Answered step by step

Verified Expert Solution

Question

1 Approved Answer

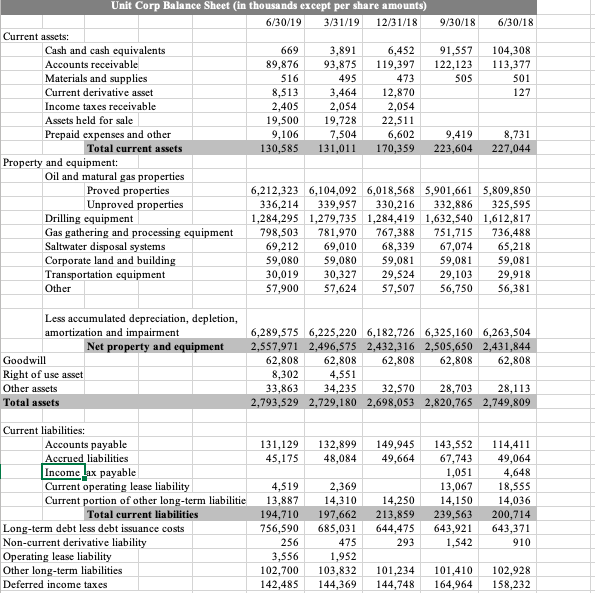

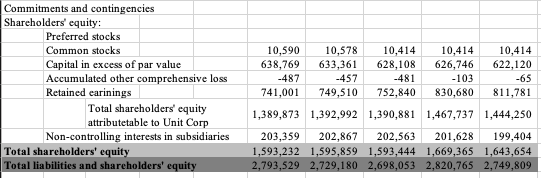

Develop common size AND common base-quarter indexed balance sheets for all the quarters in the excel file. 8.5.5 Unit Corp Balance Sheet (in thousands except

Develop common size AND common base-quarter indexed balance sheets for all the quarters in the excel file.

