Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Devin Co. has the following information for the year 20x1: Warranty obligation of P300,000 was accrued. This amount is tax deductible only when paid

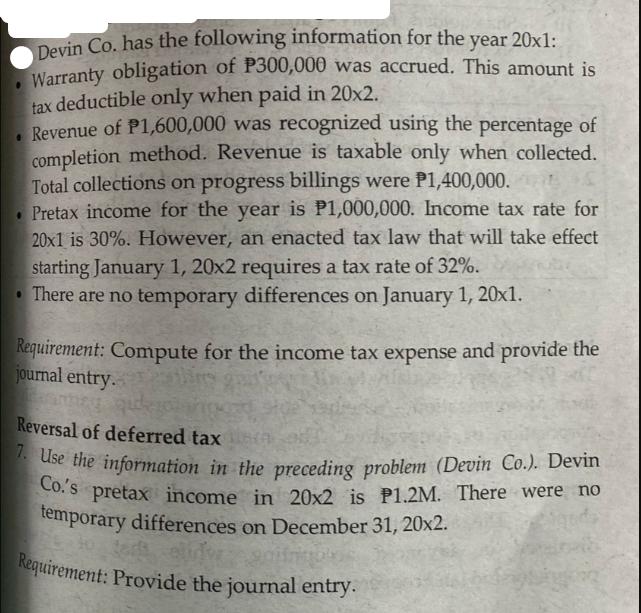

Devin Co. has the following information for the year 20x1: Warranty obligation of P300,000 was accrued. This amount is tax deductible only when paid in 20x2. . Revenue of P1,600,000 was recognized using the percentage of completion method. Revenue is taxable only when collected. Total collections on progress billings were P1,400,000. Pretax income for the year is P1,000,000. Income tax rate for 20x1 is 30%. However, an enacted tax law that will take effect starting January 1, 20x2 requires a tax rate of 32%. There are no temporary differences on January 1, 20x1. Requirement: Compute for the income tax expense and provide the journal entry. Reversal of deferred tax 7. Use the information in the preceding problem (Devin Co.). Devin Co.'s pretax income in 20x2 is P1.2M. There were no temporary differences on December 31, 20x2. Requirement: Provide the journal entry.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTIONS Calculation of income tax expense for the year 20x1 Income before ta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started