Question

Devon Inc. has developed a powerful efficient snow blower that is significantly less polluting than existing snow blowers currently on the market. The company spent

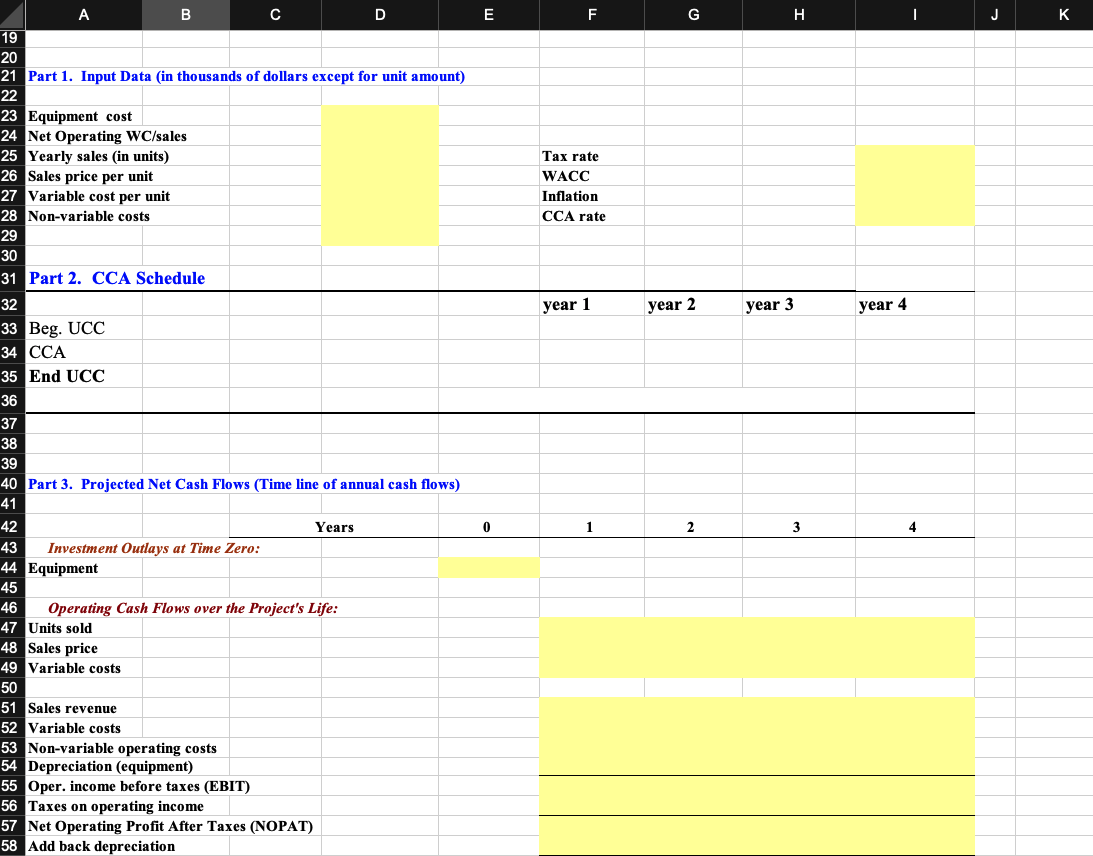

Devon Inc. has developed a powerful efficient snow blower that is significantly less polluting than existing snow blowers currently on the market. The company spent $2,500,000 developing this product and the marketing department spent another $350,000 to assess the market demand. It would cost $25 million at Year 0 to buy the equipment necessary to manufacture the efficient snow blower. The project would require net working capital at the beginning of each year equal to 20% of sales (NOWC0 = 20%(Sales1), NOWC1 = 20%(Sales2), etc.). The efficient snow blowers would sell for $3,500 per unit, and the company believes that variable costs would amount to $990 per unit. The company expects that the sales price and variable costs would increase at the inflation rate of 4% after year 1. The companys non-variable costs would be $800,000 in Year 1 and are expected to increase with inflation. The efficient snow blower project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project is expected to be of average risk. The firm believes it could sell 3,500 units per year. The equipment would be depreciated using a CCA rate of 30%. The estimated market value of the equipment at the end of the projects 4-year life is its undepreciated capital cost (i.e. book value) at the end of year 4. The company has other assets in this asset class. Toefield Inc.s federal-plus-provincial tax rate is 30%. Its cost of capital is 7% for average risk projects. Low-risk projects are evaluated with a WACC of 6%, and high-risk projects at 10%. Assume that the half-year rule applies to the CCA.

1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started