Develop an Executive Summary for Mellisa

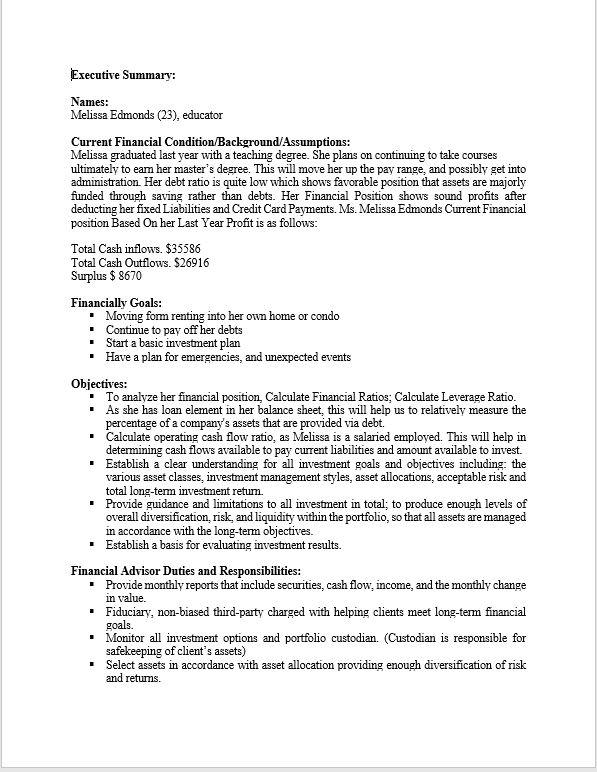

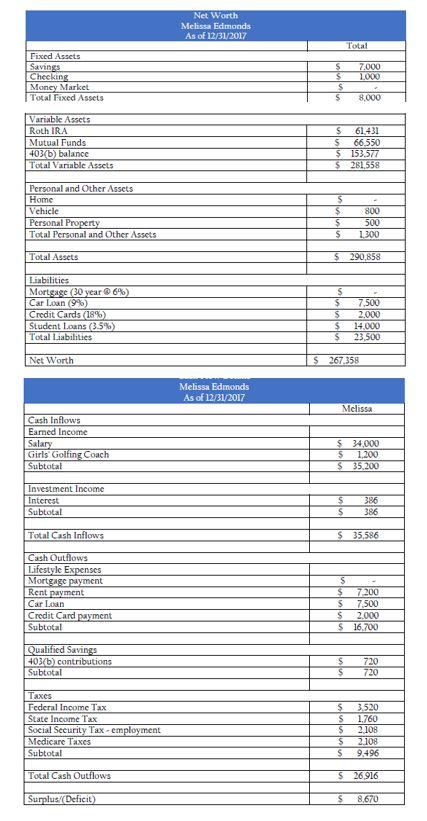

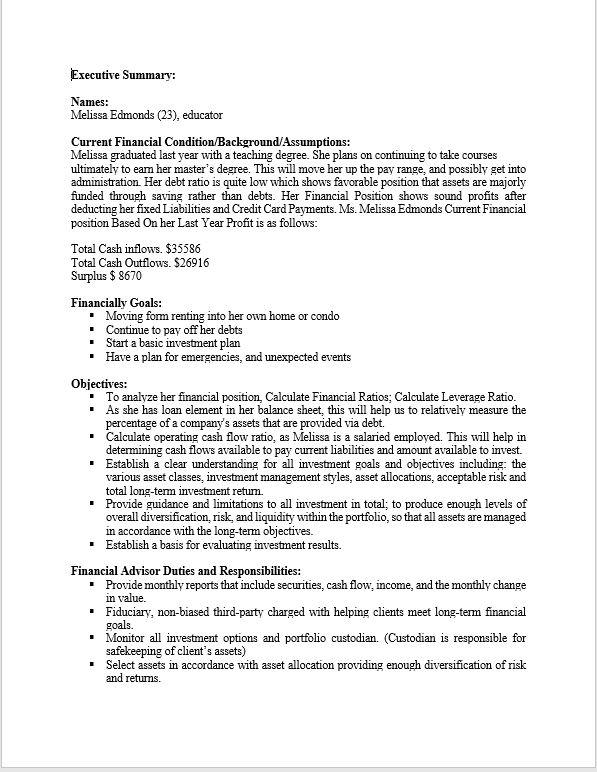

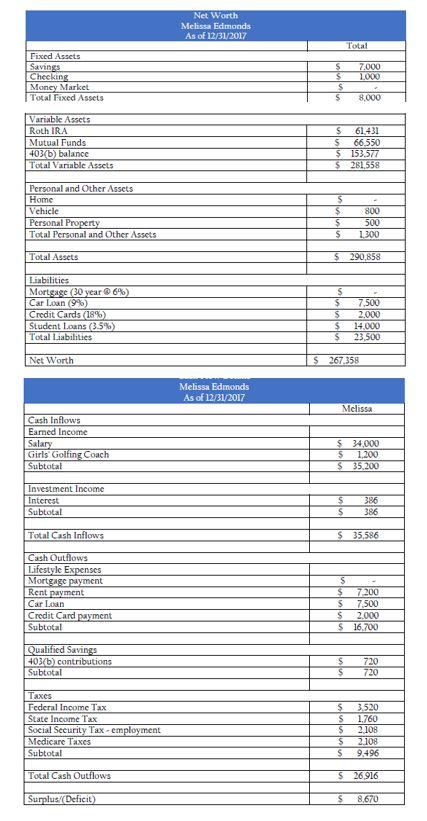

Executive Summary: Names: Melissa Edmonds (23), educator Current Financial Condition/Background/Assumptions: Melissa graduated last year with a teaching degree. She plans on continuing to take courses ultimately to eam her master's degree. This will move her up the pay range and possibly get into administration. Her debt ratio is quite low which shows favorable position that assets are majorly funded through saving rather than debts. Her Financial Position shows sound profits after deducting her fixed Liabilities and Credit Card Payments. Ms. Melissa Edmonds Current Financial position Based On her Last Year Profit is as follows: Total Cash inflows. $35586 Total Cash Outflows. $26916 Surplus $ 8670 Financially Goals: Moving form renting into her own home or condo Continue to pay off her debts Start a basic investment plan Have a plan for emergencies, and unexpected events Objectives: To analyze her financial position, Calculate Financial Ratios: Calculate Leverage Ratio. As she has loan element in her balance sheet, this will help us to relatively measure the percentage of a company's assets that are provided via debt. Calculate operating cash flow ratio, as Melissa is a salaried employed. This will help in determining cash flows available to pay current liabilities and amount available to invest. Establish a clear understanding for all investment goals and objectives including: the various asset classes, investment management styles, asset allocations, acceptable risk and total long-term investment retum. Provide guidance and limitations to all investment in total; to produce enough levels of overall diversification, risk, and liquidity within the portfolio, so that all assets are managed in accordance with the long-term objectives. Establish a basis for evaluating investment results. Financial Advisor Duties and Responsibilities: Provide monthly reports that include securities, cash flow income, and the monthly change in value. . Fiduciary, non-biased third-party charged with helping clients meet long-term financial goals. Monitor all investment options and portfolio custodian. (Custodian is