growth is expected to incre the next three years, and sales are estimated to more than double 1998. The Whatleys predict sales of $1,933,100 in 1996, $2,609 7 $3,131,600 in 1998. On one hand, the twins are extremely pleased w cast because it is evidence of what they have long believed: The ufactures quality products at a reasonable price. The downside is the growth will undoubtedly require external financing and could cause a to increase sharply in n double by the end of $2.609,700 in 1997, and pleased with the fore- ved: The company man- upside is that such large vuld cause manager- 1998. The Whatleyone hand, the two long believed: The comp ial difficulties. While the partners will explore a number of financing alternatives. th ognize that the first step is to estimate the external funds needed for 1996-1998 period. After all, before they decide on a financing option, they a reasonable projection of what needs to be raised. And it is even possible the most of the expected growth can be internally financed. FORECASTING CONSIDERATIONS In order to develop the forecast the partners decided to meet with Fred Lanzi, the firm's accountant, and Karl Shatner, Topeka's general manager. All agree that the sales projections are "quite reasonable" in view of the activity resulting from the trade shows and may even be a bit low. They also decide to concentrate on the 1996 forecast at the initial meeting. A few months ago Shatner began implementing a number of cost-cutting measures that are expected to generate a 32 percent gross margin each year of the forecast. Due to economies of scale administrative expenses are expected increase less than proportionately with sales, and the group estimates a 20 per cent increase in 1996. The relevant tax rate is 40 percent. Lanzi pointed out that the financial forecast needs to consider the credit terms offered by many of the firm's suppliers. Company record that two years ago about 80 percent of Topeka's purchases were on 2/10, net 30. That is, most suppliers offered a 2 percent discount to cus who paid within ten days but, in any event, full payment was expected thirty. Roughly 20 percent of the purchases were on terms of net course," noted Lanzi, "always took the discount when it was offere Company records also show that during the past year only abo firm's suppliers offered the above discount. Lanzi strongly believes fewer vendors will offer a discount in the future, and thinks that it is sume--and the Whatley's concur-that only a third of all future purch be made on terms of 2/10, net 30. In addition, he recommends that gross margin estimate be reduced to 31 percent, in part because of te discounts. After some discussion, Shatner agrees that Lanzi's points made and my estimate of gross margin is probably a bit high." ompany records show ases were on terms of scount to customers was expected by day is of net 30. "We, of It was offered." cento in any othered, Ka's pun Compander the tick a Lanz about half of the leves that even that it is wise to as- purchases will that Shatner's I fewer trade Points "are well CASE 12 TOPEKA ADHESIVES (1) 27 The discussion then turns has been a problem for To tory turnover (CGS/inven ers with shorter delivery ti that it is unrealistic to thin proved and believes patterns is appropriate. Des use Elizabeth's estimate. on then turns to working capital management. Inventory control blem for Topeka at times. Elizabeth Whatley believes that inven- ICGS/inventory) can be increased to 7.7 mainly by using suppli- er delivery time. Karen Whatley, however, is skeptical. She thinks calistic to think that the firm's inventory management can be im- sd believes that some type of estimate based on historical inventory appropriate. Despite her objections, however, the group decides to clear that the firm's historical experience with its accounts receivable will flittle help in predicting future receivables. In the past, Topeka has offered arms of net 30; 1/10, net 30; and 2/10, net 30. Quite frankly, which one Topeka offered depended on the bargaining power and importance of the customer. And many of Topeka's new clients are quite large firms who have insisted on a longer payment period. For the purpose of this forecast, the Whatleys decide to assume that they will offer credit terms of net 30 and net 45. They estimate that 40 percent of all sales will be on terms of net 30, and that 80 percent of this group will pay on time, though taking the full 30 days. The 20 percent who pay late are expected to take an extra 10 days, or 40 days in all. Sixty percent of all sales are estimated to be made on terms of net 45. The Whatleys believe that these customers will tend to be "more reliable and stable" and, thus, expect that 90 percent of these sales will be paid on time, that is, on day 45. The 10 percent who will be late are predicted to take an extra ten days. The Whatleys expect