Develop common size and common base-quarter (do not combine quarters to have annual numbers) indexed balance sheets and income statements for all the quarters in the excel file. Please do not include the original financial statements in the indexed financial statements.

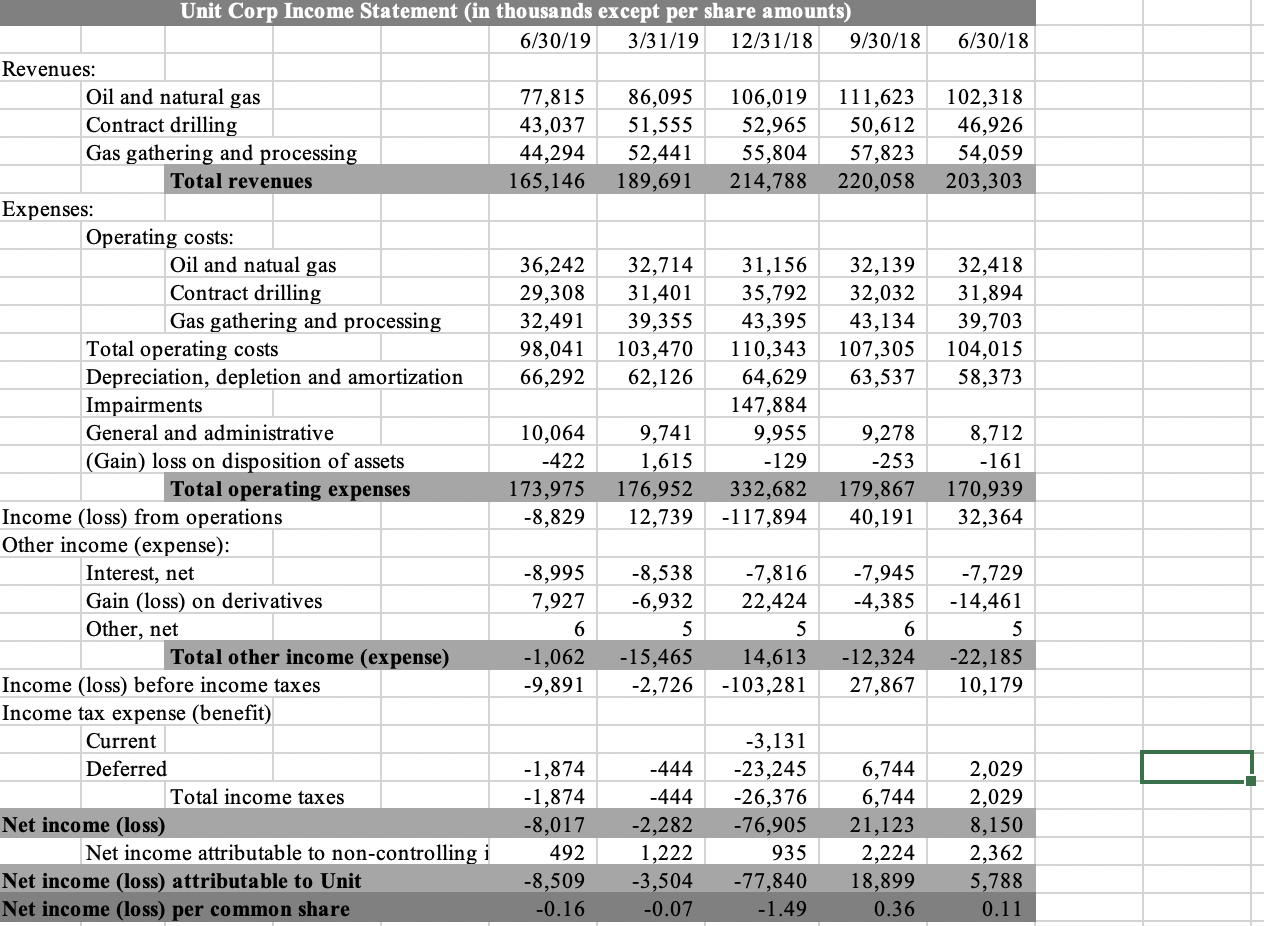

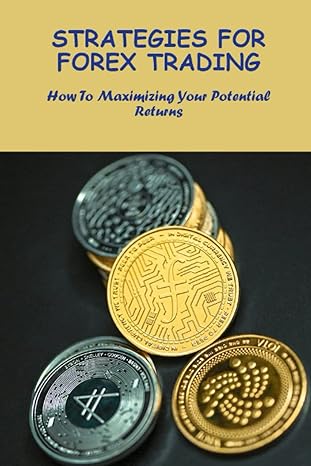

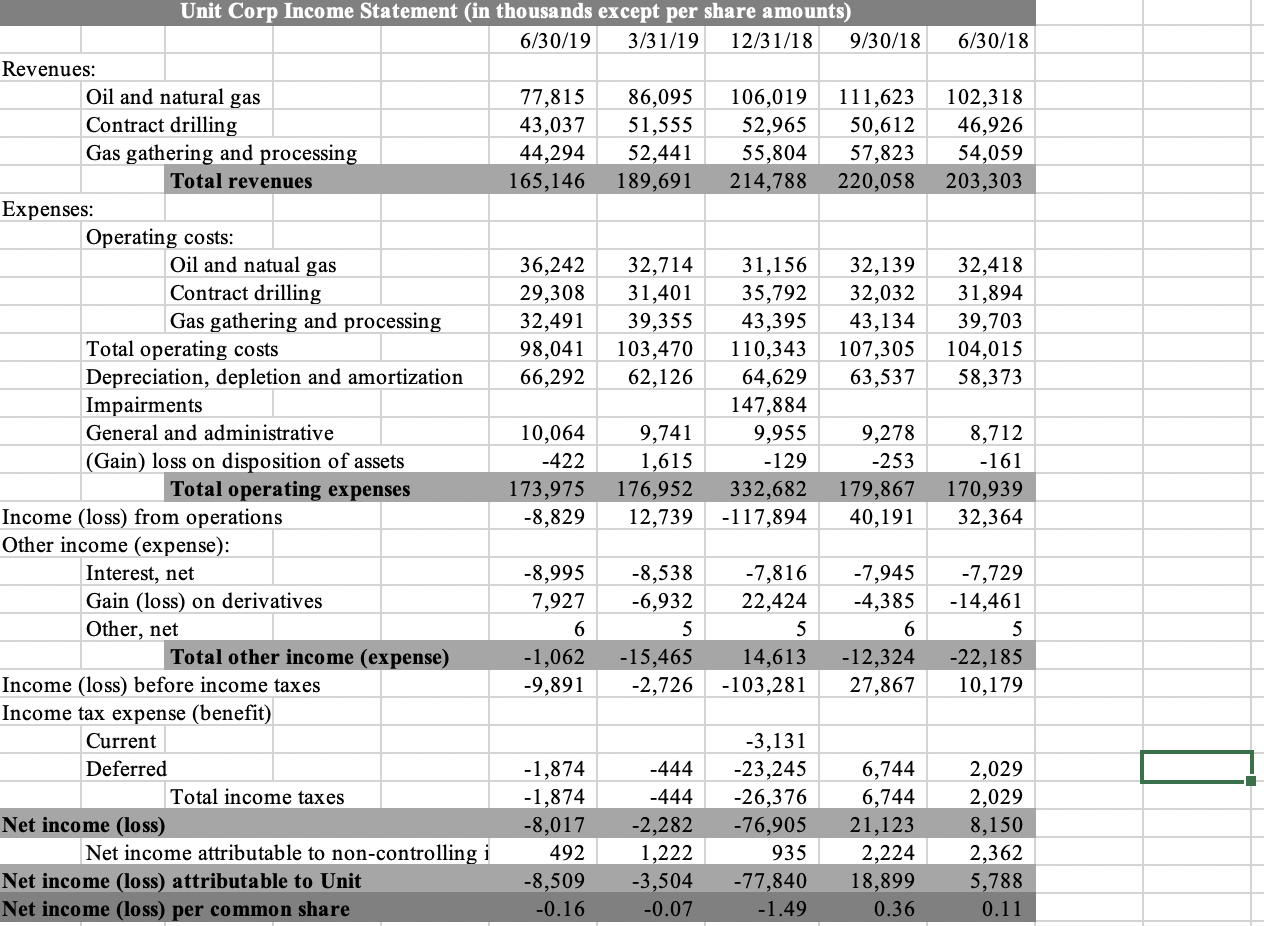

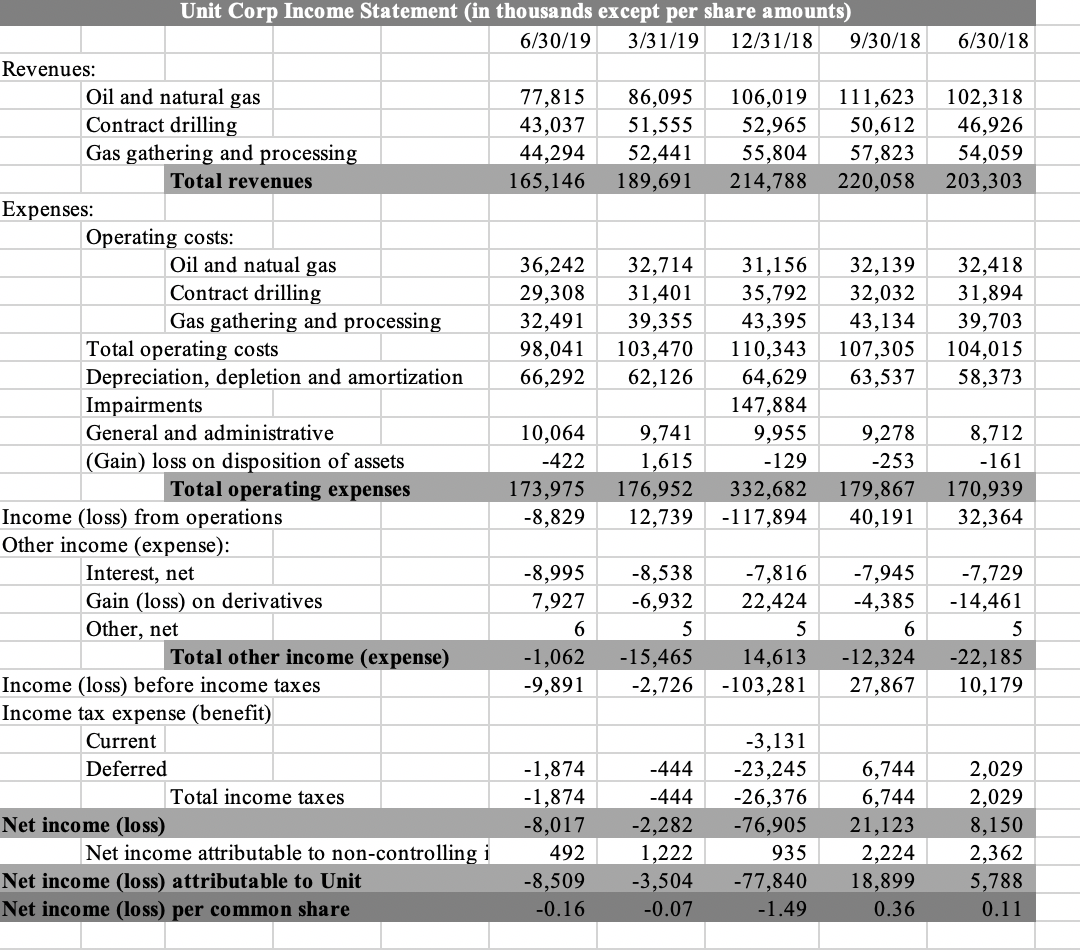

6/30/18 102,318 46,926 54,059 203,303 32,418 31,894 39,703 104,015 58,373 Unit Corp Income Statement (in thousands except per share amounts) 6/30/19 3/31/19 12/31/18 9/30/18 Revenues: Oil and natural gas 77,815 86,095 106,019 111,623 Contract drilling 43,037 51,555 52,965 50,612 Gas gathering and processing 44,294 52,441 55,804 57,823 Total revenues 165,146 189,691 214,788 220,058 Expenses: Operating costs: Oil and natual gas 36,242 32,714 31,156 32,139 Contract drilling 29,308 31,401 35,792 32,032 Gas gathering and processing 32,491 39,355 43,395 43,134 Total operating costs 98,041 103,470 110,343 107,305 Depreciation, depletion and amortization 66,292 62,126 64,629 63,537 Impairments 147,884 General and administrative 10,064 9,741 9,955 9,278 (Gain) loss on dis sition of assets -422 1,615 -129 -253 Total operating expenses 173,975 176,952 332,682 179,867 Income (loss) from operations -8,829 12,739 -117,894 40,191 Other income (expense): Interest, net -8,995 -8,538 -7,816 -7,945 Gain (loss) on derivatives 7,927 -6,932 22,424 -4,385 Other, net 6 5 5 6 Total other income (expense) -1,062 -15,465 14,613 -12,324 Income (loss) before income taxes -9,891 -2,726 -103,281 27,867 Income tax expense (benefit) Current -3,131 Deferred -1,874 -444 -23,245 6,744 Total income taxes -1,874 -444 -26,376 6,744 Net income (loss) -8,017 -2,282 - 76,905 21,123 Net income attributable to non-controlling i 492 1,222 935 2,224 Net income (loss) attributable to Unit -8,509 -3,504 -77,840 18,899 Net income (loss) per common share -0.16 -0.07 -1.49 0.36 8,712 -161 170,939 32,364 -7,729 -14,461 5 -22,185 10,179 2,029 2,029 8,150 2,362 5,788 0.11 6/30/18 102,318 46,926 54,059 203,303 32,418 31,894 39,703 104,015 58,373 Unit Corp Income Statement (in thousands except per share amounts) 6/30/19 3/31/19 12/31/18 9/30/18 Revenues: Oil and natural gas 77,815 86,095 106,019 111,623 Contract drilling 43,037 51,555 52,965 50,612 Gas gathering and processing 44,294 52,441 55,804 57,823 Total revenues 165,146 189,691 214,788 220,058 Expenses: Operating costs: Oil and natual gas 36,242 32,714 31,156 32,139 Contract drilling 29,308 31,401 35,792 32,032 Gas gathering and processing 32,491 39,355 43,395 43,134 Total operating costs 98,041 103,470 110,343 107,305 Depreciation, depletion and amortization 66,292 62,126 64,629 63,537 Impairments 147,884 General and administrative 