responsible for safekeeping of client's assets) Select assets in accordance with asset allocation providing enough diversification of risk and retums. Net Worth Melissa Edmonds As of 12/31/2017 Total S 7.000 Fixed Assets Savings Checking Money Market Total Fixed Assets $ $ 8.000 Variable Assets Roth IRA Mutual Funds 403(b) balance Total Variable Assets $ 61 431 $ 66,550 $ 153,577 $ 281558 Personal and Other Assets Home Vehicle Personal Property Total Personal and Other Assets $ $ $ $ 800 500 1.300 Total Assets $ 290,858 Liabilities Mortgage (30 year 6%) Car Loan (9%) Credit Cards (188) Student Loans (3.5%) Total Liabilities S $ 5 $ $ 7,500 2.000 14,000 23,500 Net Worth $ 267,358 Melissa Edmonds As of 12/31/2017 Melissa Cash Inflows Earned Income Salary Girls Golfing Coach Subtotal $ 34,000 S 1,200 $ 35,200 Investment Income Interest Subtotal 3836 $ $ 386 Total Cash Inflows $ 35,586 Cash Outflows Lifestyle Expenses Mortgage payment Rent payment Car Loan Credit Card payment Subtotal $ $ 7.200 $ 7,500 S 2.000 S 16.700 Qualified Savings 403(b) contributions Subtotal $ $ 720 720 Taxes Federal Income Tax State Income Tax Social Security Tex-employment Medicare l'axes Subtotal $ S $ S S 3.520 1.760 2.108 2.108 9.496 Total Cash Outflows $ 26,916 Surplus/Delicit) $ 8,670 Executive Summary: Names: Melissa Edmonds (23), educator Current Financial Condition/Background/Assumptions: Melissa graduated last year with a teaching degree. She plans on continuing to take courses ultimately to eam her master's degree. This will move her up the pay range and possibly get into administration. Her debt ratio is quite low which shows favorable position that assets are majorly funded through saving rather than debts. Her Financial Position shows sound profits after deducting her fixed Liabilities and Credit Card Payments. Ms. Melissa Edmonds Current Financial position Based On her Last Year Profit is as follows: Total Cash inflows. $35586 Total Cash Outflows. $26916 Surplus $ 8670 Financially Goals: Moving form renting into her own home or condo Continue to pay off her debts Start a basic investment plan Have a plan for emergencies, and unexpected events Objectives: To analyze her financial position, Calculate Financial Ratios: Calculate Leverage Ratio. As she has loan element in her balance sheet, this will help us to relatively