that "virtually all" sales will be collected and they esti- mate that bad debt expense will be "insignificant" and can be ignored. The group also thinks that cash should be 3 percent of sales, "other cur- rent" assets will be .6 percent of sales, and accruals are best estimated using past information. The firm's predicted 1996 spending on plant, land, and equipment is 75,000. These expenditures partly reflect the replacement of existing equip- ment but mainly result from the new facilities necessary to accommodate the growth in sales. FINANCIAL ISSUES eka will pay no dividends during 1996. The firm has one loan outstanding ne amount due is $20.000 each year. Assuming no additional borrowing, interest expense will decline since the loan's balance also declines and S fixed. Still, it is likely that some if not most of any new funds would wed. For the time being, however, the forecasters decide to ignore the possibility of any ne "y of any new debt except for the assumption that interest expense will remain constant over the forecasting perio anzi says he has enough information to develop an estimate for 1996 and the meeting is about to break up, Kare reak up, Karen Whatley raises an issue that annual interest expense w the rate is fixed. Still, it is likely be borrowed. For the time Lanzi says he ha then, as the meeting is EXHIBIT 1 Income Statements of Topeka Adhesives: 1993-1995 (000s) 1993 1994 1995 Sales Cost of goods Gross margin Administrative Depreciation EBIT Interest EBT Taxes Net income $1,347.0 956.4 390.6 323.3 29.6 37.7 - 14.0 23.7 9.5 $14.2 $1,448.0 1,010.7 437.3 350.4 31.9 55.0 12.0 43.0 17.2 $25.8 $1,546.5 1,076.4 470.1 368.1 34.0 68.0 10.0 58.0 23.2 $34.8 EXHIBIT 2 Balance Sheets of Topeka Adhesives: 1993-1995 (0000s) 1993 1994 1995 $56.6 88.5 138.5 8.7 Assets Cash Receivables Inventory Other current Current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets $47.6 97.3 134.7 8.1 287.7 194.3 (59.6) 134.7 $422.4 292.2 232.1 (91.5) 140.6 $432.8 $47.0 110.8 149.5 9.3 316.6 266.1 (125.5) 140.6 $457.2 $48.3 20.0 34.0 Liabilities and equity Accounts payable Debt due Accruals Current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity $39.8 20.0 28.3 88.1 120.0 110.0 104.2 $422.4 39.5 20.0 33.3 92.8 100.0 110.0 130.0 102.4 80.0 110.0 164.9 $457.2 $432.8 er. Spears. The sis s for the coming PART III FINANCIAL PLANNING contacts with some industrial users and even one national retailer ters are in the process of negotiating a number of large contracts year (1996) and product inquiries are markedly higher. As a result of all this, Topeka's sales growth is expected to incre the next three years, and sales are estimated to more than double 1998. The Whatleys predict sales of $1,933,100 in 1996, $2,609 7 $3,131,600 in 1998. On one hand, the twins are extremely pleased w cast because it is evidence of what they have long believed: The ufactures quality products at a reasonable price. The downside is the growth will undoubtedly require external financing and could cause a to increase sharply in n double by the end of $2.609,700 in 1997, and pleased with the fore- ved: The company man- upside is that such large vuld cause manager- 1998. The Whatleyone hand, the two long believed: The comp ial difficulties. While the partners will explore a number of financing alternatives. th ognize that the first step is to estimate the external funds needed for 1996-1998 period. After all, before they decide on a financing option, they a reasonable projection of what needs to be raised. And it is even possible the most of the expected growth can be internally financed. FORECASTING CONSIDERATIONS In order to develop the forecast the partners decided to meet with Fred Lanzi, the firm's accountant, and Karl Shatner, Topeka's general manager. All agree that the sales projections are "quite reasonable" in view of the activity resulting from the trade shows and may even be a bit low. They also decide to concentrate on the 1996 forecast at the initial meeting. A few months ago Shatner began implementing a number of cost-cutting measures that are expected to generate a 32 percent gross margin each year of the forecast. Due to economies of scale administrative expenses are expected increase less than proportionately with sales, and the group estimates a 20 per cent increase in 1996. The relevant tax rate is 40 percent. Lanzi pointed out that the financial forecast needs to consider the credit terms offered by many of the firm's suppliers. Company record that two years ago about 80 percent of Topeka's purchases were on 2/10, net 30. That is, most suppliers offered a 2 percent discount to cus who paid within ten days but, in any event, full payment was expected thirty. Roughly 20 percent of the purchases were on terms of net course," noted Lanzi, "always took the discount when it was offere Company records also show that during the past year