Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Develop and solve an optimization model of this problem in an Excel worksheet titled Investments. An investor wants to invest $100,000, considering asset allocation

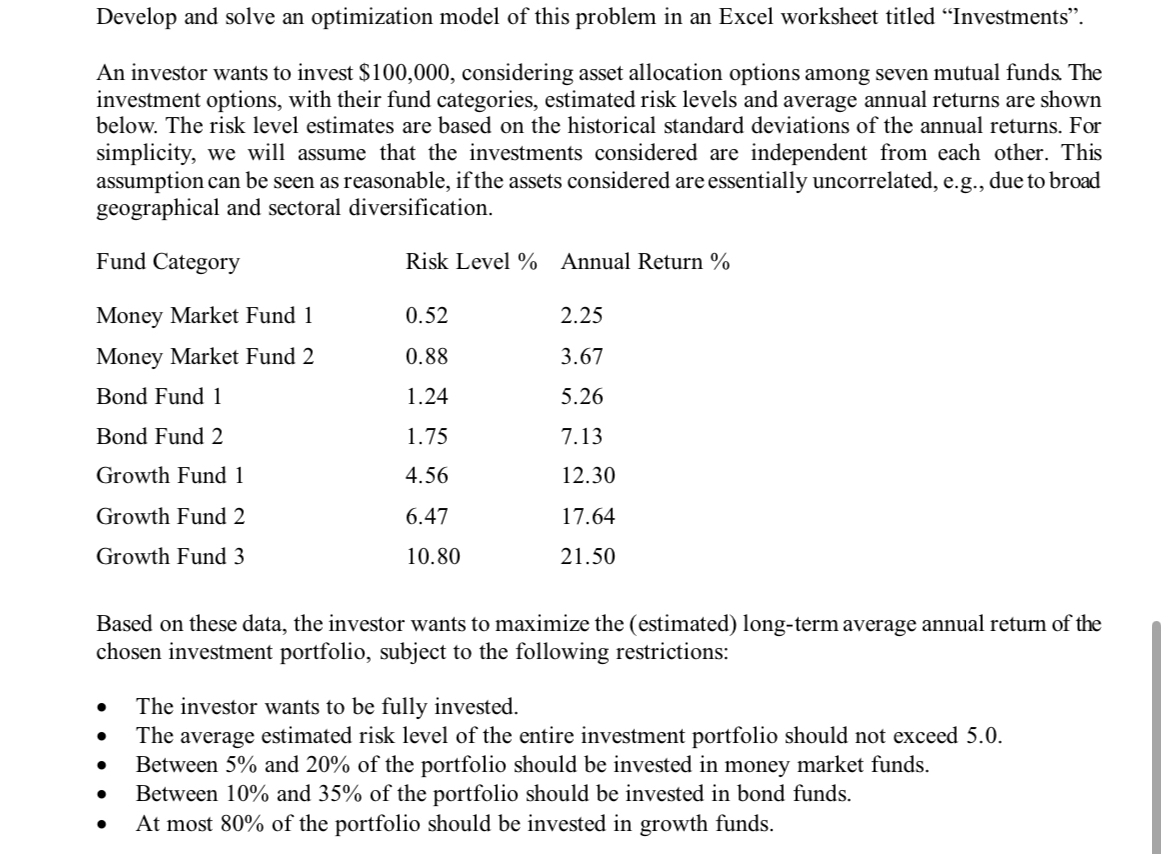

Develop and solve an optimization model of this problem in an Excel worksheet titled Investments. An investor wants to invest $100,000, considering asset allocation options among seven mutual funds. The investment options, with their fund categories, estimated risk levels and average annual returns are shown below. The risk level estimates are based on the historical standard deviations of the annual returns. For simplicity, we will assume that the investments considered are independent from each other. This assumption can be seen as reasonable, if the assets considered are essentially uncorrelated, e.g., due to broad geographical and sectoral diversification. Fund Category Risk Level % Annual Return % Money Market Fund 1 0.52 2.25 Money Market Fund 2 0.88 3.67 Bond Fund 1 1.24 5.26 Bond Fund 2 1.75 7.13 Growth Fund 1 4.56 12.30 Growth Fund 2 6.47 17.64 Growth Fund 3 10.80 21.50 Based on these data, the investor wants to maximize the (estimated) long-term average annual return of the chosen investment portfolio, subject to the following restrictions: . The investor wants to be fully invested. The average estimated risk level of the entire investment portfolio should not exceed 5.0. Between 5% and 20% of the portfolio should be invested in money market funds. Between 10% and 35% of the portfolio should be invested in bond funds. At most 80% of the portfolio should be invested in growth funds.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started