10,064 9,741 9,955 9,278 (Gain) loss on dis sition of assets -422 1,615 -129 -253 Total operating expenses 173,975 176,952 332,682 179,867 Income (loss) from operations -8,829 12,739 -117,894 40,191 Other income (expense): Interest, net -8,995 -8,538 -7,816 -7,945 Gain (loss) on derivatives 7,927 -6,932 22,424 -4,385 Other, net 6 5 5 6 Total other income (expense) -1,062 -15,465 14,613 -12,324 Income (loss) before income taxes -9,891 -2,726 -103,281 27,867 Income tax expense (benefit) Current -3,131 Deferred -1,874 -444 -23,245 6,744 Total income taxes -1,874 -444 -26,376 6,744 Net income (loss) -8,017 -2,282 - 76,905 21,123 Net income attributable to non-controlling i 492 1,222 935 2,224 Net income (loss) attributable to Unit -8,509 -3,504 -77,840 18,899 Net income (loss) per common share -0.16 -0.07 -1.49 0.36 8,712 -161 170,939 32,364 -7,729 -14,461 5 -22,185 10,179 2,029 2,029 8,150 2,362 5,788 0.11 6/30/18 102,318 46,926 54,059 203,303 32,418 31,894 39,703 104,015 58,373 Unit Corp Income Statement (in thousands except per share amounts) 6/30/19 3/31/19 12/31/18 9/30/18 Revenues: Oil and natural gas 77,815 86,095 106,019 111,623 Contract drilling 43,037 51,555 52,965 50,612 Gas gathering and processing 44,294 52,441 55,804 57,823 Total revenues 165,146 189,691 214,788 220,058 Expenses: Operating costs: Oil and natual gas 36,242 32,714 31,156 32,139 Contract drilling 29,308 