measure the percentage of a company's assets that are provided via debt. Calculate operating cash flow ratio, as Melissa is a salaried employed. This will help in determining cash flows available to pay current liabilities and amount available to invest. Establish a clear understanding for all investment goals and objectives including: the various asset classes, investment management styles, asset allocations, acceptable risk and total long-term investment retum. Provide guidance and limitations to all investment in total; to produce enough levels of overall diversification, risk, and liquidity within the portfolio, so that all assets are managed in accordance with the long-term objectives. Establish a basis for evaluating investment results. Financial Advisor Duties and Responsibilities: Provide monthly reports that include securities, cash flow income, and the monthly change in value. . Fiduciary, non-biased third-party charged with helping clients meet long-term financial goals. Monitor all investment options and portfolio custodian. (Custodian is responsible for safekeeping of client's assets) Select assets in accordance with asset allocation providing enough diversification of risk and retums. Net Worth Melissa Edmonds As of 12/31/2017 Total S 7.000 Fixed Assets Savings Checking Money Market Total Fixed Assets $ $ 8.000 Variable Assets Roth IRA Mutual Funds 403(b) balance Total Variable Assets $ 61 431 $ 66,550 $ 153,577 $ 281558 Personal and Other Assets Home Vehicle Personal Property Total Personal and Other Assets $ $ $ $ 800 500 1.300 Total Assets $ 290,858 Liabilities Mortgage (30 year 6%) Car Loan (9%) Credit Cards (188) Student Loans (3.5%) Total Liabilities S $ 5 $ $ 7,500 2.000 14,000 23,500 Net Worth $ 267,358 Melissa Edmonds As of 12/31/2017 Melissa Cash Inflows Earned Income Salary Girls Golfing Coach Subtotal $ 34,000 S 1,200 $ 35,200 Investment Income Interest Subtotal 3836 $ $ 386 Total Cash Inflows $ 35,586 Cash Outflows Lifestyle Expenses Mortgage payment Rent payment Car Loan Credit Card payment Subtotal $ $ 7.200 $ 7,500 S 2.000 S 16.700 Qualified Savings 403(b) contributions Subtotal $ $ 720 720 Taxes Federal Income Tax State Income Tax Social Security Tex-employment Medicare l'axes Subtotal $ S $ S S 3.520 1.760 2.108 2.108 9.496 Total Cash Outflows $ 26,916 Surplus/Delicit) $ 8,670