Question

Devon, Inc., is a manufacturer of computer accessories and peripherals that was started several years ago by two talented engineers. On December 31, 2020 (fiscal-year-end),

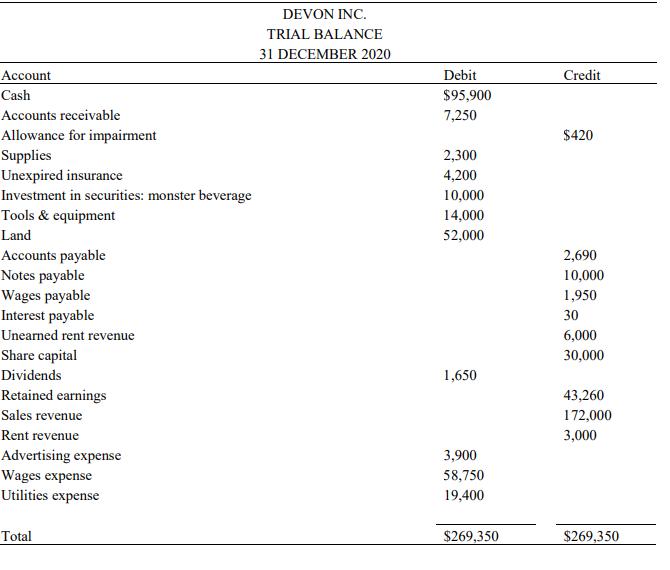

Devon, Inc., is a manufacturer of computer accessories and peripherals that was started several years ago by two talented engineers. On December 31, 2020 (fiscal-year-end), the company created a trial balance in preparation of financial statements for the year (see below for the trial balance). In addition, the following information was obtained after the trial balance was created and before adjusting entries or closing entries were prepared. 1. The company’s remaining supplies was $1,100. 2. A 6-month casualty insurance policy was purchased on November 1, 2020 for $4,200. 3. A new equipment with an estimated useful life of five years was acquired on February 1, 2020. The cost of equipment was $14,000. The company uses the straight-line method for depreciation. 4. On November 1, 2020, the company received $6,000 in advance for a 6-month rental contract. 5. On December 31, 2020, the company owes wages of $950, which will be paid on January 5, 2021. 6. On November 30, 2020, the company borrowed $10,000 from Bank of Korea and issued a note payable. The interest will be paid in 6 months (May 31, 2021) with an annual interest rate of 6%. 7. The company uses the balance sheet approach to estimate uncollectible accounts expense. At year-end, the company had the following groups of accounts receivables: (Group 1) not yet due: $3,200, (Group 2) 1-30 days past due: $2,500, (Group 3) 31-60 days past due: $950, (Group 4) Over 60 days past due: $600. Based on the past experience, the company estimated the percentages of uncollectible as follows: (Group 1) 1%, (Group 2) 3%, (Group 3) 10%, and (Group 4) 50%. 8. On October 1, 2020 the company purchased 2,000 shares of Monster Beverage Corporation for investment and paid $4.98 per share, plus a brokerage commission of $40. On December 31, 2020 Monster Beverage stock’s market value was $4.92 per share. 9. On November 30, 2020, the company declared and paid a total of $1,650 dividends to shareholders. 10. Income tax rate is 40% (round income tax expense to the nearest ones).

Required:

1. Provide adjusting journal entries as needed for each of the above. If necessary, explain why you recorded certain entries and amounts. (100 points)

2. Provide closing journal entries. Clearly show how you arrived at the amounts presented in journal entries. (100 points) 3. Prepare a balance sheet and income statement. (100 points)

Account Cash Accounts receivable Allowance for impairment Supplies Unexpired insurance Investment in securities: monster beverage Tools & equipment Land Accounts payable Notes payable Wages payable Interest payable Unearned rent revenue Share capital Dividends Retained earnings Sales revenue Rent revenue Advertising expense Wages expense Utilities expense Total DEVON INC. TRIAL BALANCE 31 DECEMBER 2020 Debit $95,900 7,250 2,300 4,200 10,000 14,000 52,000 1,650 3,900 58,750 19,400 $269,350 Credit $420 2,690 10,000 1,950 30 6,000 30,000 43,260 172,000 3,000 $269,350

Step by Step Solution

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Adjusting Journal Entries 1 Supplies Expense Debit 1100 Credit Accounts Payable 1100 2 Prepaid Ins...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started