31,401 35,792 32,032 Gas gathering and processing 32,491 39,355 43,395 43,134 Total operating costs 98,041 103,470 110,343 107,305 Depreciation, depletion and amortization 66,292 62,126 64,629 63,537 Impairments 147,884 General and administrative 10,064 9,741 9,955 9,278 (Gain) loss on dis sition of assets -422 1,615 -129 -253 Total operating expenses 173,975 176,952 332,682 179,867 Income (loss) from operations -8,829 12,739 -117,894 40,191 Other income (expense): Interest, net -8,995 -8,538 -7,816 -7,945 Gain (loss) on derivatives 7,927 -6,932 22,424 -4,385 Other, net 6 5 5 6 Total other income (expense) -1,062 -15,465 14,613 -12,324 Income (loss) before income taxes -9,891 -2,726 -103,281 27,867 Income tax expense (benefit) Current -3,131 Deferred -1,874 -444 -23,245 6,744 Total income taxes -1,874 -444 -26,376 6,744 Net income (loss) -8,017 -2,282 - 76,905 21,123 Net income attributable to non-controlling i 492 1,222 935 2,224 Net income (loss) attributable to Unit -8,509 -3,504 -77,840 18,899 Net income (loss) per common share -0.16 -0.07 -1.49 0.36 8,712 -161 170,939 32,364 -7,729 -14,461 5 -22,185 10,179 2,029 2,029 8,150 2,362 5,788 0.11 6/30/18 102,318 46,926 54,059 203,303 32,418 31,894 39,703 104,015 58,373 Unit Corp Income Statement (in thousands except per share amounts) 6/30/19 3/31/19 12/31/18 9/30/18 Revenues: Oil and natural gas 77,815 86,095 106,019 111,623 Contract