only abo firm's suppliers offered the above discount. Lanzi strongly believes fewer vendors will offer a discount in the future, and thinks that it is sume--and the Whatley's concur-that only a third of all future purch be made on terms of 2/10, net 30. In addition, he recommends that gross margin estimate be reduced to 31 percent, in part because of te discounts. After some discussion, Shatner agrees that Lanzi's points made and my estimate of gross margin is probably a bit high." ompany records show ases were on terms of scount to customers was expected by day is of net 30. "We, of It was offered." cento in any othered, Ka's pun Compander the tick a Lanz about half of the leves that even that it is wise to as- purchases will that Shatner's I fewer trade Points "are well CASE 12 TOPEKA ADHESIVES (1) 27 The discussion then turns has been a problem for To tory turnover (CGS/inven ers with shorter delivery ti that it is unrealistic to thin proved and believes patterns is appropriate. Des use Elizabeth's estimate. on then turns to working capital management. Inventory control blem for Topeka at times. Elizabeth Whatley believes that inven- ICGS/inventory) can be increased to 7.7 mainly by using suppli- er delivery time. Karen Whatley, however, is skeptical. She thinks calistic to think that the firm's inventory management can be im- sd believes that some type of estimate based on historical inventory appropriate. Despite her objections, however, the group decides to clear that the firm's historical experience with its accounts receivable will flittle help in predicting future receivables. In the past, Topeka has offered arms of net 30; 1/10, net 30; and 2/10, net 30. Quite frankly, which one Topeka offered depended on the bargaining power and importance of the customer. And many of Topeka's new clients are quite large firms who have insisted on a longer payment period. For the purpose of this forecast, the Whatleys decide to assume that they will offer credit terms of net 30 and net 45. They estimate that 40 percent of all sales will be on terms of net 30, and that 80 percent of this group will pay on time, though taking the full 30 days. The 20 percent who pay late are expected to take an extra 10 days, or 40 days in all. Sixty percent of all sales are estimated to be made on terms of net 45. The Whatleys believe that these customers will tend to be "more reliable and stable" and, thus, expect that 90 percent of these sales will be paid on time, that is, on day 45. The 10 percent who will be late are predicted to take an extra ten days. The Whatleys expect that "virtually all" sales will be collected and they esti- mate that bad debt expense will be "insignificant" and can be ignored. The group also thinks that cash should be 3 percent of sales, "other cur- rent" assets will be .6 percent of sales, and accruals are best estimated using past information. The firm's predicted 1996 spending on plant, land, and equipment is 75,000. These expenditures partly reflect the replacement of existing equip- ment but mainly result from the new facilities necessary to accommodate the growth in sales. FINANCIAL ISSUES eka will pay no dividends during 1996. The firm has one loan outstanding ne amount due is $20.000 each year. Assuming no additional borrowing, interest expense will decline since the loan's balance also declines and S fixed. Still, it is likely that some if not most of any new funds would wed. For the time being, however, the forecasters decide to ignore the possibility of any ne "y of any new debt except for the assumption that interest expense will remain constant over the forecasting perio anzi says he has enough information to develop an estimate for 1996 and the meeting is about to break up, Kare reak up, Karen Whatley raises an issue that annual interest expense w the rate is fixed. Still, it is likely be borrowed. For the time Lanzi says he ha then, as the meeting is EXHIBIT 1 Income Statements of Topeka Adhesives: 1993-1995 (000s) 1993 1994 1995 Sales Cost of goods Gross margin Administrative Depreciation EBIT Interest EBT Taxes Net income $1,347.0 956.4 390.6 323.3 29.6 37.7 - 14.0 23.7 9.5 $14.2 $1,448.0 1,010.7 437.3 350.4 31.9 55.0 12.0 43.0 17.2 $25.8 $1,546.5 1,076.4 470.1 368.1 34.0 68.0 10.0 58.0 23.2 $34.8 EXHIBIT 2 Balance Sheets of Topeka Adhesives: 1993-1995 (0000s) 1993 1994 1995 $56.6 88.5 138.5 8.7 Assets Cash Receivables Inventory Other current Current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets $47.6 97.3 134.7 8.1 287.7 194.3 (59.6) 134.7 $422.4 292.2 232.1 (91.5) 140.6 $432.8 $47.0 110.8 149.5 9.3 316.6 266.1 (125.5) 140.6 $457.2 $48.3 20.0 34.0 Liabilities and equity Accounts payable Debt due Accruals Current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity $39.8 20.0 28.3 88.1 120.0 110.0 104.2 $422.4 39.5 20.0 33.3 92.8 100.0 110.0 130.0 102.4 80.0 110.0 164.9 $457.2 $432.8