Answered step by step

Verified Expert Solution

Question

1 Approved Answer

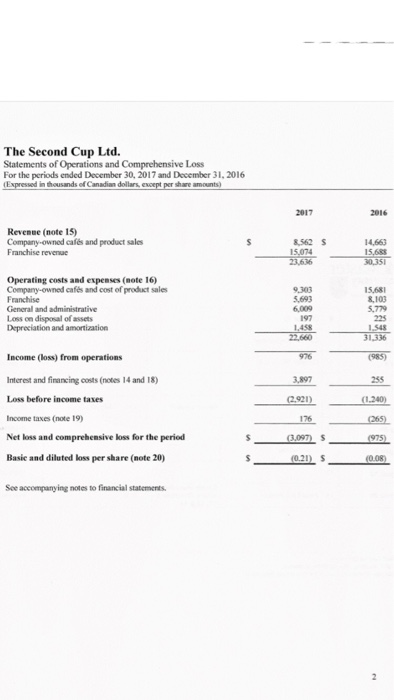

Develop an audit program for the Revenue process (or you may choose one other important accounting process, for example purchases, inventory production, payroll, investments, etc.,

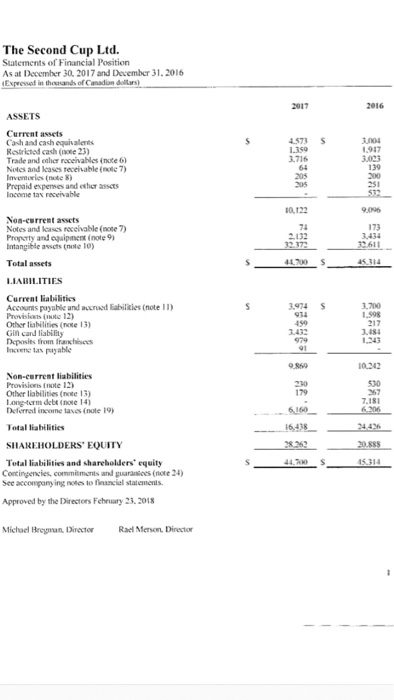

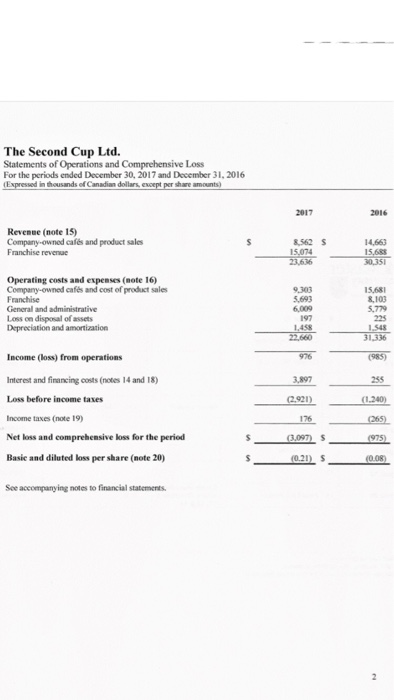

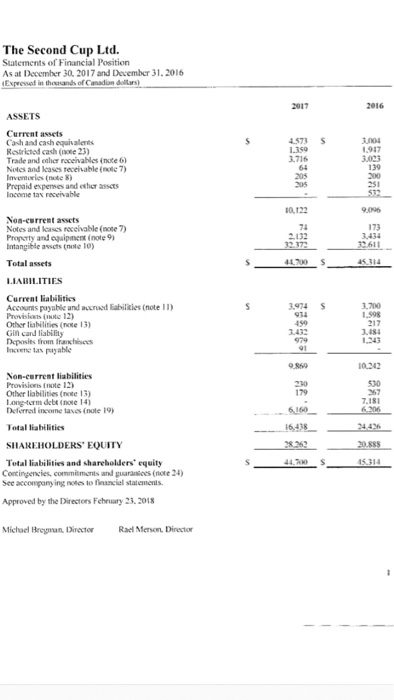

Develop an audit program for the Revenue process (or you may choose one other important accounting process, for example purchases, inventory production, payroll, investments, etc., that you think will produce significant risk of material misstatement in this company but please discuss this with me first). List the financial statement transactions (journal entries) and balances (general ledger accounts) in the revenue/receivables/receipts (or other) accounting cycle, and the assertions related to them. Apply the audit risk model and assess the risk components for the key assertions (*i.e. assess risk of material misstatement at the assertion level). Indicate whether you would use a substantive or combined approach to audit this process. List specific audit procedures to be performed for this process, being sure to specify the type of evidence-gathering audit techniques to be used (e.g. confirmation, inspection, observation, enquiry, etc.). The procedures in your program should follow from your risk assessment for the balances and transactions in this process, and the approach you have decided to use.

The Second Cup Ltd. Statements of Financial Position As at December 30. 2017 and December 31.2016 Expressed in thouands of Canadian 2016 ASSETS Current assets Cash and cash equivaleres Restricted cash (ote 23) Trade and eher roceivables (note 6) Notcs and leases receinable (nle7 Invenorics (note 8) Prepaid expenses and ethr assetS lncome tax receivable 4573 S 004 1.947 139 251 3.716 64 205 9096 Non-current assets Notes and lcases roceivable (note 7) Proparty and equipment (note 9) Intangible assets (note 10) 2132 Total assets 45.314 IABILITIES Current liabilities Accounts puyable und accrusd Eabilities (note I) Provisions (nute 12) Other liablities (nte 13) Gin card liabiEty Deposies fron rachibees Incerne tapayable .974S 3.700 3.432 .484 9869 Non-curremt liabilities Provisions (note 12 Other liabilities (note 13) Long-term debe tnoe 14 Deferred income tases (note 19) 10.242 530 7.181 230 179 6160 Total liahilities SHAREHOLDERS EQUITY Total liabilities and shareholders' equity Concingencies, commitments and gusarandces(note 24) See accompany ing notes to financiel statements. Approved by the Directors Feheuary 23. 2018 Michael Breyman Director Rael Merson Directio PS. I just need the journal entries. I dont know how to derive entries from financial statements itself.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started