drilling 43,037 51,555 52,965 50,612 Gas gathering and processing 44,294 52,441 55,804 57,823 Total revenues 165,146 189,691 214,788 220,058 Expenses: Operating costs: Oil and natual gas 36,242 32,714 31,156 32,139 Contract drilling 29,308 31,401 35,792 32,032 Gas gathering and processing 32,491 39,355 43,395 43,134 Total operating costs 98,041 103,470 110,343 107,305 Depreciation, depletion and amortization 66,292 62,126 64,629 63,537 Impairments 147,884 General and administrative 10,064 9,741 9,955 9,278 (Gain) loss on dis sition of assets -422 1,615 -129 -253 Total operating expenses 173,975 176,952 332,682 179,867 Income (loss) from operations -8,829 12,739 -117,894 40,191 Other income (expense): Interest, net -8,995 -8,538 -7,816 -7,945 Gain (loss) on derivatives 7,927 -6,932 22,424 -4,385 Other, net 6 5 5 6 Total other income (expense) -1,062 -15,465 14,613 -12,324 Income (loss) before income taxes -9,891 -2,726 -103,281 27,867 Income tax expense (benefit) Current -3,131 Deferred -1,874 -444 -23,245 6,744 Total income taxes -1,874 -444 -26,376 6,744 Net income (loss) -8,017 -2,282 - 76,905 21,123 Net income attributable to non-controlling i 492 1,222 935 2,224 Net income (loss) attributable to Unit -8,509 -3,504 -77,840 18,899 Net income (loss) per common share -0.16 -0.07 -1.49 0.36 8,712 -161 170,939 32,364 -7,729 -14,461 5 -22,185 10,179 2,029 2,029 8,150 2,362 5,788 0.11