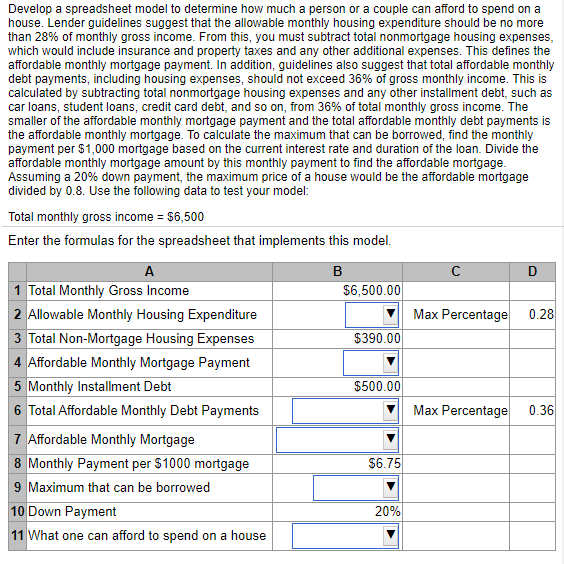

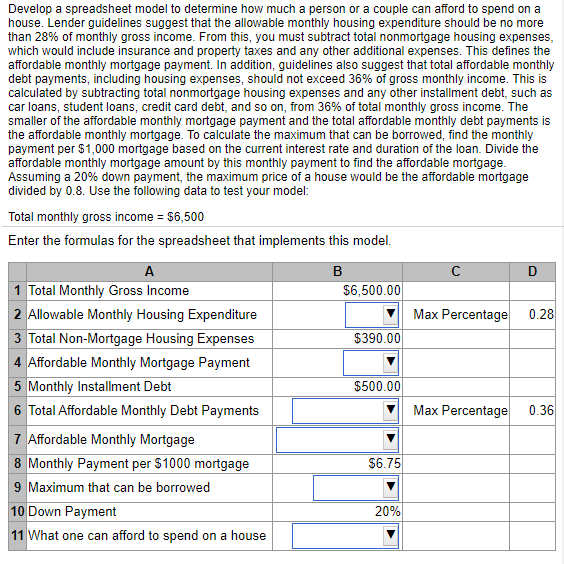

Develop a spreadsheet model to determine how much a person or a couple can afford to spend on a house. Lender guidelines suggest that the allowable monthly housing expenditure should be no more than 28% of monthly gross income. From this, you must subtract total nonmortgage housing expenses, which would include insurance and property taxes and any other additional expenses. This defines the affordable monthly mortgage payment. In addition, guidelines also suggest that total affordable monthly debt payments, including housing expenses, should not exceed 36% of gross monthly income. This is calculated by subtracting total nonmortgage housing expenses and any other installment debt, such as car loans, student loans, credit card debt, and so on, from 36% of total monthly gross income. The smaller of the affordable monthly mortgage payment and the total affordable monthly debt payments is the affordable monthly mortgage. To calculate the maximum that can be borrowed, find the monthly payment per $1,000 mortgage based on the current interest rate and duration of the loan. Divide the affordable monthly mortgage amount by this monthly payment to find the affordable mortgage. Assuming a 20% down payment, the maximum price of a house would be the affordable mortgage divided by 0.8. Use the following data to test your model: Total monthly gross income = $6,500 Enter the formulas for the spreadsheet that implements this model. B C D 1 Total Monthly Gross Income $6,500.00 2 Allowable Monthly Housing Expenditure Max Percentage 0.28 3 Total Non-Mortgage Housing Expenses $390.00 4 Affordable Monthly Mortgage Payment 5 Monthly Installment Debt $500.00 6 Total Affordable Monthly Debt Payments Max Percentage 0.36 7 Affordable Monthly Mortgage 8 Monthly Payment per $1000 mortgage $6.75 9 Maximum that can be borrowed 10 Down Payment 20% 11 What one can afford to spend on a house Develop a spreadsheet model to determine how much a person or a couple can afford to spend on a house. Lender guidelines suggest that the allowable monthly housing expenditure should be no more than 28% of monthly gross income. From this, you must subtract total nonmortgage housing expenses, which would include insurance and property taxes and any other additional expenses. This defines the affordable monthly mortgage payment. In addition, guidelines also suggest that total affordable monthly debt payments, including housing expenses, should not exceed 36% of gross monthly income. This is calculated by subtracting total nonmortgage housing expenses and any other installment debt, such as car loans, student loans, credit card debt, and so on, from 36% of total monthly gross income. The smaller of the affordable monthly mortgage payment and the total affordable monthly debt payments is the affordable monthly mortgage. To calculate the maximum that can be borrowed, find the monthly payment per $1,000 mortgage based on the current interest rate and duration of the loan. Divide the affordable monthly mortgage amount by this monthly payment to find the affordable mortgage. Assuming a 20% down payment, the maximum price of a house would be the affordable mortgage divided by 0.8. Use the following data to test your model: Total monthly gross income = $6,500 Enter the formulas for the spreadsheet that implements this model. B C D 1 Total Monthly Gross Income $6,500.00 2 Allowable Monthly Housing Expenditure Max Percentage 0.28 3 Total Non-Mortgage Housing Expenses $390.00 4 Affordable Monthly Mortgage Payment 5 Monthly Installment Debt $500.00 6 Total Affordable Monthly Debt Payments Max Percentage 0.36 7 Affordable Monthly Mortgage 8 Monthly Payment per $1000 mortgage $6.75 9 Maximum that can be borrowed 10 Down Payment 20% 11 What one can afford to spend on a house