8.5.5

Unit Corp Balance Sheet (in thousands except per share amounts) 6/30/19 3/31/19 12/31/18 9/30/18 6/30/18 Current assets: Cash and cash equivalents 669 3,891 6,452 91,557 104,308 Accounts receivable 89,876 93,875 119,397 122,123 113,377 Materials and supplies 516 495 473 505 501 Current derivative asset 8,513 3,464 12,870 127 Income taxes receivable 2,405 2,054 2,054 Assets held for sale 19,500 19,728 22,511 Prepaid expenses and other 9,106 7,504 6,602 9,419 8,731 Total current assets 130,585 131,011 170,359 223,604 227,044 Property and equipment: Oil and matural gas properties Proved properties 6,212,323 6,104,092 6,018,568 5,901,661 5,809,850 Unproved properties 336,214 339,957 330,216 332,886 325,595 Drilling equipment 1,284,295 1,279,735 1,284,419 1,632,540 1,612,817 Gas gathering and processing equipment 798,503 781,970 767,388 751,715 736,488 Saltwater disposal systems 69,212 69,010 68,339 67,074 65,218 Corporate land and building 59,080 59,080 59,081 59,081 59,081 Transportation equipment 30,019 30,327 29,524 29,103 29,918 Other 57,900 57,624 57,507 56,750 56,381 Less accumulated depreciation, depletion, amortization and impairment Net property and equipment Goodwill Right of use asset Other assets Total assets 6,289,575 6,225,220 6,182,726 6,325,160 6,263,504 2,557,971 2,496,575 2,432,316 2,505,650 2,431,844 62,808 62,808 62,808 62,808 62,808 8,302 4,551 33,863 34,235 32,570 28,703 28,113 2,793,529 2,729,180 2,698,053 2,820,765 2,749,809 131,129 45,175 132,899 48,084 149,945 49,664 Current liabilities: Accounts payable Accrued liabilities Income lax payable Current operating lease liability Current portion of other long-term liabilitie Total current liabilities Long-term debt less debt issuance costs Non-current derivative liability Operating lease liability Other long-term liabilities Deferred income taxes 4,519 13,887 194,710 756,590 256 3,556 102,700 142,485 2,369 14,310 197,662 685,031 475 1,952 103,832 144,369 143,552 67,743 1,051 13,067 14,150 239,563 643,921 1,542 114,411 49,064 4,648 18,555 14,036 200,714 643,371 910 14,250 213,859 644,475 293 101,234 144,748 101,410 164,964 102,928 158,232 Commitments and contingencies Shareholders' equity: Preferred stocks Common stocks Capital in excess of par value Accumulated other comprehensive loss Retained carinings Total shareholders' equity attributetable to Unit Corp Non-controlling interests in subsidiaries Total shareholders' equity Total liabilities and shareholders' equity 10,590 10,578 10,414 10,414 10,414 638,769 633,361 628,108 626,746 622,120 -487 -457 -481 -103 -65 741,001 749,510 752,840 830,680 811,781 1,389,873 1,392,992 1,390,881 1,467,737 1,444,250 203,359 202,867 202,563 201,628 199,404 1,593,232 1,595,859 1,593,444 1,669,365 1,643,654 2,793,529 2,729,180 2,698,053 2,820,765 2,749,809 Unit Corp Balance Sheet (in thousands except per share amounts) 6/30/19 3/31/19 12/31/18 9/30/18 6/30/18 Current assets: Cash and cash equivalents 669 3,891 6,452 91,557 104,308 Accounts receivable 89,876 93,875 119,397 122,123 113,377 Materials and supplies 516 495 473 505 501 Current derivative asset 8,513 3,464 12,870 127 Income taxes receivable 2,405 2,054 2,054 Assets held for sale 19,500 19,728 22,511 Prepaid expenses and other 9,106 7,504 6,602 9,419 8,731 Total current assets 130,585 131,011 170,359 223,604 227,044 Property and equipment: Oil and matural gas properties Proved properties 6,212,323 6,104,092 6,018,568 5,901,661 5,809,850 Unproved properties 336,214 339,957 330,216 332,886 325,595 Drilling equipment 1,284,295 1,279,735 1,284,419 1,632,540 1,612,817 Gas gathering and processing equipment 798,503 781,970 767,388 751,715 736,488 Saltwater disposal systems 69,212 69,010 68,339 67,074 65,218 Corporate land and building 59,080 59,080 59,081 59,081 59,081 Transportation equipment 30,019 30,327 29,524 29,103 29,918 Other 57,900 57,624 57,507 56,750 56,381 Less accumulated depreciation, depletion, amortization and impairment Net property and equipment Goodwill Right of use asset Other assets Total assets 6,289,575 6,225,220 6,182,726 6,325,160 6,263,504 2,557,971 2,496,575 2,432,316 2,505,650 2,431,844 62,808 62,808 62,808 62,808 62,808 8,302 4,551 33,863 34,235 32,570 28,703 28,113 2,793,529 2,729,180 2,698,053 2,820,765 2,749,809 131,129 45,175 132,899 48,084 149,945 49,664 Current liabilities: Accounts payable Accrued liabilities Income lax payable Current operating lease liability Current portion of other long-term liabilitie Total current liabilities Long-term debt less debt issuance costs Non-current derivative liability Operating lease liability Other long-term liabilities Deferred income taxes 4,519 13,887 194,710 756,590 256 3,556 102,700 142,485 2,369 14,310 197,662 685,031 475 1,952 103,832 144,369 143,552 67,743 1,051 13,067 14,150 239,563 643,921 1,542 114,411 49,064 4,648 18,555 14,036 200,714 643,371 910 14,250 213,859 644,475 293 101,234 144,748 101,410 164,964 102,928 158,232 Commitments and contingencies Shareholders' equity: Preferred stocks Common stocks Capital in excess of par value Accumulated other comprehensive loss Retained carinings Total shareholders' equity attributetable to Unit Corp Non-controlling interests in subsidiaries Total shareholders' equity Total liabilities and shareholders' equity 10,590 10,578 10,414 10,414 10,414 638,769 633,361 628,108 626,746 622,120 -487 -457 -481 -103 -65 741,001 749,510 752,840 830,680 811,781 1,389,873 1,392,992 1,390,881 1,467,737 1,444,250 203,359 202,867 202,563 201,628 199,404 1,593,232 1,595,859 1,593,444 1,669,365 1,643,654 2,793,529 2,729,180 2,698,053 2,820,765 2,749,809 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started